Annual Report User Guide

Homeowner Assistance Fund

HAF_CloseoutReportingUserGuide 050625

Final Annual Report

OMB: 1505-0269

Homeowner Assistance Fund:

Closeout Reporting User Guide

March 27, 2024 (Revised May 20, 2025)

January

7, 2022 Version:

1

January

XX, 2022 Version

1

XXX Version:

1.0

August

9, 2021 Version:

1.0

HAF Closeout Reporting User Guide Change Summary

Section |

Changes |

May XX, 2025 |

|

Throughout |

|

May 2, 2025 |

|

pp. 9-10 |

|

November 26, 2024 |

|

Section I |

|

Section II |

|

Section III.k |

|

Section IV.e |

|

Section V |

|

Throughout |

|

Table of Contents

Section II. Navigation and Logistics 4

Section III. Final Quarterly Report 9

Section IV. Final Annual Report 45

Section V. Financial Closeout Confirmation Module 58

Appendix A – Designating HAF Points of Contact by HAF Account Administrators 65

List of Figures

Figure 1 Portal Landing Page 5

Figure 2 Closeout Reports Landing Page 6

Figure 3 Top of Navigation Bar for Final Quarterly Report 7

Figure 4 Reopen Submitted Report for Editing 8

Figure 5 Recipient Information Example 10

Figure 6 Recipient Information Example – Audit 10

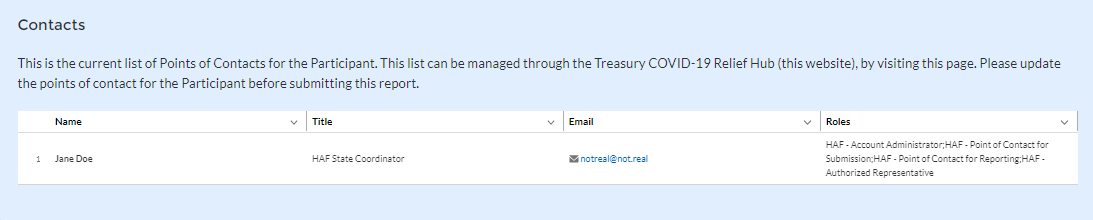

Figure 7 Point of Contact List Example 11

Figure 9 Programmatic Information pt. 1 13

Figure 10 Programmatic Information pt. 2 16

Figure 11 Reimbursement Expenses Breakout 18

Figure 12 Import Disaggregated Data 20

Figure 13 Import Disaggregated Data Upload Module 21

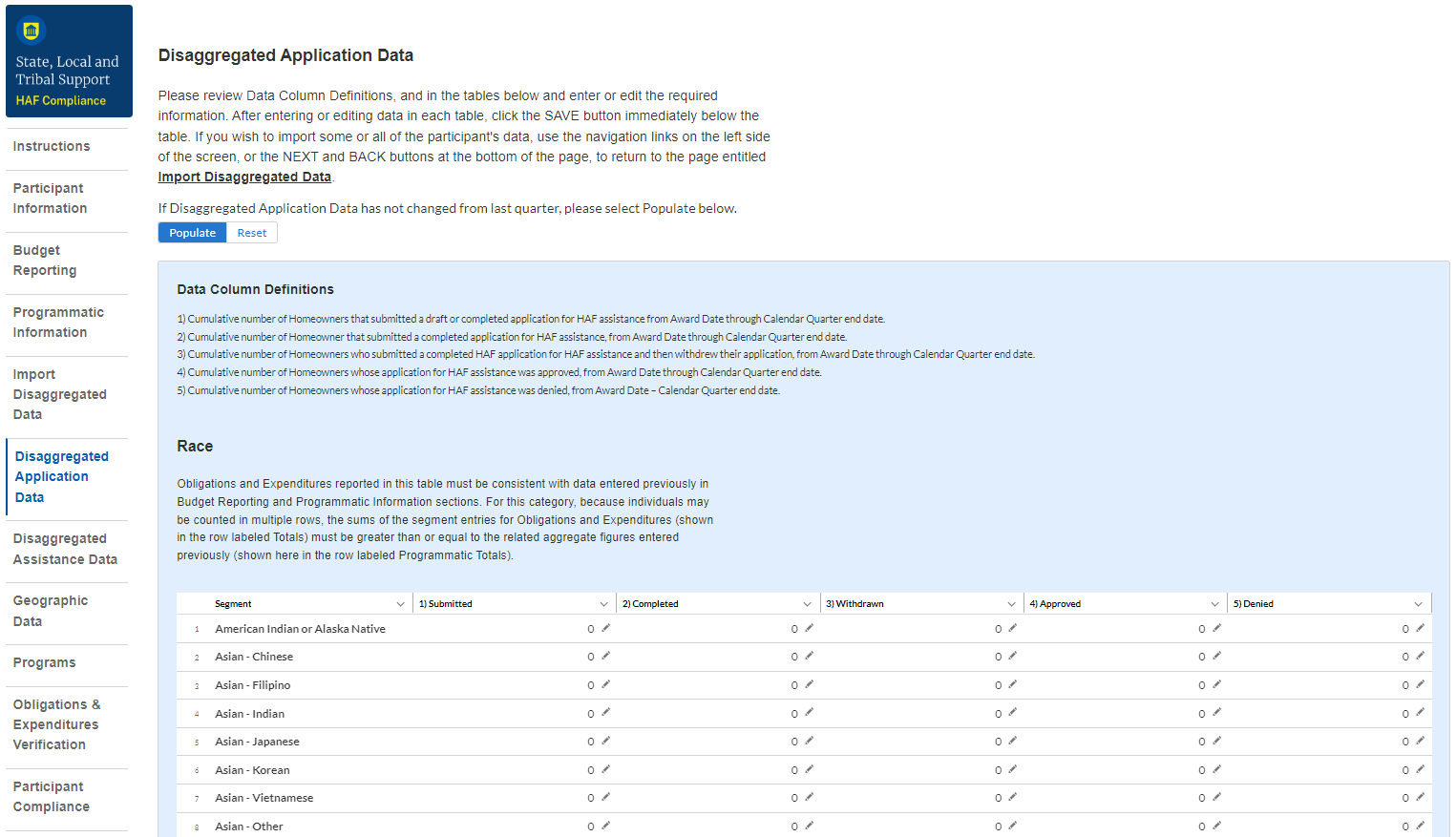

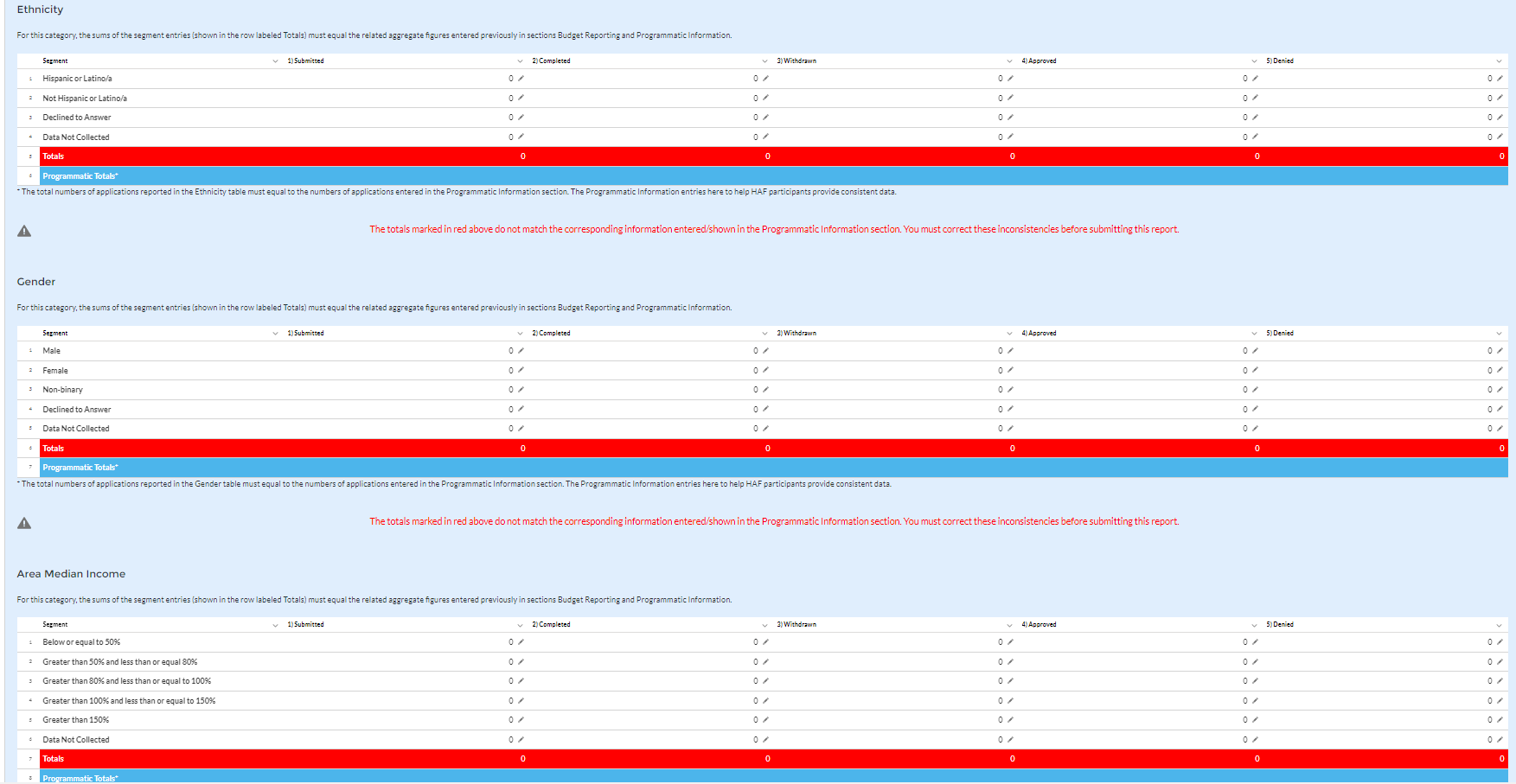

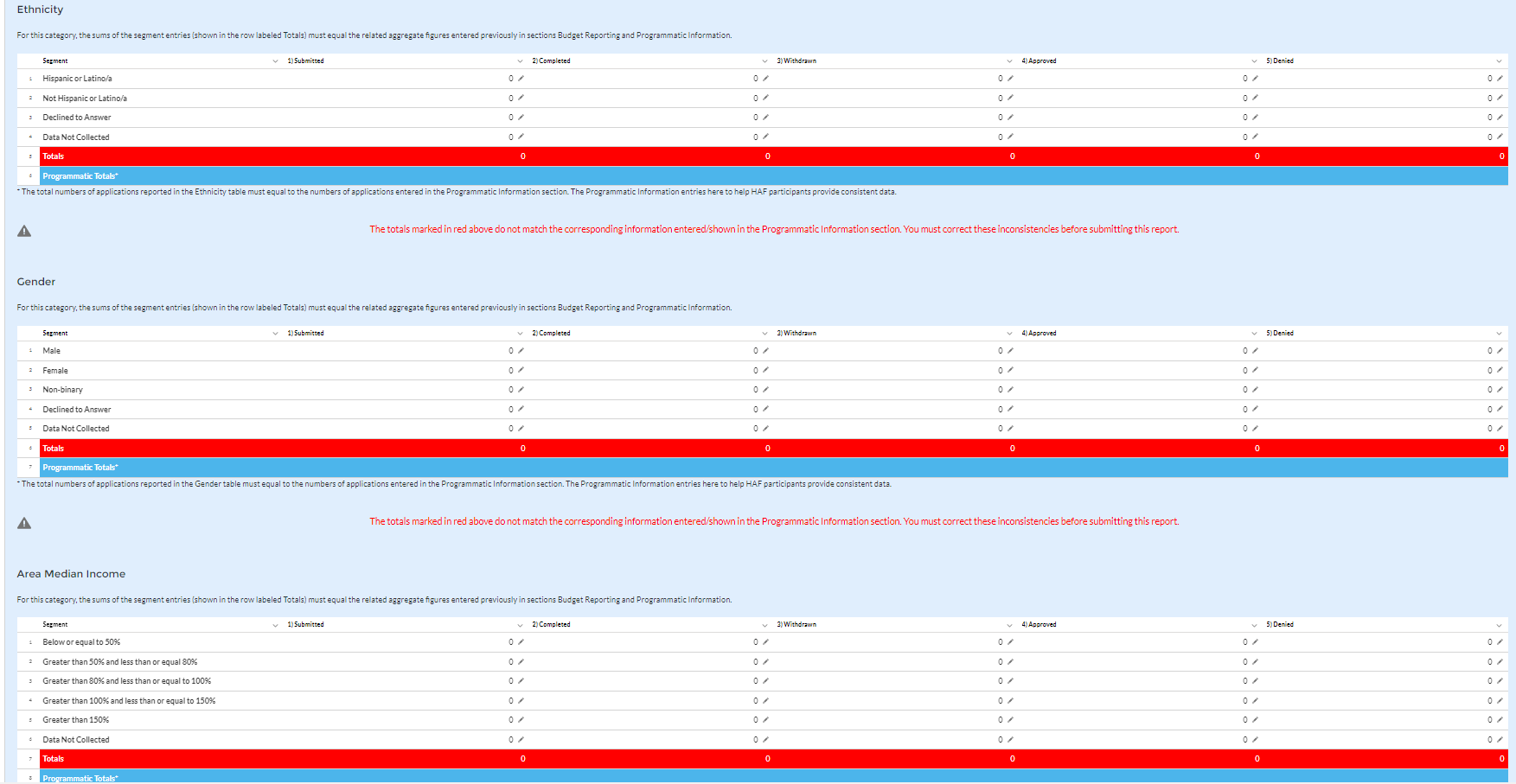

Figure 14 Disaggregated Application Data pt.1 22

Figure 15 Disaggregated Application Data pt. 2 23

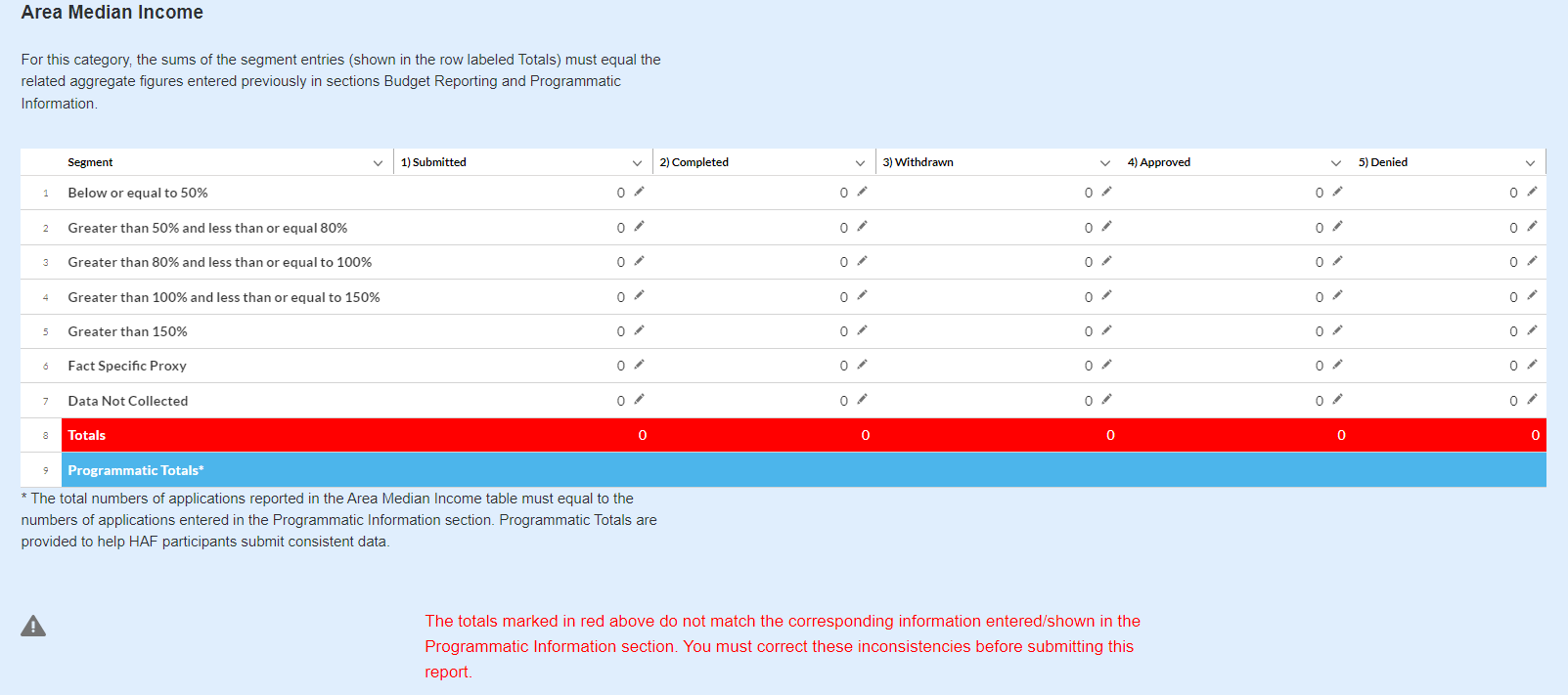

Figure 16 Disaggregated Application Data pt. 3 24

Figure 17 Disaggregated Assistance Data pt. 1 25

Figure 18 Disaggregated Assistance Data pt. 2 27

Figure 19 Disaggregated Assistance Data pt. 3 28

Figure 20 Disaggregated Assistance Data pt. 4 29

Figure 21 Geographic Data Upload 30

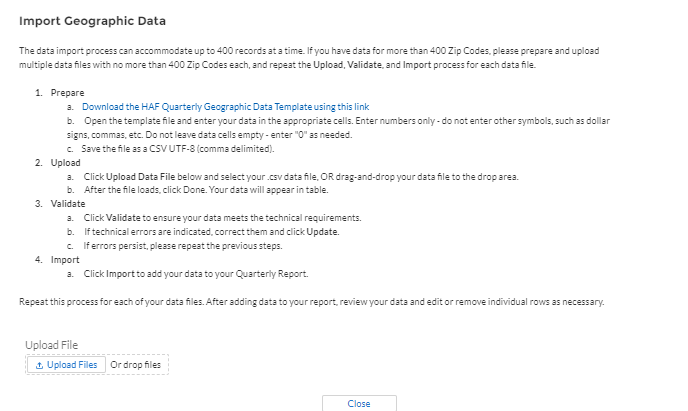

Figure 22 Import Geographic Data Pop-Up 31

Figure 23 Geographic Exceptions 31

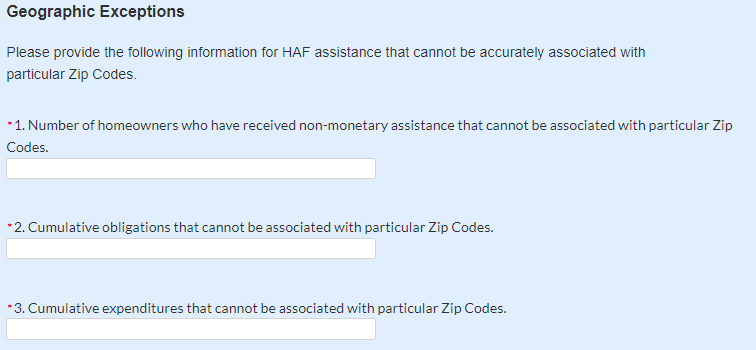

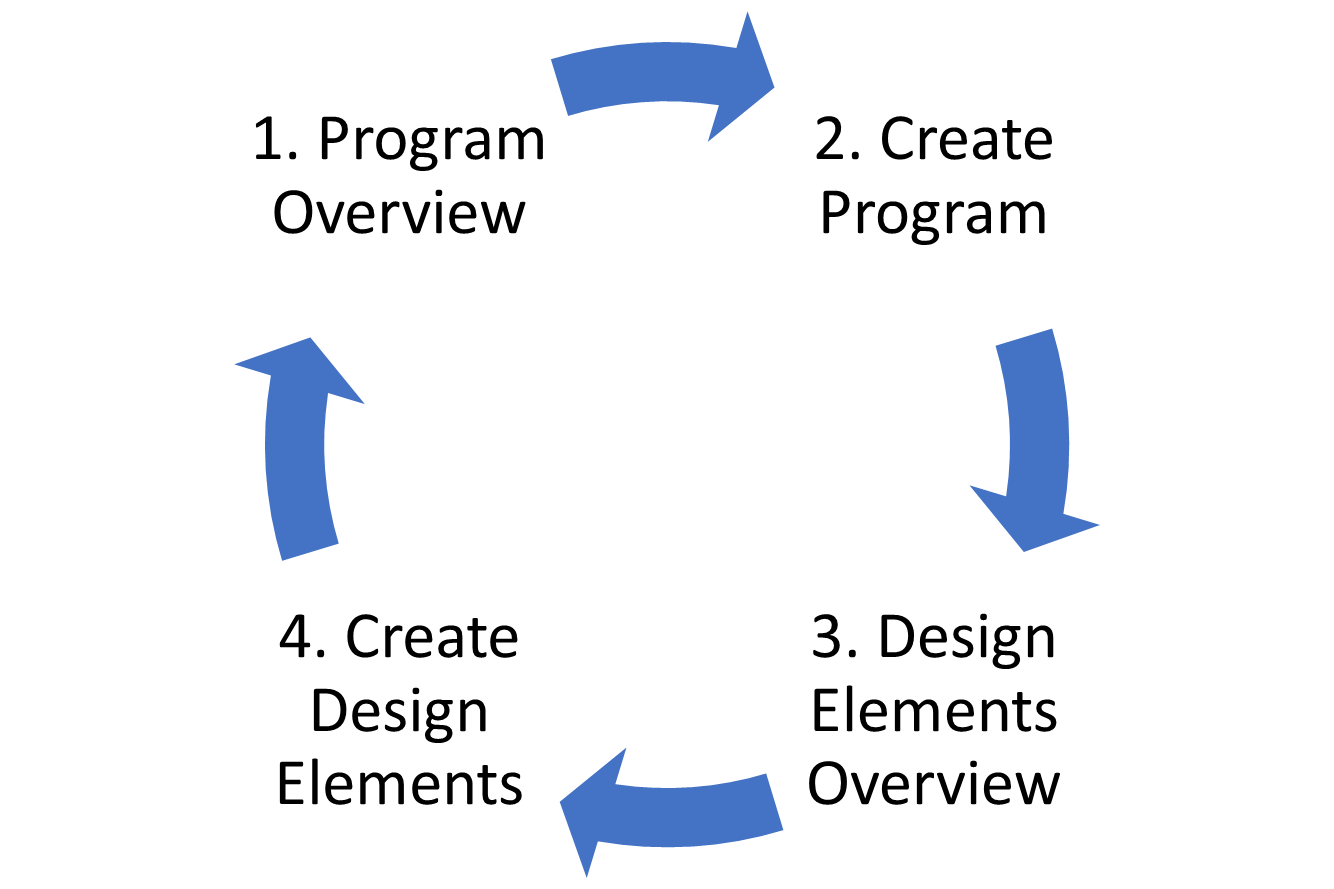

Figure 24 Program Creation Process 32

Figure 27 Create/Edit Design Element 34

Figure 28 Add/Edit Design Elements 34

Figure 29 Obligations & Expenditures Verification 35

Figure 30 Participant Compliance Screen 36

Figure 31 SF-428 Introduction pt. 1 39

Figure 32 SF-428 Introduction pt. 2 40

Figure 33 Add/Edit SF-428S Equipment 41

Figure 34 Certification Screen 43

Figure 35 HAF Compliance Report Survey 44

Figure 36 Participant Information Example 45

Figure 37 Contact List Example 46

Figure 38 Community Engagement Screen 47

Figure 39 - Community-Based Organization Engagement 49

Figure 40 Add New Community-Based Organization 50

Figure 41 Performance Goals 50

Figure 42 – Performance Record 52

Figure 43 - New Performance Goal 53

Figure 44 Methods for Targeting 53

Figure 45 Best Practices & Coordination 54

Figure 46 Certification Screen 56

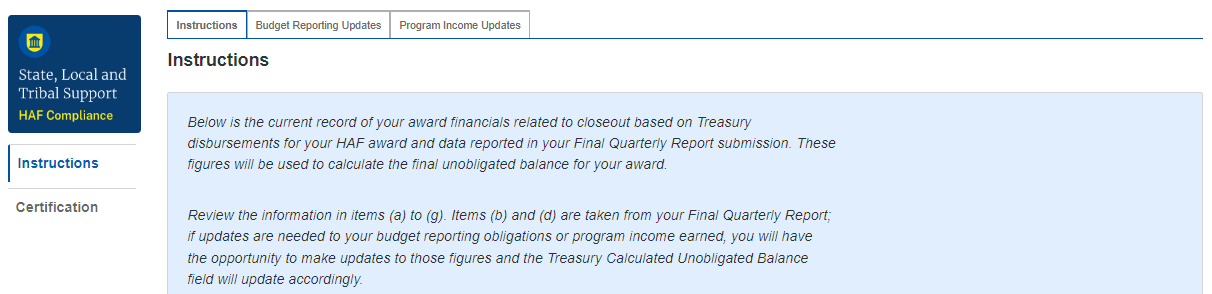

Figure 47 Instructions Screen with Total Balance Due to Treasury formula and components 58

