Electric Power Surveys

Electricity Data Program

923 Instructions for 2013 Oct 23

Electric Power Surveys

OMB: 1905-0129

|

Form EIA-923

POWER

PLANT OPERATIONS |

Year: 2013 Form Approval: OMB No. 1905-0129 Approval Expires: 10/31/2013 Burden: 2.7 Hours |

|

||

|

Form EIA-923 collects information from electric power plants and combined heat and power (CHP) plants in the United States (see Required Respondents immediately below). Data collected on this form include electric power generation, fuel consumption, fossil fuel stocks, delivered fossil fuel cost, combustion byproducts, operational cooling water data, and operational data for NOx, SO2, and particulate matter control equipment. These data are used to monitor the status and trends of the electric power industry and appear in many U.S. Energy Information Administration (EIA) publications including: Electric Power Monthly, Electric Power Annual, Monthly Energy Review, Annual Energy Review, Natural Gas Monthly, Natural Gas Annual, Cost and Quality of Fuels, Quarterly Coal Report, and the Renewable Energy Annual. Further information can be found at http://www.eia.gov/fuelelectric.html. The “Stocks at End of Reporting Period” information (SCHEDULE 4), Nonutility “Total Delivered Cost” information (SCHEDULE 2), and “Commodity Cost” information (SCHEDULE 2) reported on this form are protected information. |

||||||||||||||||||||||||||||||||||||

REQUIRED |

The Form EIA-923 is a mandatory report for all electric power plants and CHP plants that meet the following criteria: 1) have a total generator nameplate capacity (sum for generators at a single site) of 1 megawatt (MW) or greater; and 2) where the generator(s), or the facility in which the generator(s) resides, is connected to the local or regional electric power grid and has the ability to draw power from the grid or deliver power to the grid. To lessen the reporting burden, a sample of plants is collected on a monthly basis. Plants that are not selected to respond monthly must respond annually for the calendar year. Facilities that do not generate electricity but serve either as a transfer terminal or offsite storage facility for fossil fuel stocks for generating stations may be required to report on the Form EIA-923. See instructions for each schedule for more specific filing requirements. |

||||||||||||||||||||||||||||||||||||

RESPONSE DUE DATE |

Monthly respondents are required to file SCHEDULE 1 through SCHEDULE 5 and SCHEDULE 9 of this form with EIA by the last day of the month following the reporting period. For example, if reporting for July, survey data are due on August 31. Supplemental respondents (monthly respondents’ filings of Schedule 6 through Schedule 8) are required to file the form approximately 45 calendar days after the form opens for data entry – typically around March 31 following the end of the reporting year. Annual respondents are required to file the form approximately 45 calendar days after the form opens for data entry – typically around March 31 following the end of the reporting year. (Schedules 3A, 5A, and 8D require monthly level data for the calendar year. All other schedules collect aggregated annual data for the calendar year.) See instructions for each schedule for more specific filing requirements. |

||||||||||||||||||||||||||||||||||||

METHODS OF

|

Submit your data electronically using EIA’s secure e-file system. This system uses security protocols to protect information against unauthorized access during transmission. If you have not registered with the e-file Single Sign-On (SSO) system, send an email requesting assistance to: EIA-923@eia.gov. If you have registered with SSO, log on at: https://signon.eia.gov/ssoserver/login If you are having a technical problem with logging into or using the e-file system, contact the Help Desk at: Email: EIASurveyHelpCenter@eia.gov, or Phone: 202-586-9595 If you need an alternate means of filing your response, contact the Help Desk. Retain a completed copy of this form for your files. |

||||||||||||||||||||||||||||||||||||

CONTACTS |

E-file System Questions: For questions related to the e-file system, see the help contact information immediately above. Data Questions: For questions about the data requested on the Form EIA-923, contact the appropriate survey manager listed below, preferably by email at EIA-923@eia.gov. Schedules 1 & 4: Chris Cassar 202-586-5448 Schedule 2: Rebecca Peterson 202-586-4509 Schedules 3 & 5: Ron Hankey 202-586-2630 Schedules 6, 7, & 8: Channele Wirman 202-586-5356 EIA-923

Fax: 202-287-1938 |

||||||||||||||||||||||||||||||||||||

GENERAL

|

Revision Policy:

Submit revisions to data previously reported as soon as possible

after the error or Revisions or adjustments to data should be made only to the survey month(s) to which they pertain. (Do not adjust the current month to reflect a revision or adjustment to a prior month submission.)

If you are unable to make a revision through the e-file system because the monthly data file has been closed, please email your changes to EIA-923@eia.gov, and indicate ‘Revision’ in subject line. Be sure to include your Plant ID, the specific revision, and the month that is being revised. Correcting prepopulated information: For e-file users, much of the information on the form is prepopulated by EIA. Verify the administrative information and make corrections to the contact name, phone numbers, addresses, or email addresses. Please note that PLANT NAME, PLANT CODE, and COMPANY NAME cannot be changed. Contact the survey manager if these items are incorrect. Correcting errors: For e-file users, data that fail our edits will be amassed into an edit log. Upon hitting the “Submit” button, the system will notify you if there are failed edits in the log. You will be directed to the log and given the opportunity to either revise the data in question or override it. When an edit is overridden, the system will ask for a comment/explanation. Each explanation is reviewed by EIA and, if it does not sufficiently explain the anomaly, you will be contacted for a more detailed clarification.

