Letter to Employer Requesting Wage Information

Letter to Employer Requesting Wage Information

SSI Wage Screens

Letter to Employer Requesting Wage Information

OMB: 0960-0138

SENSITIVE - NOT TO BE SHARED WITH THE PUBLIC |

05/20/16 (TN #1132)

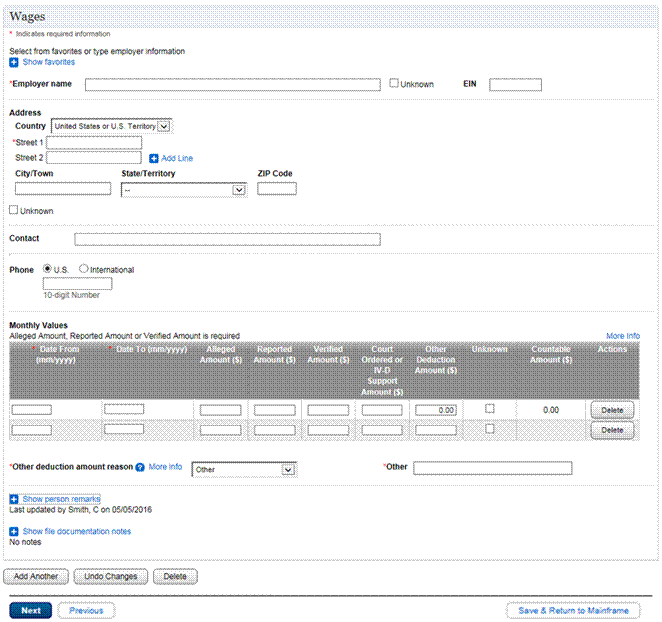

INTRANETSSI.014.027 Wages

The Wages page is used to record and display information on wages a person receives.

References: POMS SI 00820.100, Wages – General.

POMS SI 00820.125, When Wage Verification Is and Is Not Required.

POMS SI 00820.127, Period for Wage Verification.

POMS SI 00820.133, Wage Verification – General.

POMS SI 00820.144, Monthly Wage Reporting for Recruiting Reporter.

POMS SI 00820.147, Evidence of Wages – Wage Verification Companies.

POMS SI 00820.150, Estimating Future Wages.

[Add Another] Select this button to add a new iteration of this income to the claim path. In Query mode, this item is disabled.

[Delete] Select this button to delete this income from the claim path. In Query mode, this item is disabled.

[Next] Select this button to save inputs on the current page and move to the next page.

[Previous] Select this button to save inputs on the current page and move to the prior page.

[Save & Return to Mainframe] Select this button to save inputs on the current page and navigate to the main frame from any point in the web path. In Query mode, this item is displayed as [Return to Mainframe].

WAGES

* indicates required information

SELECT FROM FAVORITES OR TYPE SOURCE INFORMATION.

[+/-] SHOW/HIDE FAVORITES

Wages FAVORITES

[REFRESH] MANAGE OFFICE LEVEL FAVORITES

SOURCE ADDRESS PHONE ACTIONS

SS[VARIES]SS SS[VARIES]SS SS[VARIES]SS [SELECT]

EMPLOYER NAME xx[maximum of 40 characters]xx [ ]unknown EIN: 999999999

*address country --

street 1: xx[maximum of 22 characters]xx

street 2: xx[maximum of 22 characters]xx [+] add line

street 3: xx[maximum of 22 characters]xx

street 4: xx[maximum of 22 characters]xx

city/town: xx[maximum of 22 characters]xx state/territory: -- zip code: 99999

unknown [ ]

Contact: xx[maximum of 40 characters]xx

Phone ( ) u.s. ( ) international

(999)999-9999 999999999999999

10-digit number country code + number

monthly values

alleged Amount, reported amount or verified amount is required

more info

[24-m] [25-M] [26-C] [27-O] [28-o] [29-O] [30-o] [31-o] [32-D] [33-o]

*date from *date to alleged REPORTED verified court ordered other UNKNOWN countable ACTIONS

(mm/yYYy) (mm/YYyy) amount($) amount($) AMOUNT($) or iv-d deduction amount($)

support amount($) amount($)

99/9999 99/9999[c] 99999.99 99999.99 99999.99 99999.99 99999.99 [ ] sssss.ss [DELETE]

*other deduction amount reason (?)More info -- *Other xX[maximum of 40 characters]xx

[+/-] show/Hide person remarks

person remarks (printed): xx[maximum of 1000 characters]xx

[+/-} show/hide file documentation notes

file documentation notes: xx[maximum of 1000 characters]xx

[add another] [clear page/undo changes] [delete]

[next] [previous] [save & return to mainframe}

1. Default Screen

2. Field Office Favorites Table

E. Facsimile 2: project alleged income and deductions – display when Standard Projection monthly values “date to” field is “continuing”

PROJECT ALLEGED INCOME AND DEDUCTIONS

PROVIDE INCOME AND DEDUCTIONS INFORMATION FOR ONE PAYMENT PERIOD TO PROJECT TOTAL MONTHLY ALLEGED INCOME AND TOTAL MONTHLY DEDUCTIONS.