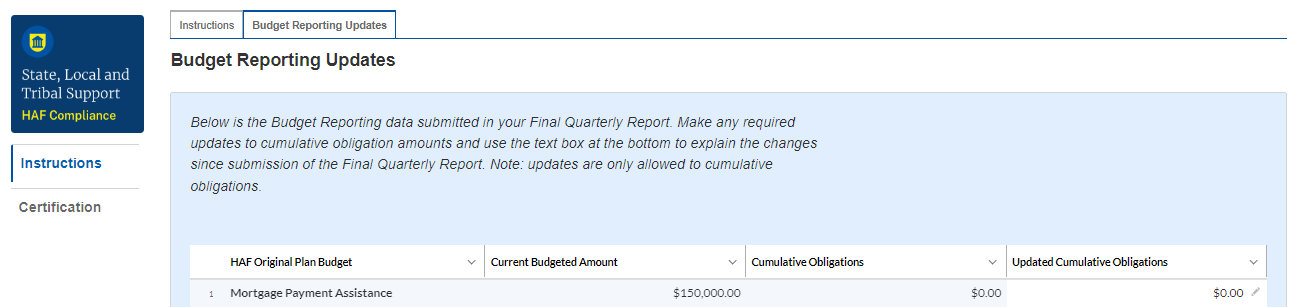

Figure 48 Budget Reporting Updates tab navigation 60

Figure 49 Budget Reporting Updates 60

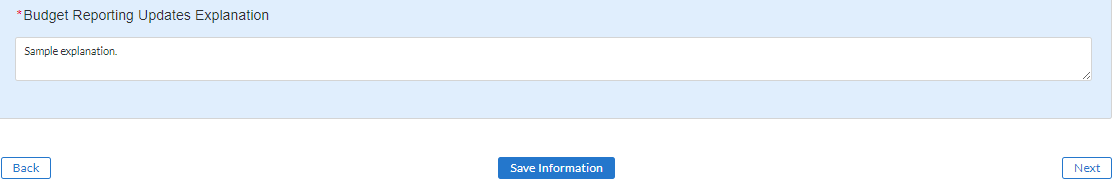

Figure 50 Budget Reporting Updates Explanation 61

Figure 51 Program Income Updates tab navigation 61

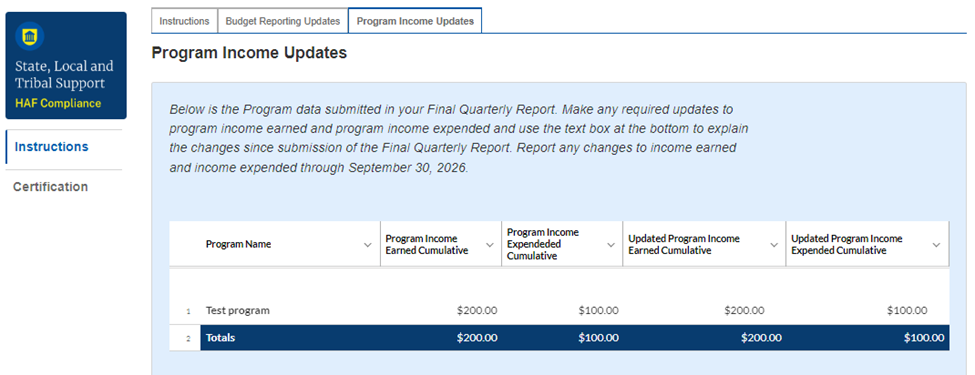

Figure 52 Program Income Updates 62

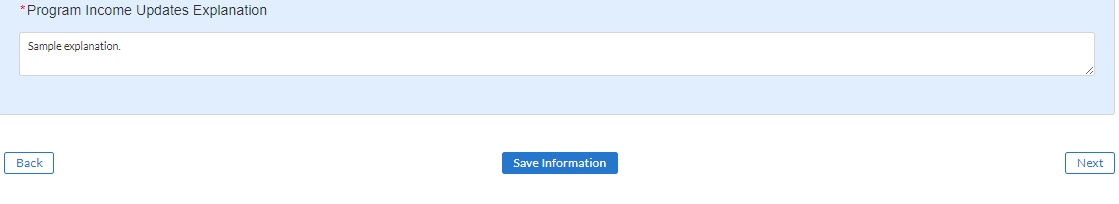

Figure 53 Program Income Updates Explanation 62

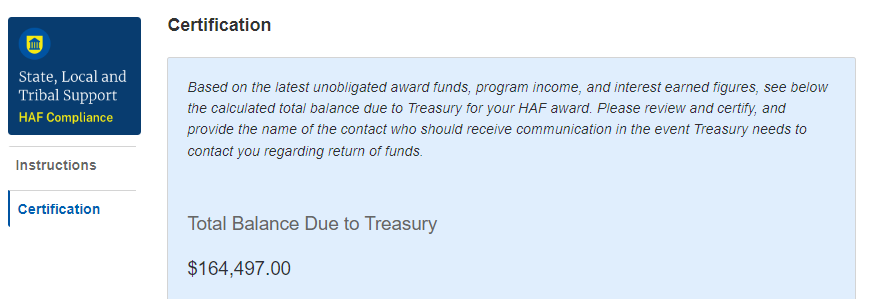

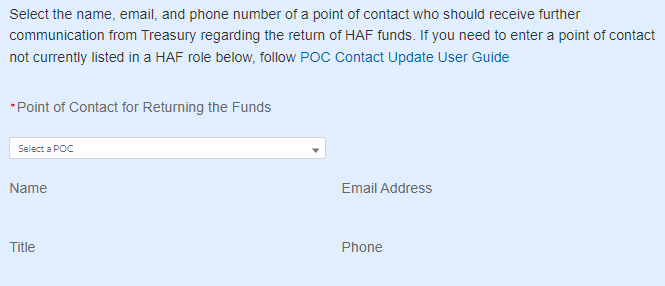

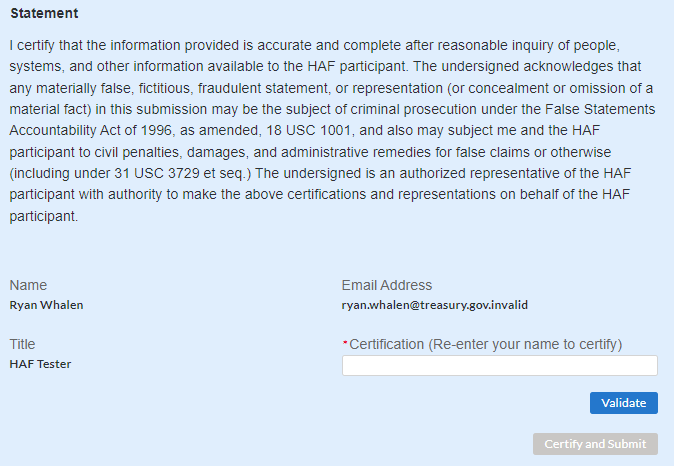

Figure 54 Certification Screen: Total Balance Due to Treasury 63

Figure 55 Certification Screen: Point of Contact for Returning Funds 63

Figure 56 Certification Screen: Validate and Certify 64

Figure 57 State, Local and Tribal Support Landing Page 65

Figure 58 My Compliance Reports 66

Overview

This document provides information on using Treasury’s Portal to submit the required Homeowner Assistance Fund (HAF) Final Reports and the Financial Closeout Confirmation module. The Final Reports consist of two reports, the HAF Annual Report and the HAF Quarterly Report, which contains a new section to report on tangible personal property acquired with the HAF award. The Financial Closeout Confirmation module was developed to calculate the total balance due to Treasury at closeout of the HAF award. This document also supplements the HAF Guidance on Participant Compliance and Reporting Responsibilities containing relevant information on reporting requirements.

Additionally, you should visit Treasury’s HAF home page for the latest guidance and updates on Programmatic and reporting topics. The home page now includes a HAF Program Closeout Resource that provides more details on the Final Reports and the HAF closeout process.

As part of the Final Report requirement, HAF participants are required to submit a Final Quarterly Report with performance and financial information, including background information about applications approved, applications received, Homeowners assisted, and details about HAF award obligations and expenditures. The Final Quarterly Report contains a new section regarding tangible personal property acquired with the HAF award that was not previously included in the report. HAF Participants are also required to submit a Final Annual Report with descriptions and figures related to their community engagement and outreach activities, performance goals, targeting plan, and coordination efforts during the reporting period. The Annual Report also solicits information from the HAF participants regarding their progress in implementing their HAF program(s), including contact information, outreach expenditures, performance on goals laid out in the HAF Plan, and coordination efforts with community-based organizations, housing agencies, and servicers.

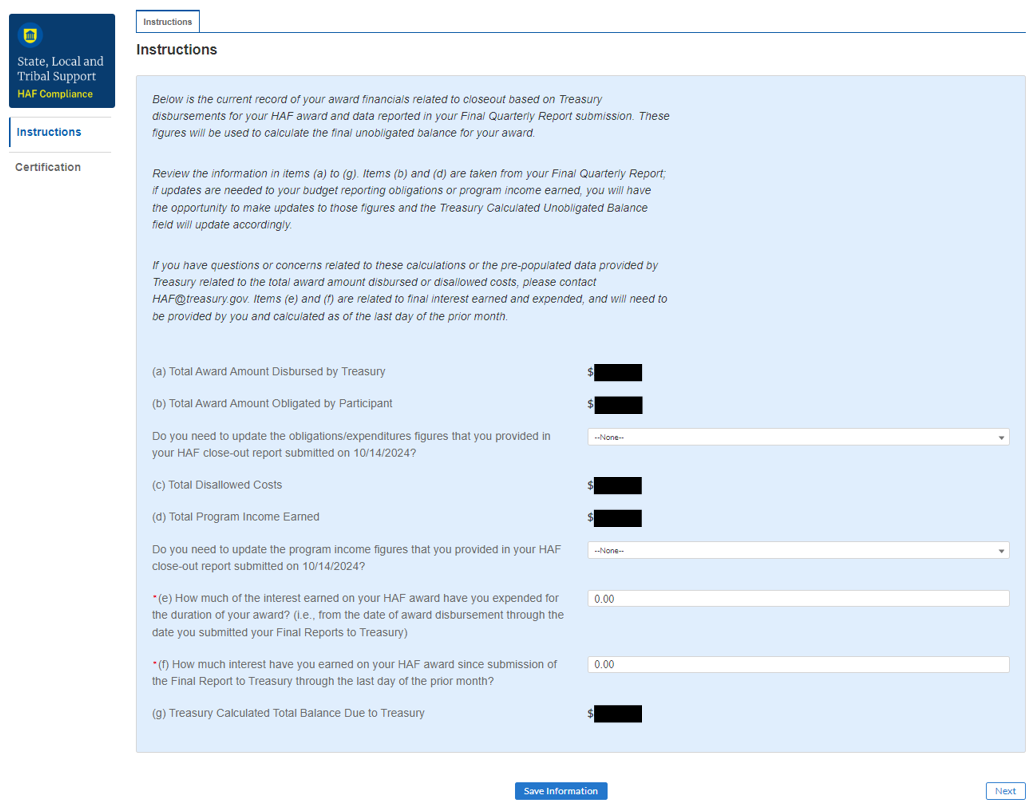

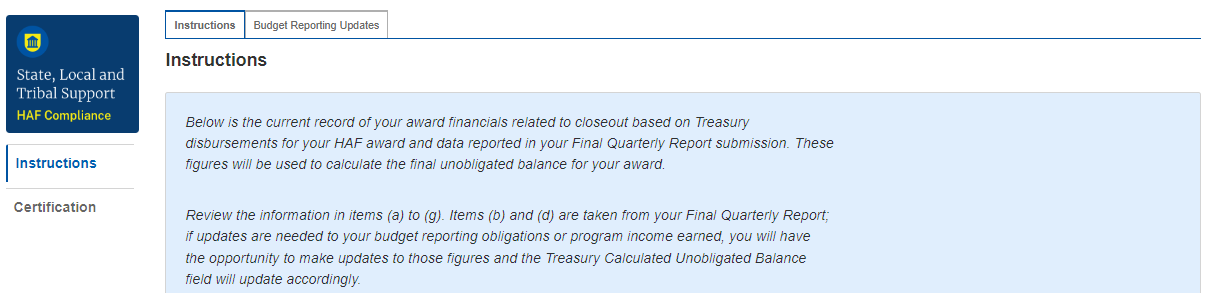

The Financial Closeout Confirmation module provides a current record of the financial information related to the HAF participant’s award for closeout based on Treasury’s disbursements of the HAF award funds and the data reported by HAF participants in their Final Quarterly Report submission. In the module, HAF participants must review each component of the formula used to calculate the Total Balance Due to Treasury. The Total Balance Due to Treasury formula is based on the latest reported figures Treasury received from HAF participants on unobligated award funds, program income, and interest earned. HAF participants are given an opportunity to provide updates to their budget reporting, reported obligations and/or program income earned. HAF participants are also asked to provide the latest figures related to interest earned on their HAF award. In the module, HAF participants are required to certify that the Total Balance Due to Treasury is accurate and complete after reasonable inquiry of people, systems, and other information available to the HAF participant, and provide a point of contact who should receive communication from Treasury regarding the return of HAF award funds.

What is Covered in this User Guide?

This User Guide contains detailed guidance and instructions for HAF participants in using Treasury’s Portal for submitting the HAF Final Quarterly Report, HAF Final Annual Report, and the HAF Financial Closeout Confirmation module. HAF participants must submit required Final Quarterly Report, HAF Final Annual Report, and the HAF Financial Closeout Confirmation module via Treasury’s Portal. This guide is not comprehensive and is meant to be used as a functional reference and in conjunction with the documents mentioned above.

This User Guide provides detailed instructions to help recipients enter and submit the following:

Budget data

Programmatic data

Expenditure data

Compliance information

Equipment information

Information on community engagement & outreach

Performance goal information

Information on methods for targeting

Information on best practice & coordination

The Total Balance Due to Treasury for the HAF award, calculated based on the latest reported information Treasury received from HAF participants on unobligated award funds, program income, and interest earned

Award Date means the date the HAF participant signed the HAF Financial Assistance Agreement.

Expended means any HAF assistance that a HAF participant or Subrecipient has spent. Please note cumulative Expenditures cannot exceed cumulative Obligations.

Homeowner means an individual who applied and/or receives funds from the HAF participant or Subrecipient to pay for a singular qualified expense (i.e., if a Homeowner receives HAF assistance for more than one qualified expense category, they are counted for more than one qualified expense category).

In some places, Guidance requires that you provide the number of unique Homeowners. Unique Homeowners are only counted one time even if they applied and or/received funding for more than one qualified expense category.

HAF Assistance means any assistance provided by the HAF Program, whether through funds received by the HAF Program for qualified expenses or through services made available by the HAF program.

Monetary HAF Assistance means HAF assistance in the form of money provided to Homeowners or on behalf of Homeowners to financial institutions, utility providers, and taxing authorities or other third-party payees under a HAF Program. Homeowners that received both Monetary and Non-monetary Assistance should be counted once as having received Monetary HAF Assistance.

Non-monetary HAF Assistance means HAF assistance in any form other than money provided to Homeowners under a HAF Program (e.g., housing counseling or referral to legal services, etc.). Only Homeowners that received Non-monetary HAF Assistance and no Monetary HAF Assistance are to be counted as having received Non-Monetary HAF Assistance.

Obligated means an order placed for property and services, contracts and subawards, and similar transactions requiring payment. (See 2 CFR § 200.1.) Obligated funds include funds that have been Expended.

Examples of Obligated funds include:

HAF funds that have been committed, pledged, or otherwise promised, in writing, to a specific individual or entity as part of a HAF Program

HAF funds that have been set aside to cover obligations arising from loan guarantees; HAF funds that have been committed, pledged, or otherwise promised, in writing, as part of a transaction

HAF funds that have been committed, pledged, or otherwise promised, in writing, for allowable administrative expenses (e.g., an executed contract for services).

HAF funds expended to provide assistance to a Homeowner for one or more qualified expense category.

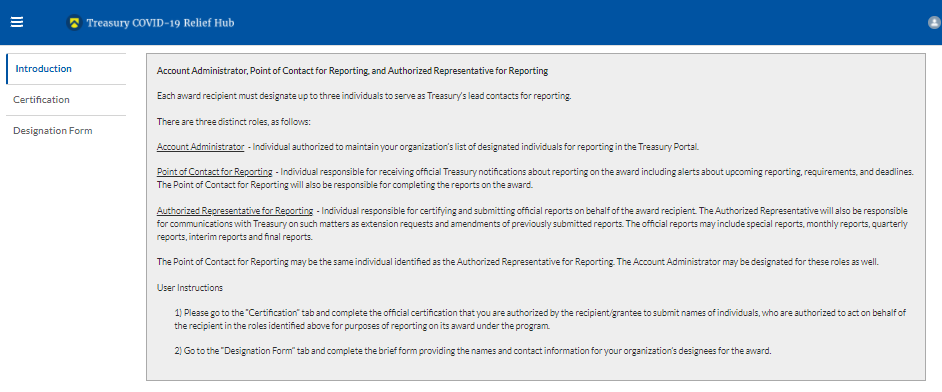

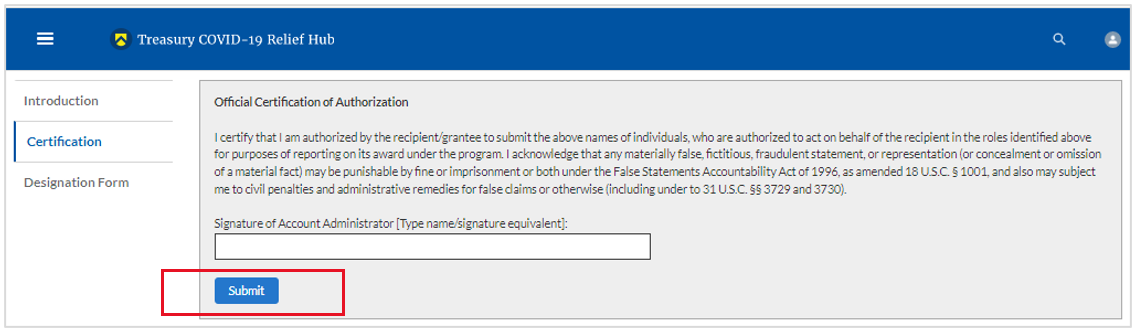

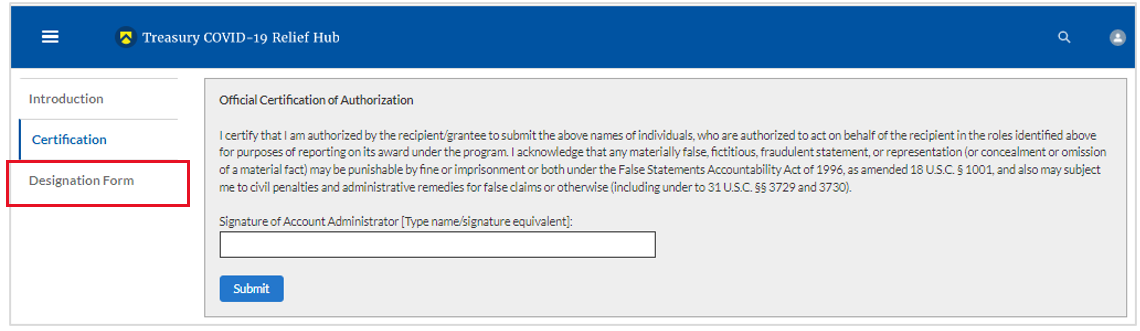

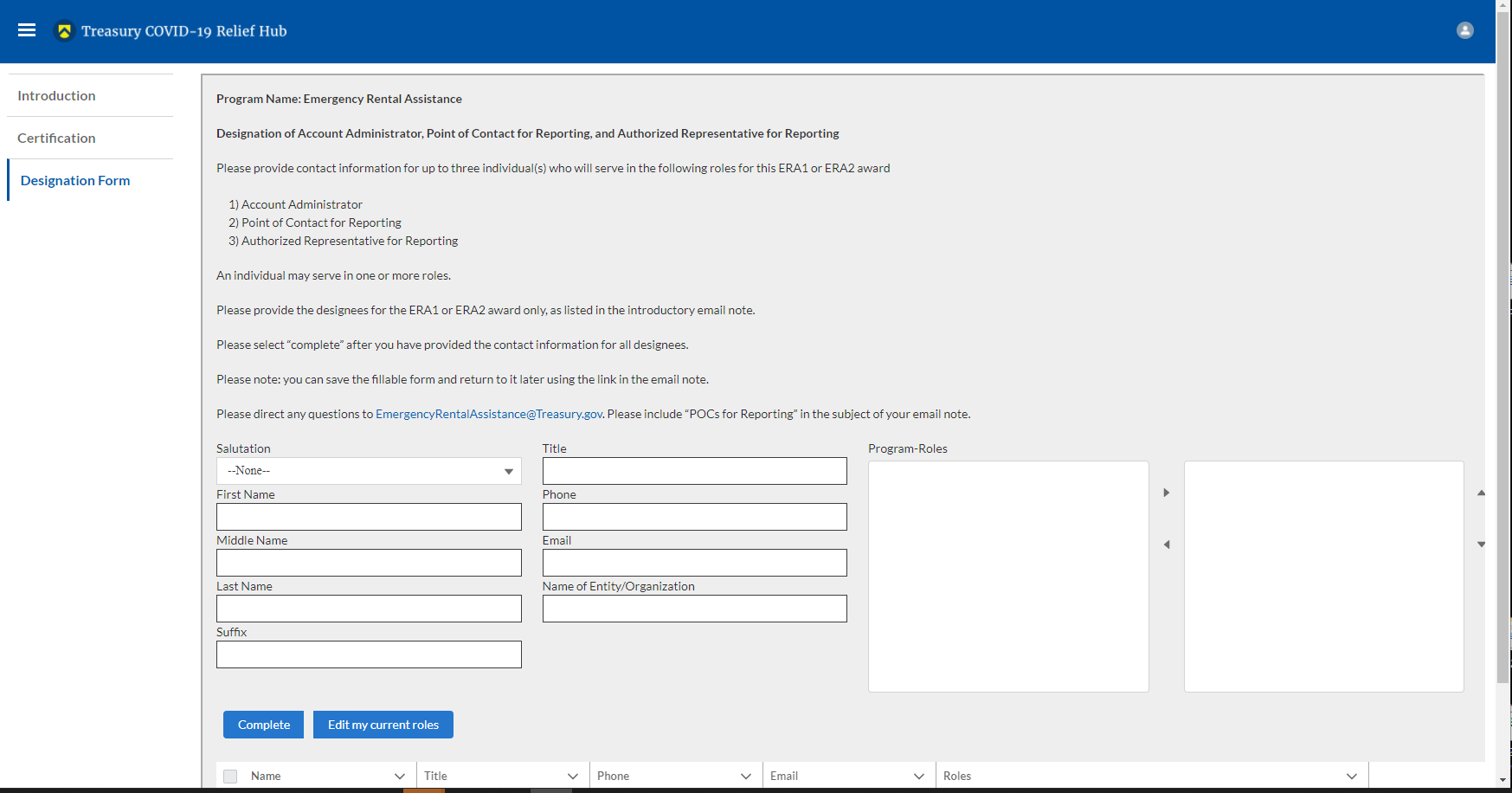

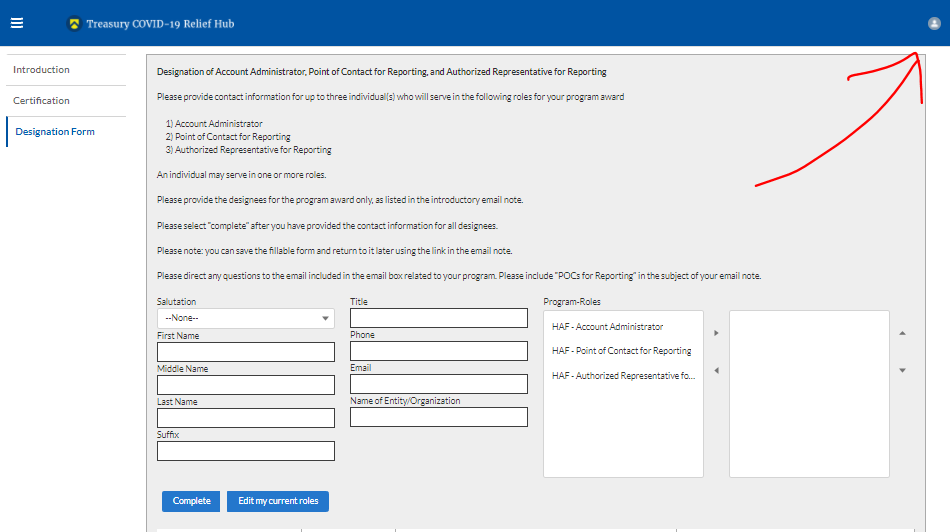

Designating Staff for Key Roles in Managing HAF Reports User Designations

HAF participants must designate staff or officials for the following three roles in managing reports for their HAF award. Participants must make the required designations before accessing Treasury’s Portal. The required roles are as follows:

Account Administrator for the HAF award maintains the names and contact information of the designated individuals for HAF reporting. The Account Administrator is also responsible for working within your organization to determine its designees for the roles of Point of Contact for Reporting and Authorized Representative for Reporting and providing their names and contact information via Treasury’s Portal. Finally, the Account Administrator is responsible for making any changes or updates to the user roles as needed over the award period. We recommend that the Account Administrator identify an individual to serve in their place in the event of staff changes. The Account Administrator may also certify and submit official reports on behalf of the HAF participant.

