Form 1 - Excel Version 1 - Excel Version Tribal Budget and Narrative Justification Template - Exc

Tribal Budget and Narrative Justification Template

Tribal Budget and Narrative Justification Template - Excel_2026_Revised FINAL.xlsx

Tribal Budget and Narrative Justification – Excel

OMB: 0970-0548

⚠️ Notice: This form may be outdated. More recent filings and information on OMB 0970-0548 can be found here:

Document [xlsx]

Download: xlsx | pdf

TAB-2_BUDGET BASICS

TAB-3_CHECKLIST

TAB-4_SAMPLE BUDGET WORKSHEET

TAB-5_BUDGET WORKSHEET

TAB-6_BUDGET AT-A-GLANCE

TAB-7_SF-424A

Overview

TAB-1_INSTRUCTIONSTAB-2_BUDGET BASICS

TAB-3_CHECKLIST

TAB-4_SAMPLE BUDGET WORKSHEET

TAB-5_BUDGET WORKSHEET

TAB-6_BUDGET AT-A-GLANCE

TAB-7_SF-424A

Sheet 1: TAB-1_INSTRUCTIONS

| TRIBAL IV-D BUDGET DEVELOPMENT | |||||||||

| INSTRUCTIONS FOR USING THE WORKSHEETS | |||||||||

| 1. Use Complete and Accurate Calculations: Gather all the necessary information you'll need prior to starting work on the budget (i.e., positions, wages, fringe calculations, supplies needed, etc. Refer to Tab-4_Sample Budget for examples). | |||||||||

| 2. Review Each Worksheet. This workbook was designed to give you an easy format to develop your budget. Please read the information in each tab before you begin completing this workbook. |

|||||||||

| 3. Budget Workbook Template: In addition to this tab, the workbook includes: - Tab-2_Budget Basics has helpful information for budget preparation. - Tab-3_Checklist is a tool to ensure you have all the required documents for your budget submission. Check items off as you complete them. - Tab-4_Sample Budget Worksheet gives you examples of how your budget line items should look. - Tab-5_Budget Worksheet is the worksheet you can use to develop your annual budget. - Tab-6_Budget-At-A-Glance auto-populates with the data you entered into Tab-5. It is designed to give you an overall summary of your budget. - Tab-7_SF-424A auto-populates with the data you entered into Tab-5 . Each worksheet is locked to reduce errors in calculations. The password to un-protect each worksheet is: 12345 |

|||||||||

| Comment Box Instructions: Throughout the workbook are comment boxes that include additional directions for your convenience. Cells that have a small red triangle in the corner indicate there is a comment box attached. Hover your curser over the cell to see the comment. | |||||||||

| Tab-5_Budget Worksheet: - Cells highlighted in light yellow are unprotected to allow you to enter your information and tab through the worksheet. - The worksheet includes free-form text areas where you can enter your justification narratives. This eliminates the need to create a separate justification narrative in a Word document. - Many cells include formulas that will calculate amounts for you. This reduces errors because if you change an amount in one cell, all connected cells and worksheets will update also. - All line items are in order to coincide with the SF-424A. |

|||||||||

| Tab-6_Budget-At-A-Glance: This worksheet provides a summary of your Total Budget. It displays a break-down of: - Total funds you are requesting This easy-to-read summary can be used when you're discussing your budget with your tribal budget committees or tribal council. |

|||||||||

| Tab-7_SF-424A was added for your convenience. It auto-populates with all the budget information you entered in Tab-5_Budget Worksheet. You can print this page and use it to copy the data into GrantSolutions, confident that all calculations are accurate and complete. |

|||||||||

| 4. Initial Budget. Download the Tribal Budget Excel Workbook from the Tribal Budget Toolbox on the OCSS website and "Save As" TRIBAL BUDGET TEMPLATE. Open the file and do another "Save As" this time saving it as FFY(budget year)_BUDGET. Create your budget in the Tab-5_Budget Worksheet. | |||||||||