*INDICATES REQUIRED INFORMATION

PAYMENT PERIOD INFORMATION (?)

*DATE FROM FOR ROW WHERE SS/SSSS

PROJECTION WAS INITIATED

*PAYMENT FREQUENCY --

*LAST OR NEXT PAYMENT DATE 99/99/9999

Month and year must match those mm/dd/yyyy

shown in the date from above

payment period deduction amounts

court ordered or IV-d support $ 99999.99

amount WEEKLY

other deduction amount $ 99999.99

WEEKLY

[ok] [cancel]

F. Screen Shot 2: project alleged income and deductions – display when Standard Projection monthly values “date to” field is “continuing”

G. Facsimile 3: Project alleged income and deductions (dEFAULT)

*PAYMENT FREQUENCY Monthly

*LAST OR NEXT PAYMENT DATE 99/99/9999

MONTH AND YEAR MUST MATCH THOSE MM/DD/YYYY

SHOWN IN THE DATE FROM ABOVE

*PAYMENT PERIOD ALLEGED AMOUNT $ 99999.99

H. Screen Shot 3: Project alleged income and deductions (dEFAULT)

The Payment Period Alleged Amount field displays when the Payment Frequency is any of the following:

Annual.

Semi-Annual.

Quarterly.

Monthly.

Bi-Monthly.

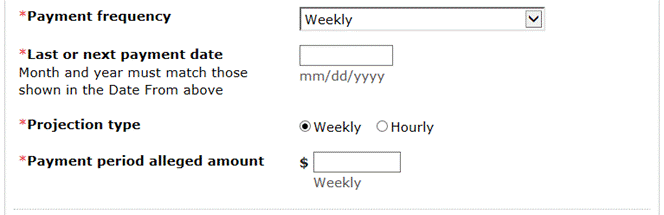

I. Facsimile 4: Project alleged income and deductions (weekly frequency)

*PAYMENT FREQUENCY WEEKLY

*LAST OR NEXT PAYMENT DATE 99/99/9999

MONTH AND YEAR MUST MATCH THOSE MM/DD/YYYY

SHOWN IN THE DATE FROM ABOVE

*PROJECTION TYPE ( )WEEKLY ( )HOURLY

*PAYMENT PERIOD ALLEGED AMOUNT $ 99999.99

J. Screen Shot 4: Project alleged income and deductions (weekly frequency)

The Payment period alleged amount field displays when the Payment frequency selected is “Weekly” and Projection type is “Weekly”.

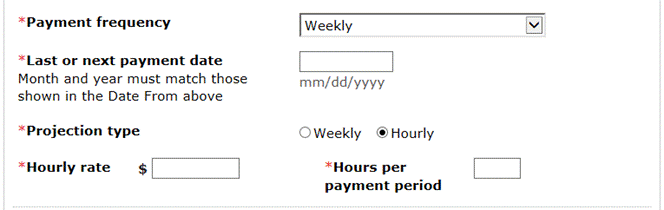

K. Facsimile 5: Project alleged income and deductions (weekly frequency / Hourly rate)

*PAYMENT FREQUENCY WEEKLY

*LAST OR NEXT PAYMENT DATE 99/99/9999

MONTH AND YEAR MUST MATCH THOSE MM/DD/YYYY

SHOWN IN THE DATE FROM ABOVE

*PROJECTION TYPE ( )WEEKLY ( )HOURLY

*HOURLY RATE $ 99999.99 *HOURS PER XXX

PAYMENT PERIOD

L. Screen Shot 5: Project alleged income and deductions (weekly frequency / Hourly rate)

The Hourly rate and Hours per payment period fields display when the Payment frequency selected is “Weekly” and Projection type is “Hourly”.