Point of Contact for Reporting is the primary contact for receiving official Treasury notifications about reporting on the HAF award, including alerts about upcoming reporting, requirements, and deadlines. The Point of Contact for Reporting is responsible for completing HAF reports but does not have the ability certify and submit official reports on behalf of the HAF participant unless designated to one of the other two reporting roles.

Authorized Representative for Reporting or ARR is primary individual responsible for certifying and submitting official reports on behalf of the HAF participant. Treasury will accept reports or other official communications only when submitted by the Authorized Representative for Reporting or the Account Administrator. The Authorized Representative for Reporting is also responsible for communications with the Treasury on extension requests and amendments of previously submitted reports. The official reports may include special reports, Quarterly or Annual reports, and final reports.

Essential items to note:

Each individual designated to one of the three roles above must register with ID.me or Login.gov to access Treasury’s Portal.

Users who have previously registered through ID.me may continue to access Treasury’s Portal through that method. This link includes further instructions.

If you have not previously registered with ID.me, you should register through Login.gov following this link. The following links provide additional information:

An individual may be designated for multiple roles. For example, the individual designated as the Point of Contact for Reporting may also be designated as the Authorized Representative for Reporting.

The recipient organization may designate one individual for all three roles.

The recipient organization may designate multiple individuals for each role.

The recipient organization may make changes and updates to the list of designated individuals whenever needed. The Account Administrator must process these changes.

Refer to Appendix A for guidance on designating individuals for the three roles.

The designated individuals’ names and contact information will be pre-populated in the “Recipient Profile” portion of the participant’s HAF reports, and recipients will update the information, if necessary.

Please contact HAF@treasury.gov for additional information on procedures for registering with ID.me or Login.gov.

Questions?

If you have any questions about the HAF Program’s reporting requirements, please contact us by email via HAF@treasury.gov.

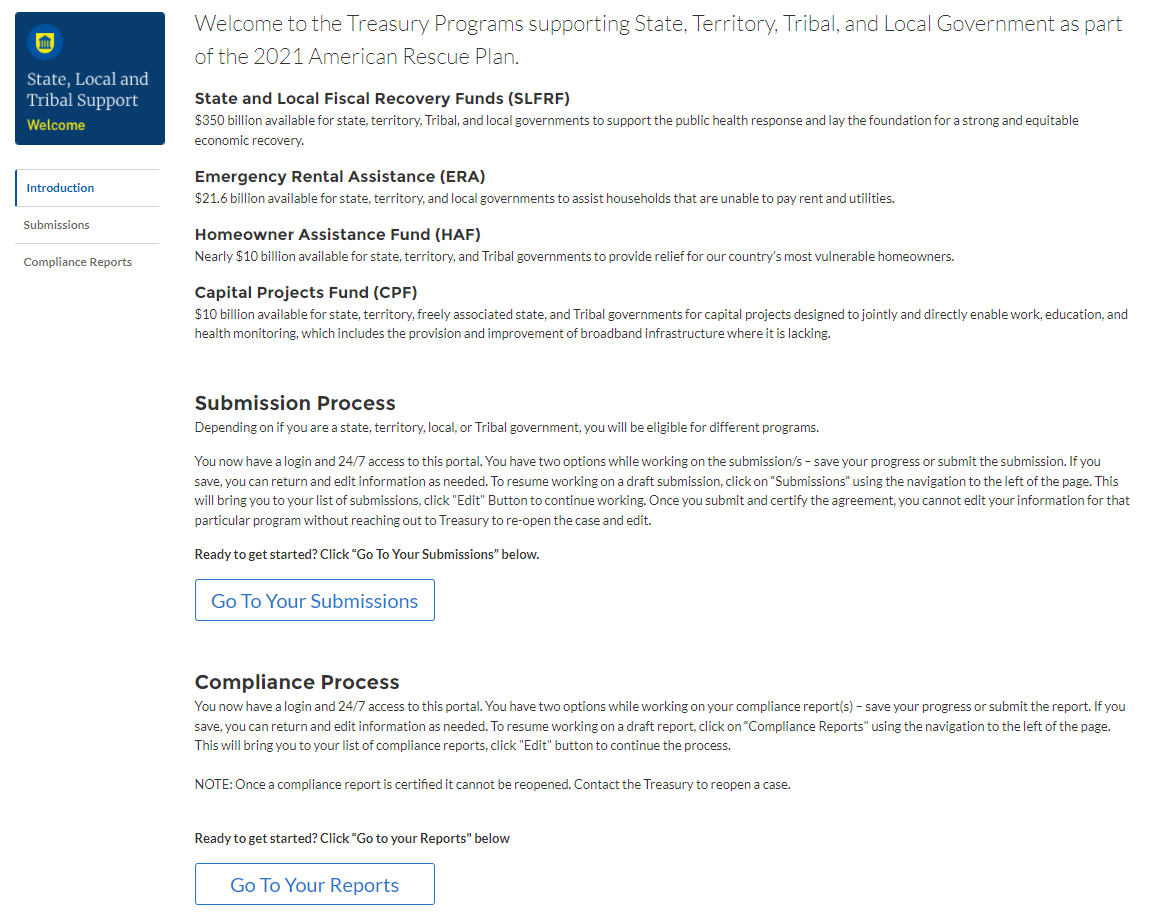

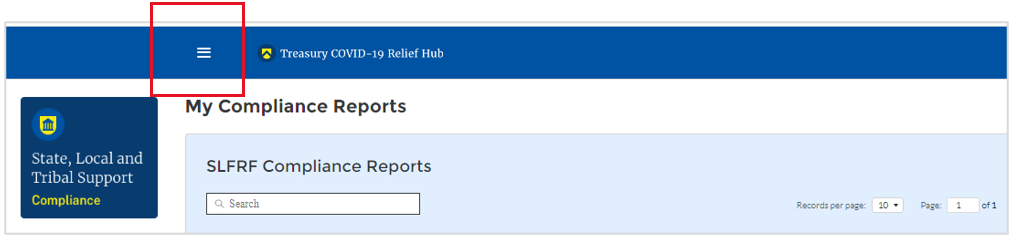

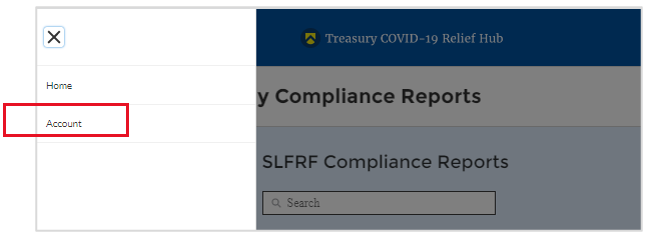

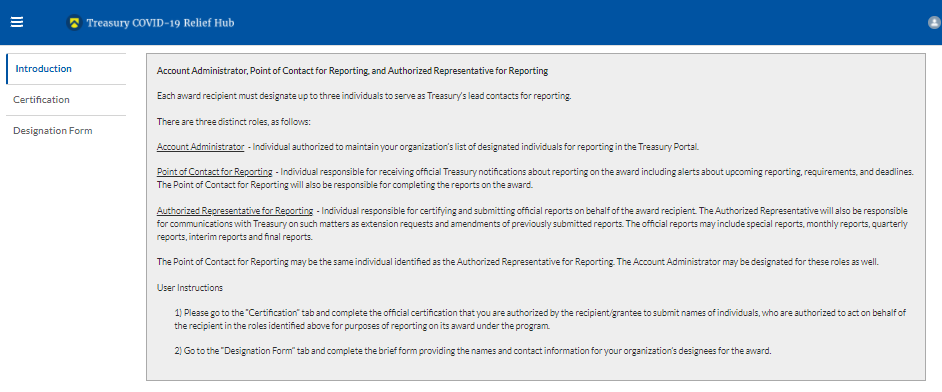

After logging into Treasury’s Portal, the landing page (see Figure 1) will appear. The landing page will display brief introductions related to reporting for the State and Local Fiscal Recovery Funds (SLFRF) Program, Emergency Rental Assistance (ERA) Programs, Homeowner Assistance Fund (HAF) Program, Capital Projects Fund (CPF) Program, and Local Assistance and Tribal Consistency Fund (LATCF) Program.

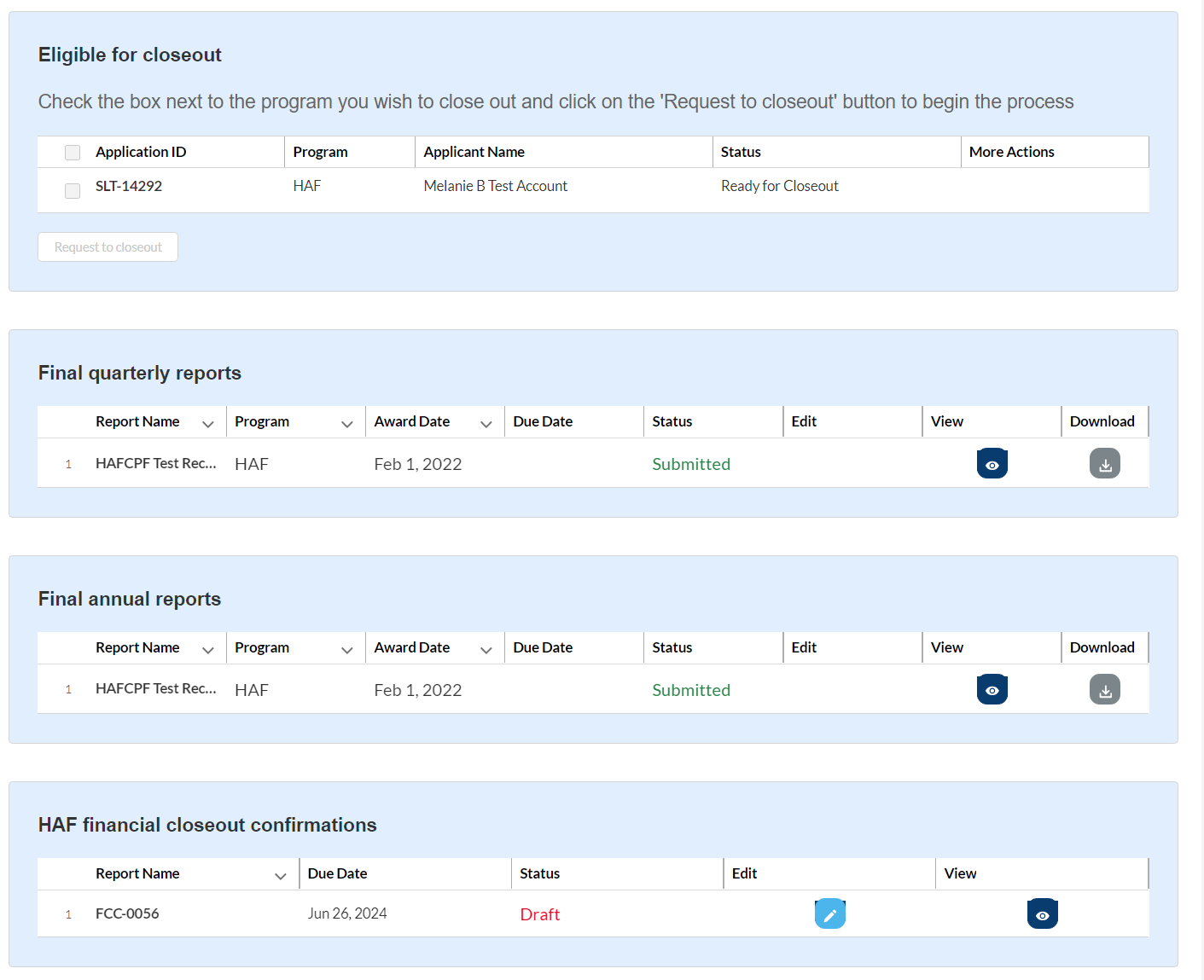

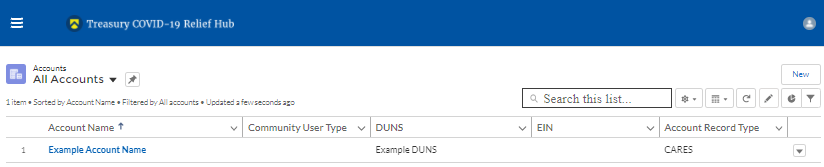

Please select “Closeout reports” on the left side panel of the Portal landing page to be taken to the Closeout Reports landing page (Figure 2 below). The Closeout Reports page displays any applications associated with your Treasury Office of Capital Access (OCA) award(s) which include HAF awards that HAF participants are eligible to request Treasury to closeout, Final Quarterly report, Final Annual report, or Financial Closeout Confirmation module that have been created and are in draft or submitted status.

Figure 2 Closeout Reports Landing Page

To begin the closeout process, check the box next to the HAF program application in the Eligible for Closeout section and select “Request to closeout”. Treasury will review your HAF award which may include a consultation with the HAF participant. For more information on the closeout process and timing, refer to the HAF Closeout Resource.

For recipients requesting early closeout:

Once Treasury has finished reviewing your request for early closeout, you will receive an email notification and the status of the HAF Final Reports on the Closeout Reports page will change to “Ready for Closeout.” You will then have access to your report records for your Final Quarterly Report and Final Annual Report (shown in Figure 2). After you submit your Final Quarterly Report and Final Annual Report, Treasury will review the reports and perform other reviews as necessary related to closeout of your HAF award. You will receive a separate email notifying you when the HAF Financial Closeout Confirmation module is ready to be completed.

For recipients engaging in standard closeout:

At the end of the Period of Performance, recipients will have 120 calendar days after September 30, 2026 to submit their Final Reports to Treasury via Treasury’s Portal. Once the Closeout Report status reflects “Ready for Closeout”, you will have access to your report records for your Final Quarterly Report and Final Annual Report (shown in Figure 2). After you submit your Final Quarterly Report and Final Annual Report, Treasury will review the reports and perform other reviews as necessary related to closeout of your HAF award. You will receive a separate email notifying you when the HAF Financial Closeout Confirmation module is ready to be completed.

To begin your Final Quarterly Report, Final Annual Report, or HAF Financial Closeout Confirmation module, select the “pencil” button under the “Edit” column shown above in Figure 2, which will take you into the report to enter information about your HAF award activities. You can complete the Final Quarterly Report and Final Annual Report in any order, but once both reports are submitted, they will be locked for review and you will not be able to make any edits. You will receive a separate email after you submit your Final Quarterly Report and Final Annual Report, and after Treasury has completed necessary closeout reviews, notifying you when the HAF Financial Closeout Confirmation module has been created for you to complete.

The Navigation Bar on the left of Treasury’s Portal will allow you to move between sections in the reports. Figure 3 displays the top of the Navigation Bar for the Final Quarterly Report.

Figure 3 Top of Navigation Bar for Final Quarterly Report

Treasury’s Portal leads you through a series of online forms that, when completed, will fulfill your reporting obligations. While navigating through Treasury’s Portal and submitting required information for the Final Quarterly Report, Final Annual Report, and Financial Closeout Confirmation module, users will need to enter data directly into Treasury’s Portal manually.

Manual Data Entry

Manual data entry requires you to provide inputs as instructed on the screen. Manual inputs are described in detail below for each User Guide section.

Your inputs will be subject to validation by Treasury’s Portal to ensure that the data provided is consistent with the expected format or description (e.g., entering “one hundred” instead of 100). If a given data entry fails a validation rule, Treasury’s Portal will display an error for you to address.

You will not be able to submit manually entered data that does not satisfy the data validation rules.

Narrative Boxes

Tip: When filling out detailed narratives, you are encouraged to type out responses in a word processing application (such as Microsoft Word) to minimize grammatical errors, track word count, and concisely answer all required narrative details. You can copy and paste the final written narratives directly into Treasury’s Portal text boxes.

Corrections and Resubmissions

Once information is entered into Treasury’s Portal, the information will be accepted by Treasury’s Portal as a record if there are no data validation errors.

Once your report is complete and has passed all data validation checks, your report is ready for certification and submission by an Account Administrator (AA) or Authorized Representative for Reporting (ARR). HAF participants should make every effort to ensure accuracy in the data they certify upon submission of their Final Quarterly Report, Final Annual Report, and HAF Financial Closeout Confirmation module. If you believe corrections are needed after you have submitted your Final Quarterly Report, Final Annual Report, or HAF Financial Closeout Confirmation module, please contact us by email at HAF@treasury.gov.

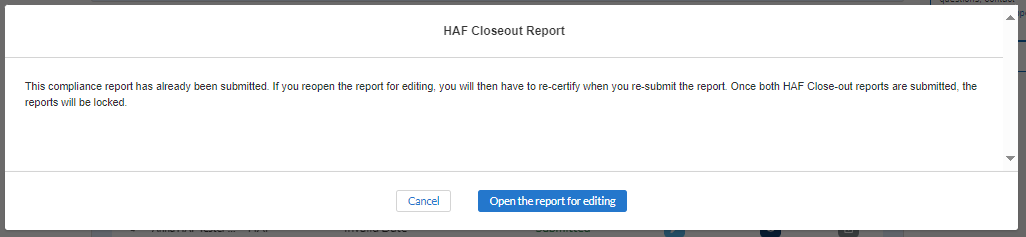

Treasury’s Portal allows for reopening of submitted Final Quarterly Report or Final Annual Report records until both reports have been submitted. If you have edits to make to your Final Quarterly Report or Final Annual Report before both reports have been submitted, a pencil icon will remain in the Edit column of the submitted report on the Closeout Reports page. Click on the pencil icon and a pop up will appear notifying you that, if the report is reopened for editing, the report will need to be re-certified upon resubmission of the report (shown in Figure 4). If you wish to continue with reopening of the report, click on “Open the report for editing” and you will be taken to the reopened report.

Figure 4 Reopen Submitted Report for Editing

The Final Quarterly Report provides information on Program obligations and expenditures covering the period from Award Date through Present. Multiple modules or “screens” will help participants navigate through the Final Quarterly Report in Treasury’s Portal as follows:

Instructions

Participant Information

Budget Reporting

Programmatic Information

Import Disaggregated Data

Disaggregated Application Data

Disaggregated Assistance Data

Geographic Data

Programs

Obligations & Expenditures Verification

Participant Compliance

SF-428

Certification

The following sections describe the reporting steps and information to be collected in each module.

Upon opening a Final Quarterly Report, you will land on an instructions page. Please read the instructions as they are essential to understand before completing the subsequent screens. After reading the instructions, please select “Next” at the bottom of the page or select the next section in the Navigation Bar (shown in Figure 3) on the left-hand side of Treasury’s Portal.

Participant Information

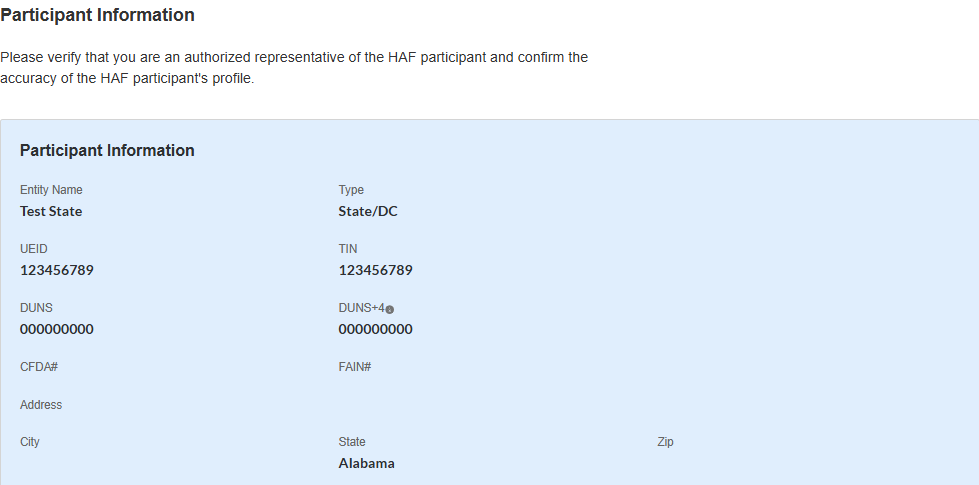

On the Participant Information page, you will review, input, and confirm critical information about your organization. Participant Information will be pre-populated with information from your HAF Application file and prior Compliance Reports.

Please Review and confirm your Recipient Profile information.

Verify the names and contact information for individuals designated for key reporting roles for the HAF award displayed on the screen (see Figure 7).

