Web Application Documentation

Appendix D1 - NPEFS Web Application Documentation 07112022.docx

National Public Education Financial Survey (NPEFS) 2022-2024

Web Application Documentation

OMB: 1850-0067

National Public Education Financial Survey (NPEFS) 2022-2024: Common Core of Data (CCD)

Appendix D.1

Documentation of NPEFS Web Application

OMB# 1850-0067 v.23

National Center for Education Statistics (NCES)

May 2022

revised August 2022

The web application for the NPEFS data collection decreases the paperwork burden of the state respondents and our data analysts. The application provides respondents with tools to review their data and helps decrease keying errors. We continuously make upgrades to the web application based on feedback received from respondents. The application integrates all parts of NPEFS data collection:

Fiscal data plan

Crosswalk module

Current year submission

Prior year revisions

Digital or hard copy confirmation by designated authorized official

Frequently asked questions

Awards criteria for early submission of clean data

NPEFS and Crosswalk reports available after survey submission

Enhanced edits of NPEFS data before survey submission

Enhanced form printing capability

Help screens

Imputation review (acceptance and denial options)

Reporting instructions and a user guide in PDF format

The web application is designed to assist respondents and analysts. The survey application includes displays of prior year data and built-in data validity checks. The reporting instructions, user guide, and online help text answers many questions respondents may have about completing the survey online. Within the NPEFS web application, our respondents, analysts, and sponsor can view and print the survey data, and we can easily track the states’ survey submissions and re-submissions and provide technical assistance to support states in responding to the survey.

The U.S. Census Bureau upgraded the web application in FY 2021. This upgrade improved the user experience and made the site more secure. As part of the upgrade, the Census Bureau developed a comprehensive user guide to provide respondents with step-by-step instructions for entering data into the NPEFS form, using the crosswalk application to complete the NPEFS form, responding to the fiscal data plan, signing the submission, and making revisions to prior year data. Help text is available for each data item which contains the reporting instructions plus additional information from the NCES Accounting Handbook1 to make reporting instructions easier to find.

Formal training on the upgraded web application was provided to respondents via webinar on February 3, 2022. Ninety-six fiscal coordinators and SEA staff attended the workshop. On February 8, NCES held a focus group with 8 respondents to gather feedback on the functionality of the application and new features. Feedback on the web application was generally positive. The new application is more user friendly and easier to navigate and understand the tasks that need to be completed. Participants of both the training workshop and focus group requested additional features, such as the addition of an “export to excel” feature, addition of revenue and expenditure exclusions in the crosswalk, ability to initiate edits their fiscal data plan submission, and the ability to compare different versions of their submissions made in the same cycle. These features were added in February and March of 2022. Additional fixes were also made to account for decimals in the crosswalk and the re-naming of some buttons based on feedback from respondents.

This appendix includes screenshots of the NPEFS web application and a listing of the item help text available to respondents within the web application. The appendix also includes the user guide providing instructions and resources to data users on how to use the web application.

Home page and login

Burden statement

Main page

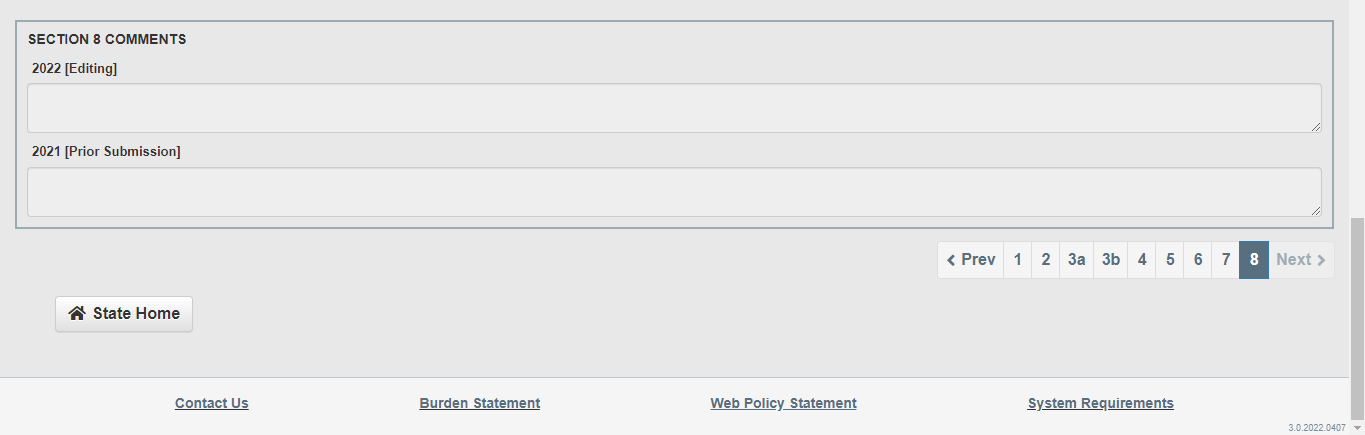

Within the web application, the status of submission (not started, not submitted, submitted, signed, unchanged from original) will be above the link that the respondent will use to complete the necessary step. The status is also color coded with a green bar if the step is complete, a red bar if actions are required, and a gray bar for optional actions.

