Justification for no Material/Nonsubstantive Change

Form M1 - No Material-Nonsubstantive Change SCA-12182024.docx

Annual Report for Multiple Employer Welfare Arrangements

Justification for no Material/Nonsubstantive Change

OMB: 1210-0116

Justification for No material or Nonsubstantive Change to Currently Approved Collection

AGENCY: Employee Benefits Security Administration (EBSA)

TITLE: Form M-1: Report for Multiple Employer Welfare Arrangements and Certain Entities Claiming Exception

STATUS: OMB Control Number: 1210-0116 Exp. Date: 08/31/2025

The Department of Labor is submitting a no material/non-substantive change request for the Form M-1: Report for Multiple Employer Welfare Arrangements (MEWAs) and Certain Entities Claiming Exception (ECEs) (OMB Control Number 1210-0116). As further discussed below, the Department is proposing to add limited, clarifying language to the Form and instructions. The Department is neither changing nor adding questions to the Form.

The Form M-1 is used to report information concerning a MEWA that provides benefits consisting of medical care (within the meaning of ERISA section 733(a)(2)) and any entity claiming exception (ECE). Reporting is required pursuant to ERISA sections 101(g), 104(a), 505 and 734 of the Employee Retirement Income Security Act of 1974 (ERISA), as amended, and 29 CFR 2520.101-2 and 103-1. The following changes are being made to the form and instructions:

Adding list using bullets to Form M-1

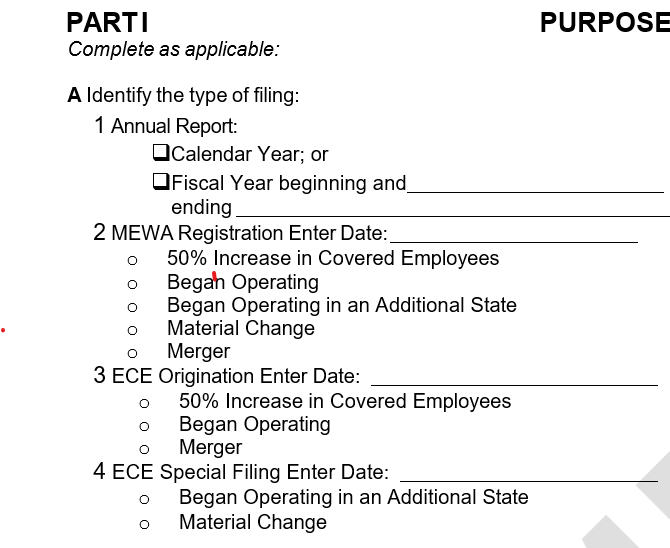

To assist the MEWA or ECE administrator with completing Part I, lines A2, A3 and A4, the Department is adding lists, in bullet form, of the events that, upon having occurred, generate the requirement to report information in these lines. The events and related information required to be reported have not been changed. No changes have been made to the instructions to Part I, lines A2, A3 and A4. This change is shown below (Figure 1).

Figure 1. 2024 Form M-1 Part I (excerpt)

Adding table in instructions to assist in determining eligibility to file calendar versus fiscal year