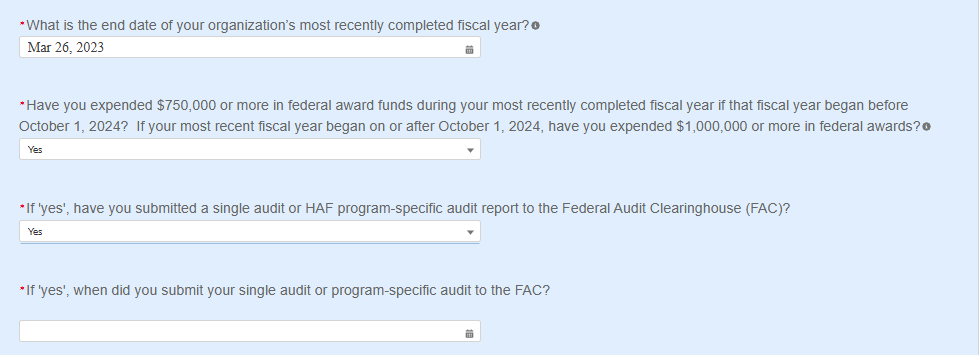

Question One Data Element: What is the end date of your organization’s most recently completed fiscal year? (Data in the format MM/DD/YYYY)

Question Two Data Element: Have you expended $750,000 or more in federal award funds during your most recently completed fiscal year if that fiscal year began before October 1, 2024? If your most recent fiscal year began on or after October 1, 2024, have you expended $1,000,000 or more in federal awards? (Answer Yes or No)

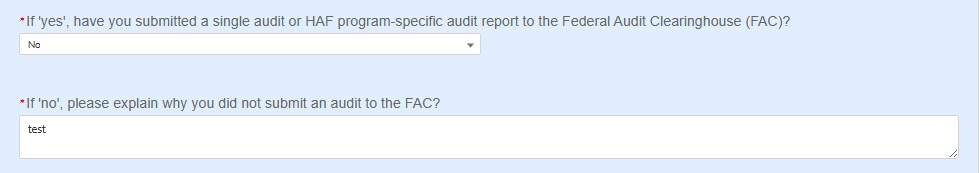

If yes, have you submitted a single audit or HAF program-specific audit report to the Federal Audit Clearinghouse (FAC)? (Answer Yes or No)

If yes, when did you submit your single audit or program-specific audit to the FAC? (Data in the format MM/DD/YYYY)

I

f

no, please explain why you did not submit an audit to the FAC.

f

no, please explain why you did not submit an audit to the FAC.

F igure

5 Recipient Information

Example

igure

5 Recipient Information

Example

W here

the recipient has not submitted a single audit or HAF

program-specific audit report to the Federal Audit Clearinghouse

(FAC):

here

the recipient has not submitted a single audit or HAF

program-specific audit report to the Federal Audit Clearinghouse

(FAC):

Figure 6 Recipient Information Example – Audit

Figure 7 Point of Contact List Example

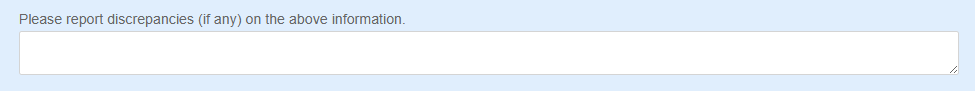

If changes to the Participant Information are needed, use the discrepancy textbox (see Figure 5). If changes to the Point of Contact List are required, use the “Manage Contacts” button below the Contacts table or navigate to the account settings and add/delete/edit information. For other questions regarding participant information, please contact us at HAF@treasury.gov.

After completing this screen, please select “Save and Next” to continue.

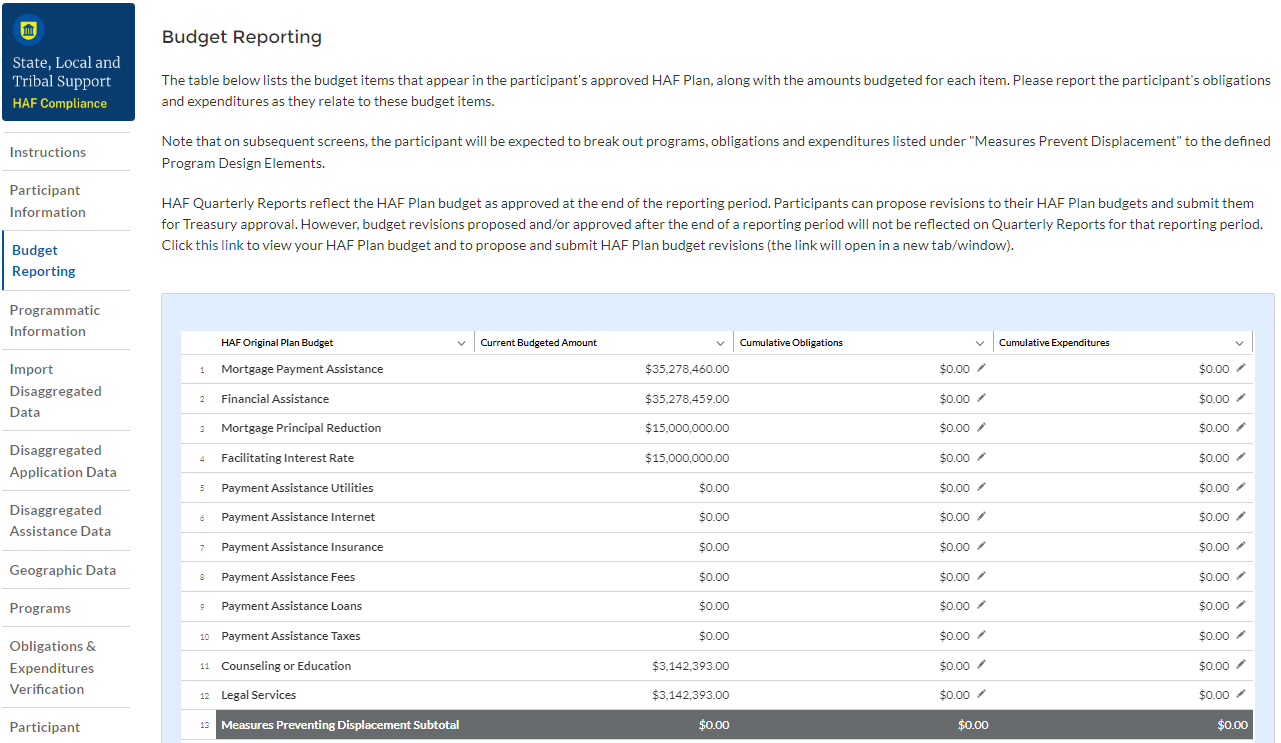

Budget Reporting

On this screen, enter cumulative Obligations (including Expenditures amounts) and cumulative Expenditures funds across all Programs related to your approved budget (see Figure 8). All Programs using the budgetary item “Other measures to prevent homeowner displacement” will need to be broken out by Program Design Element on subsequent screens in the Portal.

Column One Data Element: “Current Budgeted Amount” by Program Design Element.

This information will be prepopulated from the participant’s submitted HAF Plan. The budgeted amounts reflected here should match one-to-one with the participant’s submitted HAF Plan.

Column Two Data Element: “Cumulative Obligations” by Program Design Element.

The sum of the Obligated amount, across all Programs, for each Program Design Element noted in the HAF participant’s submitted HAF Plan.

Expended funds should not exceed Obligated funds. Please refer to Obligated in the Definitions in section 1.c. if you need further clarification.

Column Three Data Element: “Cumulative Expenditures” by Program Design Element.

The sum of the Expended amount, across all Programs, for each Program Design Element noted in the HAF participant’s submitted HAF Plan. Please refer to Expended in the Definitions section 1.c. if you need further clarification.

After completing this screen, please select “Save”, “Save and Back,” or “Save and Next” to continue.

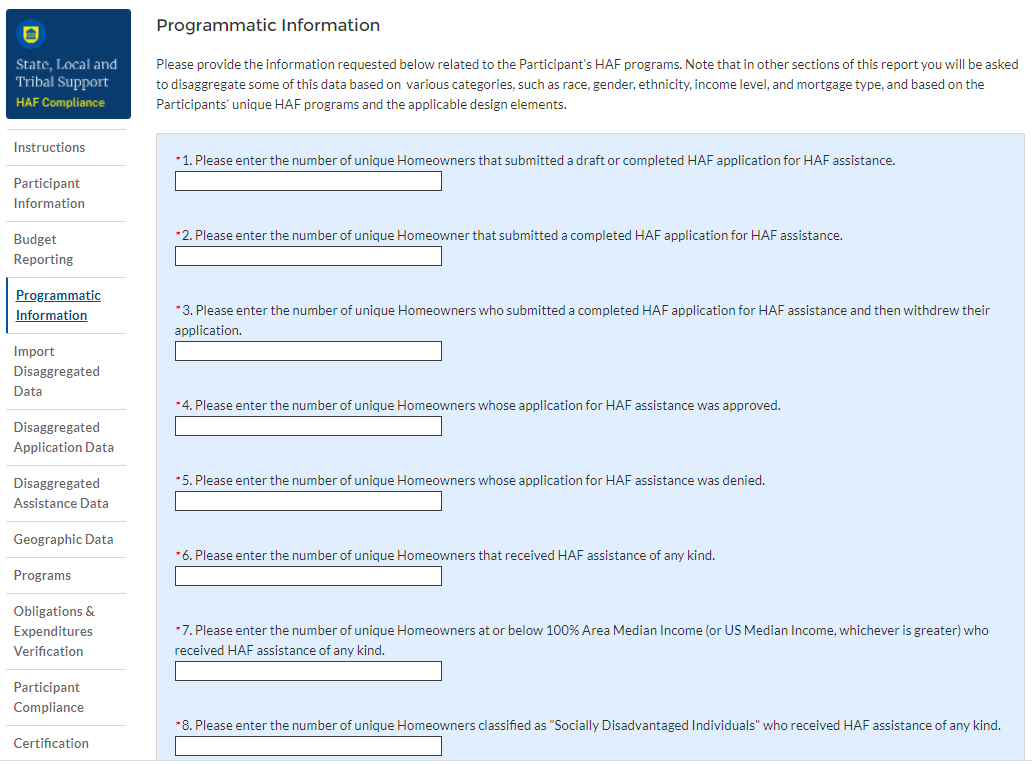

Programmatic Information

On the next screen, HAF participants will be asked to provide programmatic information related to HAF assistance. State HAF Participants will also be asked to disaggregate certain data elements by various categories detailed in section e) Disaggregated Data1 below. Please note that all numerical figures provided on this screen will be Cumulative from the Award Date to the Calendar Quarter end date.

Figure 9 Programmatic Information pt. 1

Question One Data Element: Cumulative Number of Unique Homeowners Submitted Draft or Completed Application

Please enter the cumulative number of unique Homeowners that submitted a draft or completed HAF application for HAF assistance from the Award Date to the Calendar Quarter end date.

Include incomplete applications as “draft applications.”

Please note, you will be asked to disaggregate this number by Race, Ethnicity, Sex, AMI.2

Question Two Data Element: Cumulative Number of Unique Homeowners Submitted Completed Application

Please enter the cumulative number of unique Homeowners that submitted a completed HAF application for HAF assistance from the Award Date to the Calendar Quarter end date.

Completed applications should not include “draft applications”

Please note, you will be asked to disaggregate this number by Race, Ethnicity, Sex, AMI.3

Question Three Data Element: Cumulative Number of Unique Homeowners Withdrawn Application

Please enter the cumulative number of unique Homeowners that submitted a draft or completed HAF application that was subsequently withdrawn by the Homeowner from the Award Date – Calendar Quarter end date.

Please note, you will be asked to disaggregate this number by Race, Ethnicity, Sex, AMI.4

Question Four Data Element: Cumulative Number of Unique Homeowners Approved Application

Please enter the cumulative number of unique Homeowners whose application for HAF assistance was approved from the Award Date to the Calendar Quarter end date.

Please note, you will be asked to disaggregate this number by Race, Ethnicity, Sex, AMI.5

Question Five Data Element: Cumulative Number of Unique Homeowners Denied Application

Please enter the cumulative number of unique homeowners whose application for HAF assistance was denied from the Award Date to the Calendar Quarter end date.

Please note, you will be asked to disaggregate this number by Race, Ethnicity, Sex, AMI, and Reasons for Denial.6

Question Six Data Element: Cumulative Number of Unique Homeowners Assisted

Please enter the cumulative number of unique Homeowners that received HAF assistance of any kind from the Award Date – Calendar Quarter end date. This includes Homeowners who received all forms of assistance including Non-monetary HAF Assistance.

Please note, you will be asked to disaggregate this number by Race, Ethnicity, Sex, AMI, SDI qualifying status(es), Mortgage type, Housing type, and Zip code.7

Question Seven Data Element: Cumulative Number of Unique Homeowners – AMI Targeting

Please enter the cumulative number of unique Homeowners at or below 100% Area Median Income (or U.S. Median Income, whichever is greater) who received HAF assistance of any kind from Award Date – Calendar Quarter end date.

Note that you will be asked to disaggregate all HAF Homeowners by AMI regardless of whether or not 100% AMI is greater than US Median Income in the Disaggregate Data section.

Question Eight Data Element: Cumulative Number of Unique Homeowners as SDI’s

Please enter the cumulative number of unique Homeowners classified as SDIs who received HAF assistance of any kind from Award Date – Calendar Quarter end Date.

While one individual may qualify as an SDI based upon multiple indicators, provide the unique number of Homeowners as SDI’s assisted.

Please note, you will be asked to disaggregate this number by Race, Ethnicity, Sex, AMI, SDI qualifying status(es), Mortgage type, Housing type, and Zip code.8

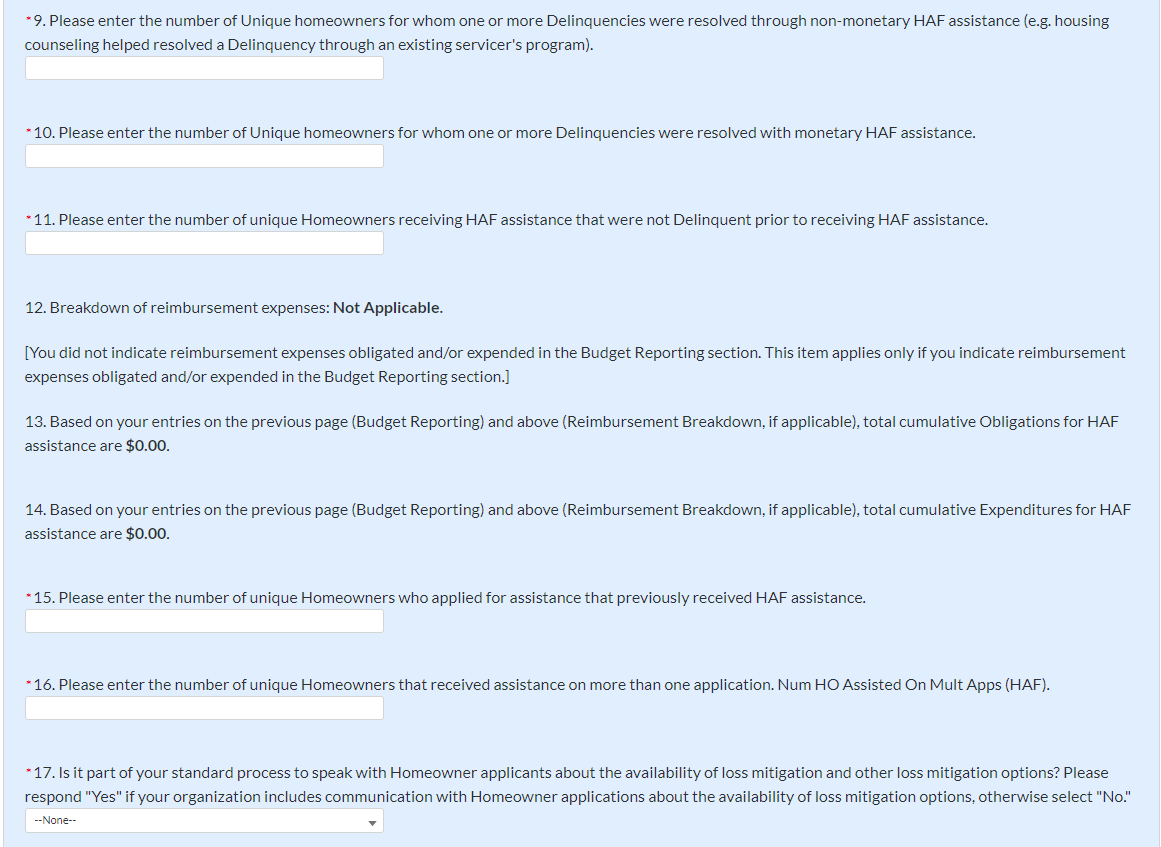

Figure 10 Programmatic Information pt. 2

Question Nine Data Element: Cumulative Number of unique homeowners for whom one or more Delinquencies were Resolved w/ Non-Monetary HAF assistance.

Please enter the cumulative number of unique homeowners with Delinquencies resolved through non-monetary HAF assistance from Award Date to Calendar Quarter end date.

Note that this count should only include instances where hardships were resolved without direct financial payment to or on behalf of the Homeowner. See the Definitions section for further clarification.

HAF funds may or may not be expended during this process due to operational costs, etc. For example:

The direct payment of a balance in arrears on behalf of a Homeowner to resolve delinquency would not count in the category.

A HAF program connecting a homeowner to housing counseling services, including services funded using HAF funds, would count.

Please note that circumstances that could count in this data element are not limited to the example given above. Participants must use the definition provided in the Definitions section to determine what qualifies as non-monetary HAF assistance.

Question Ten Data Element: Cumulative Number of unique homeowners for whom one or more Delinquencies were Resolved w/ Monetary HAF Assistance

Please enter the number of unique homeowners with Delinquencies resolved with Expended monetary HAF assistance from Award Date – Calendar Quarter end date.

Note that this count should include instances where hardships were resolved by direct financial payments made to or on behalf of the Homeowner. See the Definitions section for further clarification.

Question Eleven Data Element: Cumulative Number of Unique Non-Delinquent Homeowners receiving HAF assistance

Please enter the cumulative number of unique Homeowners who received HAF assistance that are not Delinquent from the Award Date to the Calendar Quarter end date.

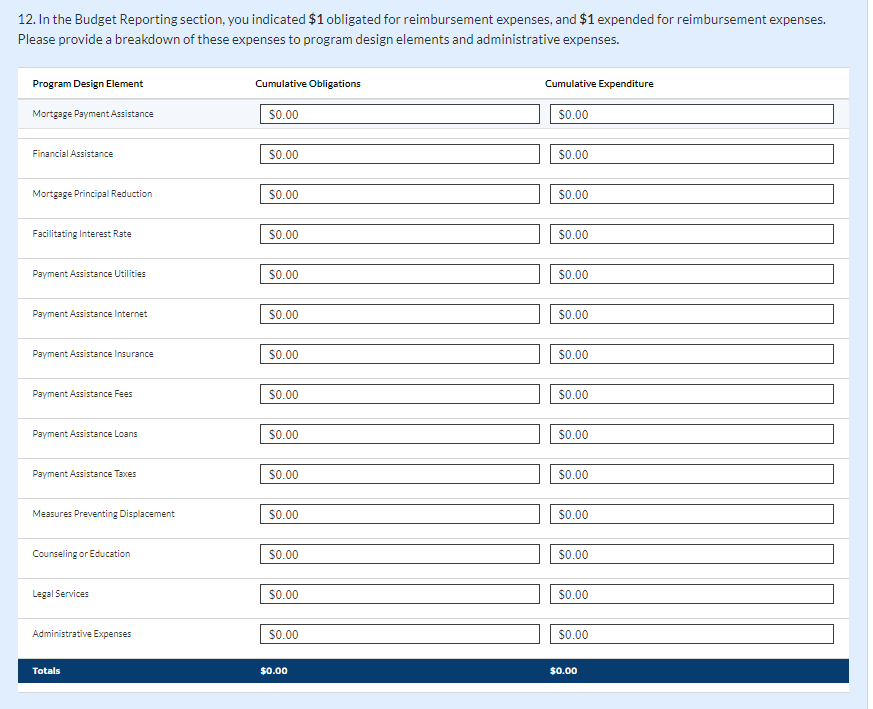

Question Twelve Data Element: Cumulative Dollars of Reimbursement Expenses

If you identified Reimbursement Expenses Obligated and Expended per the Budget Reporting screen, you will be presented with the table below (see Figure 11). This table disaggregates your reimbursement Expenses Obligated and Expended by Program Design Element. If your organization did not identify Reimbursement Expenses on the Budget Reporting Screen, this table will not be available to edit.

Column 1 Data Element: Cumulative Reimbursement Obligations

Please enter the dollar amount of HAF Reimbursements Obligated (including expenditures) from Award Date – Calendar Quarter end date.

Column 2 Data Element: Cumulative Reimbursement Expenditures

Please enter the dollar amount of HAF Reimbursement Expenditures from Award Date – Calendar Quarter end date.

Please note that both your cumulative disaggregate Reimbursement Expenses Obligated and your cumulative disaggregate Reimbursement Expenses Expended must sum to align with what you reported on the previous Budget Reporting screen.

Figure 11 Reimbursement Expenses Breakout

Question Thirteen Data Element: Cumulative Dollars of HAF Assistance Obligated less Administrative expenses

The cumulative dollar amount of HAF assistance Obligated (not including administrative expenses) from Award Date – Calendar Quarter end date will be prepopulated using the Budget Reporting screen.

Please note, you will be asked to disaggregate this dollar amount by Race, Ethnicity, Sex, AMI, SDI qualifying status(es), Mortgage type, Housing type, and Zip code9

Note that Cumulative HAF Obligations should include current and past expenditures and obligations for future expenditures. See the Definitions section for further clarification.

Question Fourteen Data Element: Cumulative Dollars of HAF Assistance Expended less Administrative expenses

The cumulative dollar amount of HAF assistance Expended (not including administrative expenses) from Award Date – Calendar Quarter end date will be prepopulated using the Budget Reporting screen.

Please note, you will be asked to disaggregate this dollar amount by Race, Ethnicity, Sex, AMI, SDI qualifying status(es), Mortgage type, Housing type, and Zip code10

Question Fifteen Data Element: Cumulative Number of Unique Homeowners Applied – Previously Assisted

Please enter the cumulative number of unique Homeowners who applied for assistance that previously received HAF assistance from Award Date – Calendar Quarter end date.

If a Homeowner was previously assisted by any Program under your organization’s HAF Program and applied for assistance again, count them here.

Note, any homeowner counted under Question 16 below should also be counted under Question 15 as receipt of assistance a second time, an applicant must have applied multiple times.

Question Sixteen Data Element: Cumulative Number of Unique Homeowners Receiving Assistance– Previously Assisted

Please enter the cumulative number of unique Homeowners that received assistance on more than one application from Award Date – Calendar Quarter end date.

If a Homeowner was previously assisted by any Program under your organization’s HAF Award and received additional assistance by the same or another Program, count them here.

Question Seventeen Data Element: Loss Mitigation Prioritization

Please respond “Yes” if it is part of your standard process to speak with Homeowner applicants about the availability of loss mitigation and other loss mitigation options.

Please respond “No” if it is not part of your standard process.

After completing this screen, please select “Save”, “Save and Back,” or “Save and Next” to continue.