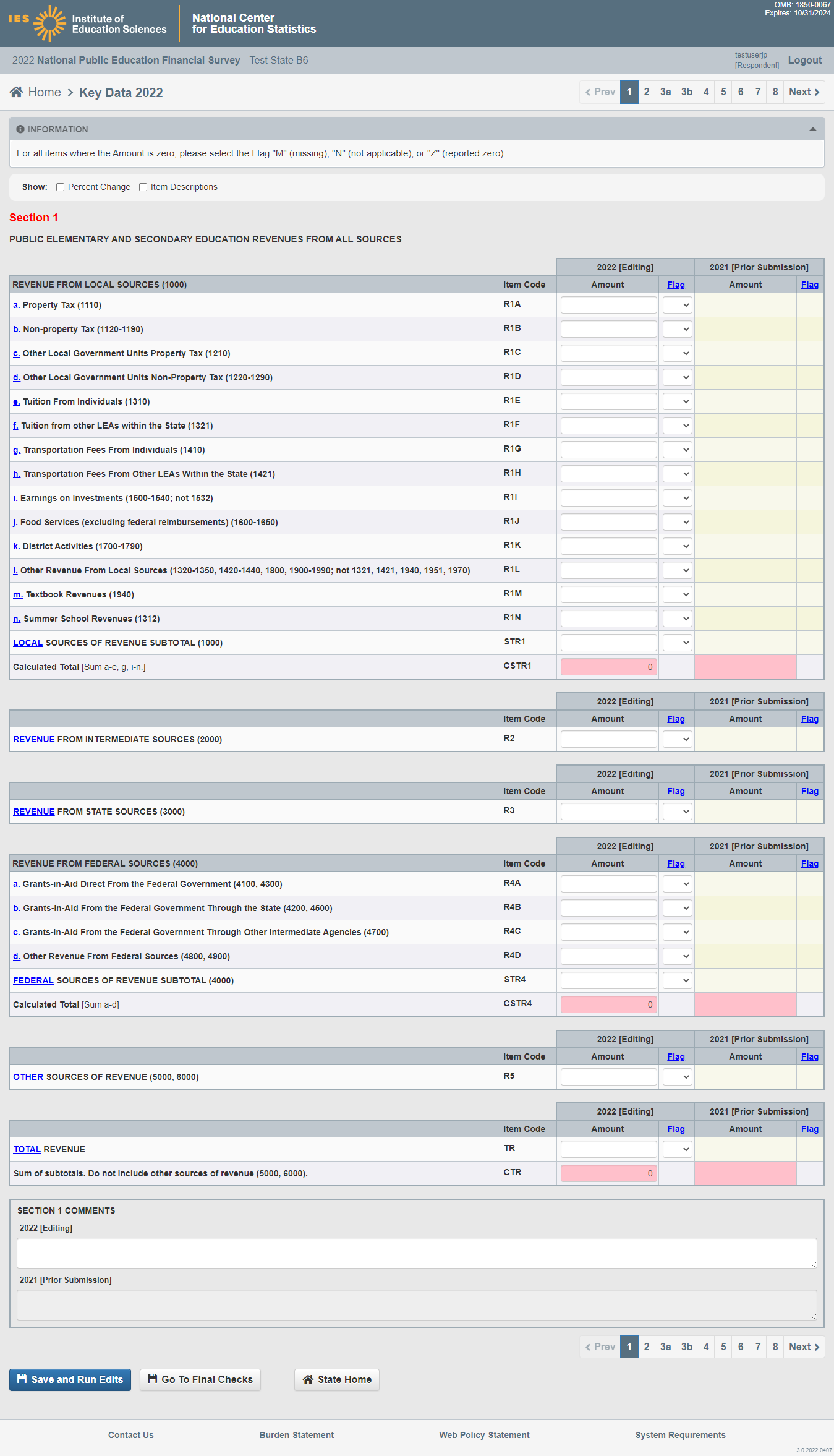

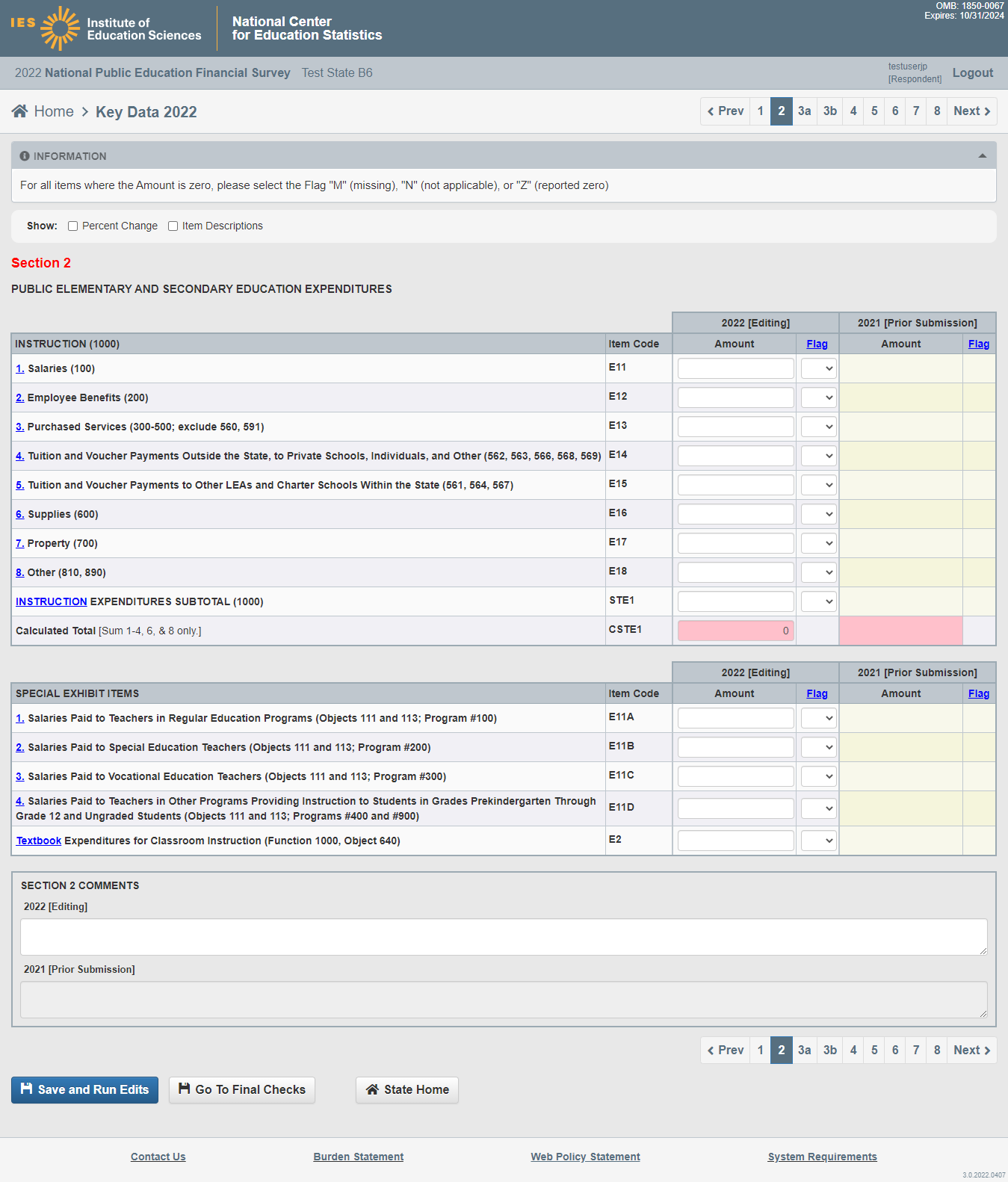

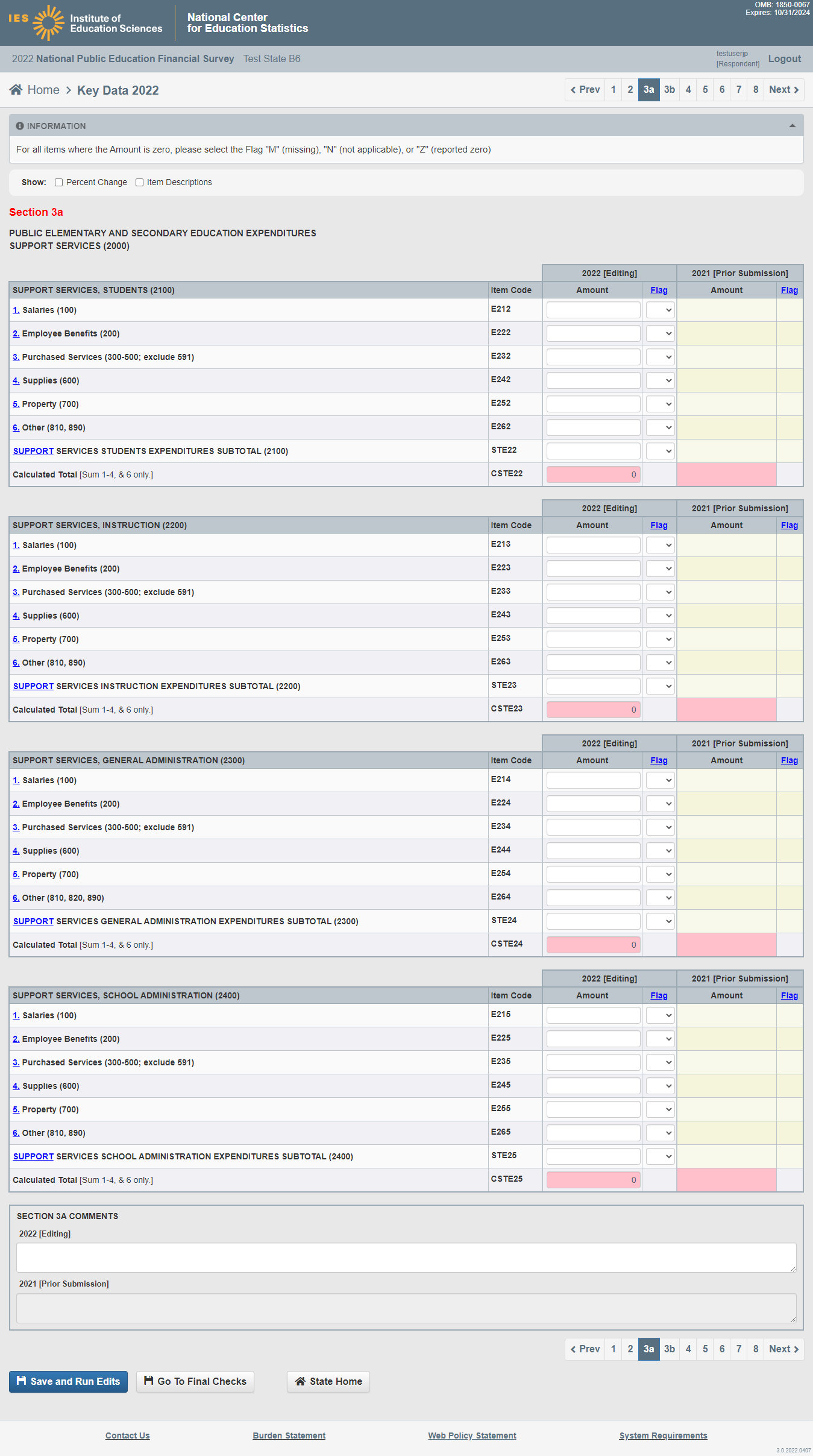

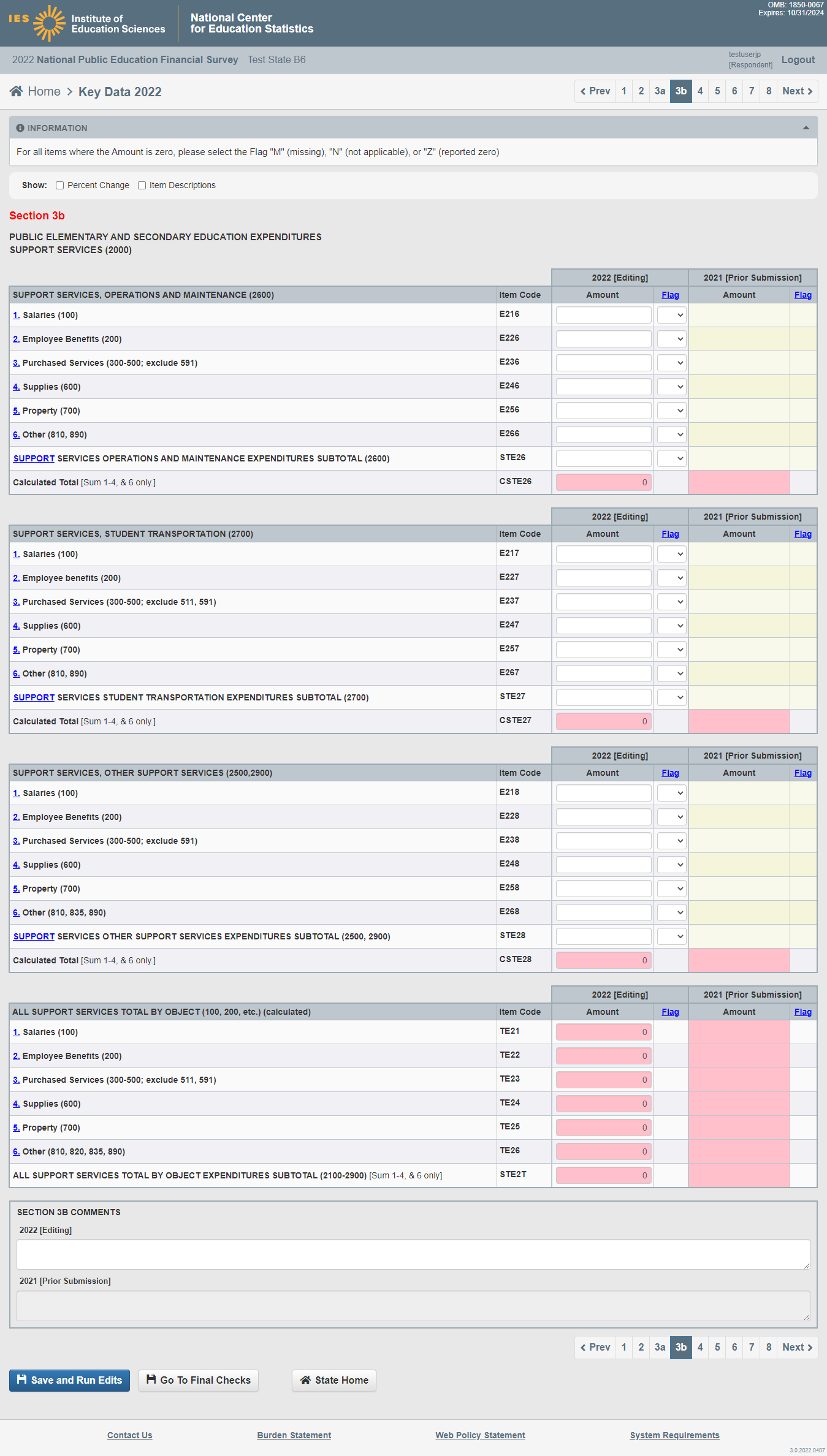

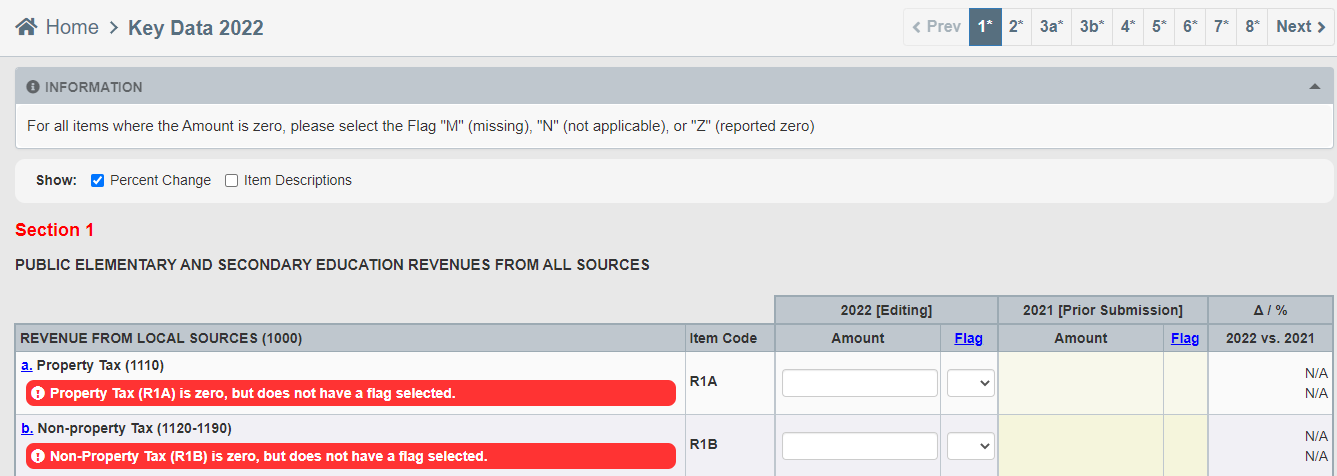

NPEFS “key data” form

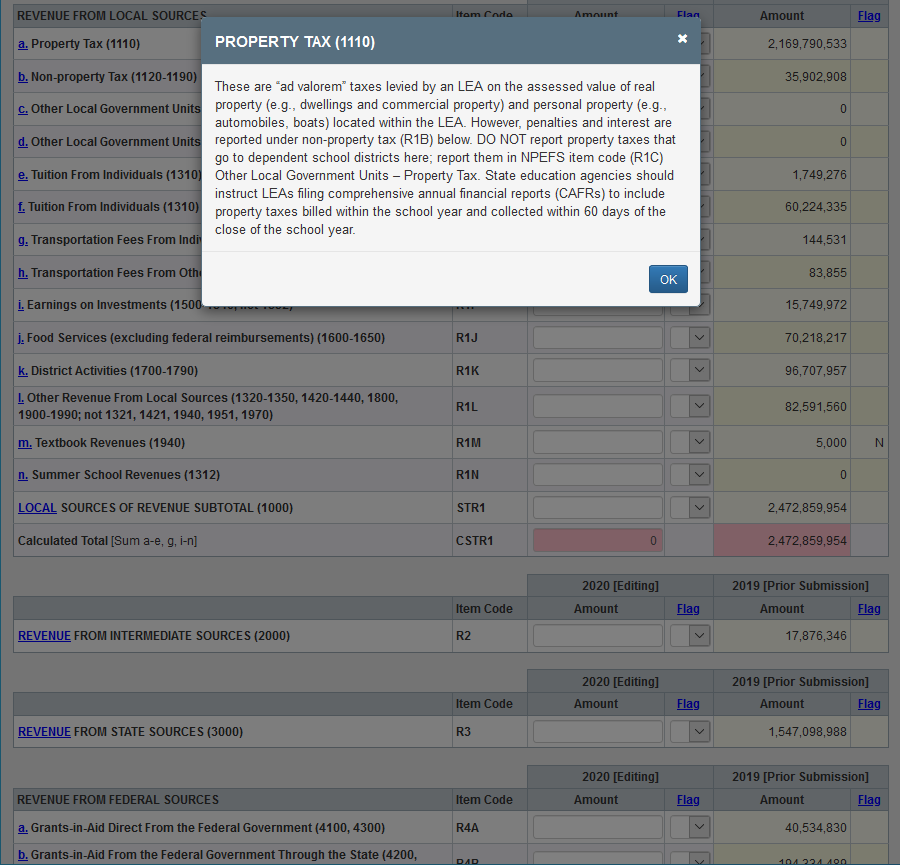

The web application contains help text for each data item and data edit checks.

![]()

Item help – opens a popup specific to the item that was clicked.

Data

edit checks – the

edit appears underneath the item which has been flagged. Edit checks

are documented in the NPEFS Web Application User Guide.

