ACF-700 Guide _20Sept2021_CLEAN

Child Care and Development Fund Tribal Annual Report

ACF-700 Guide _20Sept2021_CLEAN

OMB: 0970-0430

CCDF Tribal Annual Report (ACF-700) Manual: Guide For CCDF Tribal Lead Agencies

Child Care and Development Fund

Tribal Annual Report

(ACF-700) Manual:

Guide for CCDF

Tribal Lead Agencies

DRAFT

Revised September 2021

For ACF-700 Reports for Federal Fiscal Year (FY) 2021 and Later

Table of Contents

I. Introduction and Overview of the ACF-700 CCDF Tribal Annual Report 3

I1. New Changes to the ACF-700 CCDF Tribal Annual Report 3

I2. Overview of the ACF-700 CCDF Tribal Annual Report 4

II. Preparing Introduction: Program Characteristics of the ACF-700 CCDF Tribal Annual Report 6

III. Preparing Part 1: Administrative Data of the ACF-700 CCDF Tribal Annual Report 7

III2. Tips for Reporting Part 1: Administrative Data 7

III3. Manual Preparation of Part 1: Administrative Data 11

III4. Computer Preparation of Part 1: Administrative Data 22

IV. Preparing Part 2: Tribal Narrative of the ACF-700 CCDF Tribal Annual Report 24

VI. Submitting the Annual Report 36

VI1. Accessing and Using the ACF-700 Submission Site 37

VI2. Submission of Introduction: Program Characteristics 38

VI3. Submission of Part 1: Administrative Data 38

VI4. Submission of Part 2: Tribal Narrative 39

VI5. Submission of Part 3: American Rescue Plan (ARP) Act Stabilization Grants 39

I. Introduction and Overview of the ACF-700 CCDF Tribal Annual Report

On an annual basis, Tribal Lead Agencies for the Child Care and Development Fund (CCDF) are required to submit aggregate information on services provided via the CCDF Tribal Annual Report, also known as the ACF-700 report. The ACF-700 report offers the Office of Child Care (OCC) a glimpse into how CCDF program dollars are being spent. The submitted report helps to tell the CCDF Tribal child care “story.” The data are essential for demonstrating the accomplishments of Tribal child care programs.

The information submitted on the ACF-700 report provides the United States Congress with information on Tribal programs, and it serves to inform policy and fiscal decisions. The data gathered for the ACF-700 report are also a rich source of information that can be used for a variety of program needs including informing your Tribal Council about your program, assessing needs, evaluating your program, training staff, resource development, and community education. (See Appendix A for the ACF-700 Report form.)

I1. New Changes to the ACF-700 CCDF Tribal Annual Report

OCC made several changes to the ACF-700 report for Federal Fiscal Year (FFY) 2021 and later years to:

(a) provide clarification about what data is reported under:

Introduction: Program Characteristics. Which CCDF dollars -- CCDF Coronavirus Aid, Relief, and Economic Security (CARES) Act moneys, or CCDF Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act dollars, or CCDF American Rescue Plan (ARP) Act Supplemental Discretionary funds—were included in serving families and children as reported under Part 1: Administrative Data;

Part 1: Administrative Data. The Administrative Data section should include information about families and children who meet CCDF eligibility requirements, and whose direct child care services were provided during the Federal fiscal year, regardless of which year’s CCDF funds paid for those services. These funds could be broader CCDF dollars, or CARES Act moneys, or CRRSA Act dollars, or CCDF ARP Act Supplemental Discretionary funds.

Part 2: Tribal Narrative. The Tribal Narrative section should include information about quality improvement efforts the Tribal Lead Agency funded during the Federal fiscal year, regardless of which year’s CCDF funds paid for those services. These funds could be broader CCDF dollars, or CARES Act moneys, or CRRSA Act dollars, or CCDF ARP Act Supplemental Discretionary funds.

(b) establish a new data reporting section for the American Rescue Plan (ARP) Act stabilization grants. This new section, Part 3, should include information about the ARP Act stabilization grants awarded to providers during the Federal fiscal year.

PART 3: American Rescue Plan (ARP) Act Stabilization Grants. The ARP Act included funding for child care stabilization grants to stabilize the child care sector and build back a stronger child care system that supports the developmental and learning needs of children, meets parents’ needs and preferences with equal access to high-quality child care, and supports a professionalized workforce that is fairly and appropriately compensated for the essential skilled work that they do. Tribal Lead Agencies must spend stabilization funds to support the stability of the child care sector during and after the COVID-19 public health emergency. This section should include information about the ARP stabilization grants awarded to providers during the Federal fiscal year.

I2. Overview of the ACF-700 CCDF Tribal Annual Report

The ACF-700 report consists of the following parts:

Introduction: Program Characteristics – Details information about the Tribal Lead Agency’s use of CCDF and non-CCDF funds, describes which children are reported on Part 1: Administrative Data, and explains how small allocation programs administer their programs.

Part 1: Administrative Data – Reports the number of families and children who received CCDF child care services, and the type of services provided.

Part 2: Tribal Narrative – Describes child care quality activities in the Tribal Lead Agency’s reservation or Tribal service area.

Part 3: American Rescue Plan (ARP) Act Stabilization Grants – Reports information about the ARP Act stabilization grants awarded to providers during the Federal fiscal year.

The data reported on the ACF-700 form should reflect services provided during the Federal fiscal year (October 1 through September 30). For example, Part 1: Administrative Data should reflect services provided during the Federal fiscal year, regardless of whether the services were paid for with CCDF funds from that year or a previous year, or whether the funds used were Tribal Mandatory Funds or Discretionary Funds. OCC prefers that Tribal grantees limit their ACF-700 reports to include only those families and children served with CCDF funds. If a Tribal grantee is unable to only report CCDF-funded families and children, it is acceptable to report families and children served regardless of funding. In this instance, Tribes should indicate the use of those funds and identify the funding source in the Introduction: Program Characteristics section of the ACF-700 report.

The CCDF Tribal Annual Report is due by DECEMBER 31

NOTE: CCDF Tribal grantees with an approved Pub. L. 102-477 Plan are not required to complete the ACF-700 form. For further details, refer to the CCDF-ACF-PI-2019-04 program instruction available at https://www.acf.hhs.gov/occ/policy-guidance/consolidate-ccdf-under-indian-employment-training-and-related-services. Contact your OCC Regional Office (see https://www.acf.hhs.gov/occ/resource/regional-child-care-program-managers) for additional information.

Reporting guidance specific to the COVID-19

health crisis are embedded in callout boxes throughout this Guide.

II. Preparing Introduction: Program Characteristics of the ACF-700 CCDF Tribal Annual Report

The Introduction: Program Characteristics section of the ACF-700 report seeks to capture information about how Tribal Lead Agencies administer their child care program, and what population of children are reported on Part 1: Administrative Data. Several of the questions featured in this new section were previously included in Part 2: Tribal Narrative, but since they impact how OCC may conduct the analysis of the administrative data reported, the questions were moved to the Introduction section. More specifically, the questions detail whether Tribal Lead Agencies:

Supplement the CCDF grant with dollars from other sources, and if so, require Tribal Lead Agencies to identify the other sources of funding;

Report only CCDF funded children served (preferred), or report all children served regardless of funding, if Tribal grantees do not have the capability to identify just CCDF funded children;

Identify which additional CCDF funds (CARES Act moneys, or CRRSA Act dollars, or ARP Act Supplemental Discretionary funds) funded child care services for families and children included in Part 1: Administrative Data; and

(Applicable to Tribes with small allocations only) Provide direct child care services or use dollars instead to support quality initiatives, thereby exempting the Tribal Lead Agencies from reporting Part 1: Administrative Data.

The Program Characteristics section must be completed electronically via the ACF-700 submission site.