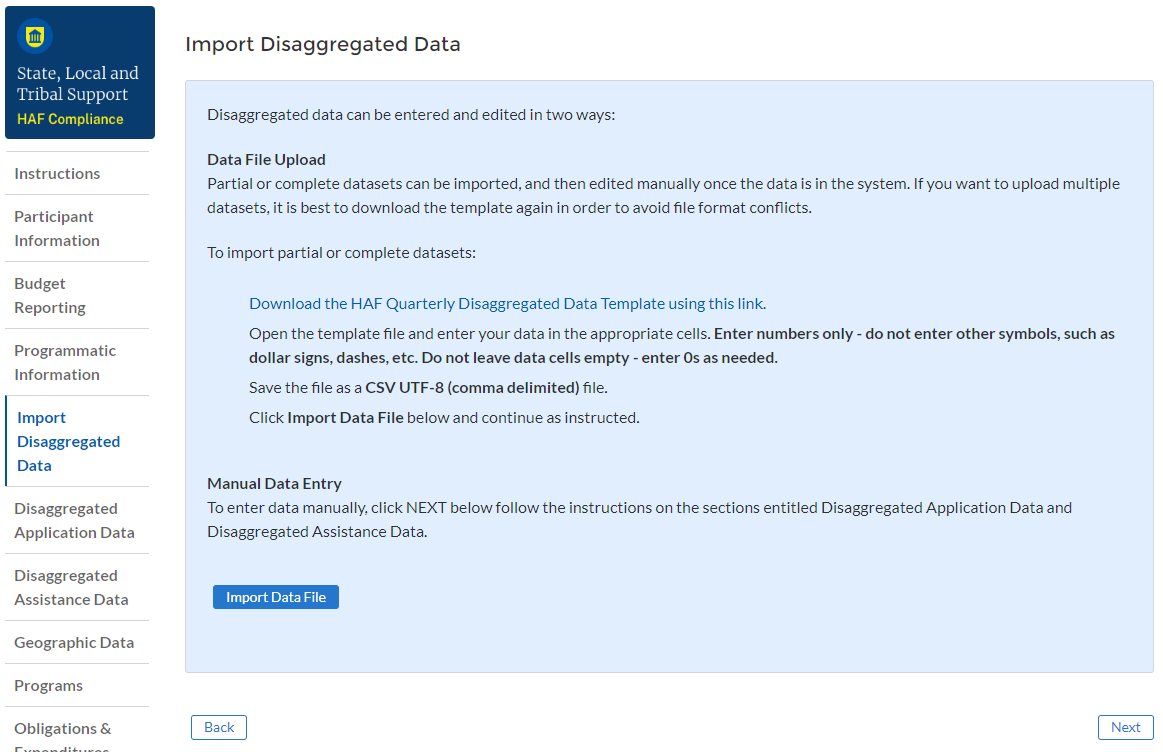

You have been provided with the option to bulk upload your disaggregated data related to applications and assistance using an Excel Template for ease of reporting. Please refer to section f and section g below for information on requirements to be collected.

Figure 12 Import Disaggregated Data

To use the bulk upload feature, please download the HAF Quarterly Disaggregated Data Template by clicking the “Download the HAF Quarterly Disaggregated Data Template” button (See Figure 12 above). Once you have downloaded the template, please fill out the corresponding information. If needed, further information on each column in the template can be found in section f and section g below.

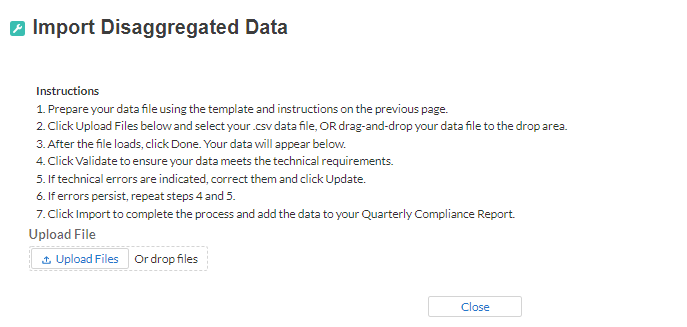

Once you have filled out all cells in the template, please select the “Import Data File” button (see Figure 12 above), and you will be presented with the upload module (see Figure 13 below).

Figure 13 Import Disaggregated Data Upload Module

Please select “Upload Files” and upload your completed disaggregated data template.11 Select “Close” to continue when you have finished entering/uploading your disaggregated data template.

Disaggregated Application Data12

In this section, you will be asked to provide disaggregate data by various categories such as race, sex, ethnicity, area median income, and reason for denial (see Figures 14-16).

If your disaggregated application data has not changed from the last quarter, you have the option to automatically populate the values submitted with your last quarterly report by using the “Populate” button (see red box on Figure 14). You can reset automatically populated values to 0 at any time using the “Reset” button.

Disaggregated application data can be entered manually on this page or uploaded directly using the template discussed in section e. Be sure to save your work as you go by using the “Save” button.

All Columns of each Table require cumulative counts of applications.

Obligations and Expenditures reported in the Disaggregated Application Data table must be consistent with data entered previously in Budget Reporting and Programmatic Information sections. If applicants selected multiple categories, they should be counted in multiple rows. The segment totals for Obligations and Expenditures (row labeled Totals) must be greater than or equal to the related aggregate figures entered in the Budget Reporting and Programmatic Information sections (shown in the row labeled Programmatic Totals). System will generate a warning if Obligations and Expenditures Totals are less than the figures entered under Budget Reporting and Programmatic Information.

Figure 14 Disaggregated Application Data pt.1

Table 1 Data Element: Disaggregate Race Application Cumulative Totals

Please provide the cumulative figures for the number of applications submitted, completed, withdrawn, approved, and denied, each broken out by Race from Award Date – Calendar Quarter end date.

Note that individuals may report more than one race, so your totals for cumulative number of applications may be greater than the total number of unique applications.

Obligations and Expenditures must be consistent with data entered previously in Budget Reporting and Programmatic Information sections. If applicants selected multiple categories, they should be counted in multiple rows.

Figure 15 Disaggregated Application Data pt. 2

Table 2 Data Element: Disaggregate Ethnicity Application Cumulative Totals

Please provide the cumulative figures for the number of applications submitted, completed, withdrawn, approved, and denied, each broken out by Ethnicity from Award Date – Calendar Quarter end date.

Note that individuals may not be both “Hispanic or Latino/a” and “Not Hispanic or Latino/a” concurrently.

The total numbers of applications reported in the Ethnicity table must equal to the numbers of applications entered in the Programmatic Information section (shown in row labeled Programmatic Totals).

Table 3 Data Element: Disaggregate Sex Application Cumulative Totals

Please provide the cumulative figures for the number of applications submitted, completed, withdrawn, approved, and denied, each broken out by Sex from Award Date – Calendar Quarter end date.

Note that individuals reporting a Sex other than “Male” or “Female” or who reported both “Male” and “Female” concurrently, should be classified as “Not Collected/Reported.”

The total numbers of applications reported in the Sex table must equal to the numbers of applications entered in the Programmatic Information section (shown in row labeled Programmatic Totals).

Table 4 Data Element: Disaggregate Area Median Income Application Cumulative Totals

Please provide the cumulative figures for the number of applications submitted, completed, withdrawn, approved, and denied, each broken out by AMI from Award Date – Calendar Quarter end date.

Please bucket applications by the percentile brackets, Fact Specific Proxy, or Data Not Collected in the Disaggregated Area Median Income Table.

The total numbers of applications reported must equal to the numbers of applications entered in the Programmatic Information section (shown in row labeled Programmatic Totals).

Figure 16 Disaggregated Application Data pt. 3

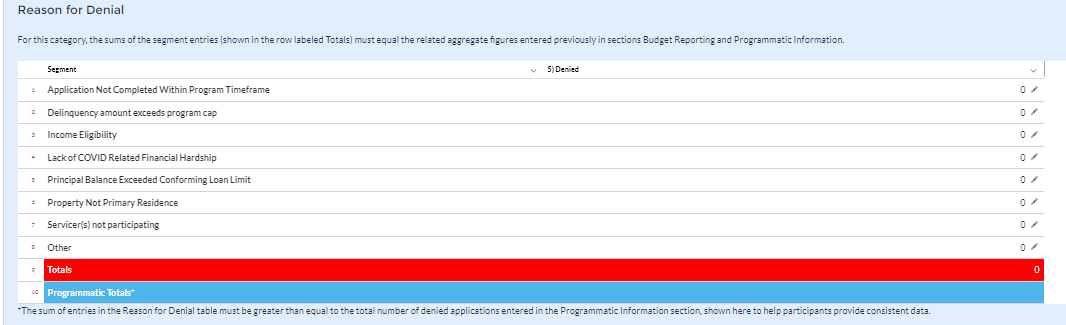

Table 5 Data Element: Disaggregate Reason for Denied Application Cumulative Totals

Please provide the cumulative figures for the number of applications denied, each broken out by Reason for Denial from Award Date – Calendar Quarter end date.

Note that applications may have been denied for more than one, so your totals for cumulative number of applications denied may be greater than the total number of unique applications denied.

The sum of entries in the Reason for Denial table must be greater than or equal to the total number of denied applications entered in Programmatic Information section (row labeled Programmatic Totals).

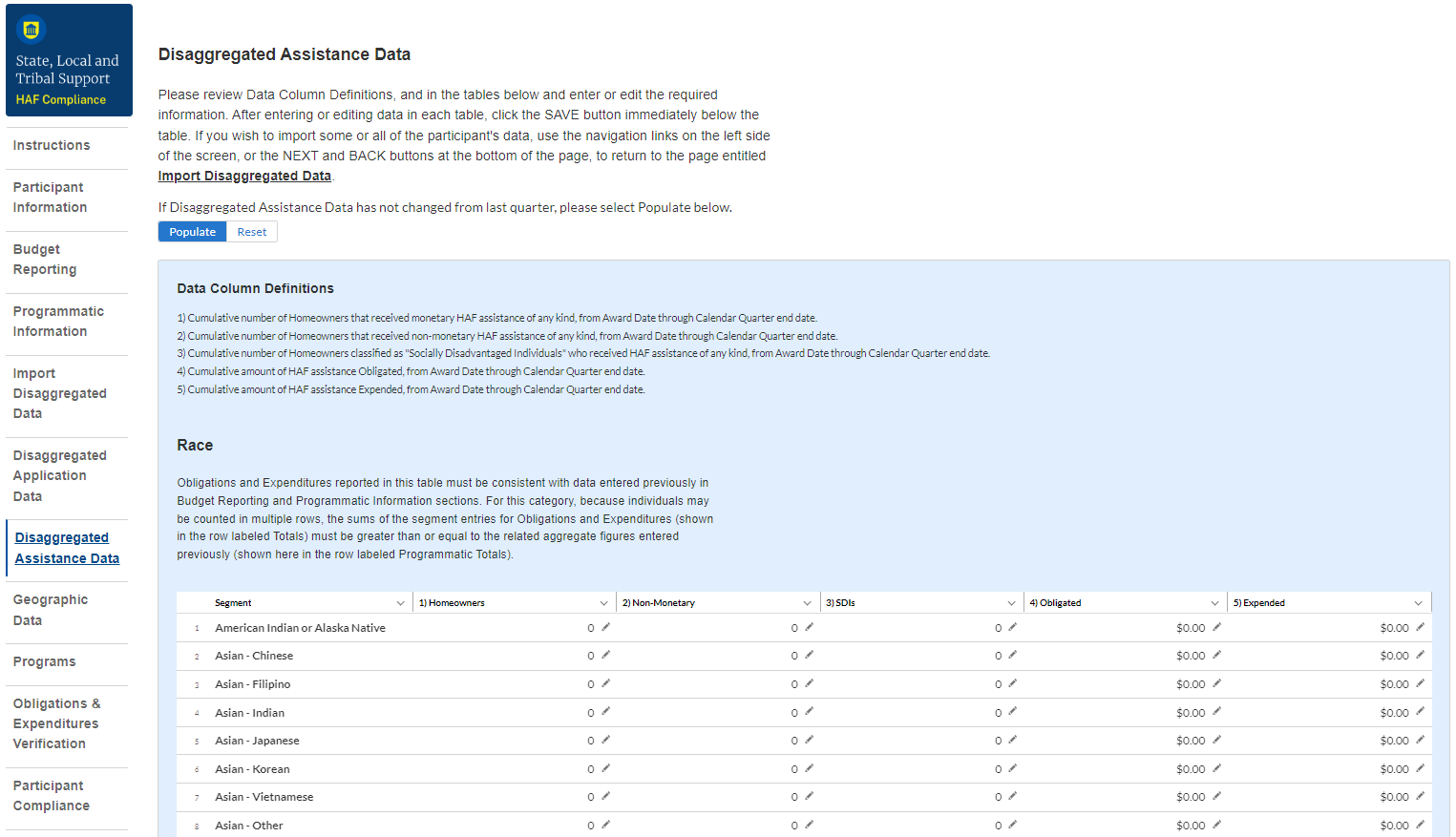

Disaggregated Assistance Data13

In this section, you will be asked to provide disaggregate assistance data by various categories such as race, sex, ethnicity, area median income, targeting, and mortgages (see Figure 17).

If your disaggregated assistance data has not changed from the last quarter, you have the option to automatically populate the values submitted with your last quarterly report by using the “Populate” button (see red box on Figure 17). You can reset automatically populated values to 0 at any time using the “Reset” button.

Disaggregated data can be entered manually on this page or uploaded directly from the template file provided to you. Be sure to save your work as you go by using the “Save” button.

Note that Columns 1, 2, and 3 of each Table in the following section require cumulative counts of homeowners that received Monetary Assistance (Homeowners), Non-Monetary Assistance, and SDIs broken out by the categories listed above. Homeowners receiving both Monetary and Non-Monetary Assistance should be reported in both Columns 1 and 2. Columns 4 and 5 require cumulative fund Obligation and Expenditure amounts, refer to the Definitions section for clarification on the distinction between the two terms.

Obligations and Expenditures reported in this table must be consistent with data entered previously in Budget Reporting and Programmatic Information sections. Target values are shown below each table to help HAF participants provide consistent data. System will generate a warning if Obligations and Expenditures Totals are less than the figures entered under Budget Reporting and Programmatic Information.

Figure 17 Disaggregated Assistance Data pt. 1

Table 1 Data Element: Disaggregate Race Cumulative Totals

Please provide the cumulative numbers of Homeowners that received Monetary Assistance, Homeowners that received Non-Monetary Assistance, and SDI’s that received Monetary or Non-Monetary Assistance, along with total funds Obligated and Expended, each broken out by Race from Award Date – Calendar Quarter end date. Note, if an individual received both Monetary and Non-Monetary Assistance, they should be reported in both Columns 1 and 2.

Note that individuals may report more than one race, so your totals for cumulative number of Homeowners assisted (Table 1, Column 1), Homeowners receiving Non-Monetary Assistance (Table 1, Column 2), cumulative number of SDI’s assisted (Table 1, Column 3), cumulative amount of Obligations (Table 1, Column 4), and cumulative amount of Expenditures (Table 1, Column 5) may not reflect the number of unique individuals assisted or total amount of Obligations and Expenditures.

For each homeowner that selected multiple race categories, the total amount of HAF assistance Obligated and Expended should be reported under each race category.

Obligations and Expenditures reported in this table must be consistent with data entered previously in Budget Reporting and Programmatic Information sections. The target values are shown at the bottom to help HAF participants provide consistent data. Because individuals may be select multiple races, the sums of the segment entries for Obligations and Expenditures (shown in the row labeled Totals) must be greater than or equal to the related aggregate figures entered previously (shown in the row labeled Programmatic Totals).

Figure 18 Disaggregated Assistance Data pt. 2

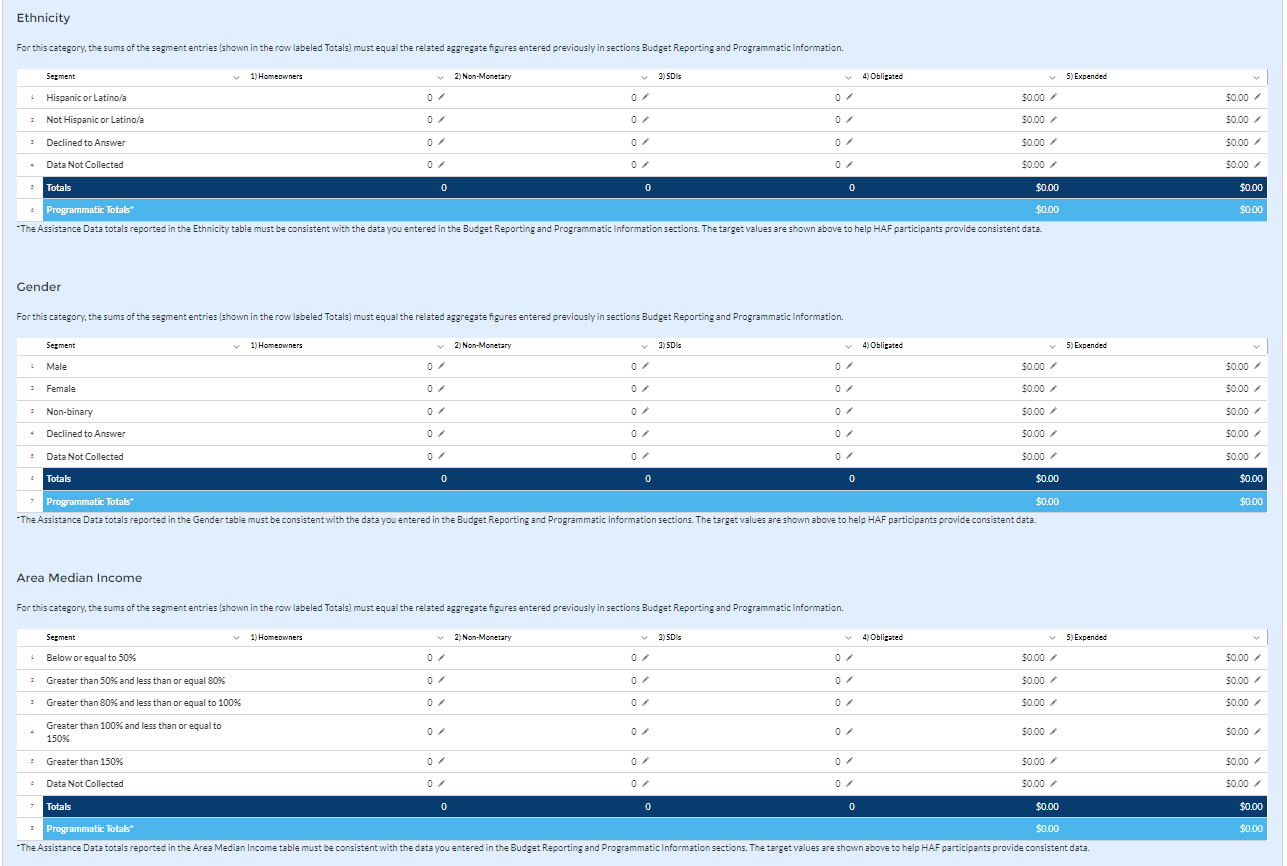

Table 2 Data Element: Disaggregate Ethnicity Cumulative Totals

Please enter the cumulative figures for the number of Homeowners that received Monetary Assistance, number of Homeowners that received Non-Monetary Assistance, number of SDI’s assisted, funds Obligated, and Funds Expended, each broken out by Ethnicity from the Award Date to the Calendar Quarter end date.

Note that individuals may not be both “Hispanic or Latino/a” and “Not Hispanic or Latino/a” concurrently.

Totals reported must be consistent with the data you entered in the Budget Reporting and Programmatic Information sections. The target values are shown above to help HAF participants provide consistent data.

Table 3 Data Element: Disaggregate Sex Cumulative Totals

Please provide the cumulative figures for the number of Homeowners that received Monetary Assistance, number of Homeowners that received Non-Monetary Assistance, number of SDI’s assisted, funds Obligated, and Funds Expended, each broken out by Sex from the Award Date to the Calendar Quarter end date.

Note that individuals reporting a Sex other than “Male” or “Female” or who reported both “Male” and “Female” concurrently, should be classified under “Not Collected/Reported.”

Totals reported must be consistent with the data you entered in the Budget Reporting and Programmatic Information sections. The target values are shown above to help HAF participants provide consistent data.

Table 4 Data Element: Disaggregate Area Median Income Cumulative Totals

Please provide the cumulative figures for the number of Homeowners that received Monetary Assistance, number of Homeowners that received Non-Monetary Assistance, the number of SDI’s assisted, funds Obligated, and Funds Expended, each broken out by AMI from Award Date – Calendar Quarter end date.

Note that Homeowners who qualified for HAF assistance in a jurisdiction where US Median Income was used for targeting, individuals should be categorized as they fall within their own locality’s AMI regardless of if US Median Income was used for targeting.

Please bucket individuals by the percentile brackets provided to you in the Disaggregate Area Median Income Table.

Totals reported must be consistent with the data you entered in the Budget Reporting and Programmatic Information sections. The target values are shown above to help HAF participants provide consistent data.

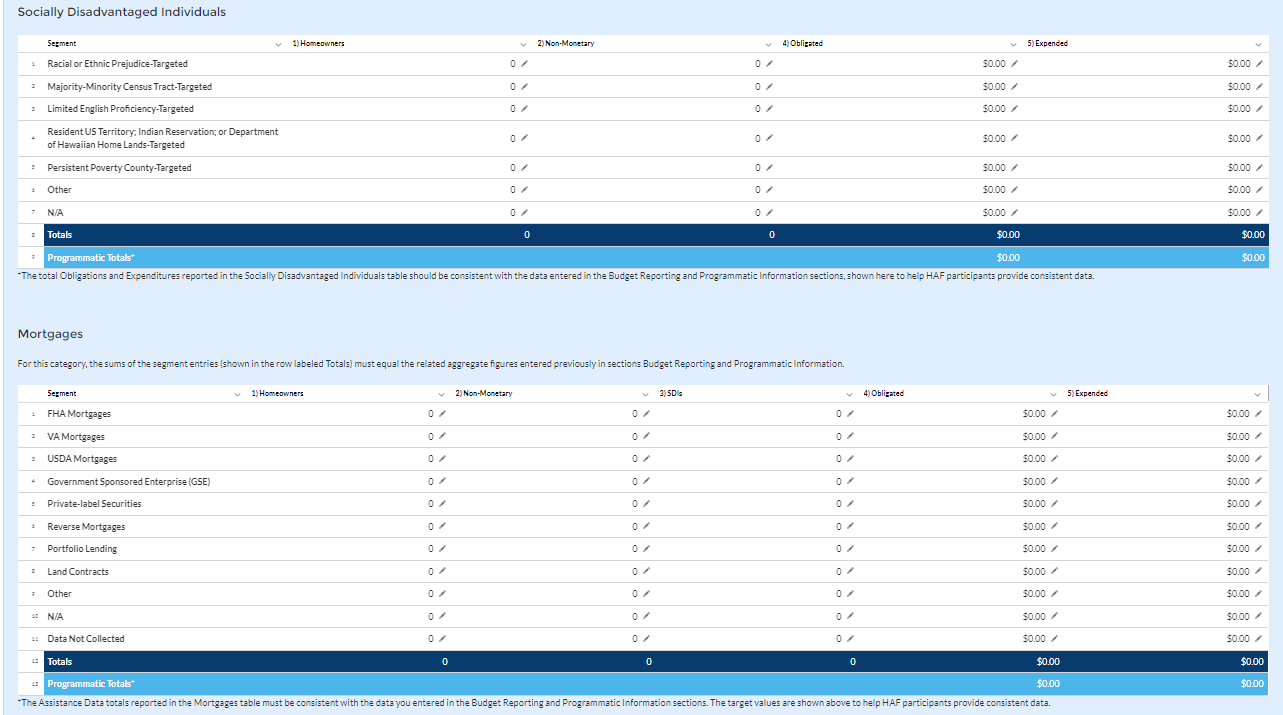

Figure 19 Disaggregated Assistance Data pt. 3

Table 5 Data Element: Disaggregate Socially Disadvantaged Individual Cumulative Totals

Please provide the cumulative figures for the number of Homeowners that received Monetary Assistance, number of Homeowners that received Non-Monetary Assistance, funds Obligated, and funds Expended, each broken out by type of Socially Disadvantaged Individual from the Award Date to the Calendar Quarter end date.