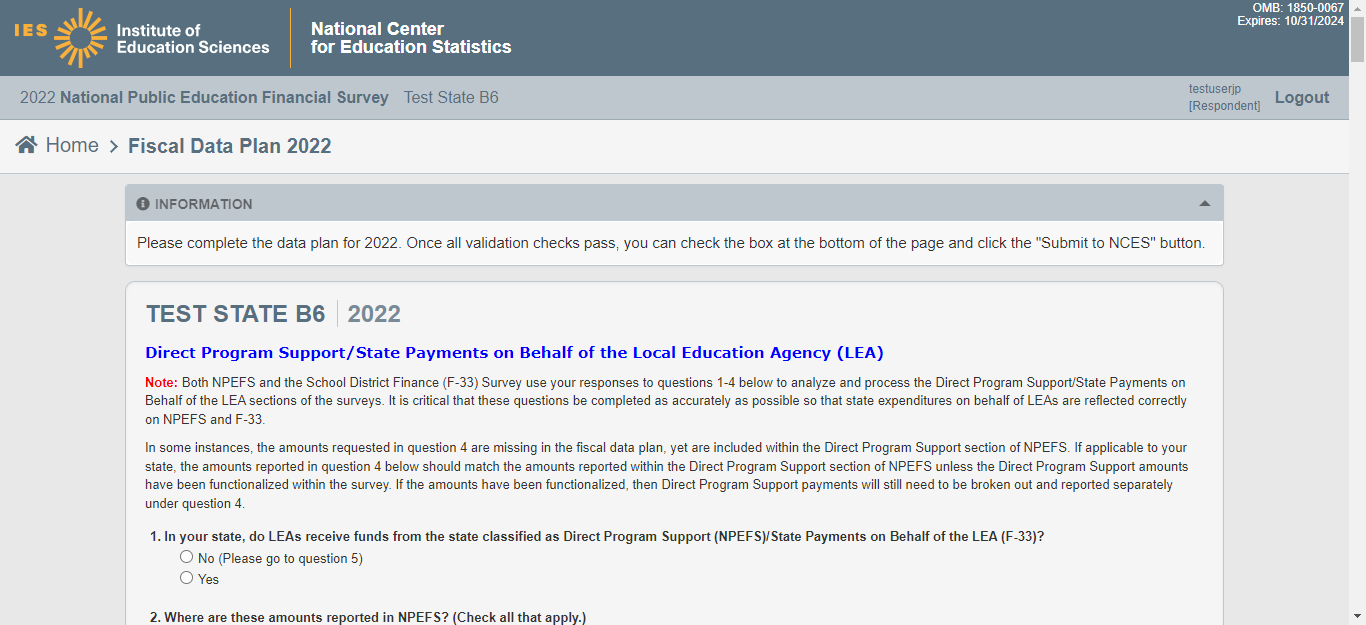

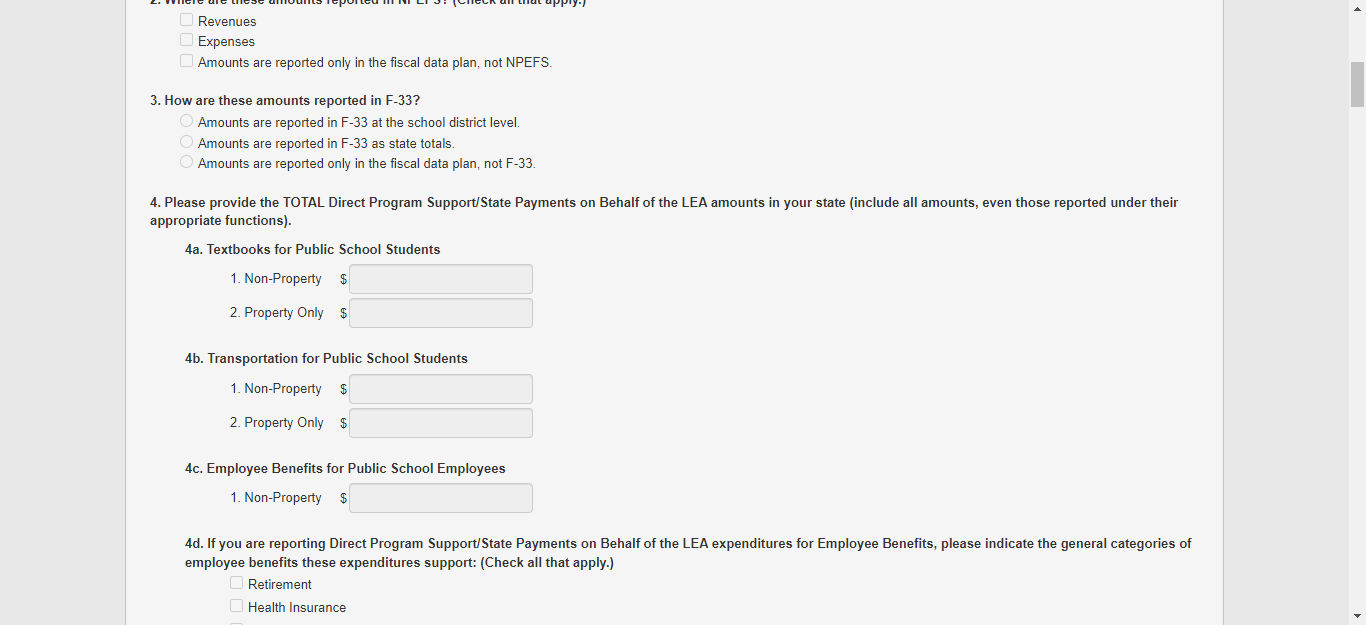

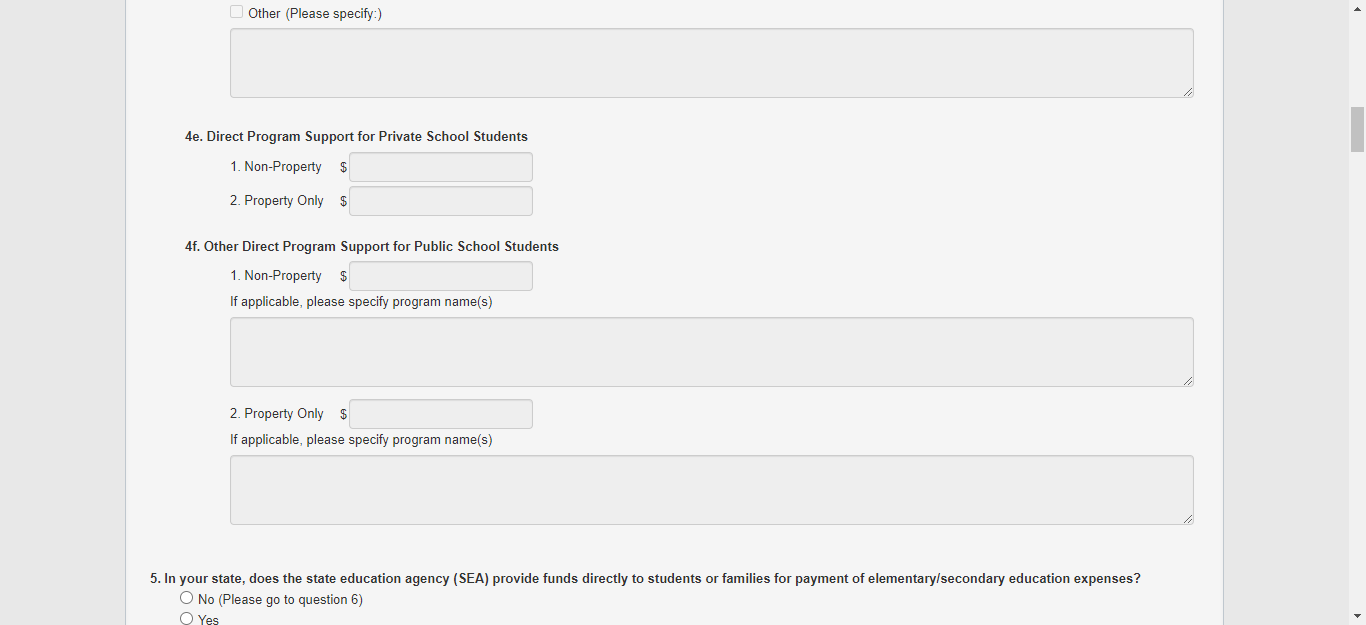

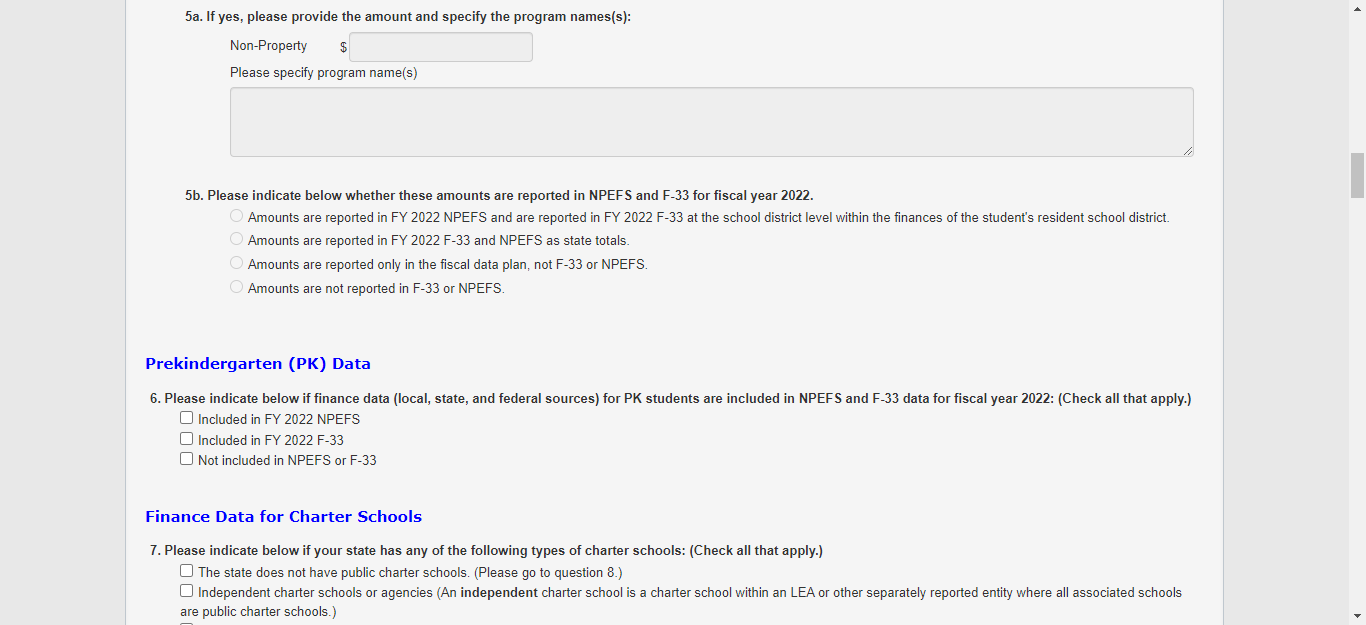

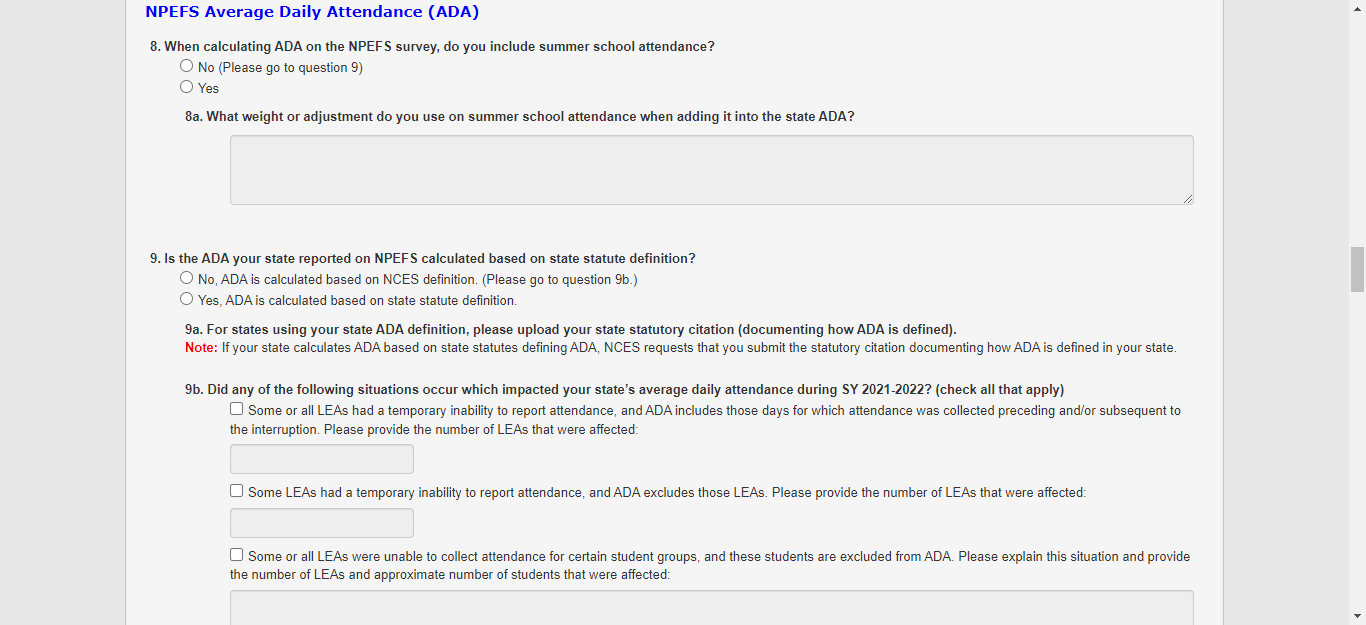

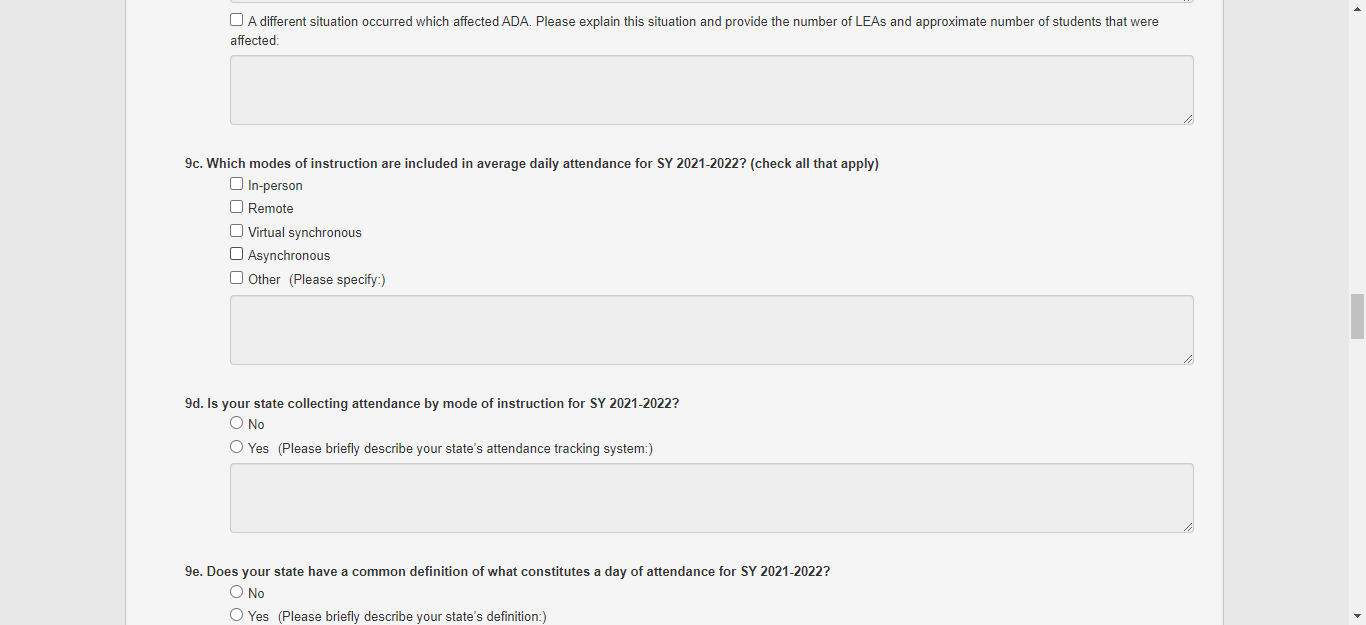

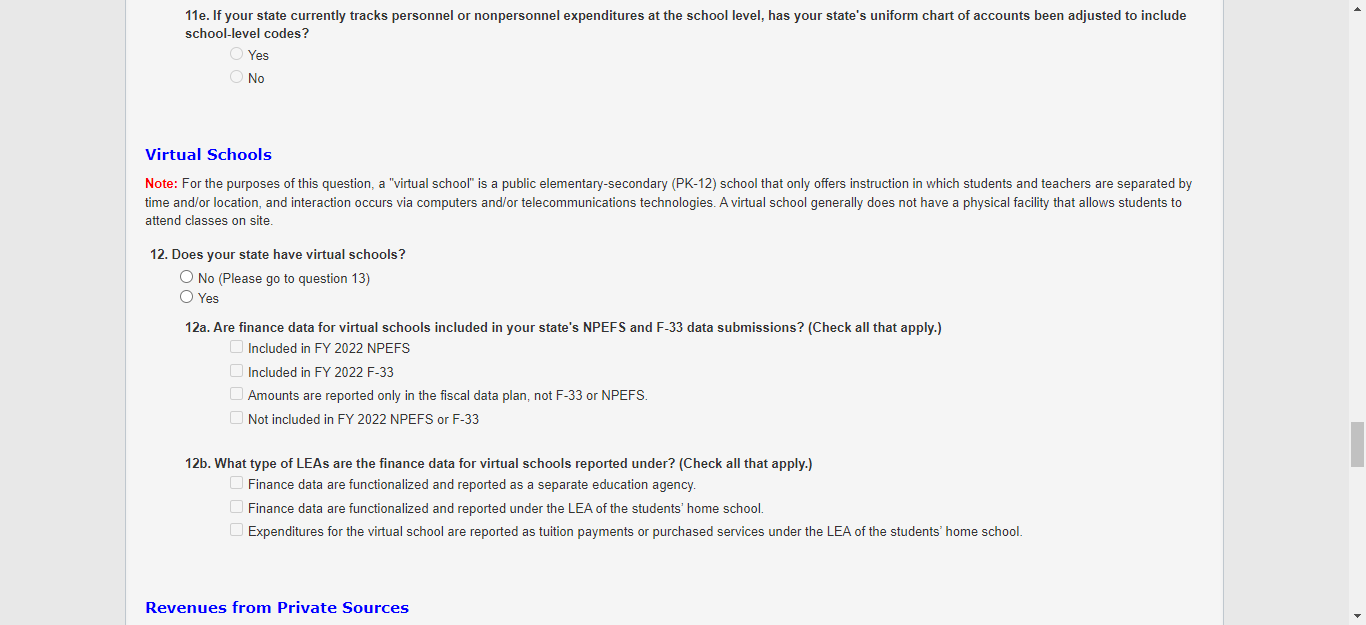

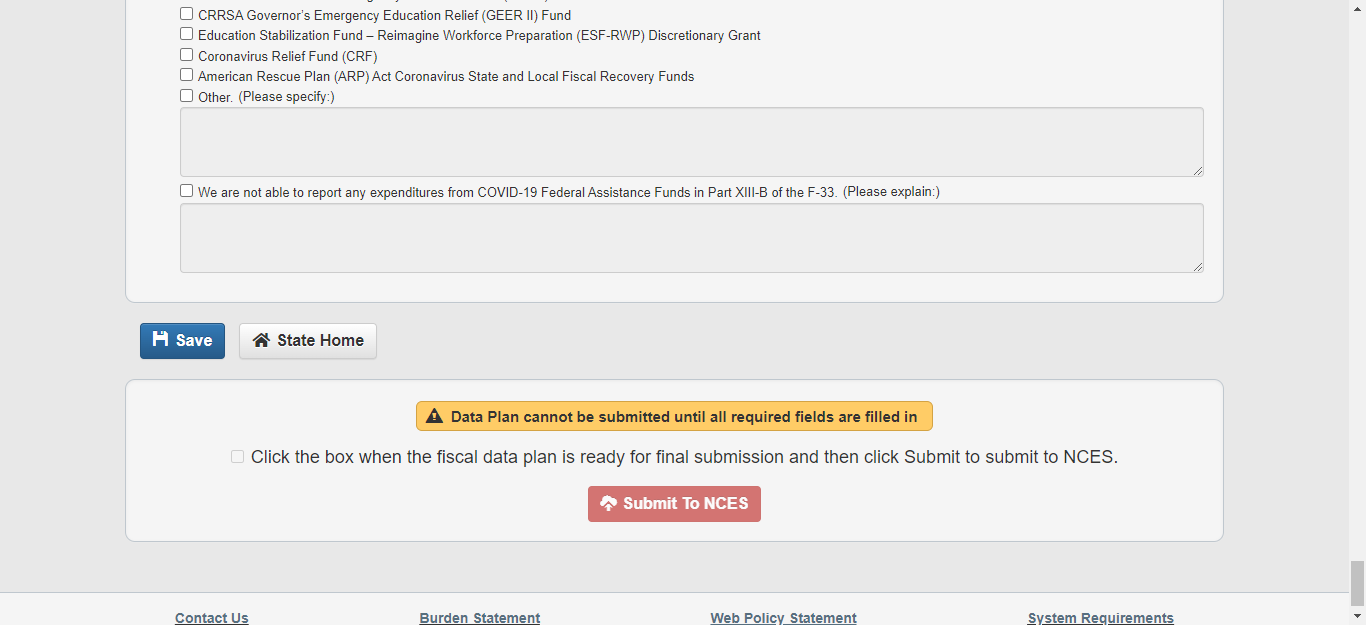

Fiscal data plan – will automatically skip items that the respondent does not need to answer based on previous responses. Includes item validation for required items.