Revising data: If you report via facsimile or email, you may send a corrected copy of the form, but be sure to indicate in SCHEDULE 9: (1) that it is a revision, (2) the month that is being revised, (3) what has been revised, and (4) the date of the revision. If you report via the e-file system, send an email to the survey manager indicating the 4 items listed above.

Schedule 9 is provided for respondents to provide comments. Use it to explain anomalies with data or to provide any further details that are pertinent to the data and plant.

|

||||||||||||||||||||||||||||||||||||

ITEM-BY-ITEM |

SCHEDULE 1. IDENTIFICATION

If any of the above

information is incorrect, revise the incorrect entry and provide

the correct information. Provide any missing information.

|

||||||||||||||||||||||||||||||||||||

|

SCHEDULE 2. COST AND QUALITY OF FUEL PURCHASES – PLANT-LEVEL REQUIRED RESPONDENTS: Coal-fueled plants 50 megawatts and above; and plants fueled by natural gas, petroleum coke, distillate fuel oil, and residual fuel oil 200 megawatts and above that exist for the generation of electric power or the combined production of electric power and useful thermal output must complete the appropriate data on Schedule 2, Cost and Quality of Fuel Receipts. Plants fired by self-produced fuels and/or minor fuels, i.e., blast furnace gas, other manufactured gases, kerosene, jet fuel, and waste oils, are not required to report. All fuel purchases that apply (coal, natural gas, petroleum coke, distillate fuel oil, and residual fuel oil) should be reported at the plant level. However, there are two circumstances that make it necessary for the terminal or storage facility to report the fuel purchase: 1. when the fuel cannot be allocated to individual plants; and/or 2. when vendor information for cost and quality of the fuel is not available to the plant. Terminals and storage facilities must list the plants where the fuel will be utilized on Schedule 9, Comments. In order to avoid duplicate data, report purchases at either the storage site or at the plant, but not both. Purchases reported by a storage site and then transferred to the plant should not be reported at the plant level. Instead, designate such transfers in Schedule 4 as a negative adjustment to stocks at the storage site and a positive adjustment to stocks at the plant, including appropriate comments. . Plant Name, Plant ID, State, Reporting Month and Year: For e-file users, verify the prepopulated information for these items at the top of this (and all) page(s). If no fuel was purchased during the reporting period, place a check in the “No Receipts” box, and go to Schedule 3. If this plant has a tolling agreement and the toller will not divulge the cost of the fuel, you may leave both the commodity and delivered prices blank. Report all other data. Be sure to indicate that there is a tolling agreement currently in place by entering a check in the box at the center of the page. For e-file users, this check will carry over into subsequent months. If the agreement expires, contact the survey manager to have the check removed. SCHEDULE 2. PAGE 1. Contract Information, RECEIPTS, AND COSTS.1. Fuel Supplier Name: Coal Purchases: Report data by supplier and mine source. (Purchased coal or petroleum coke which will be converted to synthesis gas should be reported as it is received, i.e. as coal or petroleum coke.)

Coal received from spot-market purchases and from contract purchases must be reported separately. Data on coal received under each purchase order or contract from the same supplier must be reported separately. Coal purchases can be aggregated when supplier, purchase type, contract date, coal rank, transportation mode, costs, fuel quality, and all mine information are identical. If coal received under a purchase order or contract originates in more than one State/county/mine and the mines are known as well as the amount received from each mine, split the amount received accordingly between the number of different mines and report identical quality and prices (unless the actual quality and prices are known). Mine information is reported on Page 3 of Schedule 2. If the mine or group of mines is not available on the list of mines provided for data entry on the e-filing system, contact EIA immediately (see contacts on Page 1 of the form or instructions). EIA will add appropriate choices for purchases from multiple sources to the drop down list.

Petroleum Purchases: Report data by fuel type, supplier or broker, or refinery and, if applicable, port of entry.

Oil received from spot-market purchases and from contract purchases must be reported separately. Report individual shipments as separate line items. Gas Purchases: Report data by fuel type and supplier. Aggregation of gas deliveries from various suppliers is allowed only if the deliveries are spot purchases and the transportation contracts are identical (either firm or interruptible). For aggregated deliveries, report the pipeline or distributor in the supplier column and the weighted average cost and quality of the fuel. Contract purchases must be reported as separate line items and should never be aggregated. Do not report gas injected into storage. Report it when it is delivered to the plant. Do not report any costs associated with storage.

C – Contract Purchase – Fuel received under a purchase order or contract with a term of one year or longer. Contracts with a shorter term are considered spot purchases. (See below.)