The total Obligations and Expenditures reported in the Socially Disadvantaged Individuals table should be consistent with the data entered in the Budget Reporting and Programmatic Information sections, shown here to help HAF participants provide consistent data.

Table 6 Data Element: Disaggregate Mortgage Cumulative Totals

Please provide the cumulative figures for the number of Homeowners that received Monetary Assistance, number of Homeowners that received Non-Monetary Assistance, funds Obligated, and funds Expended, each broken out by Mortgage type from the Award Date to the Calendar Quarter end date.

Note that Reverse mortgages may overlap with other mortgage types.

The Assistance Data totals reported in the Mortgage table must be consistent with the data you entered in the Budget Reporting and Programmatic Information sections. The target values are shown above to help HAF participants provide consistent data.

Figure 20 Disaggregated Assistance Data pt. 4

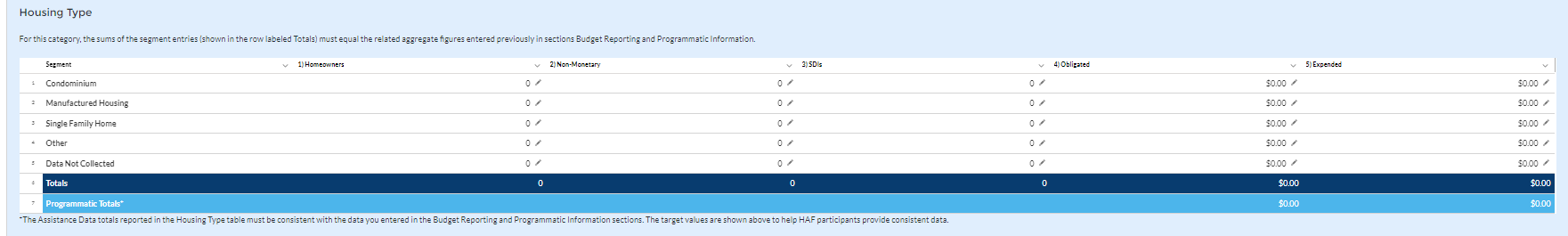

Table 7 Data Element: Disaggregate Housing Cumulative Totals

Please provide the cumulative figures for the number of Homeowners that received Monetary Assistance, number of Homeowners that received Non-Monetary Assistance, number of SDI’s assisted, funds Obligated, and Funds Expended, each broken out by Housing type from the Award Date to the Calendar Quarter end date.

The Assistance Data totals reported in the Housing Type table must be consistent with the data you entered in the Budget Reporting and Programmatic Information sections. The target values are shown above to help HAF participants provide consistent data.

You have been provided with the option to bulk upload your disaggregated data using an Excel Template for ease of reporting. Please refer to section e above for more information on the bulk upload process. You may also upload partial datasets and manually edit the missing entries using the screen displayed in Figures 17-20 above.

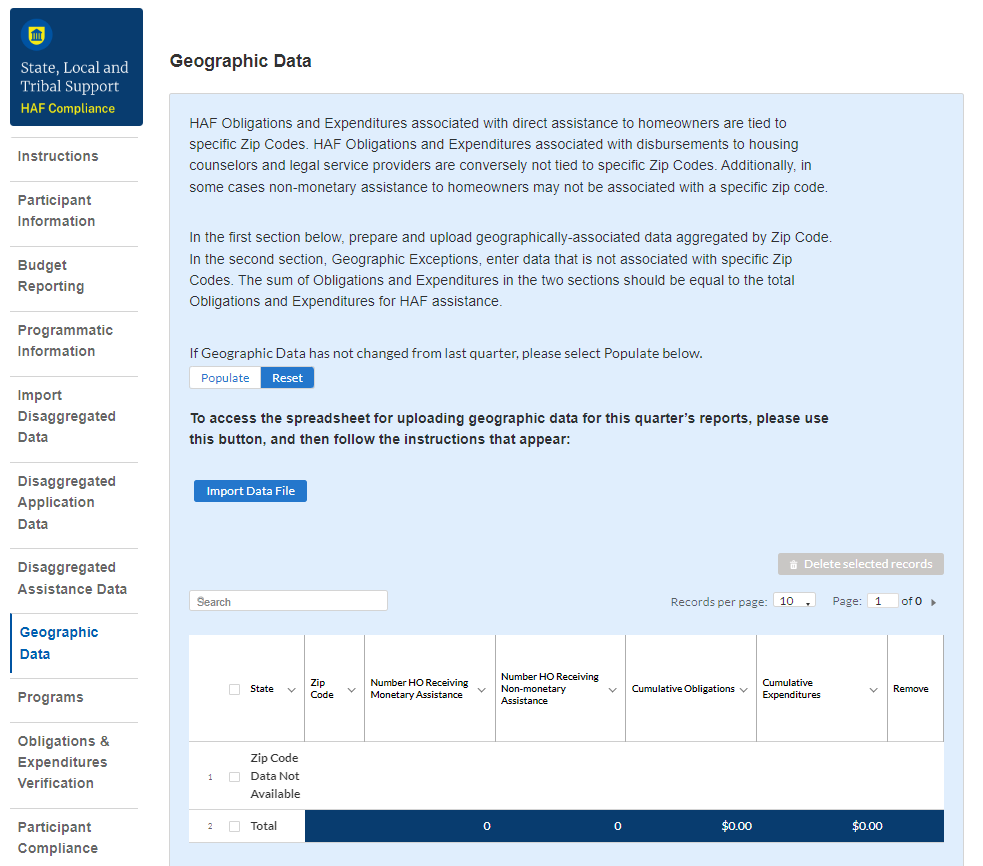

Geographic Data14

On this screen, you must provide Geographic Data by zip code. If your geographic data has not changed from last quarter, you have the option to automatically populate the values submitted with your last quarterly report by using the “Populate” button (see red box on Figure 21). You can reset automatically populated values at any time using the “Reset” button.

Data import functionality can only accommodate 400 records at a time, so if you have more than 400 zip codes to report, you must use multiple data files, each with 400 zip codes or less, and repeat the upload, validate, and import process for each data file. This information must be provided via Data File Import, as pictured in Figure 21 and 22 below.

Direct Monetary Assistance to homeowners tied to specific Zip Codes and Non-monetary assistance to homeowners associated with a specific zip code should be reported here. HAF Obligations and Expenditures associated with disbursements to housing counselors and legal service providers are conversely not tied to specific Zip Codes and should not be reported here.

Figure 21 Geographic Data Upload

The geographic data template contains zip code, state, and four data elements by zip code: number of Unique Homeowners receiving Monetary Assistance, number of Unique Homeowners receiving Non-Monetary Assistance, cumulative HAF Assistance Obligations, and cumulative HAF Assistance Expenditures.

Figure 22 Import Geographic Data Pop-Up

When you have completed the template, select “Upload Files”15. Please be sure to follow template instructions without changing anything in rows 1-7 and enter data starting in row 8. Be sure to delete the sample data provided in rows 8-15 before uploading. The file must be saved as a CSV UTF-8 (comma delimited) file. Improperly formatted submissions will fail to validate. Once your data has been uploaded, follow the instructions that appear on the import box and validate that your records populated in the table as expected (see Figure 22).

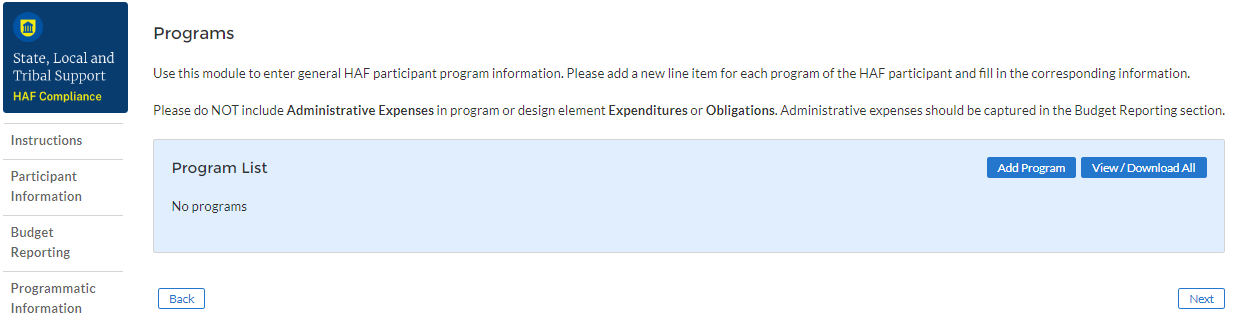

Figure 23 Geographic Exceptions

Three questions are on the Geographic Data tab. As shown in Figure 23, the fields request the number of homeowners that received Non-Monetary HAF assistance but cannot be associated with a specific zip code and cumulative obligations and cumulative expenditures associated with these homeowners.

The sum of Obligations and Expenditures reported in the zip code file and in the three questions an assistance to homeowners that cannot be associated to a specific zip code should be sum to Total Obligations and Expenditures for HAF assistance reported in the Budget Reporting and Programmatic Information sections. When you have entered data for these questions select “Save and Next” to continue.

Programs

In your HAF Plan you submitted information regarding planned HAF Programs. On this screen you will enter general HAF participant Program information as well as information on corresponding Program Design Elements. Figure 24 below outlines the process for the Programs screen. Please note that you will be asked to enter individual Program information and then brought back to summary screen. If you have more than one Program, you will need to click “Add Program” and fill out corresponding information. If the need arises, you may edit or delete existing Programs.

Figure 24 Program Creation Process

Once you have created a Program you will be asked to provide topline Program details and then to provide disaggregated details by each of the Programs’ Design Elements, which your organization submitted as a part of their HAF Plan.

To begin select “Add Program” to enter a new line item for each Program and fill in the corresponding information.

At any time, you may select “View/Download All” to review your entries in a top-down view during or after completion. The screen displayed in Figure 25 will not contain any Program entries until you have created your first Program entry.

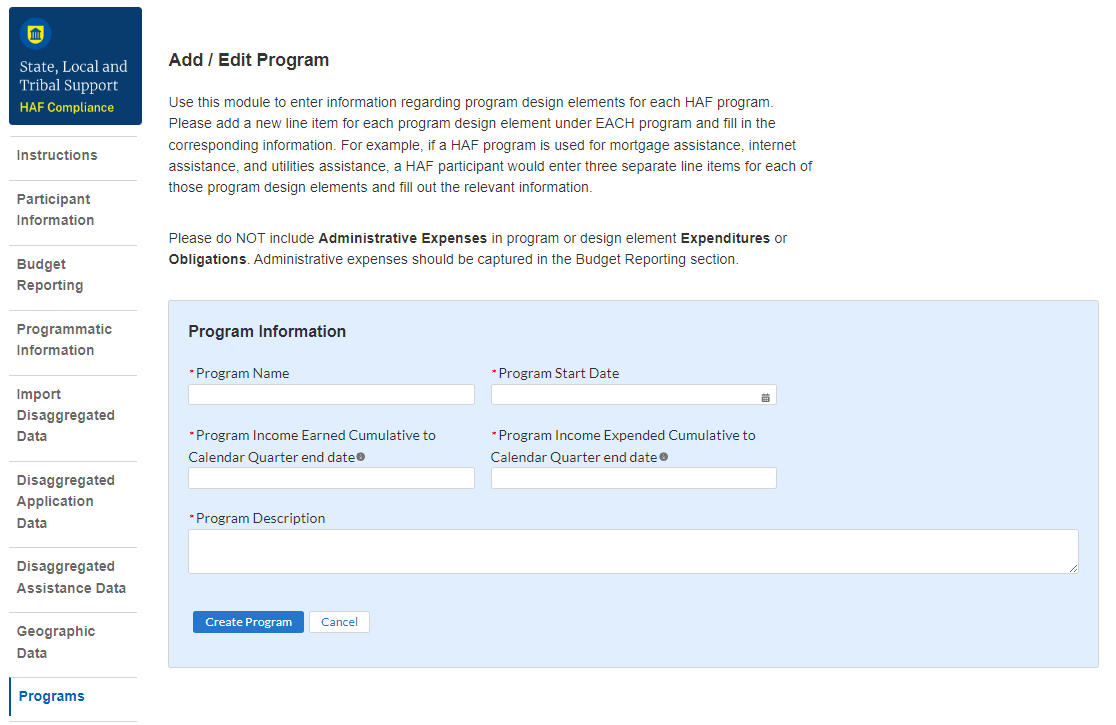

Add/Edit Program

Once you have selected “Add Program” the module displayed in Figure 26 will appear.

After selecting “Add Program”, you will be prompted to provide the Program specific figures including:

Program Details: Program name, start date, and a program description.

For the Program name, please tie the name to what was provided in your previously submitted term sheet.

Program Income Earned Cumulative to Calendar Quarter end date: Cumulative Program Income Earned, Award Date – Calendar Quarter end date.

Program Income Expended Cumulative to Calendar Quarter end date: Cumulative Program Income Expended, Award Date – Calendar Quarter end date.

Refer to the Definitions section if you need further information.

Note that all information provided should be broken out to figures specific to the Program you are currently working on. After completing a Program, you will be able to toggle between and edit existing Programs from the Programs Overview, detailed in Figure 25 above.

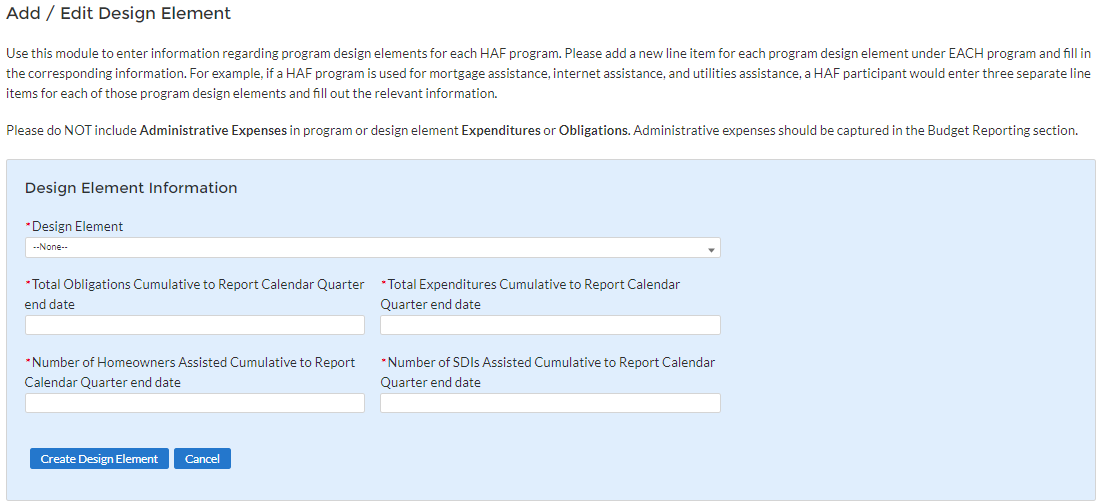

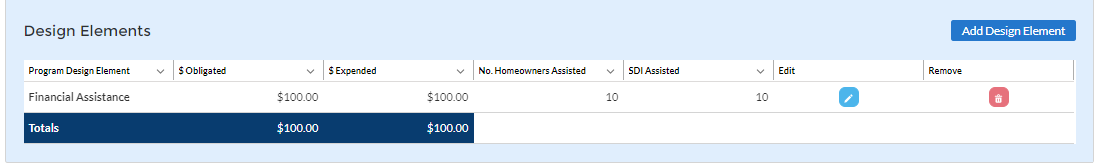

Figure 27 Create/Edit Design Element

Figure 28 Add/Edit Design Elements

Add/Edit Program Design Element

You will also be required to provide information regarding the Program Design Elements covered by each Program. When creating a Program select “Add Design Element” as shown in Figure 28 to enter the screen displayed in Figure 27. Within each Program, you will need to provide covered Program Design Elements and further disaggregated Program totals. Figure 28 above shows the Program Design Element overview displayed at the bottom of the page while a Program is created or edited. All added Program Design Elements in the Program are visible to make viewing progress and editing individual Program Design Elements more accessible.

Once you’ve chosen to either Add or Edit a given Program Design Element, you will be presented with the screen depicted in Figure 27. Provide the corresponding information to continue.

Program Design Element: Please select from the drop-down which Program Design Element you would like to add to your Program.

Total Expenditures Cumulative to Report Calendar Quarter end date by Program Design Element: The Total Cumulative Expenditures of the Program Design Element, the Award Date to the Calendar Quarter end date.

Total Obligations Cumulative to Report Calendar Quarter end date by Program Design Element: The Total Cumulative Obligations of the Program Design Element, from the Award Date to the Calendar Quarter end date.

Number of Unique Homeowners Assisted Cumulative to Report Calendar Quarter end date by the Program Design Element: The number of Homeowners assisted by the Program Design Element, from the Award Date to the Calendar Quarter end date.

Number of SDIs Assisted Cumulative to Report Calendar Quarter end date by the Program Design Element: The number of SDIs assisted by the Program Design Element, from the Award Date to the Calendar Quarter end date.

Once you have completed entering information on all Programs and their respective Program Design Elements, select “Next” to continue.

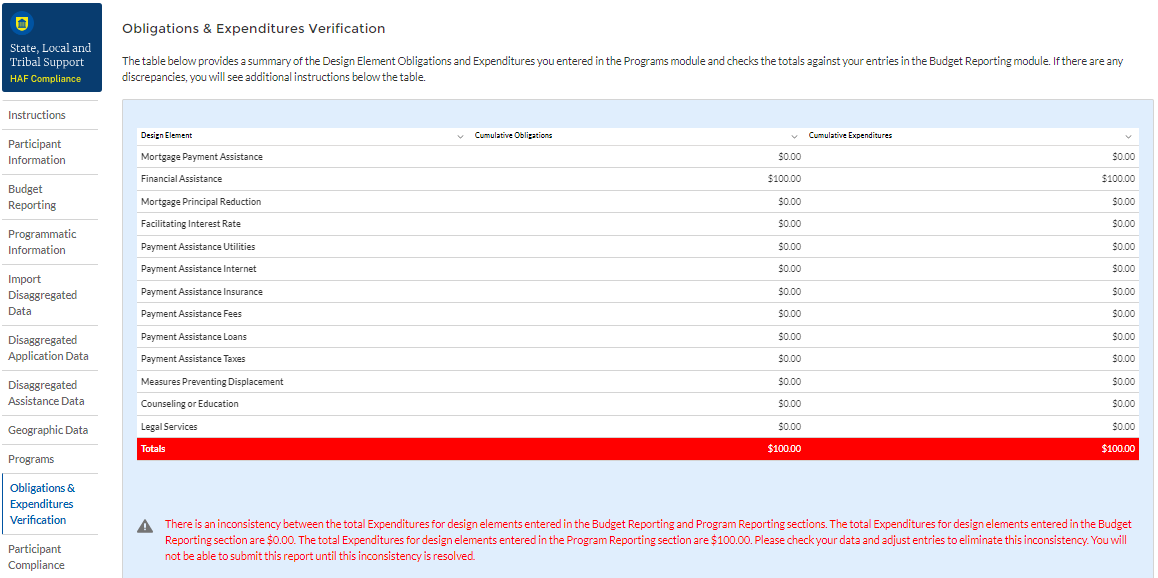

Obligations and Expenditures Verification

The information on this screen is read-only. Use the table displayed in Figure 29 to validate the figures that have been provided in previous screens. Note that this displayed information is populated by the Program Design Element screen provided earlier. This screen will display a validation error if the “Totals” figures from the Program Design Element screens do not match the information provided in the Budget Reporting screen.

Figure 29 Obligations & Expenditures Verification

Column One Data Element: Cumulative Obligations by Program Design Element

This column reflects the sum of all cumulative Obligations across all Programs by Program Design Element.

Note that we have progressed away from the Programs tab in the Navigation Bar and will now be reviewing information aggregated across all Programs by Program Design Element.

Column Two Data Element: Cumulative Expenditures by Program Design Element

This column reflects the sum of all Cumulative Expenditures across all Programs by Program Design Element.

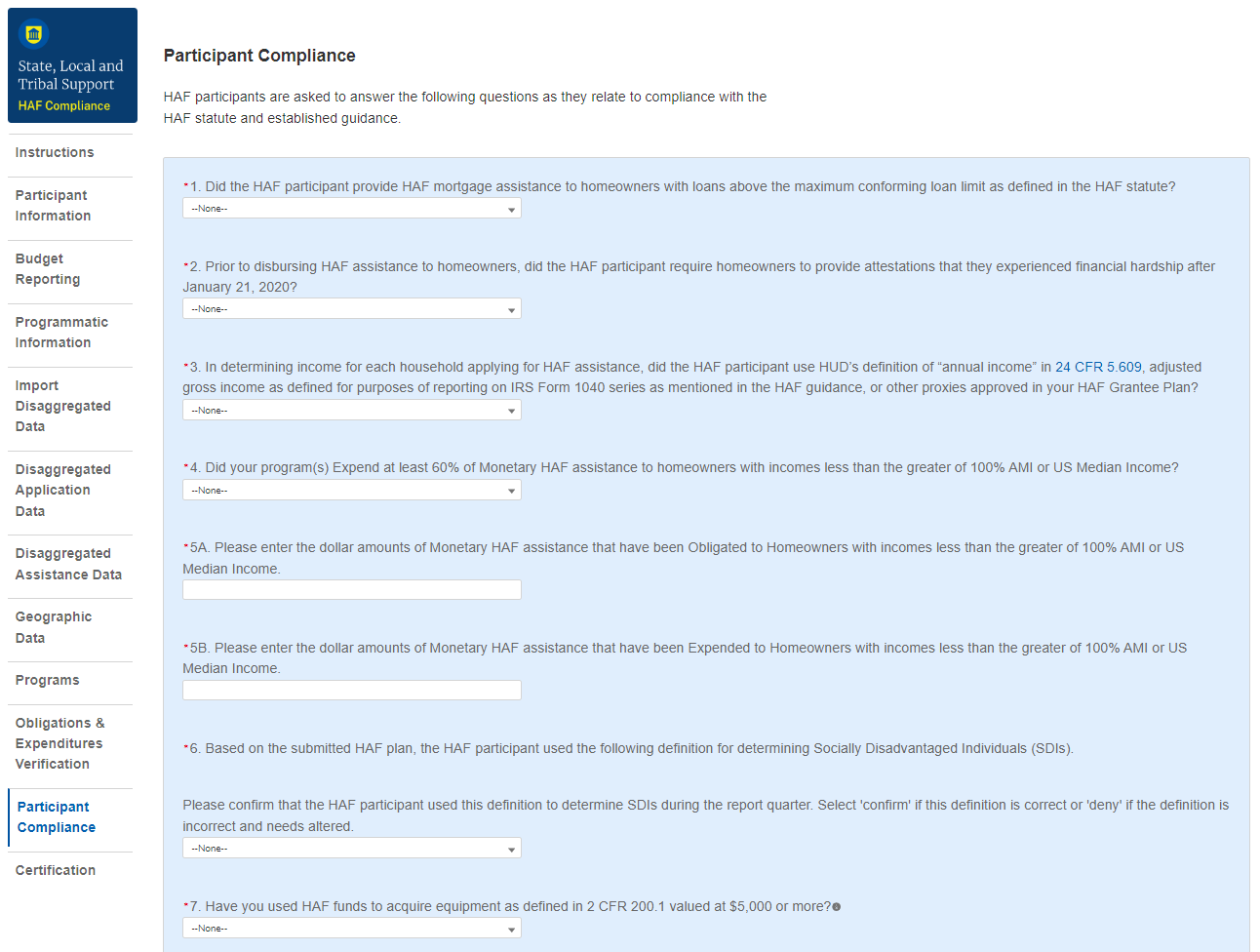

Participant Compliance

HAF participants are required to provide answers to six questions relating to compliance with the HAF statute and established guidance (see Figure 30).