![]()

![]()

Item Help Text Available Within the Web Application

R1A - Property Tax (1110): These are “ad valorem” taxes levied by an LEA on the assessed value of real property (e.g., dwellings and commercial property) and personal property (e.g., automobiles, boats) located within the LEA. However, penalties and interest are reported under non-property tax (R1B) below. DO NOT report property taxes that go to dependent school districts here; report them in NPEFS item code (R1C) Other Local Government Units – Property Tax. State education agencies should instruct LEAs filing comprehensive annual financial reports (CAFRs) to include property taxes billed within the school year and collected within 60 days of the close of the school year.

R1B - Non-Property Tax (1120-1190): These taxes include sales and use taxes imposed upon the sale and consumption of goods and services; income taxes (1130) levied on individuals, corporations, and unincorporated businesses; penalties and interest (1140) on late and delinquent taxes; and “other taxes,” such as, revenue raised through licenses and permits. DO NOT include non-property taxes that go to dependent school districts; report them in (R1D).

R1C - Other Local Government Units Property Tax (1210): This category is used to report property taxes raised by a unit of government for use by a dependent school district. DO NOT include penalties and interest here.

R1D - Other Local Government Units Non-Property Tax (1220-1290): This category is used to report non-property taxes raised by a governmental unit for use by a dependent school district. These taxes include sales and use taxes (1220); income taxes (1230) on individuals, corporations, and unincorporated businesses; penalties and interest (1240) on late or delinquent taxes; revenue in lieu of taxes (1280); and “other taxes” (1290).

R1E - Tuition from Individuals (1310): Tuition paid by an individual to attend school in an LEA other than the one in which he or she resides.

R1F - Tuition from Other LEAs within the State (1321): Tuition from one LEA to another within the same state for educating students (e.g., an LEA receives tuition from another LEA to provide a special program for a student that is not available in the LEA where the student resides). (NOTE: Tuition from LEAs outside the state should be reported in Other Revenue from Local Sources.)

R1G - Transportation Fees from Individuals (1410): Fees paid by students to be transported to school. Such students usually reside outside the zone of free public school busing established by a school district. Fees paid by students for transportation on school field trips should also be included.

R1H - Transportation Fees from Other LEAs Within the State (1421): Transportation fees received from another LEA within a state for transporting students. NOTE: Transportation fees from other LEAs outside the state (1430) and from “other sources” (1440) are included in Other Revenues from Local Sources (R1L) in Section 1 of the survey.

R1I - Earnings on Investments (1500-1540; exclude 1532): Include interest (1510) and dividends (1520) on investments; gains or losses from the sale of stocks or bonds (1530) (gains from the sale of U.S. treasury bills represent interest income and should be recorded under 1510); and earnings from investments in real property (1540), including rentals and use charges. Unrealized gains or losses on investments (1532) should not be included in the data reported on NPEFS survey.

R1J - Food Services (excluding federal reimbursements) (1600-1650): Include revenue from the daily sales of school lunch, breakfast, and milk programs to students and staff. These programs are considered reimbursable by the U.S. Department of Agriculture. These programs include the National School Lunch Program (1611), the School Breakfast Program (1612), and the Special Milk Program (1613).

R1K - District Activities (1700-1790): Revenue from cocurricular and extracurricular activities controlled and administered by school districts. These include: Admissions fees (1710); Fees from school-sponsored activities such as concerts or football games; Fees from student- sponsored bookstores (1720); Dues and fees (1730); Fees for student membership in school clubs and organizations fees (1740); Fees for goods and services such as towels, lockers, and equipment; and “other student activity income” (1790). Student transportation fees are reported in the appropriate account under Transportation Fees (1410). Only revenues that are under the control of LEAs should be reported here. Those revenues that belong to the students do not need to be reported, as long as the expenditures from those funds are not reported on NPEFS.

R1L - Other Revenue from Local Sources (1320-1350, 1420-1440, 1800, 1900-1990; not 1321, 1421, 1940, 1951, 1970): This category includes revenue from local sources not included in earlier accounts. These revenues include tuition from other government sources besides school districts (1322); tuition from other LEAs outside the state (1330); tuition from other sources (1340); transportation fees from other government sources besides school districts (1422); transportation fees from other LEAs outside the state (1430); transportation fees from other sources (1440); revenues from community services activities (1800), operated by an LEA as a community service (e.g., swimming pool, child care program); revenues from the rental (1910) of real or personal property owned by the school (however, the rental of property held for income purposes (1540) should be reported under Earnings on Investment); contributions and donations (1920) from private philanthropic foundations, organizations or individuals; gains or losses on the sale of fixed assets of proprietary funds (1930) (gains or losses on the sale of nonproprietary funds (5300) should be reported outside of local revenues as Other Sources of Revenue); revenue from services provided to other LEAs (1950), excluding revenue from LEAs within the state (1951); revenue from services provided to other local governmental units (1960); refund of prior year’s expenditures (1980); and miscellaneous local revenue not reported elsewhere (1990).

R1M - Textbook Revenues (1940): Revenue from the sale (1941) and rental (1942) of textbooks.

R1N - Summer School Revenues (1312): Include tuition, fees, and charges paid by students to attend summer school programs.

STR1 - LOCAL SOURCES OF REVENUE SUBTOTAL (1000): The sum of revenue from local sources, excluding tuition from other LEAs within the State (1320) and transportation fees from other LEAs within the State (1420).

R2 - REVENUE FROM INTERMEDIATE SOURCES: Include grants from an intermediate unit to a local education agency. Grants may be unrestricted (2100) or restricted to a categorical or specific purpose (2200). Include revenues received from the intermediate unit in lieu of taxes that the LEA would have received had its property or other tax base been subject to taxation (2800). Include commitments or payments made by an intermediate unit for the benefit of an LEA including contributions of equipment and supplies or payments made for, or on behalf of, an LEA to a pension fund for LEA employees (3900).

R3 - REVENUE FROM STATE SOURCES (3000): Include grants from a state agency to a local education agency. Grants may be unrestricted (3100) or restricted (3200). Include revenues received from a state in lieu of taxes that the LEA would have received had its property or other tax base been subject to taxation (3800). Include commitments or payments made by the state for the benefit of an LEA including contributions of equipment and supplies or payments made for, or on behalf, of an LEA to a pension fund for LEA employees (3900).

R4A - Grants-in-Aid Direct from the Federal Government (4100, 4300): Federal grants provided directly to a local education agency that can be used, without restriction, for any legal purpose desired by the LEA (4100). Federal grants provided directly to an LEA that must be used for a “categorical” or specific purpose (4300).

R4B - Grants-in-Aid from the Federal Government through the State (4200, 4500): Federal grants provided to a local education agency through the state that can be used, without restriction, for any legal purpose desired by the LEA (4200). Federal grants provided to a local education agency through the state that must be used for a “categorical” or specific purpose (4500). Include Medicaid reimbursements here. Revenue received through the Title I program should be reported here.

R4C - Grants-in-Aid from the Federal Government through Other Intermediate Agencies (4700): Federal revenue provided to a local education agency through an intermediate unit.

R4D - Other Revenue from Federal Sources (4800, 4900): Federal commitments or payments made out of general revenues to an LEA in lieu of taxes it would have had to pay had federal property or other tax base been subject to taxation by the LEA on the same basis as privately owned property or other tax base (4800). This revenue includes payments in lieu of taxes for privately owned property that is not subject to taxation on the same basis as other privately owned property because of action by the federal government. This category also includes other federal commitments or payments for the benefit of an LEA and contributions of equipment or supplies. Such revenue includes federal contributions of fixed assets and donations of food to an LEA (commodities) (4900).

STR4 - Federal Sources of Revenue Subtotal (4000): The sum of revenue from federal sources (R4A-R4D).

R5 - OTHER SOURCES OF REVENUE (5000, 6000): Include bond principal and premiums (5100). Accrued interest realized from the sale of bonds should be included when permitted by state law. Include amounts available from the sale of school property or compensation for the loss of fixed assets (5300). Report gains or losses from proprietary funds (1930) here; report these in Other Revenue from Local Sources (R1L) instead. Also include interfund transfers (5200), loan proceeds (5400), capital lease proceeds (5500), other long-term debt proceeds (5600), capital contributions (6100), amortization of premium on issuance of bonds (6200), special items (6300), and extraordinary items (6400).

TR - Total Revenue: The sum of revenue contributions emerging from local, intermediate, state, and federal sources. Other sources of revenue (5000, 6000) are not included.

E11 - Salaries (100): Include gross salary of those involved in instruction while on the payroll of the LEA. Instructional staff includes regular and part-time teachers, teachers' aides, homebound teachers, hospital-based teachers, substitute teachers (including permanent substitute teachers, teachers on sabbatical leave, and classroom assistants of any type who assist in the instructional process, including clerks and graders. Report supplemental amounts for additional duties such as coaching or supervising extracurricular activities, bus supervision, and summer school teaching. DO NOT include salaries or other expenditures for non-teaching staff that perform duties to which teachers may be assigned but that do not include instruction such as detention or lunch supervision.

E12 - Employee Benefits (200): Include amounts paid by the LEA on behalf of employees. Examples are group insurance, social security contributions, retirement contributions, tuition reimbursement, unemployment compensation, workers' compensation, and other employee benefits such as unused sick leave.

E13 - Purchased Services (300-500; exclude 560, 591): Include expenditures for purchased services related to providing instruction to students. Include computer-assisted instructional (CAI) expenditures, travel for instructional staff, and per diem expenses. Exclude tuition (560). Exclude services purchased from another school district or service agency (591) when those services are included in the appropriate expenditure categories.

E14 - Tuition and Voucher Payments Outside the State, to Private Schools, Individuals, and Other (562, 563, 566, 568, 569): Include amounts for tuition expenditures when the tuition is paid by an individual to attend elementary and secondary school (grades pre-K through 12) in an LEA other than the one in which he or she resides. Include tuition to other LEAs outside the State and tuition to private schools (in-state and out-of-state) for students who are funded by and/or the responsibility of a public LEA or the SEA, and other tuition such as state schools for the blind.

E15 - Tuition and Voucher Payments to Other LEAs and Charter Schools within the State (561, 564, 567): This category consists ONLY of tuition paid from one LEA to another within the same state for educating students (e.g. an LEA pays tuition to another LEA to provide a student a special program that is not available in the LEA where the student resides). Include payments to charter schools in the state.

E16 - Supplies (600): Include textbooks for public school children. Include amounts paid for items that are consumed, worn out, or have deteriorated through use. Examples include classroom teaching supplies, audiovisual supplies, books, and periodicals. Do not include energy expenditures.

E17 - Property (700): Include tangible property of a more or less permanent nature, other than land or buildings or improvements thereon. Examples are machinery, tools, trucks, cars, furniture, and furnishings.

E18 - Other (810, 890): Include dues and fees paid by LEAs on behalf of instructional staff for membership in professional or other organizations. Include miscellaneous expenditures not properly classified in one of the objects included above.

STE1 - Instruction Expenditures Subtotal (1000): Sum of current operation expenditures for instruction. Include expenditures for activities dealing with the interaction of teachers and students in the classroom, home, or hospital for regular elementary and secondary education programs (prek-12), special education, vocational education, cocurricular activities and athletics. Expenditures for support for nonpublic school students, adult/continuing education, community/junior colleges, and community service programs, should be reported in Section 6, Other Direct Costs. Do not include payments to other LEAs and charter schools within the state (561, 564, 567) or property (700) in this subtotal.

E11A - Salaries Paid to Teachers in Regular Education Programs (Objects 111 and 113; Program #100): Include base salaries paid to certified teachers and certified substitute teachers providing regular education instruction to students in prekindergarten through grade 12.

E11B - Salaries Paid to Special Education Teachers (Objects 111 and 113; Program #200): Include base salaries paid to certified teachers and certified substitute teachers providing instruction to students with special needs, including mental retardation, orthopedic impairment, emotional disturbance, developmental delay, specific learning disability, hearing impairment, etc.

E11C - Salaries Paid to Vocational Education Teachers (Objects 111 and 113; Program #300): Include base salaries paid to certified teachers and certified substitute teachers providing instruction to students in developing knowledge, skills, and attitudes needed for employment.

E11D - Salaries Paid to Teachers in Other Programs Providing Instruction to Students in Grades Pre-kindergarten Through Grade 12 and Un-graded Students (Objects 111 and 113; Programs #400 and #900): Include base salaries paid to certified teachers and certified substitute teachers not included in the above programs (100-300). Include salaries for teachers in programs such as: English for speakers of other languages, alternative education; gifted and talented; and cocurricular and extracurricular programs.

E2 - Textbook Expenditures for Classroom Instruction (Object 640): Exclude expenditures for library books.

E212 - Salaries (100): Include gross salary while on the payroll of the LEA. Include salaries for staff whose activities support and assist students by providing services in attendance, social work, counseling, guidance, psychology, health, hearing, speech, physical therapy and occupational therapy.

E222 - Employee Benefits (200): Include amounts paid by the LEA on behalf of employees. Examples are group insurance, social security contributions, tuition reimbursement, unemployment compensation, workers' compensation, and such other employee benefits as unused sick leave. Include only staff in attendance and social work services, guidance, health, speech pathology, and audiology.