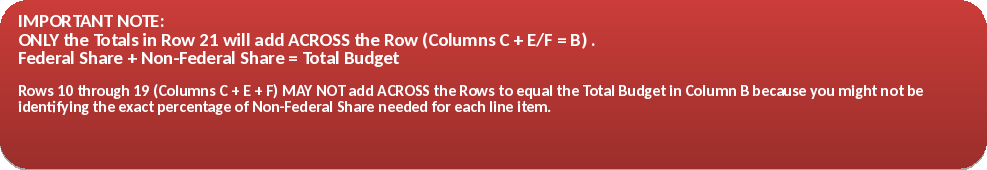

| STEP 1: Create your total tribal child support program budget by filling in the appropriate fillable (yellow) cells in Columns A through H for each cost category. The worksheet includes formulas to auto-popluate the bottom of Column I indicating the amount of federal funding you are requesting. | |||||||||

| STEP 2: Login to GrantSolutions. Enter numbers from Tab 7 in the 424A form online. Upload supporting documentation, including this Excel document, contracts, and your current Indirect Cost Rate agreement. Submit. | |||||||||

| 5. Budget Submission: Your budget submission to OCSS must include Tab-5_Budget Worksheet, Tab-6_Budget-At-A-Glance, and Tab-7_SF-424A. If you are using GrantSolutions, please delete all other tabs (Tab-1, Tab-2, Tab-3, and Tab-4) and upload the revised workbook into GrantSolutions. (To delete tabs, place your curser on the tab name, right click, and click delete). If you are not using GrantSolutions, please print the worksheets in Tab-5, Tab-6 and Tab-7 to include in your budget packet. |

|||||||||

| 6. Subsequent Budgets. After you have developed an initial budget using this Excel workbook, you can simply update it each consecutive year, saving you a lot of time. Using a standard naming format each year will allow you to create a library of budget files that will be easy to find when needed for future reference. (i.e., FFY14_Start-Up Budget_Year 1; FFY15_Start-Up Budget_Year2; FFY16_Budget; FFY16_Budget_Revision; etc.). | |||||||||

| STEP 1: When budget time rolls around, open your budget from the previous year and do a "Save As", naming the workbook with the new Federal Fiscal Year (FFY). Example: FFY19_Budget | |||||||||

| STEP 2: Update each expense and justification as needed. For example, you can update the wage for a particular staff position without having to change anything else, like the narrative, thus saving a lot of time. | |||||||||

| PAPERWORK REDUCTION ACT OF 1995 (Pub. L. 104-13) STATEMENT OF PUBLIC BURDEN: The purpose of this information collection is to assist tribal child support programs in developing their annual budget through this optional form. Public reporting burden for this collection of information is estimated to average 16 hours per grantee, including the time for reviewing instructions, gathering and maintaining the data needed, and reviewing the collection of information. This is a voluntary collection of information. An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information subject to the requirements of the Paperwork Reduction Act of 1995, unless it displays a currently valid OMB control number. If you have any comments on this collection of information, please contact OCSS Division of Regional Operations at OCSS.Tribal@acf.hhs.gov. | |||||||||

Sheet 2: TAB-2_BUDGET BASICS

| TRIBAL IV-D BUDGET DEVELOPMENT | ||||||||||

| BUDGET BASICS | ||||||||||

| 1. Federal Fiscal Year (FFY): Federal funding is awarded on a federal fiscal year cycle that begins October 1 and ends on September 30 each year. | ||||||||||

| 2. Allowable Costs: All budget expenditures must comply with the requirements in 45 CFR 309.145 and 45 CFR 75 - Uniform Administrative Requirements, Cost Principles, and Audit Requirements for HHS Awards. | ||||||||||

| 3. Start-Up Budgets: Start-Up Applications can be submitted at any time during the year. Your initial budget should be calculated beginning with the first day of the month in the quarter for which you anticipate being awarded funding and ending on the last day of the 12th month. | ||||||||||

| a. 100% Federal Funding: Start-Up programs are awarded 100% federal funding for the two-year project period. |

||||||||||

| b. Start-Up Budget up to $500,000: Start-Up program budgets cannot exceed $500,000 for two years. Note: Each year's budget should not exceed $250,000. | ||||||||||