III. Preparing Part 1: Administrative Data of the ACF-700 CCDF Tribal Annual Report

Part 1 of the ACF-700 form should include information about families and children who meet CCDF eligibility requirements, and whose direct child care services were provided during the Federal fiscal year, regardless of which year’s CCDF funds paid for those services. These funds could be broader CCDF dollars, or CCDF CARES Act moneys, or CCDF CRRSA Act dollars, or CCDF ARP Act Supplemental Discretionary funds that were used to pay for direct child care services.

Keep in mind that the Tribal Lead Agency SHOULD include further information about the ARP Stabilization Grants in the new Part 3: American Rescue Plan (ARP) Act Stabilization Grants as described further below in this guide.

III2. Tips for Reporting Part 1: Administrative Data

NOTE for Small Allocation Tribes: If you are a small allocation tribal grantee (less than $250,000 in FY2016) and only conducted quality activities and did not provide direct services during the fiscal year you should SKIP Part 1: Administrative Data, and COMPLETE Part 2: Tribal Narrative.

Part 1: Administrative Data can be prepared manually with all of the arithmetic calculations performed by hand, or it can be prepared automatically using computer software (i.e., the Child Care Data Tracker program). Regardless of the method used to calculate the report, you must keep track of certain information on a regular basis (monthly tracking is recommended). Even though the ACF-700 report is due at the end of each Federal fiscal year (by December 31st), the information required to prepare the report must be gathered on an ongoing basis throughout the year.

Administrative data should be prepared using information collected at a family’s initial intake and information collected on an ongoing basis as services are provided. At initial intake, child care programs should collect demographic information about the families and children they serve. As services are provided, programs should capture information on each child’s hours of care, the payment they make on behalf of each child, and each family’s assigned co-payment. All of this information is used to summarize data for the annual ACF-700 report.

You should include information about families and children whose direct child care services were provided during the Federal fiscal year and who met CCDF eligibility, regardless of which year’s CCDF funds paid for those services. Note that child care services should be reported whether paid for wholly or partially with CCDF funds. Child care services include those services that you offer directly through your own CCDF program, or services that you pay for with your CCDF grant but are offered by other programs and providers. Guidance for what is included in direct services for Tribally Operated Centers (TOC) can be found in Technical Bulletin #14, available at https://www.acf.hhs.gov/occ/resource/current-technical-bulletins. Child care services include slots purchased through contracts/grants, services purchased through certificates/vouchers, services purchased through cash payments, and services provided in a tribally-operated facility. See Appendix B for definitions.

Refer to the general instructions in Table 1 below to report data for all of the elements in Part 1 of the ACF-700 form. Section IIIc features guidance on how to perform quality assurance checks to ensure data accurately reflect your program. Table 2 provides additional information regarding the data quality assurance checks to review prior to submitting your report to OCC.

Table 1: General Instructions for Data Elements in Part 1: Administrative Data

Subject |

Explanation (Lower case letters (a, b…f) represent sub-elements) |

Report Period – Federal Fiscal Year |

The Federal fiscal year (FFY) begins on October 1 and ends on September 30 of each year. The ACF-700 report should only include information about CCDF activities that occurred during this time frame. |

Allowable Values |

Generally, the fields should only contain numbers or letters. Do not use decimals, dollar signs, dashes, or other characters. |

What to Report – Counts or Averages |

Some data elements require that you provide counts (for example, counts of families or children) while others require that you provide averages. Counts are required for data elements 1, 2, 2a-e, 3a-h, 4a-e, and 7a-d. Averages are required for data elements 5, 6a, and 6b. To calculate averages, refer to the guidance included in this document for each individual data element. |

Counting Children not Families |

There is only one data element that requires a family count – Element 1: Total number of families that received child care services this fiscal year. All other data elements requesting counts of who received services are counts of children (2, 2a-e, 3a-h, 4a-e, and 7a-d). Even if you collect information at the family level (for example Element 4, reason for care), the data should be reported as a count of children within those families. |

Unduplicated Counts |

For Elements 1, 2, 3a-3h, and 4a-e, you should count a child only once for each element, regardless of how many times the child may have entered and exited service during the Federal fiscal year, or if the child received services from more than one provider during the year.

(This rule does not apply to Elements 5, 6a, and 6b, as these elements ask for averages.) |

Duplicated Counts |

The numbers of children reported by provider type (Elements 2a-2d) and payment type (elements 7a-7d) may be more than the total being reported in Element 2. However, the number may not be less than Element 2. |

Blank Fields |

DO NOT LEAVE ANY BLANK FIELDS. Every field should have either a count (a number) or a zero (0). |

Rounding |

Please round all numbers up or down to the nearest whole number. If the number immediately to the right of the decimal point is 4 or less, round the number down. If it is 5 or more, you should round up. For example, a value of 66.4 or less should be rounded down to 66, while 66.5 or greater should be rounded up to 67. |

Data Accuracy Checks |

Please see the guidance included with each data element in Section IIIa to check the accuracy of the numbers you are reporting. Note that some numbers must add up to and equal numbers reported in other fields. Likewise, some numbers should be less than numbers reported in other fields. If your numbers do not meet the data accuracy check, there may be an error that you need to fix. See Table 2 for a summary of the checks. |

Comments Field |

Use the comments field to explain any unusual or inconsistent data. For example, if the number of families and children you served changed drastically from your prior year’s report, you may want to indicate the reason for the change. You should also use the comments box to provide footnotes explaining when any missing data will be submitted.

You are not able to attach documents in the comments field of the online submission form.

|

Table 2: Summary of Data Accuracy Checks for Part 1: Administrative Data

You can find more detail on the Data Accuracy Checks for each data element in Section IIIc. All consistency checks marked with an asterisk (*) indicate checks that are conducted on the ACF-700 Internet Submission Site. See Section V for more information).

Data Element |

Consistency Check |

Element 1 |

Element 1 should be less than or equal to Element 2* |

Element 2 |

Element 2 should be greater than or equal to Element 1* |

Elements 2a-e |

The total of Elements 2a-e should be equal to or greater than Element 2* |

Elements 3a-h |

The total of Elements 3a-h should be equal to Element 2* |

Elements 4a-e |

The total of Elements 4 a-e should equal the number in Element 2* |

Element 5

|

Generally, full-time care is about 160 hours per month. If most of your children received full-time care, your reported average monthly hours of service per child would not likely be substantially higher or substantially lower than 160 hours. If, however, you primarily operated a Before or After School program, your average hours per month may be substantially lower. The average hours should be representative of the program that you operated and the services that you provided. |

Elements 6a and 6b

|

In most cases, the subsidy amount (6a) will be larger than the co-payment amount (6b). If your reported co-payment is higher than your reported subsidy, you may have an error in your data. |

Elements 7a-d |

The total of Elements 7a-d must be equal to the number reported in Element 2* |

III3. Manual Preparation of Part 1: Administrative Data

If you choose to complete your Administrative Data report manually, you will have to be prepared to do the required arithmetic calculations yourself. This can be as simple as counting the number of families and children you served or as complex as calculating monthly averages. Depending upon the number of clients that a program serves, the calculations of averages for Elements 5, 6a, and 6b required for the ACF-700 report can be time-consuming and preparing the report can be a tedious process. Again, although this is an annual report, many of the calculations have to be completed for each month of the year.

Detailed instructions for manually calculating the administrative data are below. These instructions include definitions, guidance on manual calculation, and data accuracy checks for each data element. If you are completing Part 1: Administrative Data with the Child Care Data Tracker software, you may skip this section of the guide because all of the calculations are automatically completed by the Tracker software when you generate your ACF-700 report. Table 3 below provides guidance on submitting Tribal Lead Agency contact information.