E232 - Purchased Services (300-500; exclude 591): Include the services of medical doctors, social workers, psychologists, psychiatrists, audiologists, and other consultants providing for students' needs when these services are purchased from outside entities. Travel for these staff is also included. Exclude services purchased from another school district or service agency (591) when those services are included in the appropriate expenditure categories.

E242 - Supplies (600): Include expenditures for supplies related to activities designed to assess and improve the well-being of students. Include amounts paid for items that are consumed, worn out, or deteriorated through use. Examples are attendance supplies, medical supplies, films, tapes, paper supplies, books, and periodicals.

E252 - Property (700): Include expenditures for property related to activities designed to assess and improve the well-being of students. Examples are machinery, tools, trucks, cars, furniture, and furnishings. Include expenditures for furniture and fixtures, as well as desks, file cabinets, typewriters, duplicating machines, computers, and audiovisual equipment.

E262 - Other (810, 890): Include miscellaneous expenditures for goods and services not mentioned above, such as staff membership fees.

STE22 - Support Services Students Expenditures Subtotal (2100): Includes expenditures for administrative, guidance, health, and logistical support that enhance instruction. Include attendance, social work, student accounting, counseling, student appraisal, information, record maintenance, and placement services. Also include medical, dental, nursing, psychological, and speech services. Sum of Student Support Services (E212, E222, E232, E242, E262), does not include E252 Property (700).

E213 - Salaries (100): Include gross salary while on the payroll of the LEA for activities associated with assisting the instructional staff with both the content and process of providing learning experiences for students. Staff include supervisors of instruction (not department chairmen), curriculum coordinators and in-service training staff, school library staff, audiovisual staff, educational television staff, and staff engaged in the development of computer-assisted instruction.

E223 - Employee Benefits (200): Include amounts paid by the LEA on behalf of employees. Examples are group insurance, social security contributions, tuition reimbursement, unemployment compensation, workmen's compensation, and such other employee benefits as unused sick leave. Include only supervisors of instruction (not department chairmen), curriculum coordinators and in-service training staff, school library staff, audiovisual staff, educational television staff, and staff engaged in the development of computer-assisted instruction.

E233 - Purchased Services (300-500; exclude 591): Include expenditures for purchased services related to the supervision of instruction, curriculum development, instructional staff training, academic assessment, and media, library, and instruction-related technology services. Travel for these staff is also included. Exclude services purchased from another school district or service agency (591) when those services are included in the appropriate expenditure categories.

E243 - Supplies (600): Report expenditures for supplies related to the supervision of instruction service improvements, curriculum development, instructional staff training, academic assessment, and media, library, and instruction-related technology services. Include amounts paid for items that are consumed, worn out, or deteriorated through use. Examples are films, tapes, paper supplies, books, and periodicals.

E253 - Property (700): Include expenditures for property related to activities associated with assisting the instructional staff support. Include expenditures for furniture and fixtures, as well as desks, file cabinets, typewriters, duplicating machines, computers, and audiovisual equipment.

E263 - Other (810, 890): Include miscellaneous expenditures for goods and services not mentioned above, such as staff membership fees.

STE23 - Support Services Instruction Expenditures Subtotal (2200): Includes expenditures for supervision of instruction service improvements, curriculum development, instructional staff training, academic assessment, and media, library, and instruction-related technology services. Sum of Instructional Staff Support (E213, E223, E233, E243, E263), does not include E253 Property (700).

E214 - Salaries (100): Include gross salary while on the payroll of the LEA for activities concerned with establishing and administering policy for operating the LEA. Include only board of education staff, board secretary/clerk staff relations and negotiations staff, the superintendent's staff, and the superintendent.

E224 - Employee Benefits (200): Include amounts paid by the LEA on behalf of employees. Examples are group insurance, social security contributions, tuition reimbursement, unemployment compensation, workmen's compensation, and such other employee benefits as unused sick leave. Include only board of education staff, board secretary/clerk staff relations and negotiations staff, the superintendent's staff, and the superintendent.

E234 - Purchased Services (300-500; exclude 591): Include expenditures for activities concerned with establishing and administering policy for operating the LEA. Include the services of legal firms, election services, and staff relations and negotiations services. Travel for these staff is also included. Exclude services purchased from another school district or service agency (591) when those services are included in the appropriate expenditure categories.

E244 - Supplies (600): Report expenditures for supplies related to expenditures for board of education and executive administration (office of the superintendent) services. Include amounts paid for items that are consumed, worn out, or deteriorated through use. Examples are films, tapes, paper supplies, books, and periodicals.

E254 - Property (700): Include expenditures for activities concerned with establishing and administering policy for operating the LEA. Include expenditures for furniture and fixtures, as well as desks, file cabinets, typewriters, duplicating machines, computers, and audiovisual equipment.

E264 - Other (810, 820, 890): Include miscellaneous expenditures for goods and services not mentioned above, such as staff membership fees. Include amounts paid as a result of a court-related judgement against the school district.

STE24 - Support Services Expenditures General Administration Subtotal (2300): Includes expenditures for board of education and executive administration (office of the superintendent) services. Sum of General Administration Support (E214, E224, E234, E244, E264), does not include E254 Property (700).

E215 - Salaries (100): Include gross salary while on the payroll of the LEA. Include only the staff of the office of the principal (including vice principals and other assistants), full-time (non-teaching) department chairpersons, and the principal.

E225 - Employee Benefits (200): Include amounts paid by the LEA on behalf of employees. Examples are group insurance, social security contributions, tuition reimbursement, unemployment compensation, workmen's compensation, and such other employee benefits as unused sick leave. Include only the staff of the office of the principal (including vice principals and other assistants), department chairpersons, and the principal.

E235 - Purchased Services (300-500; exclude 591): Include the services of consultants, school scheduling firms, and administrative staff in-service training. Exclude services purchased from another school district or service agency (591) when those services are included in the appropriate expenditure categories.

E245 - Supplies (600): Report expenditures for supplies related to activities concerned with overall administrative responsibility for a school. Include amounts paid for items that are consumed, worn out, or deteriorated through use.

E255 - Property (700): Include expenditures for property related to activities that are concerned with overall administrative responsibility for a school. Include expenditures for furniture and fixtures, as well as desks, file cabinets, computers, vehicles, and machinery.

E265 - Other (810, 890): Include miscellaneous expenditures for goods and services not mentioned above, such as staff membership fees.

STE25 - Support Services School Administration Expenditures Subtotal (2400): Includes expenditures for activities concerned with overall administrative responsibility for a school. Include activities performed by the principal and office of the principal staff. Sum of School Administration Support (E215, E225, E235, E245, E265), does not include E255 Property (700).

E216 - Salaries (100): Include gross salary while on the payroll of the LEA. Include only operations and maintenance staff (heating, lighting, ventilation, repairing and replacing facilities and equipment), care and upkeep of grounds and equipment staff, vehicle operations and maintenance staff (exclude student transportation staff), and security and safety services staff.

E226 - Employee Benefits (200): Include amounts paid by the LEA on behalf of employees. Examples are group insurance, social security contributions, tuition reimbursement, unemployment compensation, workmen's compensation, and such other employee benefits as unused sick leave. Include only operations and maintenance staff (heating, lighting, ventilation, repairing and replacing facilities and equipment), care and upkeep of grounds and equipment staff, vehicle operations and maintenance staff (exclude student transportation staff), and security and safety services staff.

E236 - Purchased Services (300-500; exclude 591): Include the services of maintenance companies, security and safety services, equipment repair companies, and grounds upkeep expenditures. Exclude services purchased from another school district or service agency (591) when those services are included in the appropriate expenditure categories.

E246 - Supplies (600): Report expenditures for supplies related to buildings services (heating, electricity, air conditioning, property insurance), care and upkeep of grounds and equipment, vehicle operation and maintenance (other than student transportation vehicles), and security services. Include amounts paid for items that are consumed, worn out, or deteriorated through use. Examples are books and periodicals for use by operations and maintenance staff, energy expenditures, services received from utility companies, and routine auto maintenance.

E256 - Property (700): Include expenditures for property related to keeping the physical plant open, comfortable, and safe for use, and keeping the grounds, buildings, and equipment in effective working condition and state of repair.

E266 - Other (810, 890): Include miscellaneous expenditures for goods and services related to buildings services (heating, electricity, air conditioning, property insurance), care and upkeep of grounds and equipment, vehicle operation and maintenance (other than student transportation vehicles), and security not mentioned in any other operation and maintenance support service object.

STE26 - Support Services Operations and Maintenance Expenditures Subtotal (2600): Includes expenditures for buildings services (heating, electricity, air conditioning, property insurance), care and upkeep of grounds and equipment, vehicle operation and maintenance (other than student transportation vehicles), and security services. Sum of Operation & Maintenance Support (E216, E226, E236, E246, E266), does not include E256 Property (700).

E217 - Salaries (100): Include gross salary only for staff on the payroll of the LEA and involved in activities concerned with conveying students to and from school, as provided by state and federal law.

E227 - Employee benefits (200): Include amounts paid by the LEA on behalf of employees. Examples are group insurance, social security contributions, tuition reimbursement, unemployment compensation, workmen's compensation, and such other employee benefits as unused sick leave. Include only student transportation staff (vehicle operation, monitoring of students, and vehicle maintenance services).

E237 - Purchased Services (300-500; exclude 511, 591): Include the services of student busing companies and handicapped transportation services. Exclude services purchased from another school district or service agency (511, 591) when those services are included in the appropriate expenditure categories.

E247 - Supplies (600): Report expenditures for supplies related to vehicle operation, monitoring riders, and vehicle servicing and maintenance. Include amounts paid for items that are consumed, worn out, or deteriorated through use. Examples are parts and materials required for routine vehicle maintenance, energy supplies such as gasoline, and general supplies.

E257 - Property (700): Include expenditures for property related to activities that are concerned with conveying students to and from school, as provided by state and federal law.

E267 - Other (810, 890): Include miscellaneous expenditures for goods and services not mentioned above, such as staff membership fees.

STE27 - Support Services Student Transportation Expenditures Subtotal (2700): Includes expenditures for activities related to conveying students to and from school, as provided by state and federal law. Includes trips between home and school and trips to school activities. This includes expenditures for vehicle operation, monitoring riders, and vehicle servicing and maintenance. Expenditures for driver’s education programs should be included in Instruction (1000). Sum of Pupil Transportation Support (E217, E227, E237, E247, E267), does not include E257 Property (700).

E218 - Salaries (100): Include gross salary while on the payroll of the LEA. Central Services staff (2500) includes any fiscal services (budgeting, receiving and disbursing funds, payroll, internal auditing, and accounting), purchasing, warehousing, supply distribution, printing, publishing, and duplicating services. Other Support Services (2900) is designated for any other support staff not classified elsewhere.

E228 - Employee Benefits (200): Include amounts paid by the LEA on behalf of employees. Examples are group insurance, social security contributions, tuition reimbursement, unemployment compensation, workmen's compensation, and such other employee benefits as unused sick leave. Central Services staff (2500) includes any fiscal services staff, purchasing, warehousing, printing and duplicating staff, planning, research, development, and evaluation staff, public information staff, personnel staff, and any administrative technology staff. Other Support Services (2900) is designated for any other support staff not classified elsewhere.

E238 - Purchased Services (300-500; exclude 591): Include purchased business support services such as budgeting, payroll, financial accounting, internal auditing, purchasing, warehousing, printing and duplicating; purchased central support services such as planning, research, development, evaluations, and administrative technology services. Travel expenses for these staff are also included here. Exclude services purchased from another school district or service agency (591) when those services are included in the appropriate expenditure categories.

E248 - Supplies (600): Report expenditures for supplies related to other business support services (2500 and 2900). Include amounts paid for items that are consumed, worn out, or deteriorated through use. Examples are paper supplies, books, and periodicals.

E258 - Property (700): Include expenditures for property related to other business support services (2500 and 2900). Include expenditures for furniture and fixtures, as well as desks, file cabinets, computers, vehicles, and machinery.

E268 - Other (810, 835, 890): Include miscellaneous expenditures for goods and services not mentioned above, such as staff membership fees. Interest on current loans, repayable within one year of receiving the obligation, are classified as Fiscal Services – Receiving and Disbursing Funds Services (function 2510, object 835) and should be reported here.

STE28 - Support Services Other Support Services Expenditures Subtotal (2500,2900): Includes business support expenditures for fiscal services (budgeting, receiving and disbursing funds, payroll, internal auditing, and accounting), purchasing, warehousing, supply distribution, printing, publishing, and duplicating services. Also include central support expenditures for planning, research and development, evaluation, information, management services, and expenditures for other support services not classified elsewhere in the 2000 series. Sum of School Administration Support (E218, E228, E238, E248, E268), does not include E258 Property (700).

E3A11 - Salaries (100): Include gross salary while on the payroll of the LEA. Note that food services expenditures should be gross expenditures, even if substantially aided by federal nutrition programs. If food services are run as an enterprise operation in your state, enter amounts in 3100 and note practice in comments.

E3A12 - Employee Benefits (200): Include amounts paid by the LEA on behalf of employees. Examples are group insurance, social security contributions, tuition reimbursement, unemployment compensation, workmen's compensation, and such other employee benefits as unused sick leave.

E3A13 - Purchased Services (300-500; exclude 591): Include purchased food services such as those for a food service management company, meal vendors, and meal delivery services. Exclude services purchased from another school district or service agency (591) when those services are included in the appropriate expenditure categories.

E3A14 - Supplies (600): Include amounts paid for items that are consumed, worn out, or deteriorated through use; or items that lose their identity through fabrication or incorporation into different or more complex units or substances. Examples include food items, silverware, trays, napkins, and plates.

E3A2 - Property (700): Include expenditures for property related to food services. Examples include expenditures for ovens, dishwashers, and refrigerators.

E3A16 - Other (890): Include miscellaneous expenditures for goods and services not mentioned above.

E3A1 - Operation of Non-Instructional Food Services Operations Expenditures Subtotal (3100): Includes expenditures for activities that provide food to students and staff in a school or LEA. Note that food services expenditures should be gross expenditures, even if substantially aided by federal nutrition programs. If food services are run as an enterprise operation in your state, enter amounts in 3100 and note practice in comments. Sum of Food Services Expenditures (E3A11, E3A12, E3A13, E3A14, E3A16), do not include Property (700).

E3B11 - Salaries (100): Include gross salary while on the payroll of the LEA. Enterprise operations are activities that are financed by user charges (without government funds) similar to a private business. Include payments to the enterprise fund by a school system to cover deficit operations.

E3B12 - Employee Benefits (200): Include amounts paid by the LEA on behalf of employees.

E3B13 - Purchased Services (300-500; exclude 591): Include purchased enterprise operations such as preschool, computer services, and handicapped services. Exclude services purchased from another school district or service agency (591) when those services are included in the appropriate expenditure categories.

E3B14 - Supplies (600): Include amounts paid for items such as computer diskettes, laser toner, etc.

E3B2 - Property (700): Include expenditures for purchases of computers, modems, printers, etc.

E3B16 - Other (890): Include miscellaneous expenditures for goods and services not mentioned above.