M. Facsimile 6: Project alleged income and deductions (bI-weekly frequency)

*PAYMENT FREQUENCY Bi-weekly (every two weeks)

*LAST OR NEXT PAYMENT DATE 99/99/9999

MONTH AND YEAR MUST MATCH THOSE MM/DD/YYYY

SHOWN IN THE DATE FROM ABOVE

*PROJECTION TYPE ( )BI-WEEKLY ( )HOURLY

*PAYMENT PERIOD ALLEGED AMOUNT $ 99999.99

N. Screen Shot 6: Project alleged income and deductions (bI-weekly frequencY)

The Payment period alleged amount field displays when the Payment frequency selected is “Bi-weekly (every two weeks)” and Projection type is “Bi-weekly”.

O. Facsimile 7: Project alleged income and deductions (bI-weekly frequency / Hourly rate)

*PAYMENT FREQUENCY Bi-weekly (every two weeks)

*LAST OR NEXT PAYMENT DATE 99/99/9999

MONTH AND YEAR MUST MATCH THOSE MM/DD/YYYY

SHOWN IN THE DATE FROM ABOVE

*PROJECTION TYPE ( )BI-WEEKLY ( )HOURLY

*HOURLY RATE $ 99999.99 *HOURS PER XXX

PAYMENT PERIOD

P. Screen Shot 7: Project alleged income and deductions (bI-weekly frequency / Hourly rate)

The Hourly rate and Hours per payment period fields display when the Payment frequency selected is “Bi-weekly (every two weeks)” and Projection type is “Bi-weekly”.

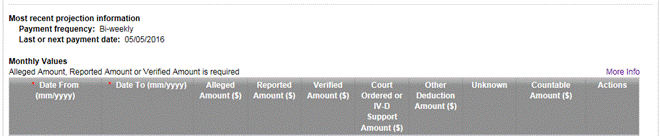

Q. Facsimile 8: most recent projection information

MOST RECENT PROJECTION INFORMATION

PAYMENT FREQUENCY: ssssssssssssssssssssssssssssss

last or next payment date: ss/ss/ssss

monthly values

alleged Amount, reported amount or verified amount is required

more info

[24-m] [25-M] [26-C] [27-O] [28-o] [29-O] [30-o] [31-o] [32-D] [33-o]

*date from *date to alleged REPORTED verified court ordered other UNKNOWN countable ACTIONS

(mm/yYYy) (mm/YYyy) amount($) amount($) AMOUNT($) or iv-d deduction amount($)

support amount($) amount($)

R. Screen Shot 8: most recent projection information

This information displays only after Project Alleged Income and Deductions has been used.

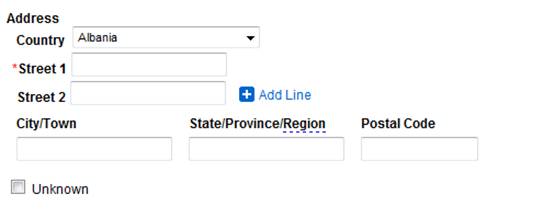

S. facsimile 9: Wages (foreign Address - Display when country is not United States or U.S. Territory)

*address country --

street 1: xx[maximum of 22 characters]xx

street 2: xx[maximum of 22 characters]xx [+] add line

street 3: xx[maximum of 22 characters]xx

street 4: xx[maximum of 22 characters]xx

city/town: xx[maximum of 22 characters]xx state/province/region: xx[maximum of 22]xx postal code: XX[MAXIMUM OF 15 CHARACTERS]XX

[ ] unknown

T. screen shot 9: Wages (foreign Address - Display when country is not United States or U.S. Territory)

You selected “Yes” for Wages on the Income Selection page.

You selected “Add Wages” on the Income Selection page.

You selected “Add Another” on the Wages List page.

You selected “Add Another” on an occurrence of the Wages page.

You selected “Next” from the prior page in the path.

You selected “Previous” from the subsequent page in the path.

You selected “Wages” in the left navigation list and there is only a single occurrence of Wages.

You selected an occurrence of Wages from the Wages List page.

You entered “IWAG” in the TRANSFER TO field.

You keyed the number associated with “IWAG” on Person Screen Status (PERS) screen.

[1-O] [+/-] Show/Hide Favorites

[2-C] [REFRESH]

[3-O] Manage Office Level Favorites

[4-D] Source: SS[VARIES]SS (FAVORITES TABLE)

[5-D] Address: SS[VARIES]SS (FAVORITES TABLE)

[6-D] Phone: SS[VARIES]SS (FAVORITES TABLE)

[7-O] Actions: [SELECT] (TABLE ROW)

[9-O] EIN: 999999999

[10-M] Country: - -

[11-M] Street 1: XX[MAXIMUM OF 22 CHARACTERS]XX

[12-O] Street 2: XX[MAXIMUM OF 22 CHARACTERS]XX

[13-O] [+] Add Line

[14-O] Street 3: XX[MAXIMUM OF 22 CHARACTERS]XX

[15-O] Street 4: XX[MAXIMUM OF 22 CHARACTERS]XX

[16-O] City/Town: XX[MAXIMUM OF 22 CHARACTERS]XX

[17-O] State/Territory: - -

[18-O] Zip Code: 99999

[19-O] Unknown: [ ]