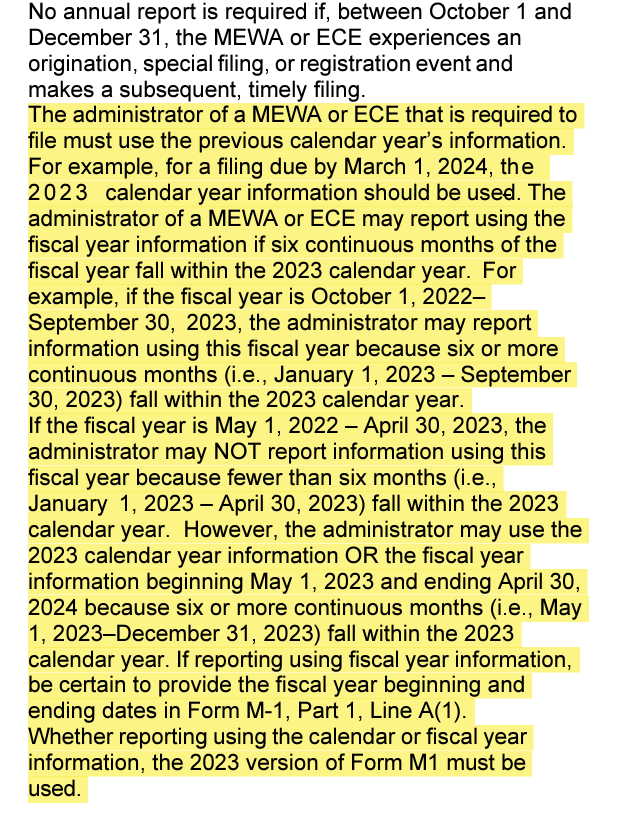

Generally, an administrator of a MEWA or ECE required to file Form M-1 must use calendar year’s information. However, an administrator of a MEWA or ECE may report using the fiscal year information if six continuous months of the fiscal year fall within the calendar year of the reporting cycle. To make this clear, the Department is adding the following table (Figure 2) to the Form M-1 instructions in Section 2, which replaces a section of text that depicted similar information (Figure 3):

Figure 2. New 2024 Form M-1 Instructions, Section 2: When to File (excerpt)

Generally, an administrator of a MEWA or ECE that is required to file must use the 2024 calendar year’s information. However, an administrator of a MEWA or ECE may report using the fiscal year information if 1) the fiscal year ends within the 2024 calendar year, and 2) six continuous months of the fiscal year fall within the 2024 calendar year:

If your MEWA’s or ECE’s operating year is |

Report information using |

Calendar year 2024 |

Calendar year 2024 |

Fiscal year 10/1/2023 – 9/30/2024 |

Calendar year 2024 -OR- Fiscal-year 10/1/2023-9/30/2024 |

Fiscal year 7/1/2023 – 6/30/2024 |

Calendar year 2024 -OR- Fiscal-year 7/1/2023-6/30/2024 |

Fiscal year 4/1/2023 – 3/31/2024 |

Calendar year 2024 |

Fiscal years ending after 12/31/2024 |

Calendar year 2024 |

Whether you report using the calendar or fiscal year, you must use the 2024 version of Form M-1.

The screenshot below (highlighted in yellow) shows the section of the Form M-1 instructions that will be deleted for the 2024 Form M-1.

Figure 3. Old 2023 Form M-1 Instructions, Section 2: When to File (excerpt)

Updating penalty amount on Form M-1 Instructions, Section 3 for 2024

In accordance with the Federal Civil Penalties Inflation Adjustment Act of 1990, the penalties for failure to file a Form M-1 increase each year. This amount changed from $1,881 in 2023 to $1,942 for the 2024 and is explained to filers in the Form M-1 Instructions in Section 3: Electronic Filing, in the subsection titled “Penalties.”

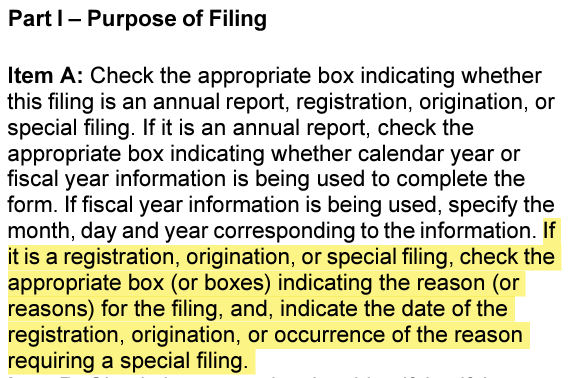

Clarifying language in Form M-1 Line-by-Line Instructions regarding dates prompting the need to file a registration, origination, and special filing

In order to clarify that the date filers should enter corresponds to the date of the event prompting the need for a registration, origination, or special filing, EBSA replaces the text below that is present in the Form M-1 Instructions Section 4: Line-by-Line Instructions (shown in Figure 4) with the following text.

New Updated text for 2024 Form M-1 Instructions (replaces highlighted text in Figure 4):

If it is a registration, origination, or special filing, check the appropriate box (or boxes) indicating the reason (or reasons) for the filing, and, indicate the date of the occurrence or event prompting the need for a registration, origination, or special filing. For example, if filing to indicate a MEWA that will soon Begin Operating, the date should be when the MEWA will begin operating. For example, if filing to indicate the MEWA experienced a 50% or greater increase in covered employees, the date entered should be the date that the employee growth reached that threshold or the date the MEWA administrator became aware of the employee growth hitting that percentage

Figure 4. 2023 Form M-1 filing instructions from Section 4: Line-by-Line Instructions (excerpt)

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Henderson, Richard L - EBSA |

| File Modified | 0000-00-00 |

| File Created | 2024-12-31 |

© 2026 OMB.report | Privacy Policy