E3B1 - Operation of Non-Instructional Enterprise Operations Services Expenditures Subtotal (3200): Includes expenditures for business-like activities (such as a bookstore) where the costs are recouped largely with user charges. Some LEAs may conduct fee-for-service activities to support other LEAs, such as instructional support, food service, and transportation. Expenditures for these activities should not be reported as Enterprise operations, but rather under the appropriate function. Sum of Enterprise Operations Expenditures (E3B11, E3B12, E3B13, E3B14, E3B16), do not include Property (700).

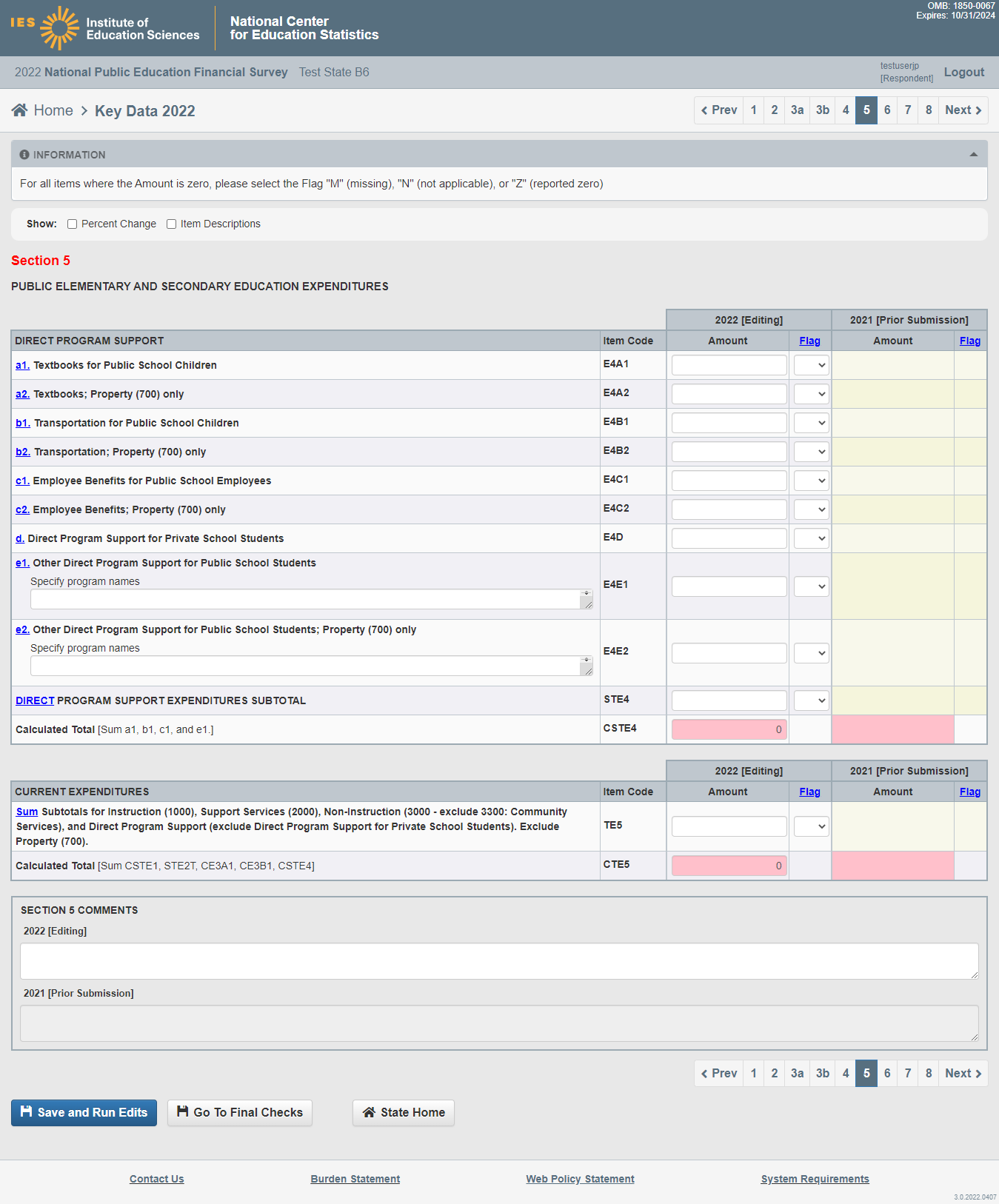

E4A1 - Textbooks for Public School Children: Include amounts paid by the state on behalf of LEAs for textbooks (object 640) that cannot be reported directly within the appropriate categories. Amounts reported in this item code will be distributed to Instruction, Supplies (E16) and Textbook Expenditures for Classroom Instruction (E2).

E4A2 - Textbooks; Property (700) only: Amounts reported in this item code will be distributed to Instruction, Property (E17).

E4B1 - Transportation for Public School Children: Include amounts paid by the state on behalf of LEAs for transportation of public school children (function 2700, objects 100-600 and 800) that cannot be reported directly within the appropriate categories. Amounts reported in this item code will be distributed among items under Support Services, Student Transportation: Salaries (E217), Employee Benefits (E227), Purchased Services (E237), Supplies (E247), Other (E267).

E4B2 - Transportation; Property (700) only: Include capitalized expenditures paid by the state on behalf of LEAs for transportation of public school children (function 2700, object 700) that cannot be reported directly within the appropriate categories. Amounts reported in this item code will be distributed to Support Services, Student Transportation, Property (E257).

E4C1 - Employees Benefits for Public School Employees: Include amounts paid by the state on behalf of LEAs for employee benefits (object 200) that cannot be reported directly within the appropriate categories. Amounts reported in this item code will be distributed to employee benefits within the following functions: Instruction (E12), Student support services (E222), Instructional support services (E223), General administration (E224), School administration (E225), Operations and maintenance (E226), Student transportation (E227), Support services other (E228), Food service operations (E3A12), and Enterprise operations (E3B12).

E4C2 - Employees Benefits; Property (700) only: Amounts reported in this item code will be distributed to property within the following functions: Instruction (E17), Student support services (E252), Instructional support services (E253), General administration (E254), School administration (E255), Operations and maintenance (E256), Student transportation (E257), Support services other (E258), Food service operations (E3A2), and Enterprise operations (E3B2).

E4D - Direct Program Support for Private School Students: Include expenditures paid by the state made for or on behalf of private school students that cannot be reported directly within the appropriate categories. Tuition payments for private school students should be reported in Tuition payments outside the state, to private schools, and other (E14). Other non-tuition state expenditures for non-public school programs may be reported in non-public school programs (E9A).

E4E1 - Other Direct Program Support for Public School Students: Amounts reported in this section will be distributed to all non-property items in the following functions: Instruction, Student support services, Instructional support services, General administration, School administration, Operations and maintenance, Student transportation, Support services other, Food service operations, and Enterprise operations. The names of the programs should be specified on the form.

E4E2 - Other Direct Program Support for Public School Students; Property (700) only: Amounts reported in this item code will be distributed to all property items in the following functions: Instruction, Student support services, Instructional support services, General administration, School administration, Operations and maintenance, Student transportation, Support services other, Food service operations, and Enterprise operations. Specify program name(s) in the box below.

STE4 - Direct Program Support Expenditures Subtotal: Do not include Direct Program Support for Private School Students (d1) or Property (700) in this subtotal. [Sum a, b, c, and e.]

TE5 - CURRENT EXPENDITURES: Current expenditures are comprised of expenditures for the day-to-day operation of schools and school districts for public elementary and secondary education. Include expenditures for staff salaries and benefits, supplies, and purchased services; instruction and support services (e.g., pupil support, school administration, etc.) expenditures that directly support public elementary-secondary education. Exclude expenditures associated with repaying debts and capital outlays (e.g., purchases of land, school construction, and equipment); programs outside the scope of public prekindergarten through grade 12 education, such as community services and adult education; payments to private schools and payments to charter schools outside of the school district. Current expenditures = Instruction expenditures (STE1) + Support Services expenditures (STE2T) + Food services operations expenditures (E3A1) + Enterprise operations expenditures (E3B1) + Direct Program Support (STE4) (excludes aid to private school students and property expenditures).

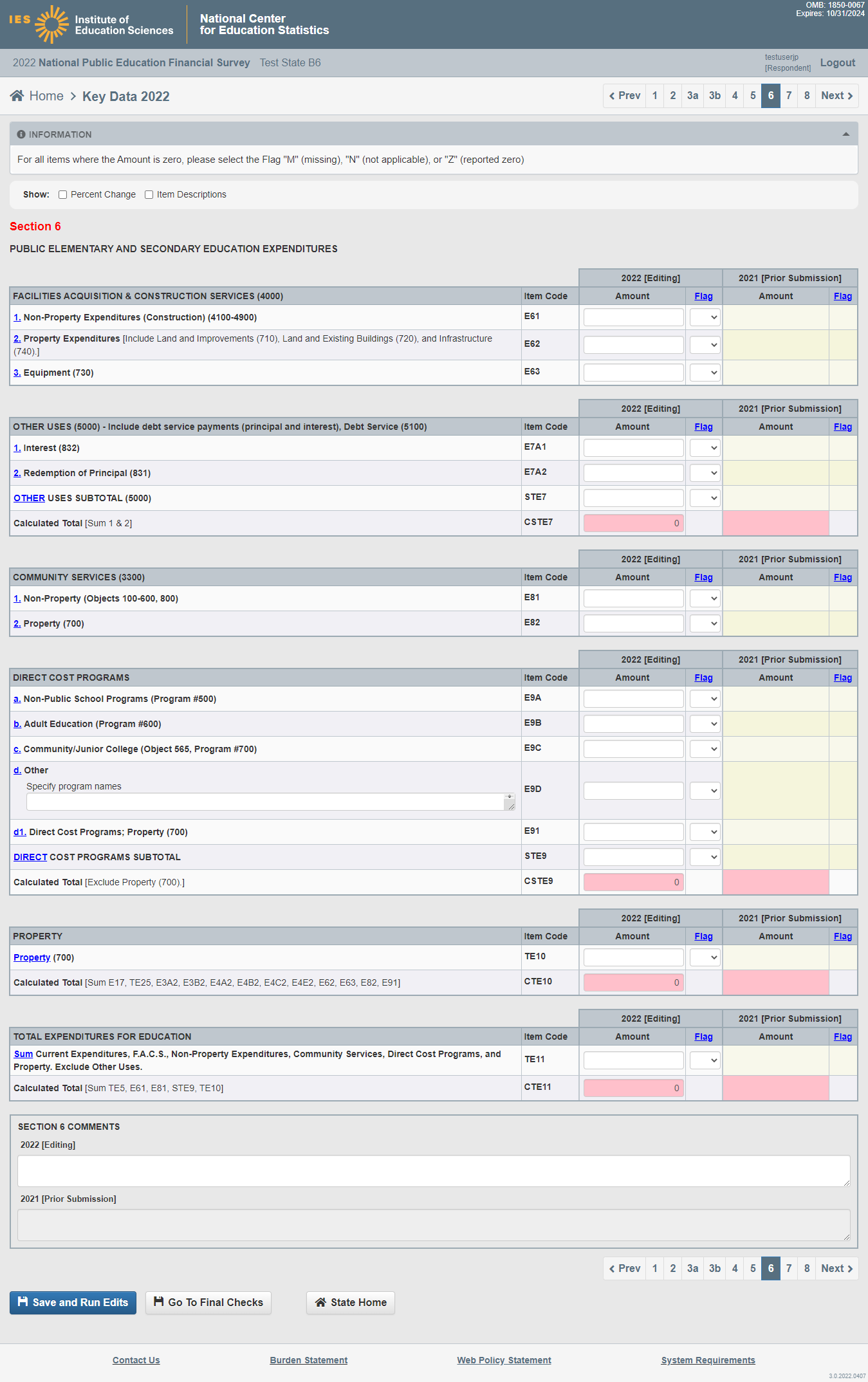

E61 - Non-Property Expenditures (Construction) (4100-4900): Report all construction costs associated with building schools and other structures required by local school districts. Include: All construction costs for new buildings, Expenditures for renovations, additions, or improvements to existing buildings if already acquired by the LEA, Expenditures on the materials used in construction, Expenditures for improvements to land and sites (after they are acquired by the LEA), Construction costs for temporary buildings and classrooms, Payments to contractors for construction and planning services, Expenditures for designing, blueprints, and other costs necessary for the construction of facilities, and Expenditures for wiring for Local Area Networks (LANs) and Internet. DO NOT include property expenditures. Expenditures for acquiring existing (already built) structures and for purchasing land should be reported under Property Expenditures (E62). Financing costs associated with facilities acquisition and construction should be reported under Other Uses, Debt Services.

E62 - Property Expenditures [Include Land and Improvements (710), Land and Existing Buildings (720), and Infrastructure (740)]: Report expenditures for the purchase of land, as well as expenditures for acquiring existing (already built) structures. Expenditures for improvements to land and infrastructure (streets, curbs, drains, etc.) should only be included here if they are special assessments against the LEA. Also, include the purchase of air rights, mineral rights, etc., if applicable. Construction expenditures should be reported under Non-Property (E61) expenditures; however, the purchase of existing structures should be reported here. DO NOT include expenditures for improving sites and adjacent ways after acquisition by an LEA here; such expenditures are classified as construction (450) or technical services (340) and should be reported under Non-Property (E61).

E63 - Equipment (730): Report expenditures for initial, additional, and replacement equipment including machinery, vehicles, and furniture and fixtures. Expenditures for the initial purchase of property items such as books for a newly constructed library or equipment for a newly constructed laboratory should be included here as well. Expenditures for the same items but for already existing structures should be reported as supplies (books) or property (lab equipment) under Instruction (1000) or Support Services (2000).

E7A1 - Interest (832): Include only interest paid on long-term debt service (obligations exceeding one year). Interest on current loans (repayable within one year of receiving the obligation) is charged to 2510 and should be reported under Other Support Services, Other (function 2500, object 800).

E7A2 - Redemption of Principal (831): Include only expenditures to retire bonds (including current and advance refundings) and long-term loans, including lease-purchase arrangements.

STE7 - Other Uses Subtotal (5000): Sum of E7A1 and E7A2.

E81 - Non-Property (Objects 100-600, 800): Community Services are activities that provide services to students, staff, or community participants. Examples include community swimming pools, recreation or transportation programs for the elderly, and child care centers. Include salaries (100), employee benefits (200), purchased services (300-500), supplies (600), and other expenditures (800).

E82 - Property (700): Includes expenditures for machinery, equipment, furniture, fixtures, and vehicles (700) related to community service activities.

E9A - Non-Public School Programs (Program #500): Report expenditures for services for students attending schools established by agencies other than states, subdivisions of states, or the federal government, which are usually supported primarily by other than public funds. The services consist of such activities as those involved in providing textbooks, instructional services, attendance and social work services, health services, and transportation services for nonpublic school students. Tuition payments to private schools should be reported in E14.

E9B - Adult Education (Program #600): Activities that develop knowledge and skills to meet the immediate and long-range educational objectives of adults who, having completed or interrupted formal schooling, have accepted adult roles and responsibilities. Adult basic education programs are included as well as career education. The activities may foster the development of fundamental learning skills, prepare students for postsecondary careers or education programs, upgrade occupational competence, prepare students for a new or different career, develop skills and appreciation for special interests, or enrich the aesthetic qualities of life.