NC – New Contract or Renegotiated Contract Purchase – Fuel received under a purchase order or contract with duration of one year or longer, under which deliveries were first made during the reporting month.

S – Spot-Market Purchase – Fuel received under a purchase order or contract with duration of less than one year.

Purchases

Cost of Fuel

SCHEDULE

2. PAGE 2. Quality

of Fuel AND TRANSPORTATION INFORMATION Fuel Supplier Name, Contract Type, Quantity Purchased, and Energy Source is prepopulated for e-file users based on the data entered on page 1 of schedule 2.

Table 1

F – Firm – Gas transportation service provided on a firm basis, i.e. the contract with the gas transportation company anticipates no interruption of gas transportation service. Firm transportation service takes priority over interruptible service. I – Interruptible – Gas transportation service provided under schedules or contracts which anticipate and permit interruption on short notice, such as in peak-load seasons, by reason of the claim of firm service customers and higher priority users. (Note: Natural Gas received under firm contracts must be reported separately from interruptible contracts.)

Do not report “truck” as a transportation mode if trucks are used to transport coal exclusively on private roads between the mine and rail load-out or barge terminal. Do not report the transportation modes used entirely within a mine, terminal, or power plant (e.g., trucks used to move coal from a mine pit to the mine load-out; conveyors at a power plant used to move coal from the plant storage pile to the plant). For mine-mouth coal plants, report “Conveyor” as the Predominant Mode if the conveyor feeding coal to the plant site originates at the mine. Otherwise report the Predominant Mode (typically truck or rail) used to move the coal to the plant site. Report Transportation Modes using the following codes: RR – Rail: Shipments of fuel moved to consumers by rail (private or public/commercial). Included is coal hauled to or away from a railroad siding by truck if the truck did not use public roads. RV – River: Shipments of fuel moved to consumers via river by barge. Not included are shipments to Great Lakes coal loading docks, tidewater piers, or coastal ports. GL – Great Lakes: Shipments of coal moved to consumers via the Great Lakes. These shipments are moved via the Great Lakes coal loading docks, which are identified by name and location as follows: Conneaut Coal Storage & Transfer, Conneaut, Ohio NS Coal Dock (Ashtabula Coal Dock), Ashtabula, Ohio Sandusky Coal Pier, Sandusky, Ohio Toledo Docks, Toledo, Ohio KCBX Terminals Inc., Chicago, Illinois Superior Midwest Energy Terminal, Superior, Wisconsin

TP – Tidewater Piers and Coastal Ports: Shipments of coal moved to Tidewater Piers and Coastal Ports for further shipments to consumers via coastal water or ocean. The Tidewater Piers and Coastal Ports are identified by name and location as follows: Dominion Terminal Associates, Newport News, Virginia McDuffie Coal Terminal, Mobile, Alabama IC Railmarine Terminal, Convent, Louisiana International Marine Terminals, Myrtle Grove, Louisiana Cooper/T. Smith Stevedoring Co. Inc., Darrow, Louisiana Seward Terminal Inc., Seward, Alaska Los Angeles Export Terminal, Inc., Los Angeles, California Levin-Richmond Terminal Corp., Richmond, California Baltimore Terminal, Baltimore, Maryland Norfolk Southern Lamberts Point P-6, Norfolk, Virginia Chesapeake Bay Piers, Baltimore, Maryland Pier IX Terminal Company, Newport News, Virginia Electro-Coal Transport Corp., Davant, Louisiana WT – Water: Shipments of fuel moved to consumers by other waterways. TR – Truck: Shipments of fuel moved to consumers by truck. Not included is fuel hauled to or away from a railroad siding by truck on non-public roads. TC – Tramway/Conveyor: Shipments of fuel moved to consumers by tramway or conveyor. SP – Slurry Pipeline: Shipments of coal moved to consumers by slurry pipeline. PL – Pipeline: Shipments of fuel moved to consumers by pipeline. SCHEDULE 2. PAGE 3. Coal Mine INFORMATION Fuel Supplier Name, Contract Type, Quantity Purchased, and Energy Source is prepopulated for e-file users based on the data entered on page 1 of schedule 2.

AS – Australia; CN – Canada; CL – Colombia; IS – Indonesia; PL – Poland; RS – Russia; VZ – Venezuela; OT – Other (specify the country in Schedule 9). The State of Origin is mandatory. If purchases originate from a broker, barge site or other third party, you must contact the broker, barge site or other party and find out the State(s) where the coal originates. If the broker or supplier is not forthcoming with State of Origin information or Mine Information, provide the name and telephone number of the supplier on Schedule 9, Comments. If coal purchased under a purchase order or contract originates in more than one State, determine from the supplier the most dominant or probable State(s) of origin for the coal. Contact EIA to have the supplier and State(s) added to the drop down list of choices for State of Origin and Mine Information on Schedule 2 Page 3. If the amount of coal from each State/Mine is known, allocate the purchase among multiple States, or report the State where the majority of the coal originates and report identical quality and cost data (unless the actual quality and costs are known). Contact EIA immediately (see contacts on Page 1 of the form or instructions) for assistance in reporting coal State of Origin or Mine Information. EIA will add appropriate choices for purchases from multiple sources to the drop down list.