Figure 30 Participant Compliance Screen

Question One: Did the HAF participant provide HAF mortgage assistance to homeowners with loans above the maximum conforming loan limit as defined in the HAF statute?

Select “Yes” if the participant provided HAF mortgage assistance to Homeowners on loans above the maximum conforming loan limit; give a narrative explanation for “Yes” answers.

Otherwise, select “No.”

Question Two: Prior to disbursing HAF assistance to homeowners, did the HAF participant require homeowners to provide attestations that they experienced financial hardship after January 21, 2020?

Select “Yes” if the participant required attestation from HAF Homeowners to having experienced financial hardship after January 21, 2020.

Otherwise, select “No”. Provide a narrative explanation for “No” answers.

Question Three: In determining income for each household applying for HAF assistance, did the HAF participant use HUD’s definition of “annual income” in 24 CFR 5.609, adjusted gross income as defined for purposes of reporting on IRS Form 1040 series as mentioned in the HAF guidance, or other proxies approved in its HAF Plan?

Select “Yes” if the participant used HUD’s definition of “annual income”, adjusted gross income as defined for purposes of reporting on IRS Form 1040 series as mentioned in the HAF guidance, or other proxies approved in its HAF Plan when determining income for each household applying for HAF assistance.

Otherwise, select “No”. Provide a narrative explanation for “No” answers.

Question Four: Did your program(s) Expend at least 60% of Monetary HAF assistance to homeowners with incomes less than the greater of 100% AMI or US Median Income?

Select “Yes” if the participant Expended at least 60% of HAF assistance to Homeowners with income less than the greater of either 100% AMI or US Median Income.

Otherwise, select “No”. Provide a narrative explanation for all “No” answers.

5a. Question Five “A”: Please enter the dollar amounts of Monetary HAF assistance that have been Obligated to Homeowners with incomes less than the greater of 100% AMI or US Median Income.

Please enter the cumulative dollar amount of monetary HAF assistance Obligated to Homeowners with income less than the greater of either 100% AMI or US Median Income.

5b. Question Five “B”: Please enter the dollar amounts of Monetary HAF assistance that have been Expended to Homeowners with incomes less than the greater of 100% AMI or US Median Income.

Please enter the cumulative dollar amount of monetary HAF assistance Expended to Homeowners with income less than the greater of either 100% AMI or US Median Income.

Question Six: Based on the submitted HAF plan, the HAF participant specified a definition for determining Socially Disadvantaged Individuals (SDIs).

Please confirm that the HAF participant used this definition to determine SDIs during the report quarter. Select 'confirm' if this definition is correct or 'deny' if the definition is incorrect and needs altered.16

A prepopulated SDI definition will be provided. This definition was pulled from your HAF Plan. Please review the definition prior to answering the next Yes/No question.

Select “Yes” if the participant used the submitted definition of SDIs when determining SDIs among HAF Homeowners.

Otherwise, select “No”. Provide a narrative explanation for “No” answers.

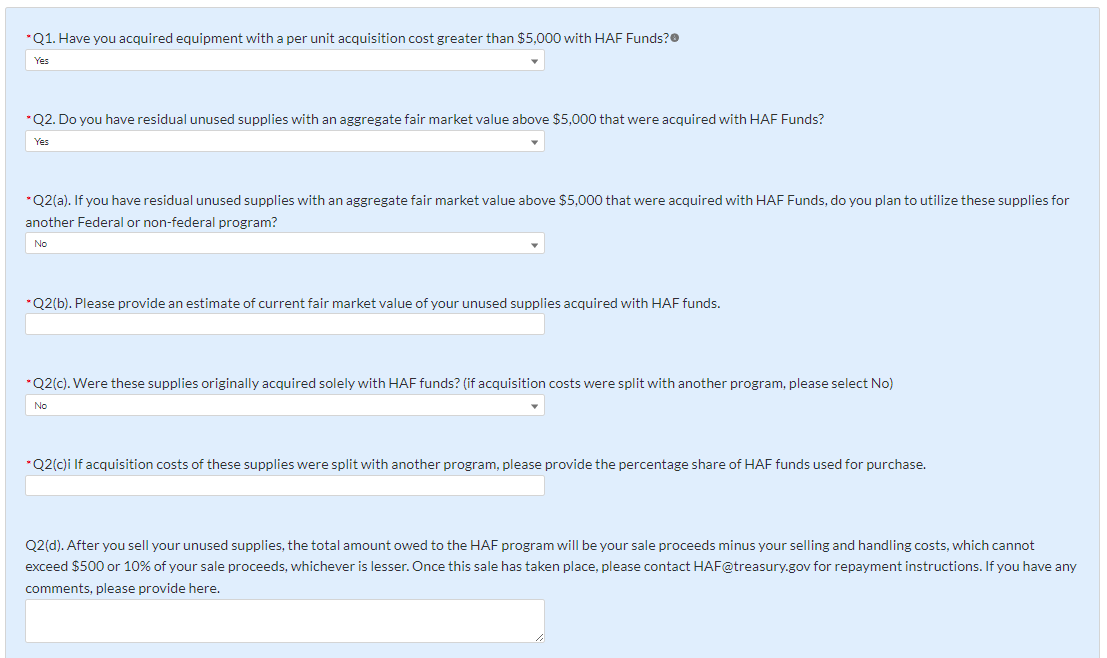

SF-428

All HAF recipients must report on tangible personal property (equipment and supplies) acquired with HAF award funds during the award POP. On this screen, you will enter in information related to tangible personal property consistent with the Tangible Personal Property Report (SF-428-B form). The SF-428-B form is required if you acquired equipment with a per unit fair market value of about $5,000 with the HAF award or if you have residual unused supplies with the total aggregate value above $5,000 that was acquired with the HAF award. HAF participants are responsible for reporting on behalf of their subrecipients if their subrecipients used HAF award funds to acquire equipment or supplies, or both.

Per the Uniform Guidance, 2 CFR 200.1, tangible personal property incudes equipment and supplies. It does not include copyrights, patents or securities. A computing device is considered a supply if the acquisition cost is less than $5,000 per unit, regardless of the length of its useful life.

Consistent with Uniform Guidance, 2 CFR 200.313(e)(1), equipment acquired with HAF award funds with a current per unit fair market value of $5,000 or less at the end of the award period of performance may be retained, sold, or otherwise disposed of by HAF recipients with no further responsibility to Treasury. Supplies acquired with HAF award funds with the total aggregate value of $5,000 or less at the end of the award POP may also be retained by HAF recipients with no further responsibility to Treasury. Additionally, Treasury permits recipients with equipment with a per unit fair market value of more than $5000 or unused supplies that have a total aggregate value of more than $5,000 to be retained by the recipient if it is needed for another federal award or for activities for non-federally funded programs or projects for the government entities which have similar objectives as the HAF program.

Introduction

On this screen, you will be asked a series of questions related to equipment you acquired with HAF Funds to determine whether you need to complete an SF-428S and whether you have further responsibility to Treasury related to equipment.

Figure 31 SF-428 Introduction pt. 1

Question One: Have you acquired equipment with a per unit acquisition cost greater than $5,000 with HAF Funds?

If you answered “Yes,” to Question 1, an SF-428S tab will appear next to the Introduction tab that you will complete on the next screen.

Question Two: Do you have residual unused supplies with an aggregate fair market value above $5,000 that were acquired with HAF funds?

Question Two (a): If you answer “Yes” to Question 2, you will be asked the following: If you have residual unused supplies with an aggregate fair market value above $5,000 that were acquired with HAF Funds, do you plan to utilize these supplies for another Federal or non-federal program?

Question Two (b): If you answer “Yes” to Question 2, you will be asked the following: Please provide an estimate of current fair market value of your unused supplies acquired with HAF funds.

Question Two (c): If you answer “Yes” to Question 2, you will be asked the following: Were these supplies originally acquired solely with HAF funds? If acquisition costs were split with another program, please select “No”.

Question Two (c)i: If you answer “Yes” to Question 2(c), you will be asked the following: If acquisition costs of these supplies were split with another program, please provide the percentage share of HAF funds used for purchase.

Question Two (d): If you answer “Yes” to Question 2, you will be asked the following: After you sell your unused supplies, the total amount owed to the HAF program will be your sale proceeds minus your selling and handing costs, which cannot exceed $500 or 10% of your sale proceeds, whichever is lesser. Once this sale has taken place, please contact HAF@treasury.gov for repayment instructions. If you have any comments, please provide here.

Figure 32 SF-428 Introduction pt. 2

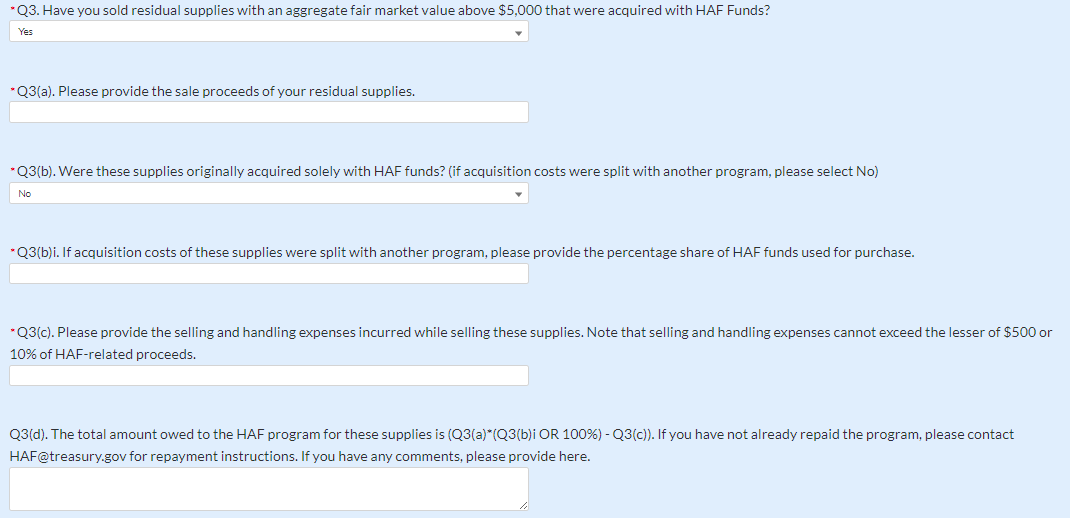

Question Three: Have you sold residual supplies with an aggregate fair market value above $5,000 that were acquired with HAF Funds?

Question Three (a): If you answer “Yes” to Question 3, you will be asked the following: Pease provide the sale proceeds of your residual supplies.

Question Three (b): If you answer “Yes” to Question 3, you will be asked the following: Were these supplies originally acquired solely with HAF funds? (If acquisition costs were split with another program, please select No)

Question Three (b)i: If you answer “No” to Question 3(b), you will be asked the following: If acquisition costs of these supplies were split with another program, please provide the percentage share of HAF funds used for purchase.

Question Three (c): If you answer “Yes” to Question 3, you will be asked the following: Please provide the selling and handling expenses incurred while selling these supplies. Note that selling and handling expenses cannot exceed the lesser of $500 or 10% of HAF-related proceeds.

Question Three (d): If you answer “Yes” to Question 3, you will be asked the following: The total amount owed to the HAF program for these supplies is (Q3(a)*(Q3(b)i OR 100%) - Q3(c)). If you have not already repaid the program, please contact HAF@treasury.gov for repayment instructions. If you have any comments, please provide here.

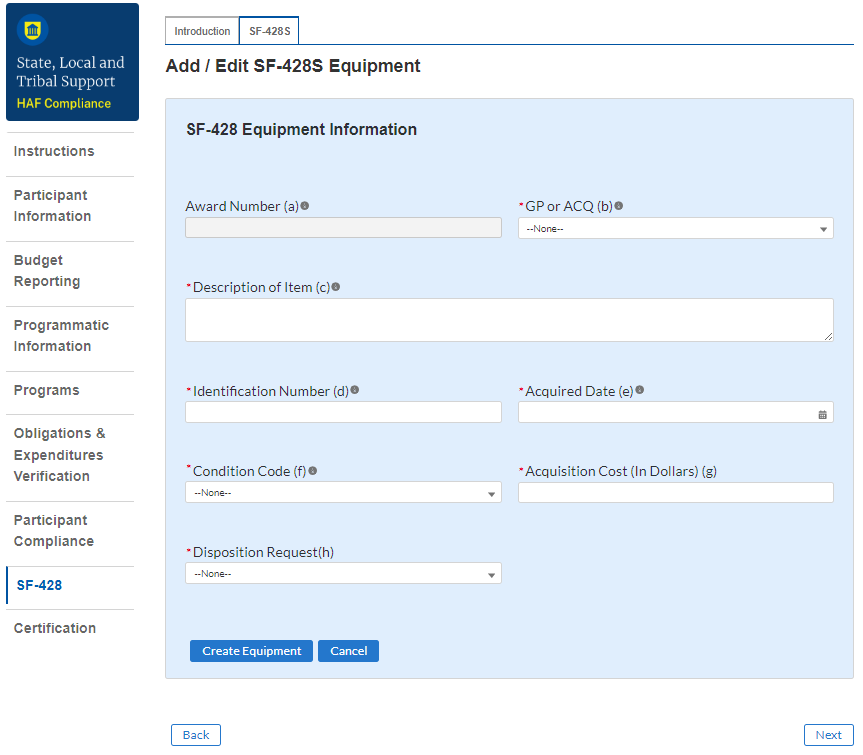

SF-428S

The SF-428S screen will appear if you indicated you have acquired equipment with a per unit acquisition cost greater than $5,000 with HAF Funds. You will be asked to enter individual pieces of equipment and return to the summary screen. If you have more than one piece of equipment, you will need to click “Add new equipment” and fill out items a-h for each piece of equipment. If the need arises, you may edit or delete existing equipment. You should create an SF-428S record for each piece of equipment you acquired with a per unit acquisition cost greater than $5,000 with HAF Funds.

To begin, select “Add new equipment” to enter a new line item for each piece of equipment and fill in the corresponding information for items a-h. Note Award Number (a) will be prepopulated with your HAF Award FAIN.

Once you have selected “Add new equipment” the module displayed in Figure 33 will appear.

Figure 33 Add/Edit SF-428S Equipment

After selecting “Add new equipment”, you will be prompted to provide the equipment specific figures including:

Award Number. For Consolidated Annual Report Attachments, enter the Federal grant, cooperative agreement or other Federal financial assistance award instrument number or other identifying number assigned to the Federal financial assistance award. For all other Report Attachments (i.e., Individual Annual, Final, and Disposition Request/Report) leave blank. Note: This field will pre-populate with your HAF Award FAIN.

GP or ACQ. Enter GP if the item is Federally-owned property. Note: Federally-owned property consists of items furnished by the Federal Government for use on the award identified in Block 1 or Column a. Enter ACQ if the item was acquired with award funds.

Description of Item. Provide a brief description of the item, including Fair Market Value ($$).

Identification Number. Enter the manufacturer’s serial number, model number, Federal stock number, national stock number, or other identification number.

Acquired Date. Enter the date the item was acquired by the recipient. For items furnished by the Federal Government, enter the date received by the recipient.

Condition Code. Enter the applicable condition code from the following list:

1 Excellent. Property that is in new condition or unused condition and can be used immediately without modification or repairs.

4 Usable. Property which shows some wear, but can be used without significant repair.

7 Repairable. Property which is unusable in its current condition but can be economically repaired.

X Salvage. Property which has value in excess of its basic material content, but repair or rehabilitation is impractical and/or uneconomical.

S Scrap. Property which has no value except for its basic material content.

Acquisition Cost. Enter the item acquisition cost.

Disposition Request. Indicate the type of disposition requested for each item from the following list:

Retain item for another Federal or non-federal program

Have already sold item for sales price greater than $5,000

Have already sold item for sales price less than or equal to $5,000

Plan to sell item

Once you have completed entering information on all equipment, select “Next” to continue.

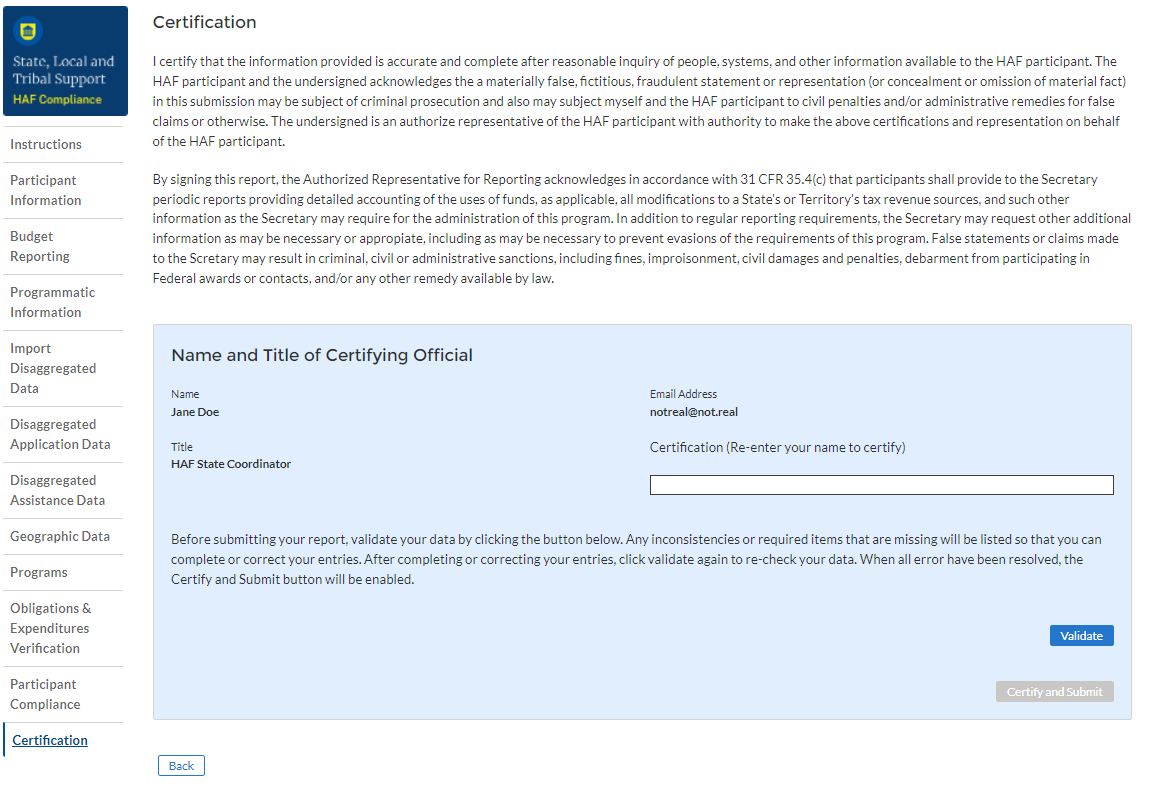

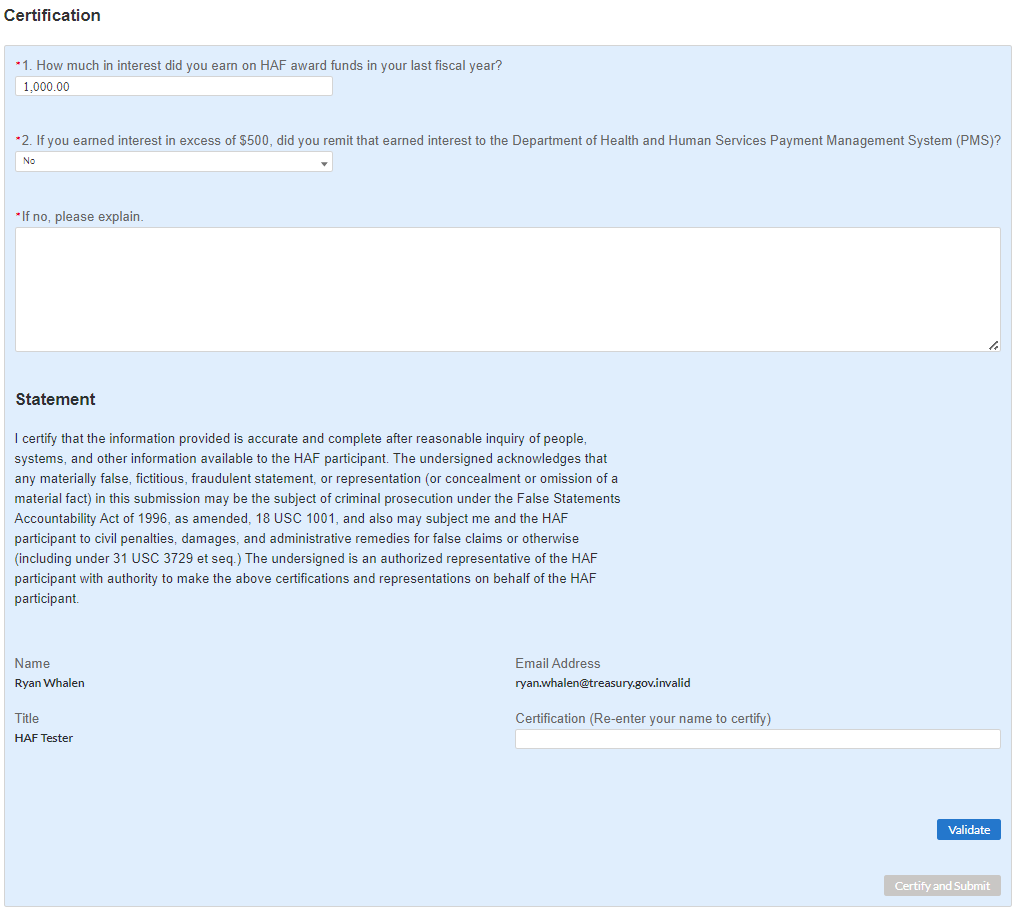

Certification

On this screen, the Authorized Representative for Reporting (ARR) will be asked to certify information pertaining to the Quarterly Report and to confirm compliance with applicable regulations. 17,18

First, use the “Validate” button at the bottom of the page (see Figure 34) to check your draft report for errors. Errors will backfill through the previous screens to make error-fixing easier.

Once validation is passed, click the “Certify and Submit” button to complete the report submission.

Figure 34 Certification Screen

HAF Compliance Report Survey

After the Authorized Representative for Reporting (ARR) has successfully Certified and Submitted their report, an optional 5 question “HAF Compliance Report Survey” will appear. Your honest assessment of HAF Quarterly Reporting is appreciated.

Figure 35 HAF Compliance Report Survey

Section IV. Final Annual Report

a) Instructions

Upon opening the Final Annual Report, you will land on an instructions page. Please read the instructions as they are essential to understand before completing the subsequent screens. After reading the instructions, please select “Next” at the bottom of the page or use the Navigation Bar on the left of Treasury’s Portal to move to the next screen.