E9C - Community College (Object 565, Program #700): Report expenditures for programs for students attending institutions of higher education that offer (in most cases) the first two years of college instruction. Institutions may also offer four-year programs. If an LEA is responsible for providing this program, all program costs should be reported here. If the LEA is not responsible for providing this program, the survey respondent should enter a zero. Report scholarships for tuition to a two or four year institution if those expenditures are within the administrative control of the school district.

E9D - Other: Report expenditures for additional Direct Cost Programs not included above. Specify program name(s) in the box below.

E91 - Direct Cost Programs; Property (700): Include equipment expenditures (property) from Nonpublic School Programs (E9A), Adult Education (E9B), Community Colleges (E9C), and Other Direct Cost Programs (E9D).

STE9 - Direct Cost Programs Subtotal: Sum of expenditures for Nonpublic School Programs (E9A), Adult Education (E9B), Community Colleges (E9C), and Other Direct Cost Programs (E9D). DO NOT include Property (Object 700; E91) in the subtotal.

TE10 - Property (700): Sum equipment (property) expenditures reported in Instruction, Support Services, Operation of Non-Instructional Services, Direct Program Support, Facilities Acquisition and Construction Services - Property and Equipment, Community Services and Direct Cost Programs.

TE11 - TOTAL EXPENDITURES FOR EDUCATION: Sum of Current Expenditures (including expenditures for Instruction, Support Services, Operation of Non-Instructional Services, and Direct Program Support), Non-Property Expenditures from Facilities Acquisition (4100-4900), Community Services (3300), Direct-Cost Programs, and Property (700). This total should include all expenditures for public elementary and secondary education in your state. To avoid double-counting, Other Uses (5000) are excluded.

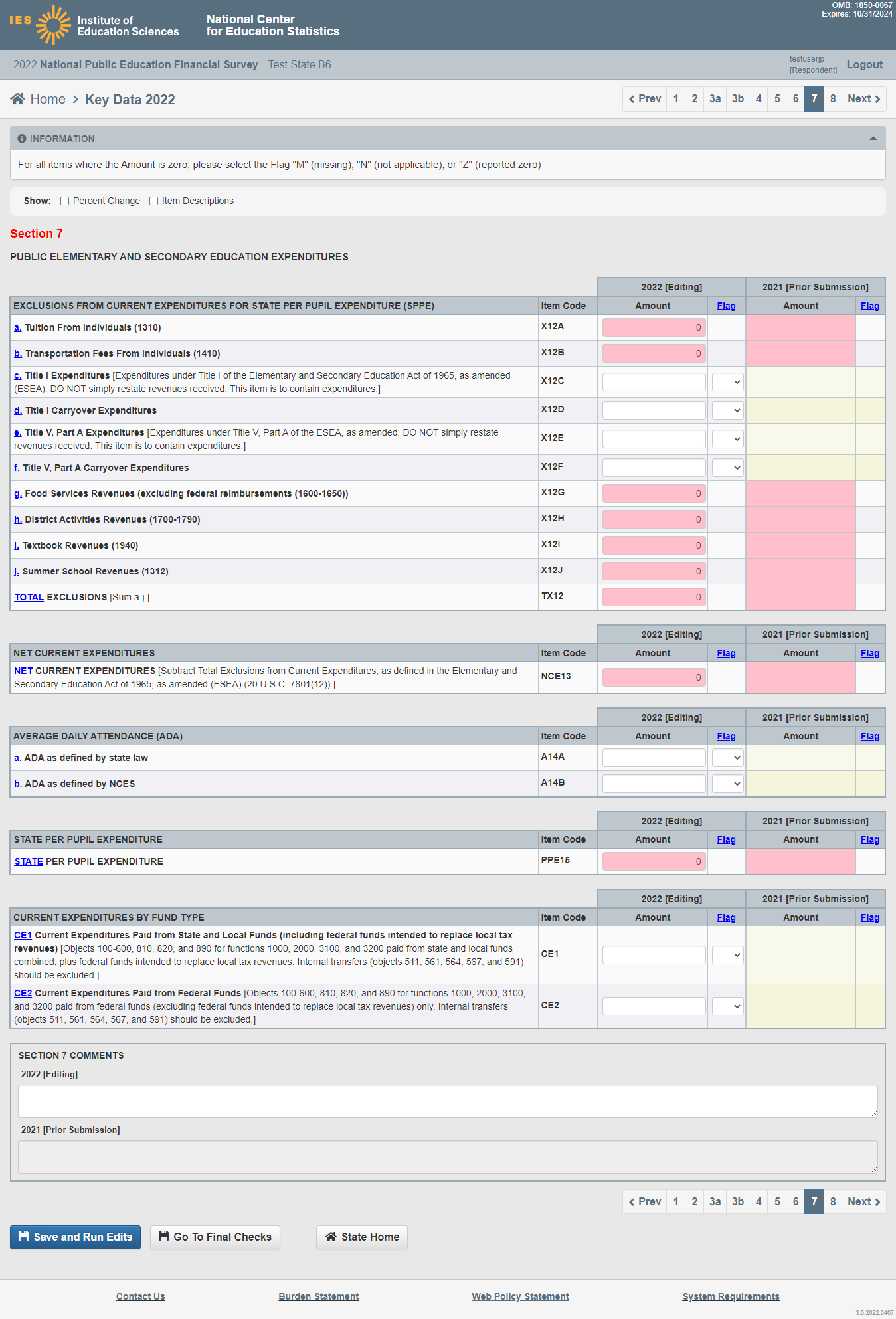

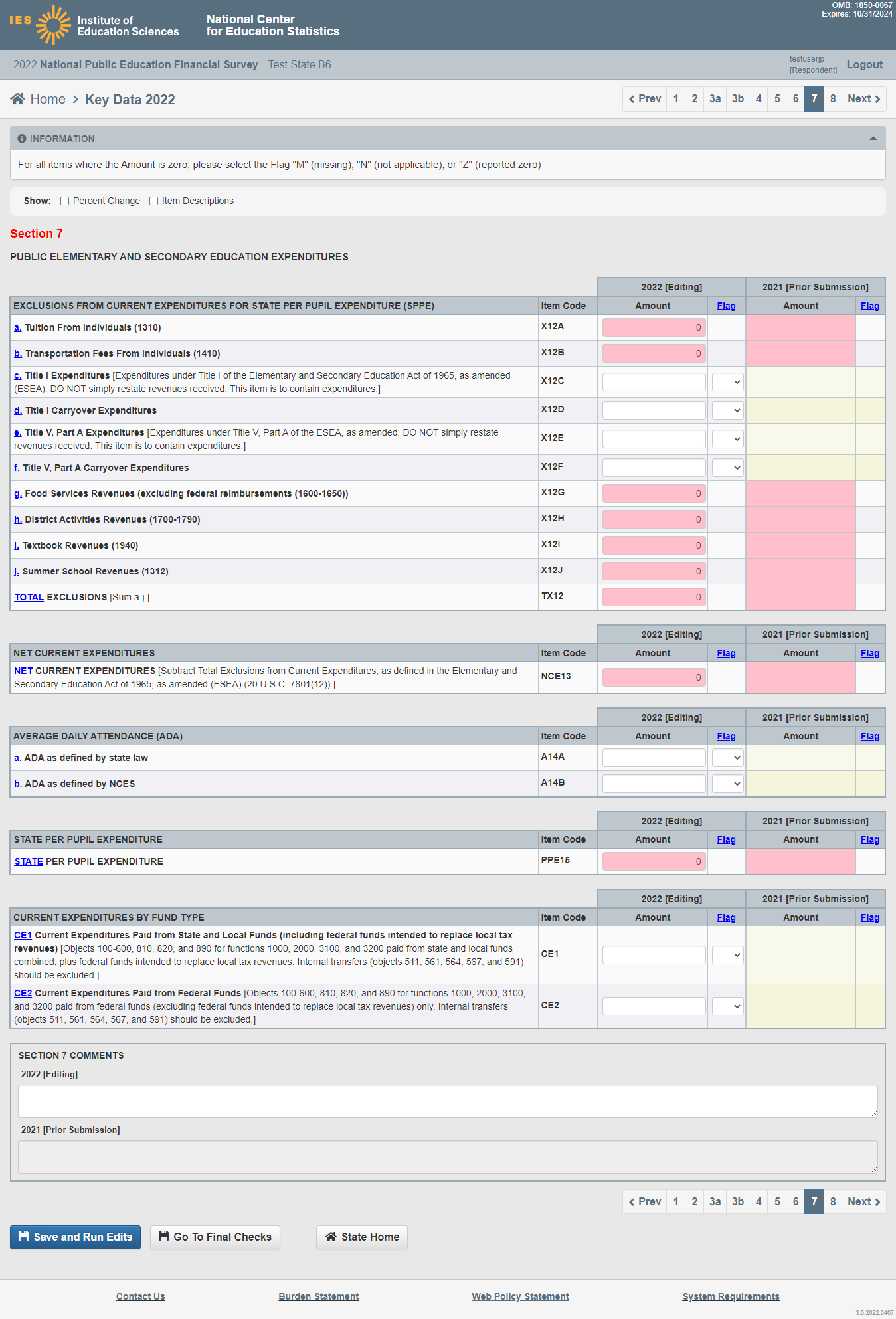

X12A - Tuition From Individuals (1310): These values are reported in the Local Revenues section (R1E) of the survey and are automatically included in this item on the web form.

X12B - Transportation Fees From Individuals (1410): These values are reported in the Local Revenues section (R1G) of the survey and are automatically included in this item on the web form.

X12C - Title I Expenditures [Expenditures under Title I of the Elementary and Secondary Education Act of 1965, as amended (ESEA). DO NOT simply restate revenues received. This item is to contain expenditures.]: Report expenditures and carryover expenditures for Title I of the ESEA (as amended). Expenditures against Title I funds, all parts, that were appropriated for the fiscal year or the school year in operation during the fiscal year should be reported in item X12C. NCES excludes expenditures from current year and carryover funds for ALL Title I programs when calculating per pupil expenditures for allocation purposes. Although the survey does not provide a separate place for reporting Title I spending in the expenditure sections, these funds must be included in the appropriate expenditure categories throughout the survey.

X12D - Title I Carryover Expenditures: Report expenditures and carryover expenditures for Title I of the ESEA (as amended). Federal law permits states to retain Title I allocations for up to 27 months in order to allow districts to spend the money at a later date. Expenditures against Title I funds, all parts, which were made against funds that were appropriated for the prior fiscal year but remained available for obligation under the carryover provision in the Title I statute are called “carryover funds” and should be reported in item X12D. NCES excludes expenditures from current year and carryover funds for ALL Title I programs when calculating per pupil expenditures for allocation purposes. Although the survey does not provide a separate place for reporting Title I spending in the expenditure sections, these funds must be included in the appropriate expenditure categories throughout the survey.

X12G - Food Services Revenues (excluding federal reimbursements) (1600-1650): These values are reported in the Local Revenues section (R1J) of the survey and are automatically included in this item on the web form.

X12H - District Activities Revenues (1700-1790): These values are reported in the Local Revenues section (R1K) of the survey and are automatically included in this item on the web form.

X12I - Textbook Revenues (1940): These values are reported in the Local Revenues section (R1M) of the survey and are automatically included in this item on the web form.

X12J - Summer School Revenues (1312): These values are reported in the Local Revenues section (R1N) of the survey and are automatically included in this item on the web form.

TX12 - TOTAL EXCLUSIONS: Sum of all Exclusions from Current Expenditures for State Per Pupil Expenditures (SPPE). This field is calculated automatically.

NCE13 - NET CURRENT EXPENDITURES: This item is automatically calculated in the web form as Current Expenditures (TE5) less Total Exclusions (TX12). Net current expenditures is defined in 20 U.S.C. 7801(12) as current expenditures less the following exclusions (local revenues and expenditures): tuition paid by individuals; transportation fees paid by individuals; food service revenues; district activity revenues; textbook revenues; summer school revenues; and expenditures from funds received from Title I programs (including expenditures from carryover funds in prior year).

A14A - ADA as defined by state law: When state laws or regulations define ADA or provide methods for calculating ADA, those definitions and methods must be used to report ADA in the NPEFS Survey. Survey respondents should become familiar with the laws and regulations regarding ADA in their states – as well as with instructions or rulings on ADA by the attorneys general of their states. Federal law requires states to report ADA exactly as mandated by their laws and regulations even if state requirements differ from those of NCES regarding attendance for remote learning, summer school attendance, partial-day attendance, excused absences, and other issues. States should ensure that attendance was collected for each day that the school was in session, whether the instruction was in-person, remote, hybrid, virtual synchronous, or asynchronous. States should also maintain appropriate records of student attendance and identify in the fiscal data plan any student groups or dates that are excluded from the calculation. In light of the unique challenges caused by the national emergency related to the COVID-19 pandemic and in order to collect the most consistent and measurable data possible, states may instead choose to report under the Federal ADA definition for SY 2021-2022.

A14B - ADA as defined by NCES: NCES requests that states with no laws or regulations governing the determination of average daily attendance use the NCES definition of ADA: (i) the aggregate number of days of attendance of all students during a school year, divided by (ii) the number of days school is in session during that year [20 U.S.C. §7801(1)]. This definition requires every school or school district in a state to collect attendance every day it is in session and to record the number of days it is in session. The aggregate number of days of student attendance for each school or school district is divided by the number of days each school or school district is in session. To calculate the state total, add the figures for every school or school district in the state. In light of the unique challenges caused by the national emergency related to the COVID-19 pandemic and in order to collect the most consistent and measurable data possible, states that have a temporary inability to report attendance may include in ADA data reporting those days for which attendance was collected preceding and subsequent to the interruption. States have the flexibility to report even if they are unable to report remote learning days from all schools or LEAs. States should ensure that attendance was collected for each day that the school was in session, whether the instruction was in-person, remote, hybrid, virtual synchronous, or asynchronous. States should also maintain appropriate records of student attendance and identify in the fiscal data plan any student groups or dates that are excluded from the calculation.

PPE15 - STATE PER PUPIL EXPENDITURE: SPPE is a key component in the formula for allocating Title I and other federal funds to states and school districts. The Title I amount and the details of the SPPE calculation are carefully scrutinized by the U.S. Department of Education and the U.S. Congress. This careful scrutiny includes routine audits by the U.S. Department of Education’s Inspector General. For purposes of calculating SPPE, expenditures (including carryover) from certain federal grants as well as fees and other revenue from individuals must be subtracted from Current Expenditures. Federal law requires NCES to use net expenditures (expenditures minus exclusions) when calculating a per pupil expenditure for allocating federal grants to states. SPPE (PPE15) is calculated by dividing Net Current Expenditures (NCE13) by Average Daily Attendance (A14A or A14B).

CE1 - Current Expenditures Paid from State and Local Funds (including federal funds intended to replace local tax revenues): Report current expenditures paid for by State and local funds combined plus Federal funds intended to replace local tax revenues. Include expenditures for objects 100-600, 810, 820, and 890 for functions 1000, 2000, 3100, and 3200, excluding all internal transfers (objects 511, 561, 564, 567, and 591).