Mine Information is mandatory. If coal purchased under a purchase order or contract originates in more than one State, determine from the supplier the most dominant or probable mine(s) of origin for the coal. List the mines on Schedule 9, Comments. If the broker or supplier is not forthcoming with State of Origin information or Mine Information, provide the name and telephone number of the supplier on Schedule 9, Comments. In cases where coal originates from multiple mines or the specific mine information cannot be determined, list the tipple/loading point or dock on Schedule 9, Comments. EIA will add appropriate choices to the drop down list of Mine Information to accommodate multiple mines or undetermined mine sources. Use Schedule 9, Comments, to provide detailed explanations of mine origin data, including names of multiple mines for a specific supplier/broker or dock, or the most probable origin of the coal (county/State) if not specifically known. Contact EIA immediately (see contacts on Page 1 of the form or instructions) for assistance in reporting coal State of Origin or Mine Information. EIA will add appropriate choices for purchases from multiple sources to the drop down list. |

||||||||||||||||||||||||||||||||||||

|

SCHEDULE

3. PART A. BOILER-LEVEL INFORMATION Required Respondents: Complete this schedule for fuels consumed in the boilers at plants with steam turbines that have a total nameplate capacity of 10 MW and above and burn organic fuels. This does not include steam turbines where the energy source is nuclear, geothermal, or solar, or plants that have less than 10 MW total steam turbine nameplate capacity.

Also report on this schedule fuels consumed at combined-cycle plants for supplementary firing of heat recovery steam generator (HRSG) units that have a total steam turbine nameplate capacity of 10 MW and above. If no fuel is consumed, for example in combined-cycle steam units (HRSG) without supplementary firing, report zero. Do not leave the field blank. Report fuels consumed in gas turbines, including the gas turbines at combined-cycle plants, and IC engines on SCHEDULE 3 PART B. For combined heat and power plants, if steam was produced for purposes other than electric power generation during this reporting period, please place a check in the box on the form. For those plants that report annually, Schedules 3A and 5A must be reported for each month. Prime movers are devices that convert one energy form (such as heat from fuels or the motion of water or wind) into mechanical energy. Examples include steam turbines, combustion turbines, reciprocating engines, and water turbines. For a complete list of prime mover codes, please refer to Table 7. Prime Mover Code: Prime mover codes are shown in Table 7. Only CA and ST can be used in Schedule 3. Part A. For e-file users, the code is prepopulated. If the prepopulated code is incorrect, delete the code and choose the correct prime mover code from the drop-down list.

Boiler

ID: The

boiler ID is prepopulated. For an ID not prepopulated, choose the

ID from the drop down list Boiler Status: Enter one of the codes listed below: Table 2

Energy Source: Use the fuel codes in Table 8. For bituminous and subbituminous coal that is blended, where possible report each coal rank consumed separately. If no allocation can be determined, report the fuel that is predominant in quantity. An estimated allocation between coal ranks is acceptable. For energy source codes OTH, OBS, OBG, OBL and OG, specify the fuel in the area at the bottom of the page. Quantity Consumed: For each month, report the amount of fuel consumed for electric power generation and, at combined heat and power stations, for useful thermal output. Include start-up and flame-stabilization fuels. Combined-cycle units should report only the auxiliary firing fuel associated with the HRSG. Do not report the fuel consumed in the combustion turbine portion of the combined-cycle unit on Schedule 3A. CT consumption must be reported on Schedule 3B. Type of Physical Units: Fuel consumption must be reported in the following units: Solids – Tons Liquids – Barrels (one barrel equals 42 U.S. gallons) Gases – Thousands of cubic feet (Mcf) Average Heat Content: For each month, report the heat content of the fuels burned to the nearest 0.001 million Btu (MMBtu) per physical unit. The heat content of the fuel should be reported as the gross or “higher heating value” (rather than the net or lower heating value). The higher heating value exceeds the lower heating value by the latent heat of vaporization of the water. The heating value of fuels generally used and reported in a fuel analysis, unless otherwise specified, is the higher heating value. If the fuel heat content cannot be reported “as burned,” data may be obtained from the fuel supplier on an “as received” basis. If this is the case, indicate on SCHEDULE 9 that the fuel heat content data are “as received.” Report the value in the following units: solids in million Btu (MMBtu) per ton; liquids in MMBtu per barrel; and gases in MMBtu per thousand cubic feet (Mcf). Refer to Table 8 for approximate ranges of heat content of specific energy sources. Sulfur Content (petroleum, petroleum coke, and coal): For each month, enter sulfur content to nearest 0.01 percent. Sulfur content should be reported for the following fuel codes: ANT, BIT, LIG, RC, SUB, WC, PC, RFO, and WO. Refer to Table 1 for approximate ranges. Ash Content (coal and petroleum coke only): For each month, enter ash content to the nearest 0.1 percent. Ash content should be reported for the following fuel codes: ANT, BIT, LIG, SUB, WC, RC, and PC. Refer to Table 1 for approximate ranges. Report actual values. If necessary, report estimated values and state that the value is an estimate on SCHEDULE 9. ENTER ZERO when an energy source was not consumed for the reporting period. Do not leave blank. SCHEDULE 3. PART B. FUEL CONSUMPTION – PRIME MOVER-LEVEL Required Respondents: Report fuel consumed in all gas turbines, including the combustion turbine part of combined-cycle plants, internal combustion engines, steam-electric plants under 10 megawatts, fuel cells, and electric power input to pumped-storage hydroelectric plants, compressed air units, and other miscellaneous energy storage technologies. Excluded from this schedule are conventional hydroelectric plants and all other plants that are not required to report energy consumed (e.g., wind, solar, geothermal, and nuclear). Do not report for each individual unit. For example, report natural gas consumed in all combustion turbines (GT) at the plant as one value and report distillate fuel oil consumed by all IC engines as one value. Combined-cycle plants should report the fuel consumed by the combustion turbines (CT) on this schedule. Report supplementary fuel consumed by the HRSG on this schedule only if the total steam-electric capacity is less than 10 MW. All steam-electric plants and HRSGs at combined-cycle plants with a total steam electric nameplate of 10 MW and above must report fuel consumption at the boiler level on Schedule 3A. Prime movers are devices that convert one energy form (such as heat from fuels or the motion of water or wind) into mechanical energy. Examples include steam turbines, combustion turbines, reciprocating engines, and water turbines. For combined heat and power plants, if steam was produced for purposes other than electric power generation during this reporting period, please place a check in the box on the form.