[20-O] Contact: XX[MAXIMUM OF 40 CHARACTERS]XX

[21-O] Phone ( ) U.S.: (999)999-9999

[22-O] Phone ( ) International: 999999999999999

[24-M] Date From (MM/YYYY): 99/9999

[25-M] Date To (MM/YYYY): 99/9999

[26-C] Alleged Amount ($): 99999.99

[27-O] Reported Amount ($): 99999.99

[28-O] Verified Amount ($): 99999.99

[29-O] Court Ordered or IV-D Support Amount ($): 99999.99

[30-O] Other Deduction Amount ($): 99999.99

[31-C] Unknown: [ ]

[32-D] Countable Amount ($): SSSSS.SS

[33-O] Actions: [DELETE] (TABLE ROW)

[37-O] [+/-] Show/Hide Person Remarks

[38-O] Person Remarks (PRINTED): XX[MAXIMUM OF 1000 CHARACTERS]XX

[39-O] [+/-]Show/Hide File Documentation Notes

[40-O] File Documentation Notes: XX[MAXIMUM OF 1000 CHARACTERS]XX

[41-O] [CLEAR PAGE/UNDO CHANGES]

[42-D] Date From for row where projection was initiated: SS/SSSS

[43-M] Payment frequency: --

[44-M] Last or next payment date: 99/99/9999

[45-O] Court ordered or IV-D support ($): 99999.99 (PAYMENT PERIOD DEDUCTION AMOUNTS)

[46-O] Other deduction amount ($): 99999.99 (PAYMENT PERIOD DEDUCTION AMOUNTS)

[47-O] [OK]

[48-O] [Cancel]

[49-M] Payment period alleged amount: 99999.99

[55-O] State/Province/Region: XX[MAXIMUM OF 22 CHARACTERS]XX

[56-O] Postal Code: XX[MAXIMUM OF 15 CHARACTERS]XX

J. field descriptions

[8-M] Employer Name: XX[MAXMUM OF 40 CHARACTERS]XX

Use this field to record the name of the employer that pays the person. The Wages page is the only page this field is used.

Select this link to access SI 00820.102 Cafeteria Benefit Plans. This will help you to determine if the person is participating in a Qualified Cafeteria Plan.

[34-C] Other deduction amount reason: - -

Use this field to document the reason this amount was deducted from the wages a person receives. This field is only displayed on the Wages page. Values available for selection are:

Certain military pay items.

Qualified cafeteria plans.

Other.

Select this link for more information about other deduction reasons.

[36-C] Other: XX[MAXMUM OF 40 CHARACTERS]XX

Use this field to record the Other deduction amount reason when the primary reasons in the drop list do not apply. This field is displayed when you select the Other option from the Other deduction amount reason drop list. It is only displayed on the Wages page.

[50-C] Projection type ( ) Weekly ( ) Hourly

Projection type ( ) Bi-weekly ( ) Hourly

This radio list field gives you the option to project future wages using an hourly rate. This field is displayed when you choose a Weekly or Bi-weekly frequency when projecting income. It is only available on the Wages page.

[51-C] Hourly Rate ($): 99999.99

Use this field to enter the hourly rate. It is only available for projection on the Wages page.

[52-C] Hours per payment period ($): 99999.99

Use this field to enter the number of hours the person works in a week. It is only available for projection on the Wages page.

[53-D] Payment frequency: SSSSSSSSSSSSSSSSSSSSSSSSSSSSSS

This field is only displayed on the Wages page after projection is used.

[54-D] Last or next payment date: SS/SS/SSSS

This field is only displayed on the Wages page after projection is used.

K. Results

Once all required fields are completed and you select to navigate away from the page, the information entered is saved and you are taken to the page selected.

L. Related references

Income Overview, INTRANETSSI 014.001

Income Selection, INTRANETSSI 014.003

Income Summary, INTRANETSSI 014.002

Wages List, INTRANETSSI 014.026

Projection Overview, INTRANETSSI 015.001

Project Alleged Income and Deductions, INTRANETSSI 015.002

Link

to this

section:

http://policynet.ba.ssa.gov/msom.nsf/lnx/INTRANETSSI014027

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Gant, Alexa |

| File Modified | 0000-00-00 |

| File Created | 2024-07-20 |

© 2025 OMB.report | Privacy Policy