Table 3: Tribal Lead Agency Contact Information Data Elements

Tribal Lead Agency Data Elements |

Definition |

Allowable Values |

Guidance |

Complete Name of Tribal Lead Agency |

Name of the CCDF Tribal Lead Agency |

Text |

|

Address |

Mailing address of the CCDF Tribal Lead Agency |

Text, Numbers |

|

Tribal Lead Agency City |

City of the mailing address of the CCDF Tribal Lead Agency |

Text |

|

Tribal Lead Agency State

|

Two-letter postal State abbreviation of the mailing address of the CCDF Tribal Lead Agency |

Valid postal State abbreviations |

A list of state abbreviations is available at: https://about.usps.com/who-we-are/postal-history/state-abbreviations.pdf |

Tribal Lead Agency ZIP Code

|

Numerical code assigned by the US Postal Service to designate a local area or entity for the delivery of mail |

Accepts all valid ZIP codes: |

You can search for valid ZIP codes at: https://tools.usps.com/go/ZipLookupAction!input.action |

Contact Person

|

Full name of individual whom the Office of Child Care should contact in regard to this report |

Text |

|

Phone

|

Area code and telephone number for the contact person |

Numbers |

Include area code |

|

Electronic mail address for the contact person |

Text, Numbers |

Be sure that the entered e-mail address is complete and clearly legible |

DATA ELEMENT 1: Total number of families that received child care services this fiscal year

Definition: Unduplicated count of families who received subsidized child care services during the Federal fiscal year.

Child care services include those that you offer directly through your own CCDF program, or services that you pay for with your CCDF grant but are offered by other programs and providers, to children whose families meet CCDF eligibility requirements. Child care services include slots purchased through contracts/grants, services purchased through certificates/vouchers, services purchased through cash payments, and services provided in a tribally-operated facility. See Appendix A for definitions.

Data Accuracy Check: Element 1, number of families receiving services, should be less than or equal to Element 2, the total number of children receiving services.

Guidance: Each family should be counted once, regardless of the number of days care was provided, and even if the family has exited and re-entered the program.

Example 1: A family leaves the program in March but is reinstated in August. The family is counted one time in Element 1.

Report the number of families for whom you provided services during the reporting period October 1 – September 30, regardless of when the payment for the service was made, or which fiscal year's funds paid for the service.

Example 2: A child received care in August only. The Tribal Lead Agency paid for that care in October. Count the family because the service was received during the report period.

When data are applicable but not available, provide a footnote in the comment section explaining when the missing data will be submitted.

DATA ELEMENT 2: Total number of children that received services this fiscal year

Definition: An unduplicated count of children who received child care services for the Federal fiscal year regardless of the type of care.

Data Accuracy Checks:

Check 1: Element 2, the total number of children receiving services, should be greater than or equal to Element 1, the total number of families receiving services.

Check 2: Element 2, the total number of children receiving services, should be less than or equal to the total of Elements 2a-e, the number of children receiving care in various provider care types.

Guidance: Each child who received services should be counted only once, regardless of the number of days care was provided or if the child exited and re-entered the program.

Example 1: A child leaves the program in March, but is reinstated in August. The child is counted one time in Element 2.

Count all children who met CCDF eligibility requirements and received direct services paid for fully or partially with CCDF funds during the Federal fiscal year. Child care services are defined as slots purchased through contracts/grants, services purchased through certificates/vouchers, services purchased through cash payments, or services provided in a tribally-operated facility funded under CCDF. See Appendix A for definitions.

Example 2: A Tribal Lead Agency provides child care certificates/vouchers to 100 families to receive child care services at a program of their choice. The total unduplicated number of children should be counted in Element 2. For Element 2, enter the number of children receiving child care through certificates/vouchers regardless of their setting type.

Example 3: A Tribal Lead Agency contracts with a center for 50 full-time slots for the Federal fiscal year. The total unduplicated number of children receiving child care through agency contracts with centers should be reported in Element 2. If you contracted for 50 slots, the number of children served through these slots will depend on the utilization rate.

Do not count children or families who only generally benefited from services such as when your program 1) receives a grant or contract to establish, expand, or conduct an early childhood school readiness enrichment program (i.e., not specific slots); or 2) you initiate an expansion of quality activities funded under the CCDF. Your use of quality dollars to improve the quality of care should be explained in the Part 2: Tribal Narrative report.

Example 4: A Tribal Lead Agency contracts with a resource and referral agency to provide professional staff development training at a Center serving 78 children. The Tribal Lead Agency does not contract for slots with the center and no children there receive CCDF certificates. Do not count the children because they did not receive direct child care services from the CCDF funds expended.

When data are applicable but not available, provide a footnote in the comment section explaining when the missing data will be submitted.

DATA ELEMENTS 2a-e: Total number of children that received services this fiscal year by category/type of child care

Definition: An unduplicated count of children who received child care services during the Federal fiscal year for each provider type. See the Definitions section below for detailed definitions of care types.

Data Accuracy Check: Add the number of children being served in each care type (Elements 2a-e). This number should be equal to or greater than the total unduplicated number of children reported in Element 2.

Guidance: A child may be counted in more than one provider type row if the child received care from more than one provider type for different portions of the typical day, week, or month. However, the child should NOT be counted more than once within a single provider type row.

Example 1: A child attends a family child care home before school hours and a child care center after school hours. The child would be counted under provider types of both family home and center based child care.

When a child changes the category of provider during the report period, count the child separately in each care type.

Example 2: A child receives care in a family child care home from September to March, uses an in-home provider during April and a center from May through October. The child would be counted under each provider type – family home, child’s home, and center care.

Provider types are broken up into three types of providers: child’s home, family home, and centers. Additionally, child’s home and family home provider types are also broken down into relative and non-relative care.

DEFINITIONS

Child’s Home: Care provided by a caregiver in the child’s own home.

Family Home: Care provided in the family home of the provider (i.e., care provided by an individual in their own private residence). Generally, family home care is provided only to a limited number of children at any one time (e.g. 3-5).

Center-Based: Care provided in a center-based setting, including programs in schools or churches.

Relative Care: Care by a provider who is a grandparent, great-grandparent, aunt or uncle, or sibling living outside the child’s home.

When data are applicable but not available, provide a footnote in the comment section explaining when the missing data will be submitted.

DATA ELEMENTS 3 a-h: Total number of children receiving services that fall into each age category

Definition: Breakdown by age of children receiving child care services.

Data Accuracy Check: Add the total number of children in each age bracket for Elements 3a-h. Compare your answer to the number in Element 2. If they are not the same, there is an error in the data which should be corrected.

Guidance: Report the child’s age as of the end of the Federal fiscal year, or the date that the child exited the program, whichever occurred first. Each child that received services should be counted only once, regardless of the number of days care was provided and even if the child has exited and re-entered the program.

Example 1: A child leaves the program in March, but is reinstated in August. The child is counted one time in Elements 3a-h.

The age of the child is reported as of the end of the report period (or the date of exit from the CCDF program).

Example 2: A 2-year-old child received services starting in March. On September 15, she turned 3 years old and continued to receive services through the reporting period. The child should be reported as a 3-year-old on line 3d.

When data are applicable but not available, provide a footnote in the comment section explaining when the missing data will be submitted.

DATA ELEMENTS 4 a-e: Number of children who received child care services because of each specified reason for care

Definition: An unduplicated count of children receiving child care services by reason for care. This element separates reason for care into five categories:

4a. Their parents worked

4b. Their parents were in training or an educational program

4c. Child received or needed Protective Services

4d. Their parents worked AND were in training/educational program* (*new category)

4e. Program has implemented categorical eligibility and employment or training status is not an eligibility criterion* (*new category)

Categorical eligibility means the Tribal Lead Agency has been approved to use categorical eligibility because its Tribal Median Income is below the level established by the Secretary (currently 85% of State Median Income), and the Indian children in the Tribe’s service area would be considered eligible for services regardless of the family’s income, work, or training status.

For tribes NOT approved to utilize the

Categorical Eligibility:

Children of essential workers, who received

services funded by CCDF CARES Act dollars, or CCDF CRRSA Act moneys,

or CCDF ARP Act Supplemental Discretionary funds and who would have

otherwise not been eligible for services (i.e. essential workers),

should be reported based on the underlying reason for care (work,

training/education, protective services or work AND

training/education). If the Tribal Lead Agency defined essential

workers as being protective services cases, then these children

should be reported with reason of protective services (4c).