Prime Mover Code: Prime mover codes are shown in Table 7. Only CA, CE, CS, CT, FC, GT, IC, PS, ST, and OT can be used in Schedule 3. Part B. For e-file users, the code is prepopulated. If the prepopulated code is incorrect, choose the correct code from the drop-down list. Each prime mover type on Schedule 3B must have a corresponding entry on Schedule 5B for electric power generation. Report actual values. If necessary, report estimated values and state that the value is an estimate on SCHEDULE 9. Energy Source: Use the fuel codes in Table 8. For bituminous and subbituminous coal that is blended, where possible report each coal rank consumed separately. If no allocation can be determined, report the fuel that is predominant in quantity. An estimated allocation between coal ranks is acceptable. For energy source codes OTH, OBS, OBG, OBL and OG, specify the fuel in the area at the bottom of the page. Quantity Consumed: For each month, report the amount of fuel consumed for electric power generation and, at combined heat and power stations, for useful thermal output. Include start-up and flame-stabilization fuels. Pumped storage hydroelectric plants and compressed air plants report the megawatthours of energy input for pumping water or compressing air for energy storage. Combined-cycle plants with no supplementary firing must report the CA unit on Schedule 3B with ZERO for fuel consumed. Each prime mover type on Schedule 3B must have a corresponding entry on Schedule 5B for electric power generation.

Type

of Physical Units: Fuel

consumption must be reported in the following units: Average Heat Content: For each month, report the heat content of the fuels burned to the nearest .001 MMBtu (million Btu) per physical unit (MMBtu per ton/barrel/thousand cubic feet). The heat content of the fuel should be reported as the gross or “higher heating value” (rather than the net or lower heating value). The higher heating value exceeds the lower heating value by the latent heat of vaporization of the water. The heating value of fuels generally used and reported in a fuel analysis, unless otherwise specified, is the higher heating value. If the fuel heat content cannot be reported “as burned,” data may be obtained from the fuel supplier on an “as received” basis. If this is the case, indicate on SCHEDULE 9 that the fuel heat content data are “as received.” Report the value in the following units: solids in MMBtu per ton; liquids in MMBtu per barrel; and gases in MMBtu per thousand cubic feet (Mcf). Refer to Table 8 for approximate ranges of heat content for specific fuels. Heat content can be blank if fuel consumed is zero and for pumped storage and compressed air plants. |

||||||||||||||||||||||||||||||||||||

|

SCHEDULE

4. FOSSIL FUEL STOCKS AT THE END OF THE REPORTING PERIOD Required Respondents: Schedule 4 regarding stocks must be completed by all plants that burn fossil fuels: COAL, DISTILLATE FUEL OILS (NO. 2, 4), RESIDUAL FUEL OIL (NO. 6), JET FUEL, KEROSENE, PETROLEUM COKE, and for plants 50 MW and above, NATURAL GAS. Although there are no stocks for natural gas, the energy balance (between receipts and consumed fuel) and comments should be completed for natural gas plants that have a total nameplate capacity of 50 MW and more (and have completed Schedule 2). Report fuel stocks ONLY for the following fuels:

Include back-up fuels and start-up and flame-stabilization fuels. Do not report stocks for waste coal, natural gas, or wood and wood waste or other biomass fuels. All fuel stocks should be reported at the plant level where possible. Stocks data should be reported by a transfer terminal or storage facility only if inventory cannot be attributed to individual plants. To avoid duplication, do not report receipts in Schedule 2 at the plant level that have already been reported by a transfer terminal or storage facility and then transferred to a plant(s). Designate such transfers in Schedule 4 as negative adjustments to stocks at the transfer terminal or storage facility and positive adjustments to stocks at the plant, including appropriate comments. Depending on the required data at transfer terminals or storage sites and associated plants, the energy balance may require an explanatory comment. ENTER ZERO in the Ending Stocks column if a plant has no stocks. Do not leave the field blank. Energy Source: For e-file users, the energy source code is prepopulated. If needed, add an energy source code from the drop-down list. Energy source codes cannot be deleted from Schedule 4. Type of Physical Units: Report coal and petroleum coke in tons and distillate and residual oils in barrels.

|

||||||||||||||||||||||||||||||||||||

|

SCHEDULE

5. PART A. GENERATOR INFORMATION FOR STEAM-ELECTRIC

Required Respondents: This schedule will be completed ONLY for generators at steam-electric organic-fueled plants with a total steam turbine capacity of 10 megawatts and above, including the steam turbine generation from combined-cycle units. Report generation for all other types of prime movers (combustion turbines, IC engines, wind, and hydraulic turbines), and steam turbine capacity of less than 10 megawatts and all plants fueled by nuclear, solar, geothermal, or other energy sources on SCHEDULE 5. PARTS B or C. Generation reported on Schedule 5. Part A. corresponds to the fuel consumption reported on Schedule 3. Part A. For those plants that report annually, Schedules 3.A. and 5.A. must be reported for each month. Prime Mover Code: Prime mover codes are shown in Table 7. Only CA and ST can be used in Schedule 5. Part A. For e-file users, the code is prepopulated. If the prepopulated code is incorrect, choose the correct prime mover code from the drop-down list.

Generator

ID: The generator ID is

prepopulated. For

an ID not prepopulated, choose the ID from the drop Data must be reported in megawatthours (MWh), rounded to whole numbers, no decimals. If no generation occurred, report ZERO. Please do not leave fields blank. Generator Status: Enter one of the codes listed in Table 3 for generator status. Table 3

Gross Generation: Enter the total amount of electric energy produced by generating units and measured at the generating terminal. For each month, enter that amount in MWh. Net Generation: Enter the net generation (gross generation minus the parasitic station load, i.e. station use). If the monthly station service load exceeded the monthly gross electrical generation, report negative net generation with a minus sign, not parentheses. For each month, enter that amount in MWh. Combined heat and power plants in the industrial and commercial sectors may choose to leave net generation blank in cases where net generation cannot be determined. Please note that net generation is not defined as electric power sold to the grid (net of direct use), but as gross minus station use. If station use is not separable from direct use at combined heat and power plants, report only gross generation and leave net generation blank. SCHEDULE 5. PART B. PRIME MOVER LEVEL GENERATION

Required

Respondents: This

schedule will be completed by: 1) steam-electric organic-fueled

plants with

Prime

Mover Code: Prime mover codes are

shown in Table 7. Only CA, CE, CS, CT, FC, GT, IC, PS, ST, and OT

can be used in Schedule 5. Part B. For e-file users, the code is

prepopulated. If the prepopulated

code is incorrect, choose the correct prime mover code from the

drop-down list. Each

prime mover type on Schedule 5B must have a corresponding entry on

Schedule 3B for fuel consumption. Note that for prime mover type

CA, the entry on Schedule 3B (fuel consumed) is ZERO. Gross Generation: Enter the total amount of electric energy produced by generating units and measured at the generating terminal. For each month, enter in the MWh generated. Net Generation: Enter the net generation (gross generation minus the parasitic station load, i.e. station use). If the monthly station service load exceeded the monthly gross electrical generation, report negative net generation with a minus sign. Do not use parentheses. For each month, enter that amount in MWh. Combined heat and power plants in the industrial and commercial sectors may choose to leave net generation blank in cases where net generation cannot be determined. Please note that net generation is not defined as electric power sold to the grid (net of direct use), but as gross minus station use. If station use is not separable from direct use at combined heat and power plants, report only gross generation and leave net generation blank.

