Justification for No Material or Nonsubstantive Change to Currently-Approved Collection

1212-0073 Nonmaterial change 2025.01.docx

Notices Following a Substantial Cessation of Operations

Justification for No Material or Nonsubstantive Change to Currently-Approved Collection

OMB: 1212-0073

Justification for No Material or Nonsubstantive Change to Currently-Approved Collection

AGENCY: Pension Benefit Guaranty Corporation (PBGC)

TITLE: Notices Following a Substantial Cessation of Operations

STATUS: OMB control number 1212-0073; expires August 31, 2025

CONTACT: Monica O’Donnell (202-229-8706)

The Pension Benefit Guaranty Corporation (PBGC) is making a non-material change to the approved PBGC Form 4062(e)-02. Section 4062(e) of the Employee Retirement Income Security Act of 1974 (ERISA) imposes reporting obligations in the event of a “substantial cessation of operations.” A substantial cessation of operations occurs when a permanent cessation at a facility causes a separation from employment of more than 15 percent of all “eligible employees.” “Eligible employees” are employees eligible to participate in any of the facility’s employer’s employee pension benefit plans.

Following a substantial cessation of operations, the facility’s employer is treated, with respect to its single-employer pension plans covered by title IV of ERISA that are covering participants at the facility, as if the employer were a withdrawing substantial employer under a multiple employer plan. Under section 4063(a) of ERISA, the Pension Benefit Guaranty Corporation (PBGC) must receive notice of the substantial cessation of operations and a request to determine the employer’s resulting liability. To fulfill such resulting liability, the employer may elect, under section 4062(e)(4)(A), to make additional contributions annually for seven years to plans covering participants at the facility where the substantial cessation of operations took place. Under sections 4062(e)(4)(E)(i)(I), (II), (III), (IV), and (V) respectively, an employer that is making the election for annual additional contributions must give notice to PBGC of: (1) its decision to make the election, (2) its payment of an annual contribution, (3) its failure to pay an annual contribution, (4) its receipt of a funding waiver from the Internal Revenue Service, and (5) the ending of its obligation to make additional annual contributions.

An employer files PBGC Form 4062(e)-02 to notify PBGC that it made the elections to pay annual contributions to a plan pursuant to section 4062(e)(4) in connection with liability for an event listed in section 4062(e)(2).

The change is as follows.

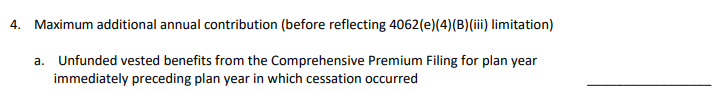

Added “from the Comprehensive Premium Filing” to item 4a.

The change made to the filing requirements will not increase the hour or cost burden for this information collection.

The change to item 4a merely adds clarity to where filers should get the information requested on the form. The change to item 4a is as follows:

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | O'Donnell Monica |

| File Modified | 0000-00-00 |

| File Created | 2025-06-07 |

© 2026 OMB.report | Privacy Policy