For tribes APPROVED to utilize the

Categorical Eligibility:

All children can be included in the

Categorical Eligibility category (4e), regardless of whether they

were receiving services prior to the onset of the COVID-19 health

crisis. Keep in mind that Tribal Lead Agencies can receive approval

to use Categorical Eligibility for all their families, or for a part

of their service area. In the case that a Tribal Lead Agency

received approval to use Categorical Eligibility for part of their

service area, only those children in that service area can be

included in the Categorical Eligibility reason of care.

Data Accuracy Check: Add the number of children recorded for Elements 4a-e. This answer and the number in Element 2 should be the same. If they are not the same, there is an error that should be corrected.

Guidance: This is a count of children, NOT families. Each child may be counted only once.

When a family receives care for more than one reason (e.g., the parent works and the child is in need of Protective Services), count only the activity in which the parent (or child, in the case of Protective Services) spends the most time and is the primary reason for needing subsidized child care – that is, the reason the family is eligible to receive a subsidy.

Element 4 entries should be unduplicated counts.

When a child’s reason for needing care changes during the report period, report the reason as of the end of the report period (or date of exit from the program).

Example 1: A child received care in October because of her parents' employment. From November through September, child care was provided because the child was in Protective Services. Count the child in line 4c only – Protective Services.

NOTE: Each Tribal Lead Agency defines the terms "working," "job training and educational program” and “protective services" in Sections 5.1.3 and 5.1.4 of its Tribal Plan.

When data are applicable but not available, provide a footnote in the comment section explaining when the missing data will be submitted.

DATA ELEMENT 5: Average number of hours of child care service provided per child per month

Definition: The average number of hours of child care service provided per child per month.

Data Accuracy Check: Generally, full-time care is about 40 hours per week for 4 weeks (160 hours per month). If most of your children received full-time care, your reported average monthly hours of service per child would not likely be substantially higher or substantially lower than 160 hours.

If, however, you primarily operate a Before and/or After School program, your average hours per month may be substantially lower. The average hours should be representative of the program you operated and the services you provided.

Guidance: This is a monthly average, NOT a yearly average. One method to calculate the average number of hours of care per child per month is:

Begin by counting the total number of hours of care for all children for the first month you provided service during the fiscal year (month X, for example October).

Count the total number of children served during month X.

Divide the total number of hours from step 1 by the total number of children from step 2 to get the average number of hours of care provided per child for month X.

Repeat steps 1 – 3 for each month services were provided.

Add together each of the monthly average hours to get a sum.

Divide the sum from step 5 by the total number of months services were provided during the year to get the average number of hours of care provided per child per month.

Some Tribal Lead Agencies do not pay for (or keep records for) the actual number of hours of service per child. Rather, they reimburse by "full" or "part" days of service (or other increments). These Tribal Lead Agencies can still calculate the average number of hours of child care per child per month based on the program’s definitions or estimate of the number of hours that “full” or “part” days represent.

For example, a Tribal Lead Agency may define a “part” day as 4 hours or fewer per day (and estimate a “part” day at 4 hours of care), and define a “full” day as more than 5 hours (and estimate a “full” day at 8 hours of care). In step #1 of the above calculations, the Tribal Lead Agency would count 4 hours of care for each “part” day, and “8” hours for each “full” day they paid for child care services in order to get the total number of hours of care for all children for month X.

When data are applicable but not available, provide a footnote in the comment section explaining when the missing data will be submitted. Tribal Lead Agencies should also describe in a footnote how they calculated the average number of hours.

For providers that closed at any point during

the COVID-19 health crisis and continued to receive CCDF funds

during the closure, grantees should report the authorized hours of

service associated with those direct service expenditures rather

than zero direct service hours.

DATA ELEMENT 6a: Average monthly CCDF program subsidy per child

Definition: The average monthly cost that your CCDF program paid for child care services per child. This does not include the parent’s co-payment.

Data Accuracy Check: Except in rare circumstances, Element 6a, the average monthly subsidy paid per child, will be greater than Element 6b the average monthly parent co-payment paid per child.

Guidance: This is a monthly average, NOT a yearly average. Tribal Lead Agencies should use the same method for calculating the average monthly subsidy amount paid in Element 6 as used to calculate the average number of hours of care for Element 5.

One method to calculate the average monthly CCDF subsidy paid for child care services per month per child is:

Begin by counting the total amount of CCDF subsidy paid for child care services for all children for the first month you provided service during the fiscal year (month X, for example October).

Count the total number of children served during month X.

Divide the total amount from step 1 by the total number of children from step 2 to get the average amount of CCDF subsidy paid for child care services for month X.

Repeat steps 1 – 3 for each month services were provided.

Add together each of the monthly averages to get a sum of averages.

Divide the sum from step 5 by the total number of months services were provided during the year to get the average subsidy amount paid for child care services per child per month.

Guidance for Tribally-Operated Centers

Some Tribal Lead Agencies run their own center(s) and do not technically “pay” a provider. Such agencies can still estimate the “average” monthly CCDF subsidy amount paid per child for child care services provided using the record of expenditures that is submitted annually on the required ACF-696T, the Tribal financial report. Additional information is available in Technical Bulletin #14) available at https://www.acf.hhs.gov/occ/resource/current-technical-bulletins.

Calculation to estimate the average monthly subsidy per child for programs with a Tribally Operated Center (TOC) when you only provide services in your TOC:

Add the Tribal Mandatory, Discretionary, Discretionary Funds Base Amount, Discretionary CARES Act Funds, Discretionary CRRSA Act Funds, and Supplemental Discretionary ARP Act expenditures (not including expenditures for construction and renovation, disaster relief , CARES Act, CRRSA Act, and ARP Act funds used for construction and renovation) that your Tribe reported for direct services on Line 4 of the ACF-696T – Expenditures for Child Care Services. (During the Federal fiscal year, if you expended funds from more than one grant year, you must add the appropriate expenditures from each of the reports submitted regardless of the year that the grant was awarded.)

Divide the above total by the number of months that you provided services during the year (ranging from 1 to 12 months) to get an overall monthly subsidy amount.

Divide the monthly subsidy amount by the average number of children served per month (calculate it separately) to estimate the average monthly subsidy per child in your center.

Calculation to estimate the average monthly subsidy per child for programs with a TOC when you support both a TOC and other provider types:

Add the Tribal Mandatory, Discretionary, Discretionary Funds Base Amount, and Discretionary CARES Act Funds, Discretionary CRRSA Act Funds, and Supplemental Discretionary ARP Act expenditures (not including expenditures for construction and renovation, disaster relief, and CARES Act, CRRSA Act, and ARP Act funds, used for construction and renovation) that your Tribe reported for direct services on Line 4 of the ACF-696T – Expenditures for Child Care Services. (During the Federal fiscal year, if you expended funds from more than one grant year, you must add the appropriate expenditures from each of the reports submitted regardless of the year that the grant was awarded.)

Add together all of the CCDF Subsidy payments you have made to all non-TOC providers during the report year.

Subtract this total of CCDF subsidy payments made to all non-TOC providers from the total you arrived at in step 1 above.

Divide the remaining subsidy amount from step 3 by the number of months that you provided services in your TOC during the year (ranging from 1 to 12 months) to get a total monthly TOC subsidy amount.

Divide the monthly amount from step 4 by the average number of children served per month (calculate it separately) in the TOC payment type (data Element 7d) to estimate the average monthly subsidy per child for your TOC.

When data are applicable but not available, provide a footnote in the comment section explaining when the missing data will be submitted.

DATA ELEMENT 6b: Average monthly parent co-payment amount paid per child for child care service

Definition: The average monthly cost that the family/parent was assessed to pay toward the cost of care per child.

Data Accuracy Check: Generally, the parent co-payment is less than the subsidy amount (Element 6a). If your co-payment is larger than the reported subsidy, check to be sure that your numbers are correct.