SCHEDULE

5. PART C. GENERATION FROM NUCLEAR AND Required Respondents: This schedule will be completed by all nuclear plants and by all wind, solar, geothermal, conventional hydroelectric or other plants where the energy source is not required to be reported on Schedules 3A or 3B, such as purchased steam or waste heat. No fuel consumption data is required for these types of plants. Report generation by energy source for nuclear, wind, solar, geothermal, conventional hydroelectric and miscellaneous sources such as purchased steam or waste heat. Report nuclear data by generating unit. For all other plant types, ignore the unit column. Do not report generation at a combined-cycle plant. All combined-cycle generation is reported on SCHEDULE 5. PARTS A or B, even though the fuel consumption for non-supplementary fired HRSG units is zero (reported on Schedule 3A or 3B with a zero for fuel). Prime Mover Code: Prime mover codes are shown in Table 7. Only HY, HA, HB, HK, BT, PV, ST, WT, and OT can be used in Schedule 5. Part C. For e-file users, the code is prepopulated. If the prepopulated code is incorrect, choose the correct prime mover code from the drop-down list. Energy Source: Enter one of the fuel codes listed in Table 8. Unit Code: The nuclear unit code is prepopulated. Contact EIA if it is incorrect. All other plants ignore this field. Gross Generation: Enter the total amount of electric energy produced by generating units and measured at the generating terminal. For each month, enter that amount in MWh. Net Generation: Enter the net generation (gross generation minus the parasitic station load, i.e. station use). If the monthly station service load exceeded the monthly gross electrical generation, report negative net generation with a minus sign. Do not use parentheses. For each month, enter that amount in MWh. Combined heat and power plants in the industrial and commercial sectors may choose to leave net generation blank in cases where net generation cannot be determined. Please note that net generation is not defined as electric power sold to the grid (net of direct use), but as gross minus station use. If station use is not separable from direct use at combined heat and power plants, report only gross generation and leave net generation blank. |

||||||||||||||||||||||||||||||||||||

|

SCHEDULE 6. NONUTILITY ANNUAL SOURCE AND DISPOSITION OF ELECTRICITYRequired Respondents: Nonutility plants report annual calendar year data for the source and disposition of electricity.

Report all generation in MWh rounded to a whole number. Source of Electricity

Disposition of Electricity

|

||||||||||||||||||||||||||||||||||||

|

SCHEDULE 7. ANNUAL REVENUES FROM SALES FOR RESALE Required Respondents: To be completed by respondents who report a positive value on SCHEDULE 6, Disposition of Electricity, Item 8, Sales for Resale. “Sales for Resale” is energy supplied to other electric utilities, cooperatives, municipalities, Federal and State electric agencies, power marketers, or other entities for resale to end-use consumers. This excludes energy supplied under tolling agreements that is intended for resale to end use customers. Report energy supplied under tolling agreements in “Other Outgoing Electricity.” Report all revenue from Sales for Resale in thousand dollars to the nearest whole number. |