CE2 - Current Expenditures Paid from Federal Funds: Report current expenditures paid from Federal funds and excludes federal funds intended to replace local tax revenues. Include expenditures for objects 100-600, 810, 820, and 890 for functions 1000, 2000, 3100, and 3200, excluding all internal transfers (objects 511, 561, 564, 567, and 591).

AR1 - Coronavirus Aid, Relief, and Economic Security (CARES) Act Elementary and Secondary School Emergency Relief (ESSER I) Fund: Report all federal revenues received from the Elementary and Secondary School Emergency Relief (ESSER I) Fund authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Include payments made from this fund on behalf of LEAs. Do not include federal revenues received from the Elementary and Secondary School Emergency Relief Fund authorized by the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act or the American Rescue Plan (ARP) here; report these revenues in items AR1B and AR1C instead.

AR1A - Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act Elementary and Secondary School Emergency Relief (ESSER II) Fund: Report all federal revenues received from the Elementary and Secondary School Emergency Relief (ESSER II) Fund authorized by the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act. Include payments made from this fund on behalf of LEAs. Do not include federal revenues received from the Elementary and Secondary School Emergency Relief Fund authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act or the American Rescue Plan (ARP) here; report these revenues in items AR1 and AR1C instead.

AR1B - American Rescue Plan (ARP) Act Elementary and Secondary School Emergency Relief (ARP ESSER) Fund: Report all federal revenues received from the Elementary and Secondary School Emergency Relief (ARP ESSER) Fund authorized by the American Rescue Plan (ARP) Act. Include payments made from this fund on behalf of LEAs. Do not include federal revenues received from the Elementary and Secondary School Emergency Relief Fund authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act or the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act here; report these revenues in items AR1 and AR1B instead.

AR2 - CARES Act Governor’s Emergency Education Relief (GEER I) Fund: Report all federal revenues received from the Governor’s Emergency Education Relief (GEER I) Fund authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Include payments made from this fund on behalf of LEAs. Do not include federal revenues received from the Governor’s Emergency Education Relief Fund authorized by the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act here; report these revenues in item AR2B instead.

AR2A - CRRSA Act Governor’s Emergency Education Relief (GEER II) Fund: Report all federal revenues received from the Governor’s Emergency Education Relief (GEER II) Fund authorized by the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act. Include payments made from this fund on behalf of LEAs. Do not include federal revenues received from the Governor’s Emergency Education Relief Fund authorized by Coronavirus Aid, Relief, and Economic Security (CARES) Act here; report these revenues in item AR2 instead.

AR3 - CARES Act Education Stabilization Fund – Reimagine Workforce Preparation (ESF-RWP) Discretionary Grant: Report all federal revenues received from the Education Stabilization Fund – Reimagine Workforce Preparation (ESF-RWP) discretionary grant program authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Include payments made from this fund on behalf of LEAs.

AR6 - Coronavirus Relief Fund (CRF): Report all federal revenues received from the Coronavirus Relief Fund (CRF), as authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and extended under the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act. Include payments made from this fund on behalf of LEAs.

AR6A - American Rescue Plan (ARP) Act Coronavirus State and Local Fiscal Recovery Funds (SLFRF): Report all federal revenues received from the Coronavirus State and Local Fiscal Recovery Funds (SLFRF) authorized by the American Rescue Plan (ARP) Act. Include payments made from this fund on behalf of LEAs.

AR7 - Education Stabilization Fund and American Rescue Plan to the Outlying Areas-State Educational Agency: Report all federal revenues received from the Education Stabilization Fund and the American Rescue Plan (ARP) Act for formula grants to the outlying areas made to the state educational agency. Include revenues received from Education Stabilization Fund formula grants authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act, as well as from U.S. Department of Education grants authorized by the ARP Act. Include payments made from this fund on behalf of LEAs. [Reporting for this item expected for American Samoa, Guam, the Northern Mariana Islands, and the U.S. Virgin Islands only.]

AR8 - Education Stabilization Fund Program Outlying Areas-Governors: Report all federal revenues received from the Education Stabilization Fund for formula grants to the outlying areas made to governor’s offices. Include revenues received from Education Stabilization Fund formula grants authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act. Include payments made from this fund on behalf of LEAs. [Reporting for this item expected for American Samoa, Guam, the Northern Mariana Islands, and the U.S. Virgin Islands only.]

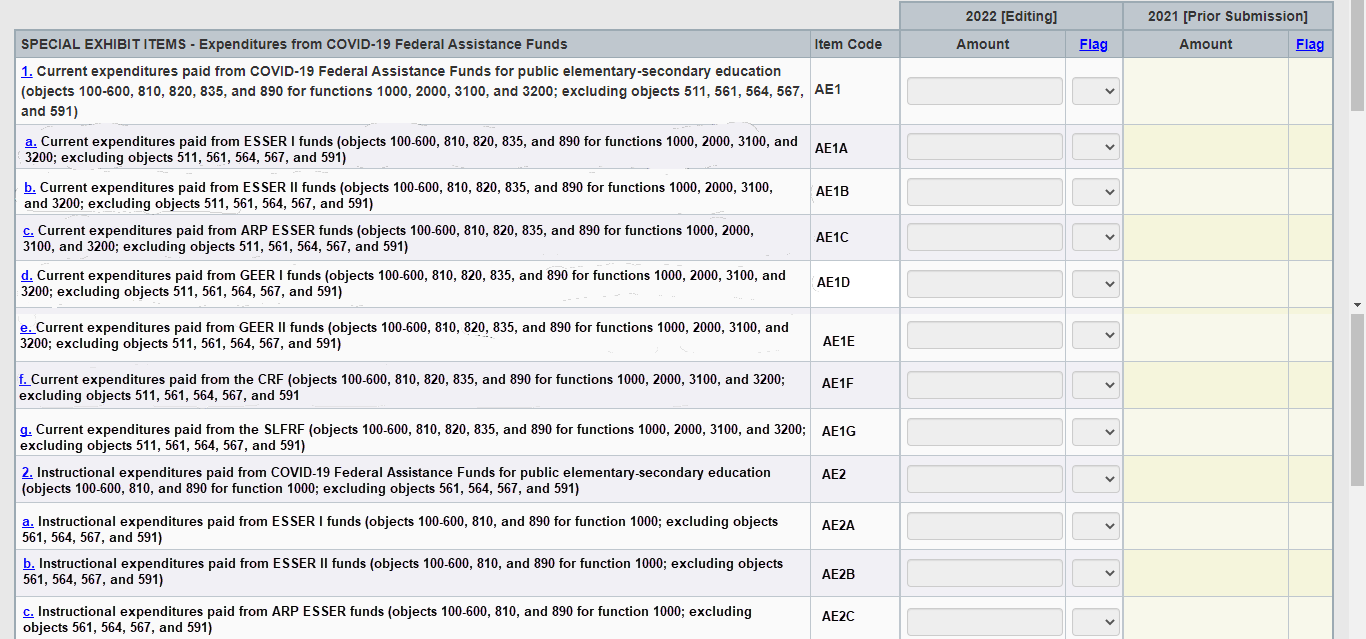

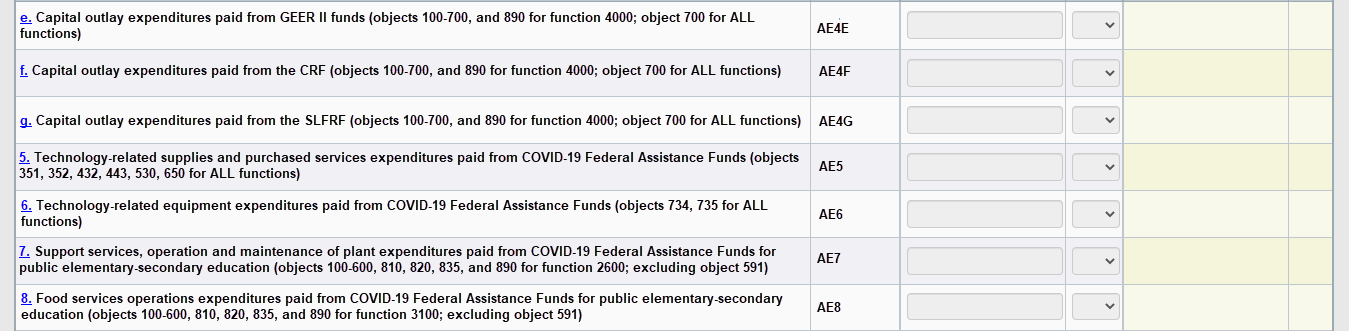

AE1 - Current expenditures paid from COVID-19 Federal Assistance Funds for public elementary-secondary education (objects 100-600, 810, 820, 835, and 890 for functions 1000, 2000, 3100, and 3200; excluding objects 511, 561, 564, 567, and 591): Report all current expenditures from all federal funds authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act, and the American Rescue Plan (ARP) Act. Include current expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state.

AE1A - Current expenditures paid from ESSER I funds (objects 100-600, 810, 820, 835, and 890 for functions 1000, 2000, 3100, and 3200; excluding objects 511, 561, 564, 567, and 591): Report all current expenditures for public elementary-secondary education that were paid from the Elementary and Secondary School Emergency Relief Fund authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act (ESSER I). Include current expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Any current expenditures reported under this item should also be reported in “Current expenditures paid from COVID-19 Federal Assistance Funds” (item AE1).

AE1B - Current expenditures paid from ESSER II funds (objects 100-600, 810, 820, 835, and 890 for functions 1000, 2000, 3100, and 3200; excluding objects 511, 561, 564, 567, and 591): Report all current expenditures for public elementary-secondary education that were paid from the Elementary and Secondary School Emergency Relief Fund authorized by the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act (ESSER II). Include current expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Any current expenditures reported under this item should also be reported in “Current expenditures paid from COVID-19 Federal Assistance Funds” (item AE1).

AE1C - Current expenditures paid from ARP ESSER funds (objects 100-600, 810, 820, 835, and 890 for functions 1000, 2000, 3100, and 3200; excluding objects 511, 561, 564, 567, and 591): Report all current expenditures for public elementary-secondary education that were paid from the Elementary and Secondary School Emergency Relief Fund authorized by the American Rescue Plan (ARP) Act (ARP ESSER). Include current expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Any current expenditures reported under this item should also be reported in “Current expenditures paid from COVID-19 Federal Assistance Funds” (item AE1).

AE1D - Current expenditures paid from GEER I funds (objects 100-600, 810, 820, 835, and 890 for functions 1000, 2000, 3100, and 3200; excluding objects 511, 561, 564, 567, and 591): Report all current expenditures for public elementary-secondary education that were paid from the Governor’s Emergency Education Relief Fund authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act (GEER I). Include current expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Any current expenditures reported under this item should also be reported in “Current expenditures paid from COVID-19 Federal Assistance Funds” (item AE1).

AE1E - Current expenditures paid from GEER II funds (objects 100-600, 810, 820, 835, and 890 for functions 1000, 2000, 3100, and 3200; excluding objects 511, 561, 564, 567, and 591): Report all current expenditures for public elementary-secondary education that were paid from the Governor’s Emergency Education Relief Fund authorized by the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act (GEER II). Include current expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Any current expenditures reported under this item should also be reported in “Current expenditures paid from COVID-19 Federal Assistance Funds” (item AE1).

AE1F - Current expenditures paid from the CRF (objects 100-600, 810, 820, 835, and 890 for functions 1000, 2000, 3100, and 3200; excluding objects 511, 561, 564, 567, and 591): Report all current expenditures for public elementary-secondary education that were paid from the Coronavirus Relief Fund authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and extended under the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act (CRF). Include current expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Any current expenditures reported under this item should also be reported in “Current expenditures paid from COVID-19 Federal Assistance Funds” (item AE1).

AE1G - Current expenditures paid from the SLFRF (objects 100-600, 810, 820, 835, and 890 for functions 1000, 2000, 3100, and 3200; excluding objects 511, 561, 564, 567, and 591): Report all current expenditures for public elementary-secondary education that were paid from the Coronavirus State and Local Fiscal Recovery Funds authorized by the American Rescue Plan (ARP) Act (SLFRF). Include current expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Any current expenditures reported under this item should also be reported in “Current expenditures paid from COVID-19 Federal Assistance Funds” (item AE1).

AE2 - Instructional expenditures paid from COVID-19 Federal Assistance Funds for public elementary-secondary education (objects 100-600, 810, and 890 for function 1000; excluding objects 561, 564, 567, and 591): Report all instructional current expenditures from all federal funds authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act, and the American Rescue Plan (ARP) Act. Include instructional expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Assuming an amount can be reported above for “Current expenditures paid from COVID-19 Federal Assistance Funds” (item AE1), any instructional expenditures reported here should also be reported in item AE1.

AE2A - Instructional expenditures paid from ESSER I funds (objects 100-600, 810, and 890 for function 1000; excluding objects 561, 564, 567, and 591): Report all instructional current expenditures for public elementary-secondary education that were paid from the Elementary and Secondary School Emergency Relief Fund authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act (ESSER I). Include instructional expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Any instructional current expenditures reported under this item should also be reported in “Instructional expenditures paid from COVID-19 Federal Assistance Funds for public elementary-secondary education” (item AE2) and under “Current expenditures paid from ESSER I funds” (item AE1A).

AE2B - Instructional expenditures paid from ESSER II funds (objects 100-600, 810, and 890 for function 1000; excluding objects 561, 564, 567, and 591): Report all instructional current expenditures for public elementary-secondary education that were paid from the Elementary and Secondary School Emergency Relief Fund authorized by the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act (ESSER II). Include instructional expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Any instructional current expenditures reported under this item should also be reported in “Instructional expenditures paid from COVID-19 Federal Assistance Funds for public elementary-secondary education” (item AE2) and under “Current expenditures paid from ESSER II funds” (item AE1B).

AE2C - Instructional expenditures paid from ARP ESSER funds (objects 100-600, 810, and 890 for function 1000; excluding objects 561, 564, 567, and 591): Report all instructional current expenditures for public elementary-secondary education that were paid from the Elementary and Secondary School Emergency Relief Fund authorized by the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act (ESSER II). Include instructional expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Any instructional current expenditures reported under this item should also be reported in “Instructional expenditures paid from COVID-19 Federal Assistance Funds for public elementary-secondary education” (item AE2) and under “Current expenditures paid from ARP ESSER funds” (item AE1C).

AE2D - Instructional expenditures paid from GEER I funds (objects 100-600, 810, and 890 for function 1000; excluding objects 561, 564, 567, and 591): Report all instructional current expenditures for public elementary-secondary education that were paid from the Governor’s Emergency Education Relief Fund authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act (GEER I). Include instructional expenditures from these funds paid directly by the LEA and paid by the state on behalf of the LEA. Exclude payments from these funds to charter schools and other school districts within the state. Any instructional current expenditures reported under this item should also be reported in “Instructional expenditures paid from COVID-19 Federal Assistance Funds for public elementary-secondary education” (item AE2) and under “Current expenditures paid from GEER I funds” (item AE1D).