Guidance: This is a monthly average, NOT a yearly average. Tribal Lead Agencies should use the same method for calculating the average monthly parent co‑payment on Element 6b as used to calculate the average number of hours of care for Element 5.

One method to calculate the average monthly parent co-payment amount paid for child care services per month per child for each category/type of child care is:

Begin by calculating the total amount of CCDF co-payments paid by all families for child care services for the first month you provided service during the fiscal year (month X, for example October).

Count the total number of children served during month X.

Divide the total amount from step 1 by the total number of children from step 2 to get the average CCDF co-payment paid per child for child care services for month X.

Do steps 1 – 3 for each month services were provided.

Add together each of the monthly co-payment averages to get a sum.

Divide the sum from step 5 by the total number of months services were provided during the year to get the average parent co-payment amount paid for child care services per month per child.

When data are applicable but not available, provide a footnote in the comment section explaining when the missing data will be submitted.

DATA ELEMENT 7a-d: Number of children served by payment type this fiscal year

Definition: This is an unduplicated count of children served by various types of payment.

This element separates payment type into four categories:

7a. Grant/Contract with provider

7b. Certificate or voucher to parent and/or provider

7c. Cash payment to parent

7d. CCDF funding to a Tribally-Operated Center for direct services.

See the Definitions section below for information on the various payment types.

Data Accuracy Check: The sum of 7a-d must be equal to Element 2. If they are not the same, there is an error that should be corrected.

Guidance: This is a count of children, NOT families.

Each child should be counted once. If payment type for services for a child changes during the reporting period, select the last known payment type.

Example: From October through February you paid for a child’s services with cash payments to the applicant. Beginning in March and through the remainder of the fiscal year, the child’s services were paid through a grant or contract with a provider. This child should be counted in 7a (grant/contract with provider) only.

If services for the child were paid for with two types of payment at the same time during the reporting period, select the primary payment type, that is, the type with the most hours.

Example: For the entire Federal fiscal year, a child received services from an in-home provider for 2 hours a day in the early morning, and this provider was paid with cash. At the same time, this child received services for the rest of the day in a center for 8 hours each day, and the center was paid through a contract. You would report this child under 7a (grant/contract with provider) only.

Definitions:

Grant/Contract with Provider: A legally binding agreement (usually via a competitive bid) with a child care provider to deliver services, defining the terms and conditions of those services.

Certificate or Voucher to Parent and/or Provider: A certificate (that may be a check or other form) that is issued by a State, Tribal or local government directly to a parent to verify their eligibility for subsidized services.

Cash Payment to Parent: Money paid to parents in the form of cash or checks to cover the cost of child care services. (This does not include two-party checks to parents and providers, or cash to providers). Note that the term “parent” includes any individual operating in loco parentis, as defined in the Tribe’s CCDF plan.

CCDF funding to a Tribally-Operated Center for direct services: A child care center operated by the Tribal Lead Agency. The center is usually located on the Tribal reservation or in the Tribal Lead Agency’s service area. A Tribally-operated center payment differs from a grant or contract in that a Tribal Lead Agency pays the operational costs of the Center (including teacher salaries).

When data are applicable but not available, provide a footnote in the comment section explaining when the missing data will be submitted.

ALL TRIBES:

If the Tribal Lead Agency knows the number of

children of essential workers who received services paid by CCDF

CARES Act dollars, or CCDF CRRSA Act moneys, or CCDF ARP Act

Supplemental Discretionary funds, please report it in the comments

field.

III4. Computer Preparation of Part 1: Administrative Data

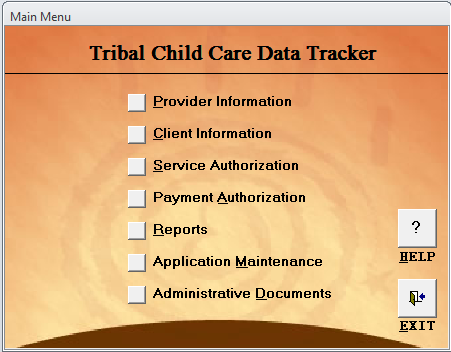

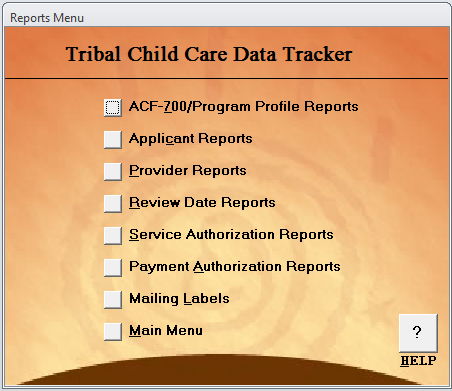

To facilitate the preparation of administrative data for the ACF-700 report, some Tribal grantees use automated systems to capture and manage the required information. OCC recognized that many Tribal grantees did not have access to information systems that would allow for the capture and management of information for the required ACF-700 report, and developed the Child Care Data Tracker (Tracker) to facilitate the reporting process. The use of this software is optional for the Tribal grantees.

Tribal Child Care Data Tracker

The Tracker is a Microsoft Access-based software tool that can installed and used on any computer that supports Microsoft Access. It is a comprehensive case management tool that can help you to maintain all of your client records and allows you to record a broad range of information about clients, including: demographics, eligibility reviews, services received, and payments made. The Tracker also can automatically generate a variety of reports, including the required ACF-700 report. The software is available free of charge to CCDF Tribal Grantees. Over time, several versions of the Tracker have been developed, each of which has made the software more user-friendly and allowed it to function more efficiently. The latest Tracker is Version 3.0, updated to reflect the administrative changes to the ACF-700 form and released in FFY2020.

The Tracker functions generally parallel the activities used by child care program staff with the families they serve. There are several data entry modules in the Tracker that allow you to keep track of your children and families, providers, service authorizations, and payments. The ACF-700 report is based on the information/data that you enter in these modules. Program information that is required for the ACF-700 report also is required by the software when you use the Tracker. This feature of requiring certain data ensures that you will be able to generate an ACF-700 report at the end of the year. In addition to generating the ACF-700 report, the report module in the Tracker allows you to generate applicant, provider, service, and payment reports with a variety of sorting options. To learn more about the Child Care Data Tracker, see the OCC website.

IV. Preparing Part 2: Tribal Narrative of the ACF-700 CCDF Tribal Annual Report

The Tribal Narrative section should include information about quality improvement efforts the Tribal Lead Agency funded during the Federal fiscal year, regardless of which year’s CCDF funds paid for those services. These funds could be broader CCDF dollars, or CCDF CARES Act moneys, or CCDF CRRSA Act dollars, or CCDF ARP Act funds.

Keep in mind that the Tribal Lead Agency SHOULD include further information about the ARP Stabilization Grants in the new Part 3: American Rescue Plan (ARP) Act Stabilization Grants as described below.

The questions Tribal grantees are required to answer are detailed on the ACF-700 form in Appendix A. Guidance is provided below for each of the questions included in Part 2: Tribal Narrative.

Question 1: What quality improvement efforts did the Tribal Lead Agency fund this fiscal year?

Guidance: Tribes must spend quality funds on at least one of the 10 allowable quality activities listed, such as training and professional development, early learning and development, quality evaluation, and other measurable quality activities including culturally responsive activities such as language immersion. In responding to this question, the Tribal Lead Agency should check all the activities that apply that are funded either entirely, or in part, with CCDF dollars.

Question 2a: What trainings did the Tribal Lead Agency provide for child care caregivers, teachers, and directors?

Guidance: Tribal Lead Agencies are required to have in place pre-service and/or orientation training requirements and ongoing training requirements for caregivers, teachers, and directors that address health and safety requirements as well as child development. In responding to this question, the Tribal Lead Agency must

check all the training topics that were available to caregivers, teachers, and directors;

describe the trainings that were available during the fiscal year; and

list how many caregivers, teachers, and directors were trained during the fiscal year.

Question 2b: Did the Tribal Lead Agency support child care caregivers, teachers, and directors in achieving any of the following along a career pathway?