| c. Transition to Comprehensive: Prior to the end of your Start-Up program, you must submit a Comprehensive Program Plan (Plan) that includes an annual budget and budget justification narrative. The time period for your Plan's annual budget will depend on when you anticipate transitioning to a comprehensive program. Starting out, your first comprehensive budget might not be on the federal fiscal year cycle. | ||||||||||

| 4. Comprehensive Program Plan Budgets: When it is time to transition from a Start-Up program to a comprehensive IV-D program, you must submit a comprehensive program budget and budget justification narrative. Pursuant to 45 CFR 309.135(2), your budget can be for less than one year, but at least six months, or more than one year, not to exceed 17 months, to get transitioned onto the federal fiscal year cycle. | ||||||||||

| a. 100% Federal Funding: Comprehensive programs are awarded 100% federal funding. | ||||||||||

| b. Annual Budget Submissions: Pursuant to 45 CFR 309.130(b)(2), an annual budget must be submitted each year no later than August 1. | ||||||||||

| 5. More Information is available on OCSS's website: | ||||||||||

| https://www.acf.hhs.gov/css/training-technical-assistance/tribal-child-support-budget-toolbox | ||||||||||

Sheet 3: TAB-3_CHECKLIST

| TRIBAL IV-D BUDGET DEVELOPMENT | ||||||||||

| ANNUAL BUDGET CHECKLIST | ||||||||||

| Pursuant to 45 CFR 309.125, the application (Start-Up and Comprehensive) must include a proposed budget and budget justification narrative. Comprehensive Program budgets must be submitted to OCSS annually no later than AUGUST 1. |

||||||||||

| The checklist includes a list of documents required pursuant to 45 CFR 309.15 (Initial Application) and 309.130 (Comprehensive) and a list of documents recommended by OCSS. As you complete each requirement, you can cross it off the list by placing an "X" in the cells highlighted in yellow. |

||||||||||

| 1. COVER LETTER (RECOMMENDED) | ||||||||||

| 2. COVER SHEET (OPTIONAL) | ||||||||||

| 3. TABLE OF CONTENTS (OPTIONAL) | ||||||||||

| 4. STANDARD FORM (SF) 424: "Application for Federal Assistance" to be submitted with the initial grant application for funding under §309.65(a) and (b) (60 days prior to the start of the funding period). | ||||||||||

| 5. STANDARD FORM (SF) 424A: "Budget Information, Non-construction Programs", to be submitted annually, no later that August 1 (60 days prior to the start of the funding period) in accordance with §309.115(a)(2) of this part. TAB-7_SF-424A auto-populates a SF-424A form for your convenience. With EACH submission the following information MUST be included: | ||||||||||

| 6. QUARTER-BY-QUARTER ESTIMATE of expenditures for the funding period. | ||||||||||

| 7. BUDGET JUSTIFICATION NARRATIVE | ||||||||||

| 8. SUPPORTING DOCUMENTATION INCLUDED AS ATTACHMENTS: | ||||||||||

| a. Current Indirect Cost Agreement | ||||||||||

| b. Contracts | ||||||||||

| c. IT specifications (if applicable) | ||||||||||

| d. Other documentation as applicable | ||||||||||

| Pursuant to 45 CFR 309.15(c), following the initial funding period, the tribe or tribal organization operating a IV-D program must submit annually a Standard Form (SF) 424A, including all the necessary accompanying information and documentation described in paragraphs (a)(2) and (a)(3) of the section. Tab-7 is a SF-424A form that auto-populates using the information you enter into Tab-5_Budget Worksheet. You can print this page and use it to enter the data into GrantSolutions. | ||||||||||