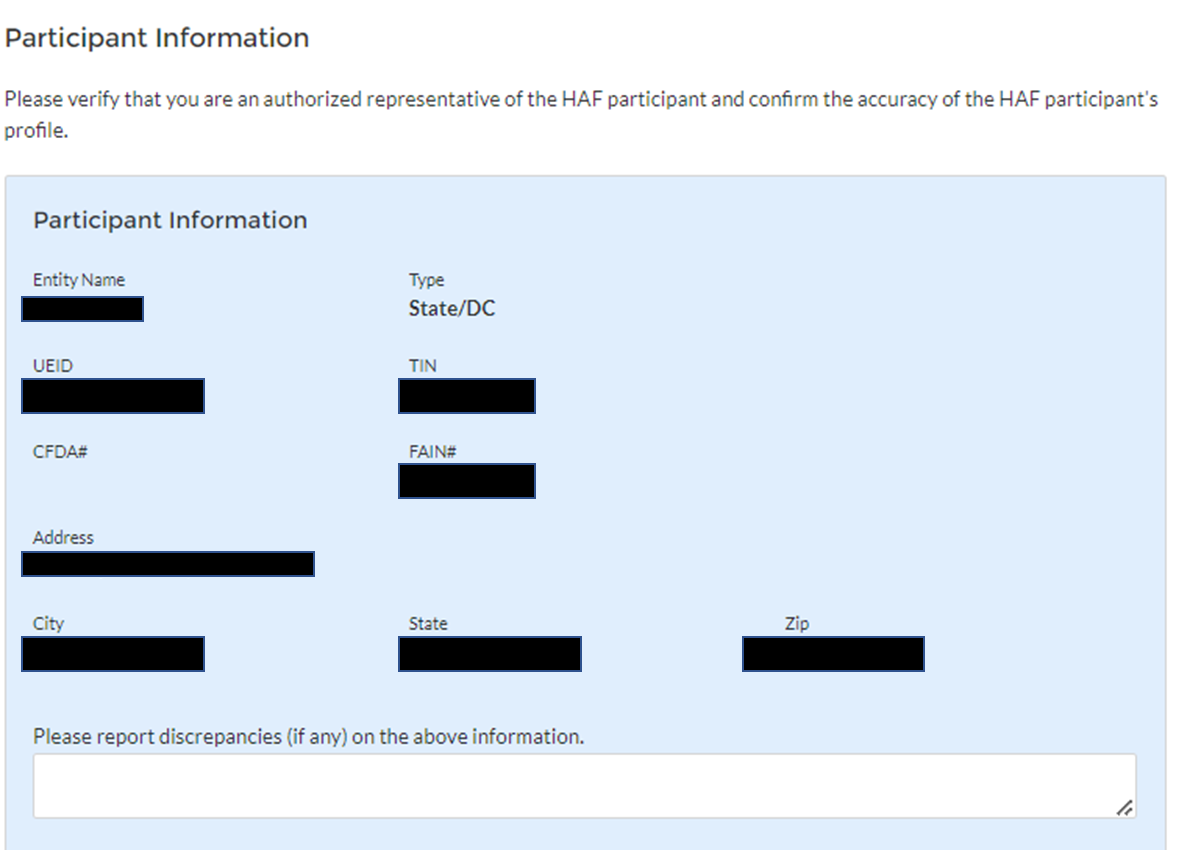

b) Participant Information

You will review and confirm information on your organization and use the text box to note any discrepancies in the information displayed on this screen. Participant Information will be pre-populated from your HAF Application file.

Review Participant Information prepopulated from your HAF Application and note any information that needs to be updated in the text box (see Figure 36).

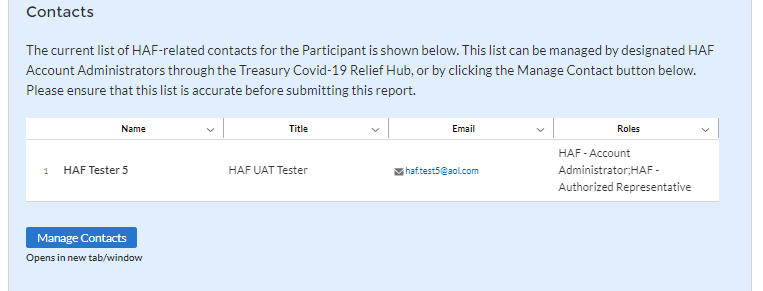

Review & verify the names and contact information for individuals the recipient has designated for key reporting roles for the HAF Program displayed on the screen (see Figure 37).

Figure 36 Participant Information Example

Figure 37 Contact List Example

If changes to the Participant Information are needed, use the discrepancy textbox (see Figure 36). If changes to the Point of Contact List are required, click on the “Manage Contacts” box shown in Figure 37 and see Appendix A for instructions on how to add, delete, or edit contact information. If you have other questions regarding Participant information, please contact us at HAF@treasury.gov.

After completing this screen, please select “Save and Next” to continue.

c) Community Engagement & Outreach

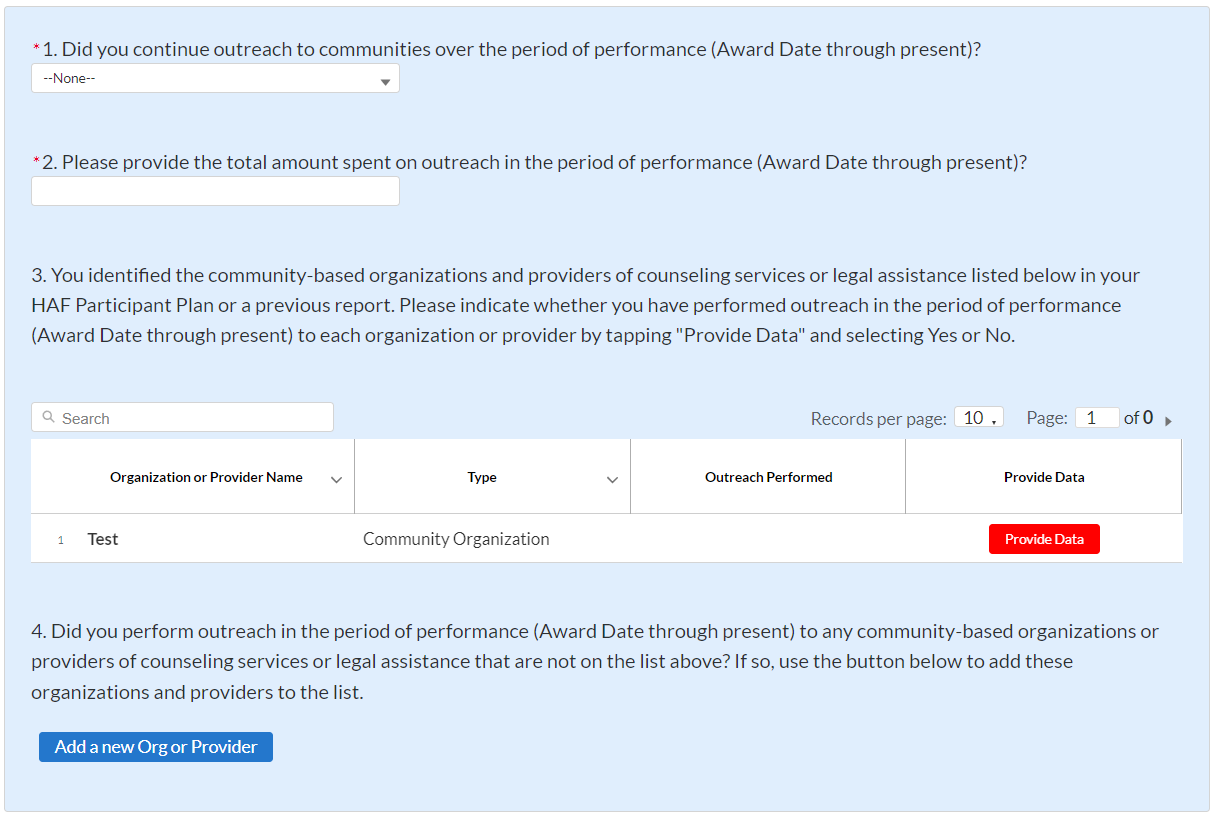

On this screen, you will be asked to provide information about ongoing HAF community engagement and outreach efforts. You will need information about the Participant’s outreach expenditures during the period of performance (from Award Date to present), and community-based organizations that the Participant has interacted with.

Figure 38 Community Engagement Screen

Question One Data Element: Continued Community Outreach

Use the dropdown provided to indicate whether the Participant continued outreach to communities once the HAF Program over the period of performance (Award Date through present).

Select “Yes” if the Participant continued community outreach efforts over the period of performance of the Participants HAF Programs.

If the Participant did not continue community outreach efforts, select “No”.

Please enter the amount of funds spent on outreach over the period of performance (Award Date through present)

Question Three Data Element: Community-Based Organizations

Use the table provided to answer a series of questions regarding the community-based organizations listed on the Participant’s HAF Participant Plan.

Table Column One Data Element: Community Based Organization Name

The first column of the table provided is pre-populated with community-based organizations listed on the Participant’s HAF Participant Plan.

No user-input is required.

Table Column Two Data Element: Type

The second column of the table provided is pre-populated with community-based organizations type.

No user-input is required.

Table Column Three Data Element: Outreach Performed

The third column of the table provided is pre-populated with a checkmark if outreach is performed as indicated by the module filled out in the fourth column of this table “Provide Data”.

No user-input is required.

Table Column Four Data Element: Provide Data

Use the module provided in the fourth column of the table to Provide Data. For each community-based organization click on “Provide Data" to enter information on outreach performed with the community-based organization in the period of performance (Award Date to present).

Community-based organization Engagement in the Reporting Period

After clicking on “Provide Data”, the screen shown in Figure 39 will appear. Review and if necessary, update organizational information on this page.

Select Yes or No under “Outreach Activity” for each of the community-based organization listed on the Participant’s HAF Plan that the Participant performed outreach to during this reporting period.

If the Participant has reached out to the listed community-based organization check “Yes”.

If the Participant has not reached to out the listed community-based organization check “No”.

Save your information to return to the Community Engagement & Outreach page.

Repeat for each community-based organization listed on the Participant’s HAF Participant Plan

Figure 39 - Community-Based Organization Engagement

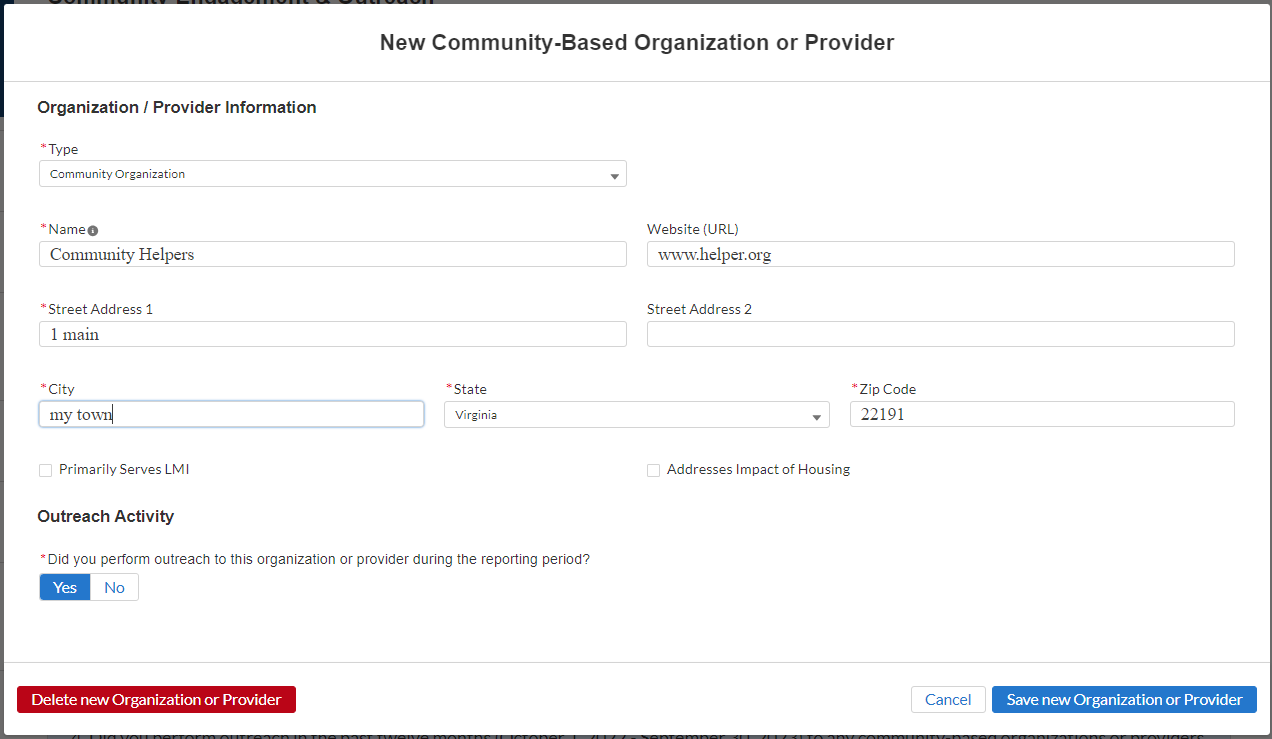

Question Four Data Element: Other Community-Based Organizations

Use the "Add a new Org or Provider” button shown in Figure 40 to add community-based organizations not listed on the Participant’s HAF Participant Plan.

Please note that Participant’s will need to know the following information to add other community-based organizations not listed on the Participant’s HAF Plan:

Type (Community Organization / Provider)

Name

Website

Street Address

Figure 40 Add New Community-Based Organization

When all information on the Participant’s Community Engagement & Outreach has been recorded, click “Save Information” or “Save and Next” at the bottom of the page.

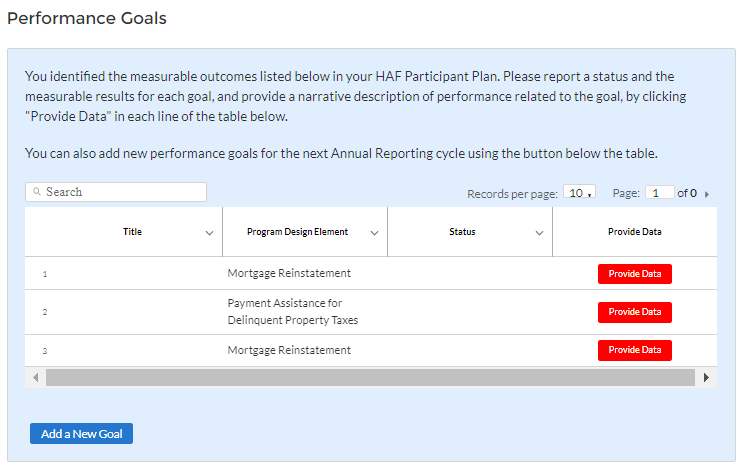

d) Performance Goals

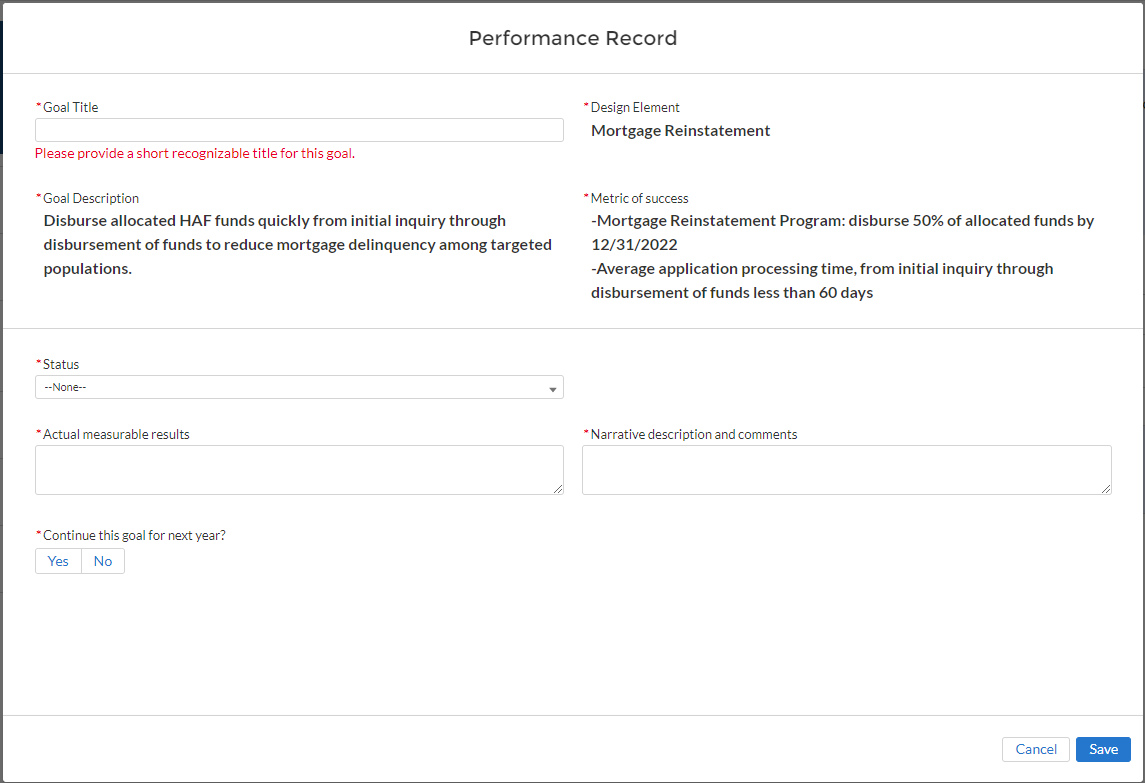

In this section, you will be asked to provide information about the progress on achieving the goals identified in your HAF Plan. The performance goals submitted in your last Annual Report will be pre-populated in the Final Annual Report for review and updates. You will need to provide information about your progress on achieving your HAF Plan Goals, and a narrative description of your progress on achieving those goals. To enter performance data, click the “Provide Data” button provided in the fourth column shown in Figure 41 to open the Performance Record screen shown in Figure 42.

Question One Data Element: HAF Plan Goals Progress

Use the table shown below in Figure 42 to provide information on the Participant’s progress on its HAF Plan Goals.

Figure 41 Column One: Goal Title

The first column of the table will populate with the title you enter in the table that opens when you click “Provide Data” in the fourth column of this table.

No User-Input is required.

Figure 41 Column Two: Program Design Element

The second column of Figure 41 is pre-populated with the program-design elements impacted by measurable outcomes identified in the Participant’s HAF Participant Plan.

No User-Input is required.

Figure 41 Column Three: Status

The third column of the table will be populated with the goal status you select in the table that opens when you click “Provide Data” in the fourth column of Figure 41.

No User-Input is required.

Figure 41 Column Four: Provide Data (Narrative Description of Target Outcome Goal)

Upon clicking on “Provide Data” in the fourth column of the table in Figure 41, the table in Figure 42 will appear for you to enter the following:

Goal title

Goal Status

Actual measurable results

Narrative description

After Participant has completed 1-5 for the Performance Goal, save your data and repeat for the remaining Performance Goals.

Figure 42 – Performance Record

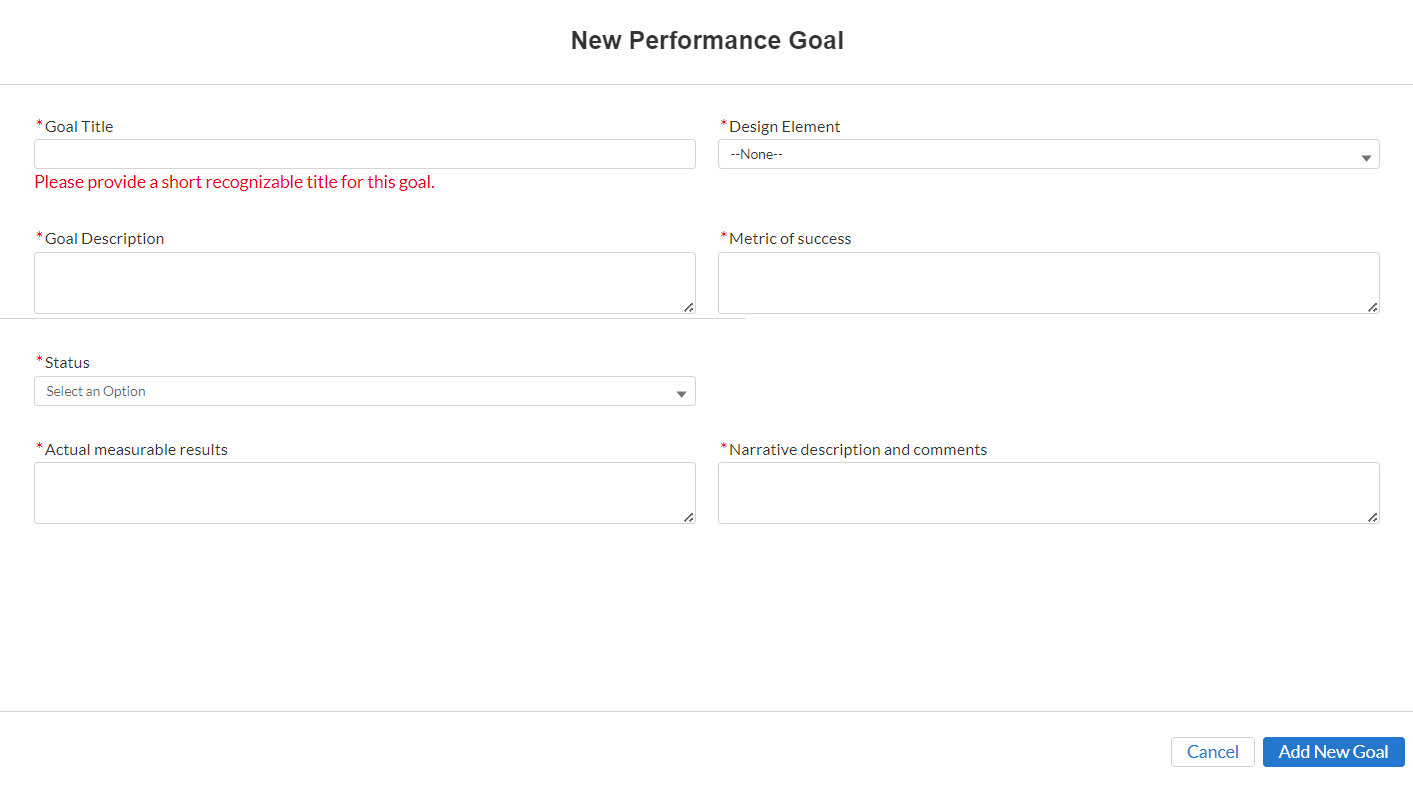

Question Two Data Element: Add a New Goal

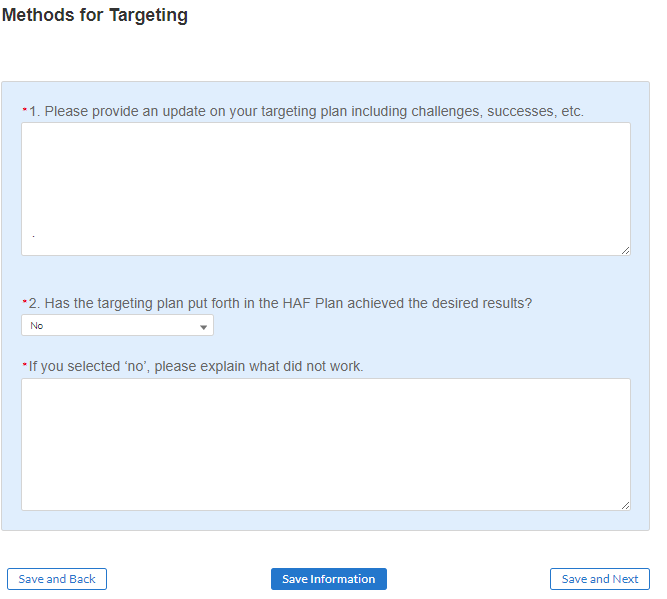

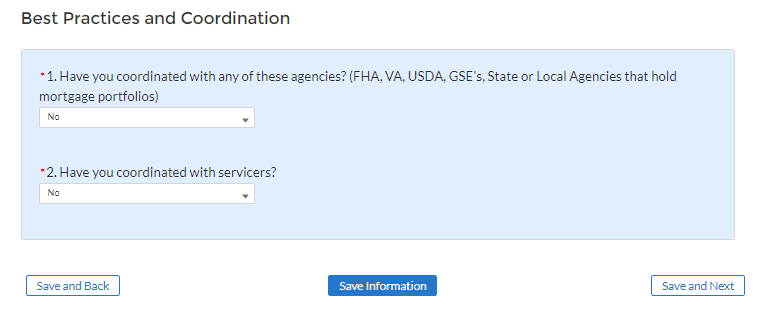

Use the “Add a New Goal” button shown in the lower left corner of Figure 41 if you plan to add new performance goals for the upcoming year.