Guidance: Tribal Lead Agency should select and describe all the support (for example through funding, scholarships, etc.) along the career development pathway that were made available to its child care workforce during the fiscal year. In the narrative, Tribal Lead Agencies are encouraged to incorporate the number of caregivers, teachers, and directors who received support to obtain credits, credentials, or degrees.

Question 2c: How did the Tribal Lead Agency assist providers in meeting health and safety standards?

Guidance: Tribal Lead Agencies are required to establish health and safety standards for all types of child care programs (i.e., center based care, including Tribally operated centers, or home based care) serving children receiving CCDF assistance, as appropriate to the provider setting and age of the children served. In responding to this question, Tribal Lead Agencies should check all that apply and describe how they assisted providers meet the established health and safety standards.

Question 2d: How did the Tribal Lead Agency support and provide culturally appropriate activities to children, parents, and providers?

Guidance: Tribal Lead Agencies must spend quality funds on at least one of 10 allowable quality activities, including culturally responsive activities such as language immersion. In responding to this question, Tribal Lead Agencies should check all the activities that apply and describe how they provided culturally appropriate activities to children, parents and providers during the fiscal year.

Question 2e: How did the Tribal Lead Agency provide consumer education to parents and providers?

Guidance: Tribal Lead Agencies must identify and describe the consumer education activities they invested in during the fiscal year.

Question 2f: Did any CCDF child care providers participate in the following?

Guidance: A quality rating and improvement system (QRIS) is a systemic approach to assess, improve, and communicate the level of quality in early and school-age care and education programs. Similar to rating systems for restaurants and hotels, QRIS award quality ratings to early and school-age care and education programs that meet a set of defined program standards. By participating in their State or Tribe’s QRIS, early and school-age care providers embark on a path of continuous quality improvement. Even providers that have met the standards of the lowest QRIS levels have achieved a level of quality that is usually beyond the minimum requirements to operate. In responding to this question, Tribal Lead Agencies should identify and describe the QRIS used during the fiscal year. If a Tribal Lead Agency selected “None”, an explanation is required for why no quality rating and improvement system is being used.

Question 2g: Describe any other significant quality activities that occurred during the past fiscal year

Guidance: Describe any other activities to improve the quality of child care services, besides the activities included in previous questions, the Tribal Lead Agency implemented during the fiscal year.

Your Tribal Lead Agency should describe any

quality activities funded by CARES Act, CRRSA Act, ARP Act

Supplemental, or ARP Act Stabilization dollars (such as

sustainability grants or supply grants) during the fiscal year to

support providers in response to the COVID-19 health crisis in

question 2g.

V. Preparing Part 3: American Rescue Plan (ARP) Act Stabilization Grants of the ACF-700 CCDF Tribal Annual Report

The ARP Act included funding for child care stabilization grants to stabilize the child care sector and build back a stronger child care system that supports the developmental and learning needs of children, meets parents’ needs and preferences with equal access to high-quality child care, and supports a professionalized workforce that is fairly and appropriately compensated for the essential skilled work that they do. Tribal Lead Agencies must spend stabilization funds to support the stability of the child care sector during and after the COVID-19 public health emergency.

Part 3 of the ACF-700 form should include information about the ARP stabilization grants awarded to providers during the Federal fiscal year.

DATA ELEMENT 1: Total number of stabilization grants awarded during the fiscal year:

Definition: A count of stabilization grants awarded during the Federal fiscal year regardless of the type of care. This is a system generated number calculated from the sum of 1a+1b+1c.

DATA ELEMENT 1a-c: Number of stabilization grants awarded during the fiscal year by type of care:

Definition: A count of stabilization grants awarded during the Federal fiscal year for each provider type.

1a. Family Home providers

1b. Center Providers

1c. Providers at Child’s Home

Provider types are broken up into three types of providers: family home, centers, and child’s home. The definitions used include:

Family Home: Care provided in the family home of the provider (i.e., care provided by an individual in their own private residence). Generally, family home care is provided only to a limited number of children at any one time (e.g. 3-5).

Center-Based: Care provided in a center-based setting, including programs in schools or churches.

Child’s Home: Care provided by a caregiver in the child’s own home.

Data Accuracy Check: This number should be equal to or less than the total number in element 1.

Guidance: This is a count of grants, NOT providers. Each grant should be counted.

When data are applicable but not available, provide a footnote in the comment section explaining when the missing data will be submitted.

DATA ELEMENT 2: Average provider capacity (i.e., number of children they can serve)

Definition: The average provider licensed or identified capacity (i.e., total number of children they can serve) of all the providers that applied for a stabilization grant.

Guidance: This is an average of all providers that applied for a stabilization grant during the federal fiscal year. Each provider should be counted once regardless if the provider received more than one grant award. If the provider operates in multiple locations, then the tribe should count each unique location as a provider when calculating the average.

An example of how to calculate the average provider capacity is provided below:

Example of Calculating the Average Provider Capacity |

|||

# |

Provider Applied for Stabilization Grant |

Provider Type |

Licensed or Identified Capacity (total number of children provider can serve) |

1 |

Provider A |

Center |

12 (4 infants, 4 toddlers, 4 preschoolers) |

2 |

Provider B |

Family Home |

4 (2 infants, 2 preschoolers) |

3 |

Provider C in one location |

Center |

23 (5 infants, 9 toddlers, 9 preschoolers) |

4 |

Provider C in another location |

Center |

19 (5 infants, 5 toddlers, 9 preschoolers) |

5 |

Provider D |

Family Home |

3 (3 preschoolers) |

6 |

Provider E |

Family Home |

5 (2 infants, 3 toddlers) |

7 |

Provider F |

Child’s Home |

1 (1 infant) |

|

TOTAL capacity |

|

67 |

Average provider capacity = 10 (see calculation below)

67 total capacity / 7 providers = 9.57 children (rounded up to 10)

Data Accuracy Check: N/A

Guidance: This is an average provider licensed or identified capacity. This is NOT a count of providers or grants.

DATA ELEMENT 2a-c: Number of stabilization grants awarded during the fiscal year by age category

Definition: A count of stabilization grants awarded during the Federal fiscal year by each age category as defined by the tribe in their tribal CCDF plan.

Guidance: This is an average of providers for each age category of children (infant, toddler, preschooler, school-age) that applied for a stabilization grant during the federal fiscal year. Each provider should be counted once under each age category (when the provider serves multiple age groups) regardless if the provider received more than one grant award. If the provider operates in multiple locations, then the tribe should count each unique location as a provider when calculating the average.

Using the example data in the table above, the average provider capacity by each age category is calculated as follows:

Average provider infant capacity = 3 (see calculation below)

4 + 2 + 5 + 5 + 2 + 1 = 19 infants / 6 providers = 3.17 infants (rounded down to 3)

Average provider toddler capacity = 5 (see calculation below)

4 + 9 + 5 + 3 = 21 toddlers / 4 providers = 5.25 toddlers (rounded down to 5)

Average provider preschooler capacity = 5 (see calculation below)

4 + 2 + 9 + 9 + 3 = 27 preschoolers / 5 providers = 5.4 preschoolers (rounded down to 5)

Average provider school age capacity = 0 (see calculation below)

Zero providers are serving school age children

DATA ELEMENT 3: Stabilization grant award amounts

Definition: This group of questions applies to the award(s) that providers received during the Federal fiscal year.

DATA ELEMENT 3a: Minimum award amount per provider

Definition: Minimum award amount per provider during the Federal fiscal year (rounded to the nearest dollar).

Guidance: This is the minimum award amount to a provider during the federal fiscal year. If a provider received more than one award during the fiscal year, all the award amounts should be added to calculate the minimum amount per provider. Each provider should be counted once. If the provider operates in multiple locations, then the tribe should count each unique location as a provider when calculating the average.