Sheet 4: TAB-4_SAMPLE BUDGET WORKSHEET

Sheet 5: TAB-5_BUDGET WORKSHEET

Sheet 6: TAB-6_BUDGET AT-A-GLANCE

| Program Name: | |

| Federal Fiscal Year: | |

| Federal Share: | 100% |

| BUDGET AT-A-GLANCE | |

| Object Class Categories | THIS IS YOUR TOTAL BUDGET |

| $ | |

| PERSONNEL | $- |

| FRINGE | $- |

| TRAVEL | $- |

| EQUIPMENT | $- |

| SUPPLIES | $- |

| CONTRACTUAL | $- |

| OTHER | $- |

| TOTALS DIRECT CHARGES: | $- |

| INDIRECT COSTS | $- |

| TOTAL BUDGET | $- |

|

|

Sheet 7: TAB-7_SF-424A

|

|

OMB Approval No. 0348-0044 | |||||

|

|

||||||

| Grant Program Function or Activity (a) |

Catalog of Federal Domestic Assistance Number (b) |

Estimated Unobligated Funds | New or Revised Budget | |||

| Federal (c) |

Non-Federal (d) |

(e) |

Non-Federal (f) |

Total (g) |

||

| 1. Child Support: Federal Share |

93.563 | $- | $- | $- | $- | $- |

|

|

||||||

| 3. | $- | |||||

| 4. | $- | |||||

| 5. Totals | $- | $- | $- | $- | $- | |

| SECTION B - BUDGET CATEGORIES | ||||||

| 6. Object Class Categories |

GRANT PROGRAM, FUNCTION OR ACTIVITY |

(5) |

||||

|

|

(2) | (3) | (4) | |||

| a. Personnel | $- | $- | $- | $- | $- | |

| b. Fringe Benefits | $- | $- | $- | $- | $- | |

| c. Travel | $- | $- | $- | $- | $- | |

| d. Equipment | $- | $- | $- | $- | $- | |

| e. Supplies | $- | $- | $- | $- | $- | |

| f. Contractual | $- | $- | $- | $- | $- | |

| g. Construction | $- | $- | $- | $- | ||

| h. Other | $- | $- | $- | $- | $- | |

| i. Total Direct Charges (sum of 6a-6h) | $- | $- | $- | $- | $- | |

| j. Indirect Charges | $- | $- | $- | $- | $- | |

| k. TOTALS (sum of 6i and 6j) | $- | $- | $- | $- | $- | |

|

|

$- | $- | $- | $- | $- | |

| Authorized for Local Reproduction | Standard Form 424A (Rev. 7-97) | |||||

| Previous Edition Usable | SF 424A & INSTRUCTIONS | Prescribed by OMB Circular A-102 | ||||

| SECTION C - NON-FEDERAL RESOURCES | ||||||

| (a) Grant Program | (b) Applicant | (c) State | (d) Other Sources | (e) TOTALS | ||

| 8. | - | - | - | - | ||

| 9. | - | - | - | - | ||

| 10. | - | - | - | - | ||

| 11. | - | - | - | - | ||

| 12. TOTAL (sum of lines 8 - 11) | - | - | - | - | ||

|

|

||||||

| 13. Federal | Total for 1st Year |

|

2nd Quarter | 3rd Quarter | 4th Quarter | |

| $- | $- | $- | $- | $- | ||

| 14 | ||||||

| 15. TOTAL (sum of lines 13 and 14) | $- | $- | $- | $- | $- | |

|

|

||||||

| a) Grant Program |

FUTURE FUNDING PERIODS (Years) | |||||

| (b) First | (c) Second | (d) Third | (e) Fourth | |||

| 16 | $- | $- | $- | $- | ||

| 17 | $- | $- | $- | $- | ||

| 18 | $- | $- | $- | $- | ||

| 19 | $- | $- | $- | $- | ||

| 20. TOTAL (sum of lines 16 - 19) | $- | $- | $- | $- | ||

| SECTION F - OTHER BUDGET INFORMATION | ||||||

| 21. Direct Charges: |

|

|

||||

| 23. Remarks: |

|

|||||

| Authorized for Local Reproduction | Standard Form 424A (Rev. 7-97) Page 2 | |||||

| SF 424A & INSTRUCTIONS | ||||||

| File Type | application/vnd.openxmlformats-officedocument.spreadsheetml.sheet |

| File Modified | 0000-00-00 |

| File Created | 0000-00-00 |

© 2026 OMB.report | Privacy Policy