||||||||||||||||||||||||||||||||||||

PRIME MOVER CODES AND DESCRIPTION

|

Table 4

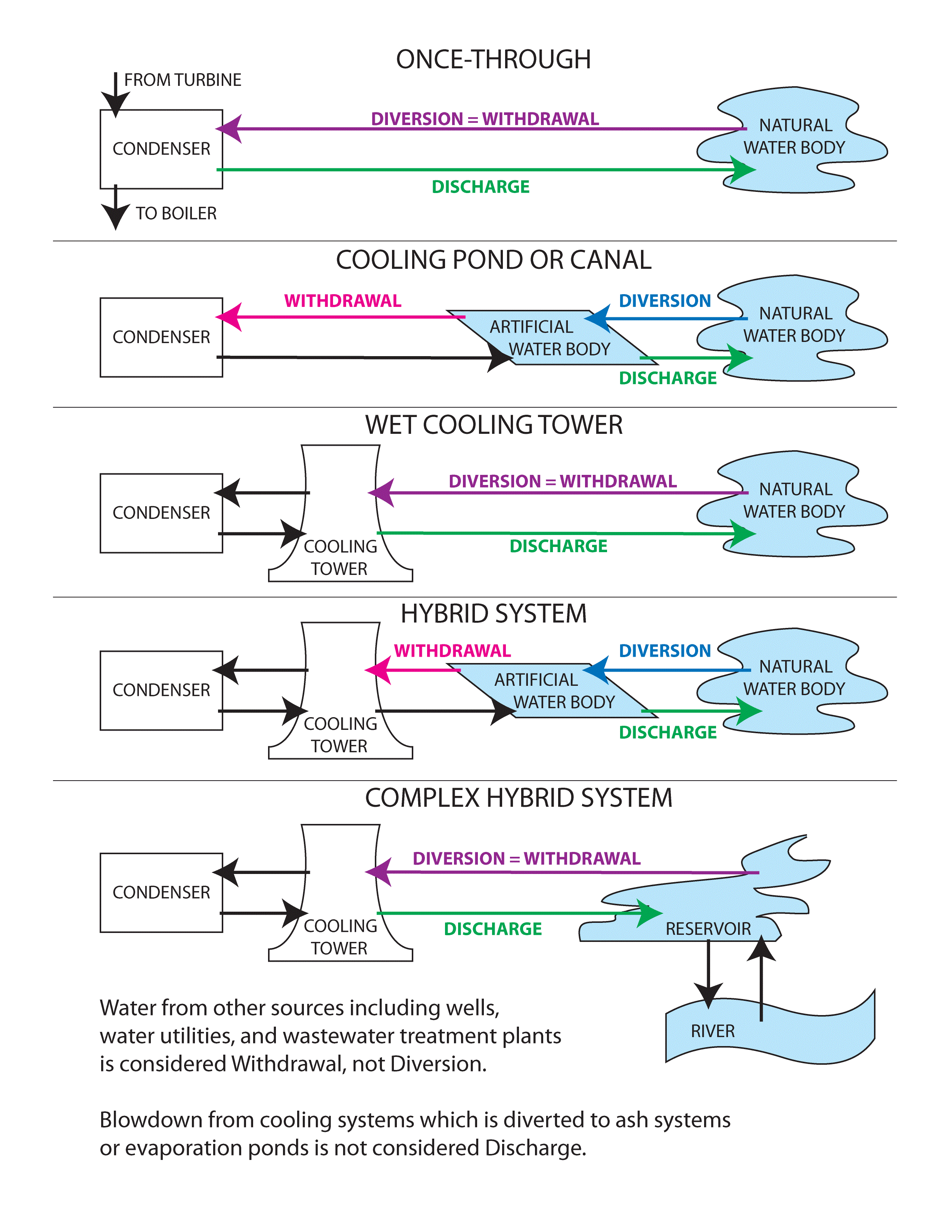

Figure 1 -- Cooling Systems

SCHEDULE 8. PART E. FLUE GAS PARTICULATE COLLECTOR INFORMATION

|

||||||||||||||||||||||||||||||||||||

ENERGY SOURCE Table

8

|

Table 5

SCHEDULE

8. PART F. FLUE GAS DESULFURIZATION UNIT INFORMATION

|

|

Table 6

SCHEDULE 9. COMMENTS This schedule provides additional space for comments. Please identify schedule, item, and identifying information (e.g., plant code, boiler ID, generator ID, prime mover) for each comment. If plant is sold, provide purchaser’s name, a telephone number (if available), and date of sale.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Table 7

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Table 8 |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GLOSSARY |

The glossary for this form is available online at the following URL: http://www.eia.gov/glossary/index.html

|

SANCTIONS |

The timely submission of Form EIA-923 by those required to report is mandatory under Section 13(b) of the Federal Energy Administration Act of 1974 (FEAA) (Public Law 93-275), as amended. Failure to respond may result in a penalty of not more than $2,750 per day for each civil violation, or a fine of not more than $5,000 per day for each criminal violation. The government may bring a civil action to prohibit reporting violations, which may result in a temporary restraining order or a preliminary or permanent injunction without bond. In such civil action, the court may also issue mandatory injunctions commanding any person to comply with these reporting requirements. Title 18 U.S.C. 1001 makes it a criminal offense for any person knowingly and willingly to make to any Agency or Department of the United States any false, fictitious, or fraudulent statements as to any matter within its jurisdiction.

|

REPORTING BURDEN |

Public reporting burden for this collection of information is estimated to average 2.6 hours per response for monthly respondents, 3.1 hours per response for annual respondents, and 4.4 hours per response for annual respondents with boiler level data, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. The weighted average burden for the Form EIA-923 is 2.8 hours per response. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the EIA, Office of Survey Development and Statistical Integration, EI-21 Forrestal Building, 1000 Independence Avenue SW, Washington, D.C. 20585-0670; and to the Office of Information and Regulatory Affairs, Office of Management and Budget, Washington, D.C. 20503. A person is not required to respond to the collection of information unless the form displays a valid OMB number.

|

DISCLOSURE |

The “Total Delivered Cost” of coal, natural gas, and petroleum received at nonutility power plants and “Commodity Cost” information for all plants in SCHEDULE 2 and “Previous Month’s Ending Stocks” and “Stocks at End of Reporting Period” information reported on SCHEDULE 4 will be protected and not disclosed to the extent that it satisfies the criteria for exemption under the Freedom of Information Act (FOIA), 5 U.S.C. §552, the Department of Energy (DOE) regulations, 10 C.F.R. §1004.11, implementing the FOIA, and the Trade Secrets Act, 18 U.S.C. §1905. All other information reported on Form EIA-923 is considered public information and may be publicly released in company identifiable form. The Federal Energy Administration Act requires the EIA to provide company-specific data to other Federal agencies when requested for official use. The information reported on this form may also be made available, upon request, to another component of the Department of Energy (DOE), to any Committee of Congress, the Government Accountability Office, or other Federal agencies authorized by law to receive such information. A court of competent jurisdiction may obtain this information in response to an order. The information may be used for any non-statistical purposes such as administrative, regulatory, law enforcement, or adjudicatory purposes. Disclosure limitation procedures are applied to the protected statistical data published from SCHEDULES 2 and 4 on Form EIA-923 to ensure that the risk of disclosure of identifiable information is very small. |

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | PURPOSE |

| Author | M. Isabel Ramos |

| File Modified | 0000-00-00 |

| File Created | 2021-01-30 |

© 2026 OMB.report | Privacy Policy