An example of how to calculate the minimum award amount per provider is provided below:

Example of How to Calculate Minimum and Maximum Award Amount |

|||

# |

Provider Applied for Stabilization Grant |

Award Amount |

Minimum and Maximum Award Amount Calculation |

1 |

Provider A |

$4,561 |

$4,561 + 2,325 + 3,156 = $10,042 |

2 |

Provider A |

$2,325.15 |

|

3 |

Provider A |

$3,156.04 |

|

4 |

Provider B |

$12,672.15 |

$12,672 |

5 |

Provider C in location X |

$21,389.89 |

$21,390 |

6 |

Provider C in location Y |

$20,250 |

$20,250 + $8,220 = $28,470 |

7 |

Provider C in location Y |

$8,220.12 |

|

8 |

Provider D |

$3,785.34 |

$3,785 |

Minimum provider award amount is $3,785.

DATA ELEMENT 3b: Maximum award amount per provider

Definition: Maximum award amount per provider during the Federal fiscal year (rounded to the nearest dollar).

Guidance: This is the maximum award amount to a provider during the federal fiscal year. If a provider received more than one award during the fiscal year, all the award amounts should be added to calculate the maximum amount per provider. Each provider should be counted once. If the provider operates in multiple locations, then the tribe should count each unique location as a provider when calculating the average.

Using the data from the table above, the maximum award amount per provider is $28,470.

DATA ELEMENT 3c: Average award amount per provider

Definition: Average award amount per provider during the Federal fiscal year (rounded to the nearest dollar).

Guidance: This is the average award amount to a provider during the federal fiscal year. If a provider received more than one award during the fiscal year, all the award amounts should be added to calculate the average award amount for each provider before calculating the average across all providers. Each provider should be counted once. If the provider operates in multiple locations, then the tribe should count each unique location as a provider when calculating the average.

An example of how to calculate the average award amount per provider is provided below:

Example of How to Calculate Average Award Amount Per Provider |

|||

# |

Provider Applied for Stabilization Grant |

Award Amount |

Average Award Amount Per Provider |

1 |

Provider A |

$4,561 |

$4,561 + 2,325 + 3,156 = $10,042 $10,042 / 3 awards = $3, 347 |

2 |

Provider A |

$2,325.15 |

|

3 |

Provider A |

$3,156.04 |

|

4 |

Provider B |

$12,672.15 |

$12,672 |

5 |

Provider C in location X |

$21,389.89 |

$21,390 |

6 |

Provider C in location Y |

$20,250 |

$20,250 + $8,220 = $28,470 $28,470 / 2 awards = $14,235 |

7 |

Provider C in location Y |

$8,220.12 |

|

8 |

Provider D |

$3,785.34 |

$3,785 |

Average award amount per provider = $11,086 (see calculation below)

$3,347 + $12,672 + $21,390 + $14,235 + $3,785 = $55,429

$55,429 / 5 providers = $11,085.8

DATA ELEMENT 4: Number of stabilization grants awarded to providers that, at the time of application, were serving children who received subsidy

Definition: Tribes are required to identify the number of grants that were awarded to providers who, at the time of the application for stabilization funding, were already serving children who received Child Care and Development Fund (CCDF) subsidies.

Guidance: This is the total number of grants that were awarded to providers who, at the time of the application for stabilization funding, were already serving children who received CCDF subsidies.

An example of how to calculate the average award amount per provider is provided below:

Example of grants awarded to providers who, at the time of the application for stabilization funding, were already serving children who received CCDF subsidies |

|||

# |

Provider Applied for Stabilization Grant |

Number of Awards (during federal fiscal year) |

Already Serving Children Receiving Subsidies (at the time of application) |

1 |

Provider A |

3 |

Y |

2 |

Provider B |

1 |

N |

3 |

Provider C in location X |

1 |

Y |

4 |

Provider C in location Y |

2 |

N |

5 |

Provider D |

1 |

N |

Total number of grants awarded to providers who, at the time of the application for stabilization funding, were already serving children who received CCDF subsidies = 4

Data Accuracy Check: This number should be equal to or less than the total number in element 1.

Guidance: This is a count of grants, NOT providers. Each grant awarded to a provider who, at the time of the application for stabilization funding, were already serving children who received CCDF subsidies should be counted.

DATA ELEMENT 5: Number of providers who temporarily closed due to public health, financial hardship, or other reasons relating to COVID-19

Definition: Tribes are required to identify the number of providers who temporarily closed, at time of application, due to public health, financial hardship, or other reasons relating to COVID-19. If the provider operates in multiple locations, then each location should be counted as a unique provider.

Guidance: This is the unduplicated total number of providers who temporarily closed. If a provider received multiple grants during the fiscal year, the provider should only be counted once. If the provider operates in multiple locations, then each location should be counted as a unique provider.

Data Accuracy Check: This number should be equal to or less than the total number in element 1.

Guidance: This is a count of providers, NOT grants.

DATA ELEMENT 5: Number of providers who temporarily closed due to public health, financial hardship, or other reasons relating to COVID-19

Definition: Tribes are required to identify the number of providers who temporarily closed, at time of application, due to public health, financial hardship, or other reasons relating to COVID-19. If the provider operates in multiple locations, then each location should be counted as a unique provider.

Guidance: This is the unduplicated total number of providers who temporarily closed. If a provider received multiple grants during the fiscal year, the provider should only be counted once. If the provider operates in multiple locations, then each location should be counted as a unique provider.

Data Accuracy Check: This number should be equal to or less than the total number in element 1.

Guidance: This is a count of providers, NOT grants.

DATA ELEMENT 6: Number of providers planning to use the stabilization grants for

Definition: Tribes are required to request information about the provider’s uses of the stabilization grant. If the provider operates in multiple locations, each location should be asked for this information.

Example data to calculate the numbers requested for 6a – 6f is provided below:

# |

Provider Applied for Stabilization Grant |

Uses of the stabilization grant |

1 |

Provider A |

Rent/Mortgage/Utilities

|

2 |

Provider A |

Employee premium pay |

3 |

Provider A |

Goods and services to resume services |

4 |

Provider B |

Rent/Mortgage/Utilities; personnel protective equipment |

5 |

Provider C in location X |

Rent/Mortgage/Utilities |

6 |

Provider C in location Y |

Rent/Mortgage/Utilities |

7 |

Provider C in location Y |

Mental health supports for children and employees |

8 |

Provider D |

Personal protective equipment |

DATA ELEMENT 6a: Personnel costs, including any sole proprietor or independent contractor-- employee benefits, premium pay, or costs for employee recruitment and retention

Definition: Total number of providers who indicated on their application that they plan to use the grant for personnel costs, including any sole proprietor or independent contractor-- employee benefits, premium pay, or costs for employee recruitment and retention.

Using the example data in the table above, the total number of providers who indicated on their application that they plan to use the grant for personnel costs = 1 (row 2).

Data Accuracy Check: This number should be equal to or less than the total number in element 1.

Guidance: This is a count of providers, NOT grants. Providers with multiple uses of the stabilization grant can be counted under each use (duplicated count).

DATA ELEMENT 6b: Rent, mortgage, utilities, facility maintenance or improvements, insurance

Definition: Total number of providers who indicated on their application that they plan to use the grant for rent, mortgage, utilities, facility maintenance or improvements, or insurance.

Using the example data in the table above, the total number of providers who indicated on their application that they plan to use the grant for this use = 4 (rows 1, 4, 5, and 6).

Data Accuracy Check: This number should be equal to or less than the total number in element 1.

Guidance: This is a count of providers, NOT grants. Providers with multiple uses of the stabilization grant can be counted under each use (duplicated count).

DATA ELEMENT 6c: Personal protective equipment cleaning and sanitization supplies and services, or training and professional development related to health and safety practices

Definition: Total number of providers who indicated on their application that they plan to use the grant for personal protective equipment cleaning and sanitization supplies and services, or training and professional development related to health and safety practices.

Using the example data in the table above, the total number of providers who indicated on their application that they plan to use the grant for this use = 1 (row 8).

Data Accuracy Check: This number should be equal to or less than the total number in element 1.

Guidance: This is a count of providers, NOT grants. Providers with multiple uses of the stabilization grant can be counted under each use (duplicated count).

DATA ELEMENT 6d: Purchases of or updates to equipment and supplies to respond to the COVID–19 public health emergency

Definition: Total number of providers who indicated on their application that they plan to use the grant for Purchases of or updates to equipment and supplies to respond to the COVID–19 public health emergency.

Using the example data in the table above, the total number of providers who indicated on their application that they plan to use the grant for this use = 0 (no providers).

Data Accuracy Check: This number should be equal to or less than the total number in element 1.

Guidance: This is a count of providers, NOT grants. Providers with multiple uses of the stabilization grant can be counted under each use (duplicated count).

DATA ELEMENT 6e: Goods and services necessary to maintain or resume child care services

Definition: Total number of providers who indicated on their application that they plan to use the grant for goods and services necessary to maintain or resume child care services.

Using the example data in the table above, the total number of providers who indicated on their application that they plan to use the grant for this use = 1 (row 3).

Data Accuracy Check: This number should be equal to or less than the total number in element 1.

Guidance: This is a count of providers, NOT grants. Providers with multiple uses of the stabilization grant can be counted under each use (duplicated count).

DATA ELEMENT 6f: Mental health supports for children and employees

Definition: Total number of providers who indicated on their application that they plan to use the grant for mental health supports for children and employees.

Using the example data in the table above, the total number of providers who indicated on their application that they plan to use the grant for this use = 1 (row 7).

Data Accuracy Check: This number should be equal to or less than the total number in element 1.

Guidance: This is a count of providers, NOT grants. Providers with multiple uses of the stabilization grant can be counted under each use (duplicated count).

DATA ELEMENT 7: Comments

Definition: Tribes are encouraged to provide any explanatory comments for any of the questions in Part 3.

VI. Submitting the Annual Report

Each Tribal Lead Agency must submit the information requested on the ACF-700 Annual Report by December 31, covering the services provided during the period from October 1 through September 30 for the preceding Federal fiscal year (FFY). ACF Regional Offices are responsible for monitoring compliance with timeliness of submissions. Tribal Lead Agencies anticipating problems in complying with the reporting requirement should contact the OCC Regional Office (see https://www.acf.hhs.gov/occ/resource/regional-child-care-program-managers).

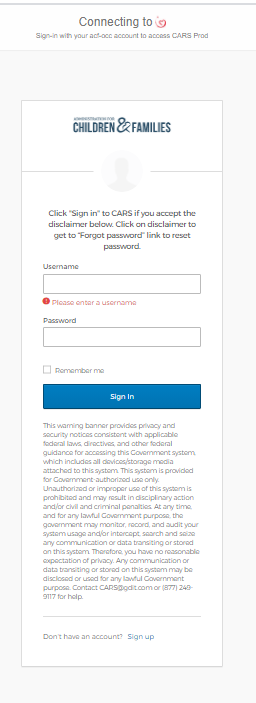

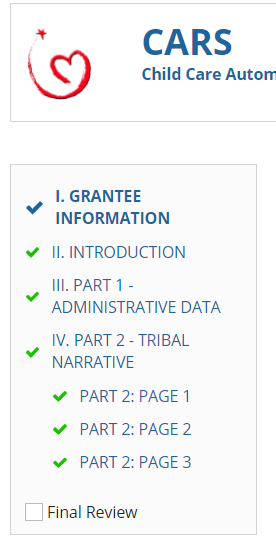

For reporting starting with federal fiscal year (FFY) 2021, OCC instructs grantees to submit all parts of the Tribal Annual Report using the Child Care Automated Reporting System (CARS) available at https://cars.acf.hhs.gov. The CARS is a web-based, password-protected application that checks the ACF-700 data for compliance with data standards at the time of submission. These built-in, edit-checking features make it easier for Tribes to identify and correct errors. Use of the paperless Internet data entry site streamlines submission processing and improves data quality. When you submit the ACF-700 report via the web site, you do not have to send additional paper copies via mail or fax

The submission web page requires a login and password.

The OCC will update this guide with instructions on how tribal users can obtain a CARS user ID and password.

VI1. Accessing and Using the ACF-700 Submission Site

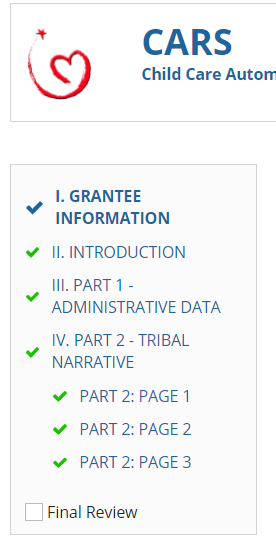

To submit your ACF-700 report (or to view and/or edit previously submitted data), you must first access the CARS application using the Internet at https://cars.acf.hhs.gov.

Once there, read the disclaimer below the login fields, enter your username and password in the appropriate fields and click the “Sign In” button if you accept the disclaimer.

VI2. Submission of Introduction: Program Characteristics

After accessing the CARS, select the ACF-700 tile, and then select the appropriate fiscal year of the data that you would like to enter from the “Period” drop-down list, and click “Start”.

This section will be updated with screen shots.

VI3. Submission of Part 1: Administrative Data

You

can access Part 1: Administrative Data by clicking the appropriate

section on the left navigational bar.

You

can access Part 1: Administrative Data by clicking the appropriate

section on the left navigational bar.

This section will be updated with screen shots.

Things to Remember:

You must enter information in each of the cells on Part 1 of the ACF-700 form on the submission site. Do not leave any cells blank. Each cell should have either a number or NA (See Table 2 for the appropriate use of NA - not applicable).

You should use the “Comments” field to enter information that would help clarify any special reporting circumstances or to explain any peculiarities in your data (See Table 1 for further information). If your program uses funds other than CCDF grant dollars to further support direct child care services for the children being reported on the ACF-700, you should indicate the use of those funds and identify the funding source in the "Comments" field on Part 1 of the ACF-700 report.

If you need to stop data entry and finish entering information at another time, you should click the Save button. Everything that you have entered to that point will be saved and available when you return later to complete the form. After 15 minutes of inactivity (not saving), the site will close and any unsaved data entry will be lost.

VI4. Submission of Part 2: Tribal Narrative

You

can access Part 2: Tribal Narrative by clicking the appropriate

section on the left navigational bar.

You

can access Part 2: Tribal Narrative by clicking the appropriate

section on the left navigational bar.

This section will be updated with screen shots.

VI5. Submission of Part 3: American Rescue Plan (ARP) Act Stabilization Grants

Part 3 is under development and this guide will be updated in the future to provide specific guidance to tribal grantees.

VII. Resources

National Center on Data and Reporting

If you have questions or need additional assistance completing the ACF-700 report or using the Child Care Data Tracker software, contact the National Center on Data and Reporting (NCDR). The NCDR was established by OCC to provide technical assistance related to the grantee reporting requirements. You may contact NCDR by e-mail or phone. The NCDR staff is available Monday-Friday, 9:00 am to 5:00 pm, prevailing Eastern Time. All voice-mail messages left during or outside of those hours are returned promptly.

National Center on Data and Reporting (NCDR)

Phone: 877-249-9117 (toll-free)

E-mail: NCDR@ecetta.info

Regional Office Contact information

If you have questions regarding policy issues, contact your Regional Office.

List of Regional Office addresses and phone numbers

https://www.acf.hhs.gov/occ/resource/regional-child-care-program-managers

Appendix A – ACF-700 Form

The ACF-700 form will be included when it is APPROVED.

Appendix B – Glossary of Commonly Used Child Care Terms

Term |

Definition |

ACF |

The Administration for Children and Families, an agency of the Department of Health and Human Services (HHS). ACF is responsible for Federal programs that promote the economic and social wellbeing of families, children, individuals, and communities. |

ACF-696T |

The financial report required to be submitted by Tribes receiving Child Care and Development Fund (CCDF) grants. |

ACF-700 |